Hi Multis

The week is already closing again and it was packed with earnings analyses. There will be more in the upcoming week.

On Wednesday morning, though, I’m already off again. This time, I’m going to Lisbon until Saturday evening. And again, it’s for business.

In Dubai, I met Matt Peterson and he developed a tool that can make AI-generated reports. The product’s good, although it still needs some fine-tuning. We will look into whether we can commercialize the product.

As Multis, you can try it out already. For free, of course.

Just give in a ticker. For now, it’s only for the American and Indian stock markets. But many companies have an ADR in the US, of course. You can use TOITF for Topicus, for example. A Belgian friend used MLXSF for the Belgian chip maker Melexis and also got a report.

It can take up to 15 minutes before you get the report in your mailbox.

You can try it out here. All feedback is welcome!

Articles In The Past Week

This is the fifth article this week.

In the first one this week, we analyzed Duolingo, which has been hammered recently. I see it as a great opportunity. Find out why here.

Cloudflare is firing on all cylinders, both as a company and as a stock, but there’s just one big problem. You can find out more in this article.

Roku hasn’t really lived up to the promise it had a few years ago. In this article, David analyzed the earnings and I updated the Quality Score and Valuation. You can read all about it here.

This month, the 15th of the month was in the weekend. That’s why I already published the Best Buys Now on Friday. Discover the 5 stocks I find most attractive now here.

Memes Of The Week

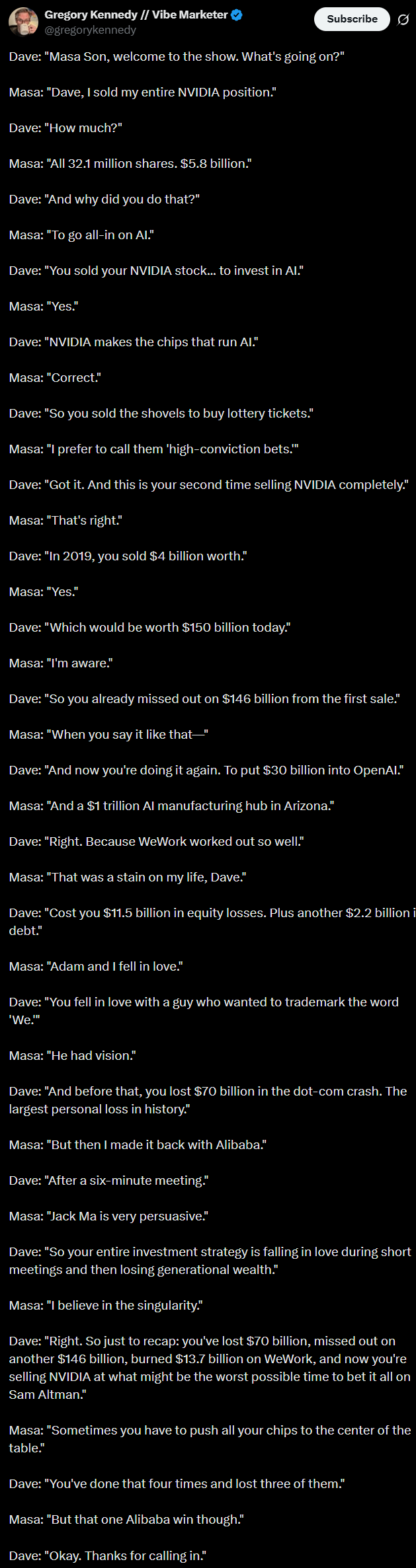

Not a traditional meme this week, but a fake conversation of Masa(yoshi) Son, the founder and CEO of Softbank, with Dave Ramsey, the personal finance guru. People can call into his show and this conversation is a parody of that.

