Hi Multis

On the 15th of every month, I publish my ‘Best Buys Now’, five handpicked stocks from my entire investing universe (not just Potential Multibaggers) that I believe are especially attractive at that moment.

And the results are amazing.

In the first three years after the launch, the selection has beaten the S&P 500 by 26.5% per stock.

I can’t guarantee that I can keep up that outperformance. Of course not. Just two weeks ago, it was an outperformance of more than 30%. That’s how fast things move.

And also don’t forget that many of my picks initially didn’t move much. That’s exactly the pattern, actually. It took a while before the sentiment caught up with the fundamentals. In the stock market, being right can feel wrong for a surprisingly long time.

Unlike what some value investors think, my stocks are not ‘momentum stocks.’ They are carefully selected stocks to hold for the long term.

Just like Warren Buffett, my favorite holding position is forever. That means that I hold as long as the thesis still stands. That can be the original thesis, or an updated one. You have to be flexible there. Cloudflare as the ‘connecting cloud’? I hadn’t seen that one coming when I picked the stock in early 2020 at $39. But it’s a full part of the thesis now.

No buy low, sell high but buy low and hold for a very long time. Ideally, until it’s a multibagger multiple times over.

Having said that, let’s go to the Best Buys Now for this month. I ordered them by market cap, from big to smaller.

1. Mercado Libre

Price: $2018.08

Mercado Libre (MELI) remains attractive.

I have already shared this stat earlier, but some may have missed it.

Marcos Galperin, the founder and (still) CEO of Mercado Libre (until the end of this year), posted this on X.