Interesting Podcasts Or Books

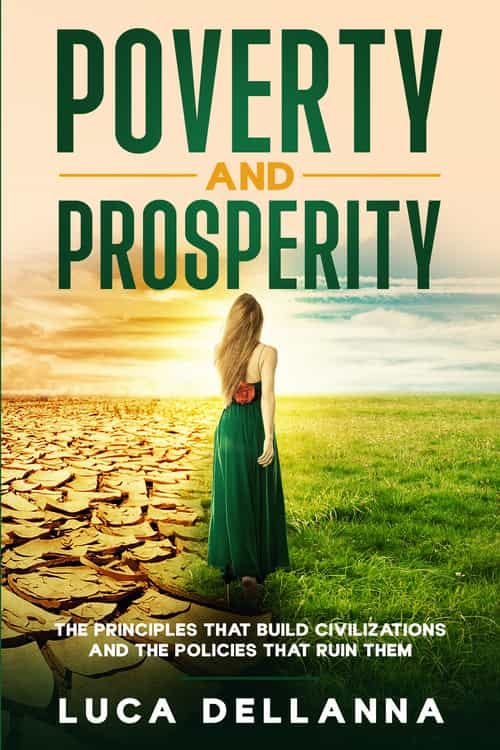

Last week, I wrote about Poverty and Prosperity by Luca Dellanna. I was a beta reader (and mentioned in the thank-you section, which I am very grateful for). As I mentioned earlier, I really love the book. It’s one of the best I’ve read in a while.

This week, the book was published. You can find it at any bookstore or online retailer (such as Kindle, Amazon, or Barnes & Noble).

It’s not directly about investing, but more about policy choices to organize the best society. If you like Nassim Nicholas Taleb’s books, you will love this one. If you want to read a sample first, you can do that here.

The markets in the past week

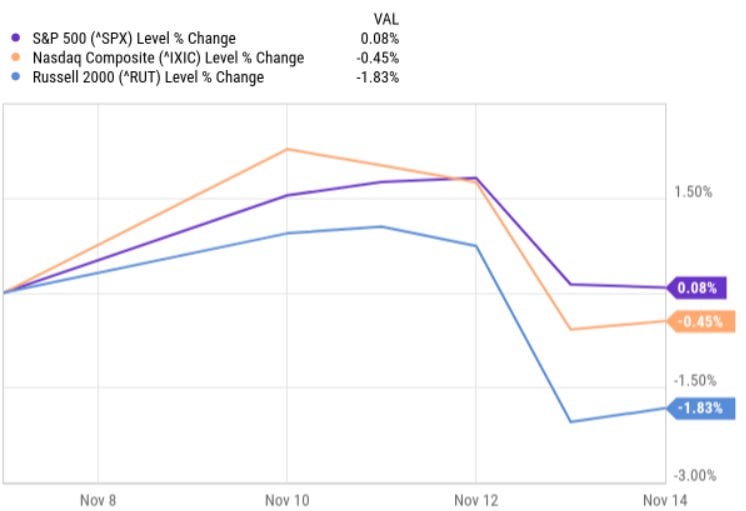

After the big sell-off last week, this week, the markets were still volatile. The S&P 500 gained 0.08%, the Nasdaq lost 0.45% and the Russell 2000 dropped 1.83%.

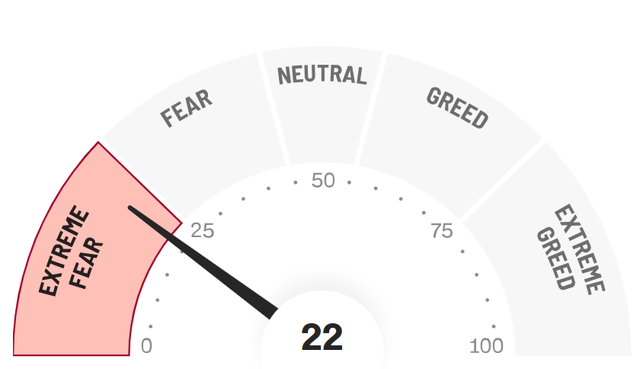

How about the Greed & Fear Index? Let’s check.

It remains in Extreme Fear, gaining one point from 21 to 22.

Lesson Of The Week

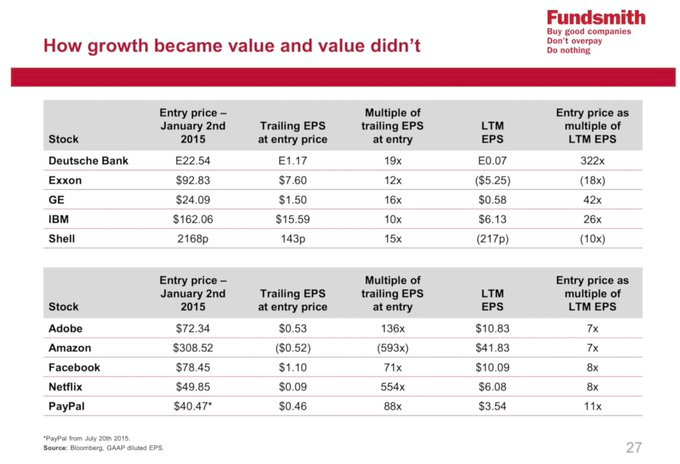

The lesson of this week comes from Terry Smith.

He shows how value can be a value trap and how “expensive” stocks can be real the real value plays.

As you see, you could have bought Amazon at a negative EPS, Netflix at 554x the 2015 EPS, Adobe at 136x the EPS and have had great returns. Only PayPal lost to the index.

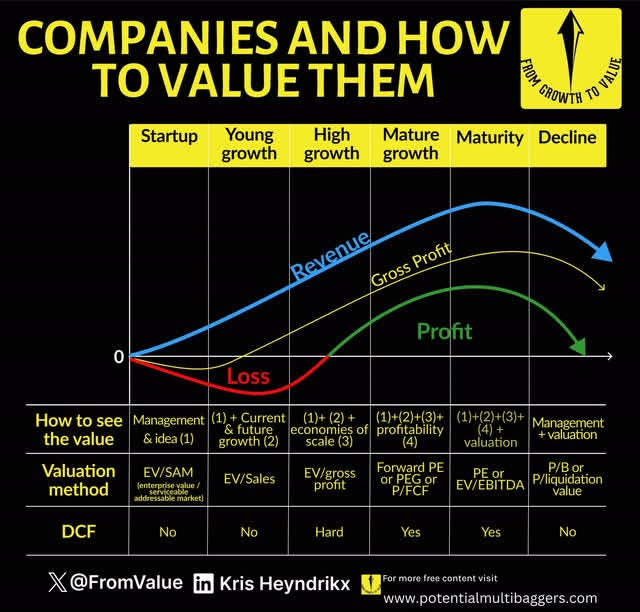

My message is not that you should never watch valuations. Rather that many only look at the PE, which is an appropriate metric for a company in mature phase, but not for companies in any other phase.

That’s the basis for the valuation methods I use.

So, don’t follow the PE herd, who have a hammer and only look for PE nails. There’s much more nuance in valuing than just PEs or DCFs, which are also only really applicable in mature growth and maturity, when cash flows become more stable.

Quick Facts

1. Shopify Leader in Gartner’s Magic Quadrant

For the third year in a row, Shopify (SHOP) was named a leader in Digital Commerce in Gartner’s Magic Quadrant. It leads in ability to execute. Salesforce, SAP and Adobe are often seen as the company’s biggest competitors, but especially the latter two lag quite a bit.

2. Is OpenAI The AI Equivalent of Yahoo!?

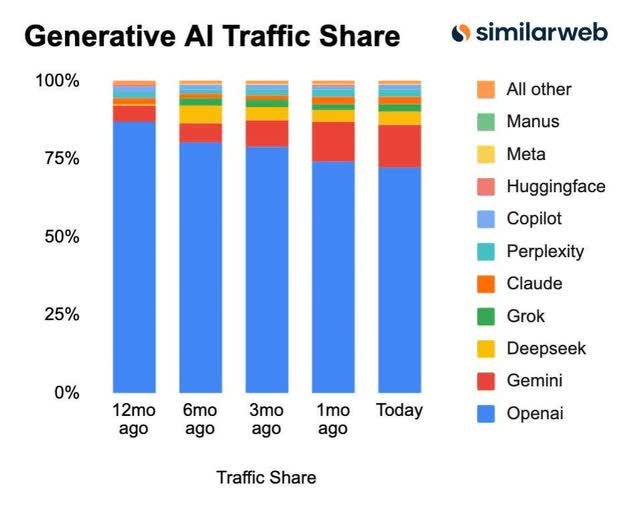

This week, I saw this graph.

As you can see, OpenAI is still by far the leader, but Gemini is gaining market share. That triggered me to post this provocative poll. After just two hours, already 250 people voted.

To be honest, I don’t know if this is true or not. But if history is any guide, if someone comes up with a better and more efficient solution later, like Google did, they can be the winner.

3. Nu’s Growth

For what it’s worth (I have not controlled this), I saw this post this week, which says that Nu Holdings (NU) is the fastest-but-one company ever, ex-China, to get to $14B in ttm revenue. The company that was faster was Uber, but that was still very unprofitable then.

It took Nubank 49 quarters to get to $14B in ttm revenue. Amazon was also fast, but it still took 54 quarters.

This again shows the exceptional business Nu is. And that’s not all.

4. Nu’s Efficiency

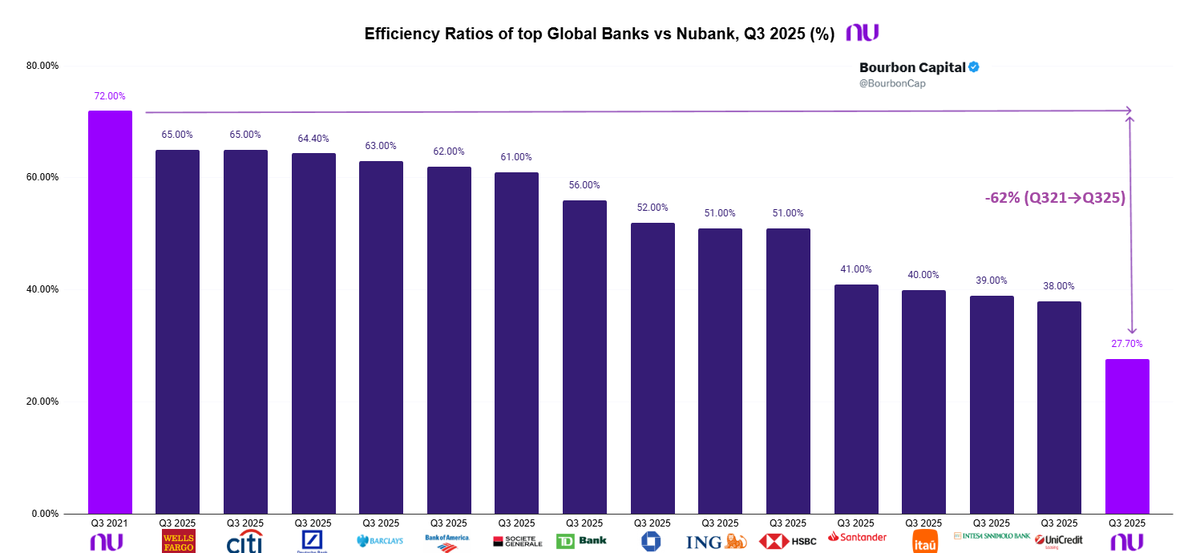

This week, I saw this chart. It compares Nubank’s efficiency ratio with those of other banks at two different points in time. In the first one, you see Nubank in Q3 2021; in the last one, you see Nubank in Q3 2025. The efficiency ratio shows how many cents a bank spends to make $1 of revenue. So, lower is better. Nu went from dead last to first. This again emphasizes its outstanding efficiency.

And very important: Nu is just in three markets: Brazil, Mexico and Colombia. It’s only profitable in one so far: Brazil. That means this will even improve when Mexico becomes profitable, too. I expect that to be next year already. Very impressive.

5. Adyen: President North America Leaves

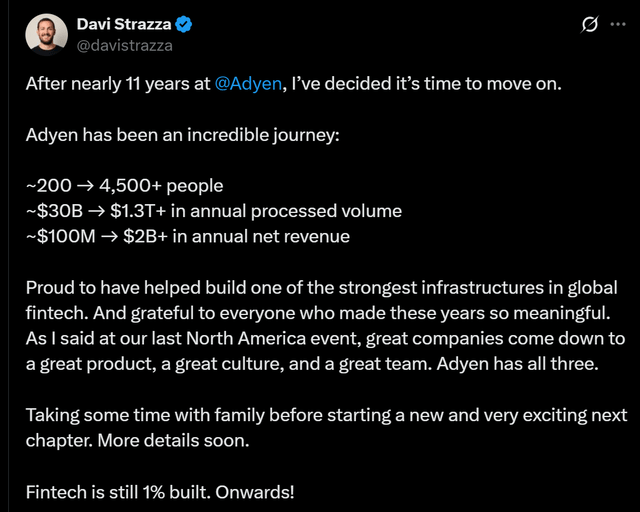

David Strazza, Adyen’s President of North America, announced this week that he will leave the company after 11 years.

He does that with these beautiful words: “Great companies come down to a great product, a great culture and a great team. Adyen has all three.”

This is not bullish or bearish, just something that happens. As he says, he will start a new chapter, so probably he was lured away.

It’s a pity, though, as he shared many insights about Adyen on X, so I will miss him because of that.

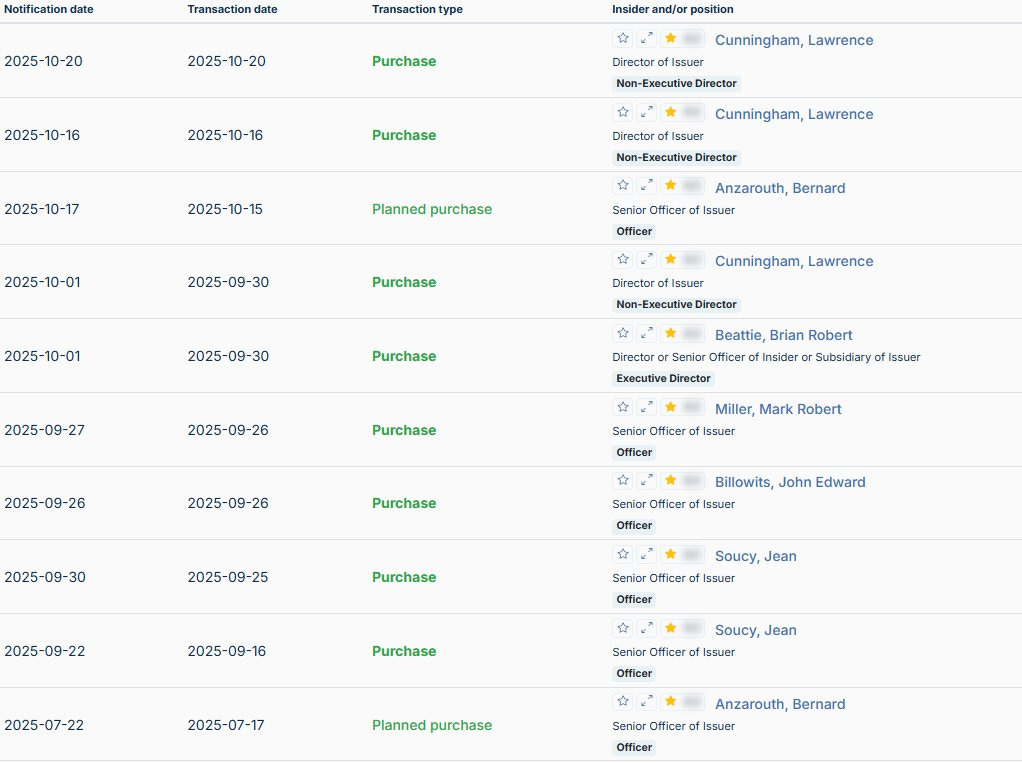

6. Constellation Insiders Buying

So often, I get the question: “Kris, this insider/executive has sold shares. Should I be worried?”

My answer is always the same. Except if an insider sells 50%+ or more of his or her shares, there’s probably a good reason.

There are many reasons why insiders sell shares:

* They want to buy a boat

* One of their children marries

* Just regular sells as a form of income

* A new house

* Investing in something else (like Jeff Bezos in Blue Origin).

etc.

There are just two reasons, though, why insiders buy:

1. Virtue signaling: they want to show investors they believe in the stock.

2. They believe the shares are undervalued.

Sometimes the two go together, but the second reason is more common than the first.

I think nobody at Constellation Software really cares about the first reason, so the insider buys show that insiders see the stock as undervalued.

Lawrence Cunningham is an author, professor and lawyer. He has written several books. The most famous ones are Quality Investing and Quality Shareholders.

Next to those, he has written multiple books about Berkshire Hathaway.

Constellation Software appointed him as a Board Member in 2017.

7. “Buffett” Buys Google Shares

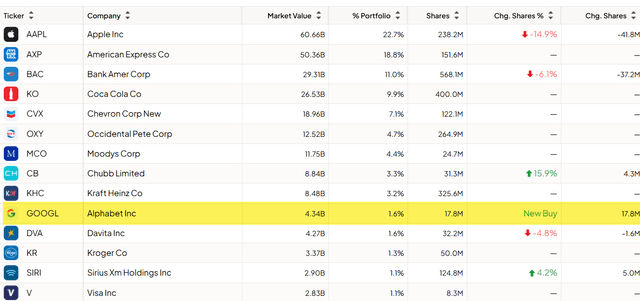

It’s the 13-F season and the most remarkable move in the Superinvestors’ portfolio was probably that Berkshire Hathaway bought 17.8 million Google shares, worth $4.34 billion. Berkshire sold more Apple shares again.

Google now lists as the 10th biggest stake in Berkshire’s portfolio.

Just like sooooooo much more, you can also find that on Fiscal AI, the best data platform for investors out there.

Because I’m a proud Fiscal AI partner, you can get a 15% discount for any plan you take.

Buffett wrote in his last shareholder letter:

“ I will no longer be writing Berkshire’s annual report or talking endlessly at the annual meeting. As the British would say, I’m “going quiet.”

It’s funny to see that so many claim that “Buffett” bought Google. It was not Buffett. Buffett lamented multiple times that he had missed Google after the IPO. He knew how much GEICO used it, so he should have bought, he said. Ted Weschler and/or Todd Combs, the Berkshire Investment Managers, will have bought Google. Probably Ted, as Todd is also the GEICO CEO.

This is where the free part ends.

If you want full access to Potential Multibaggers, here’s what you’ll get:

✅ Multiple articles every week

✅ My complete portfolio (with every transaction)

✅ Deep earnings analysis, with Quality Score and valuation updates every quarter.

✅ Access to our private chat group

✅ Best Buys Now (outperforming the market by 30% over 3 years!)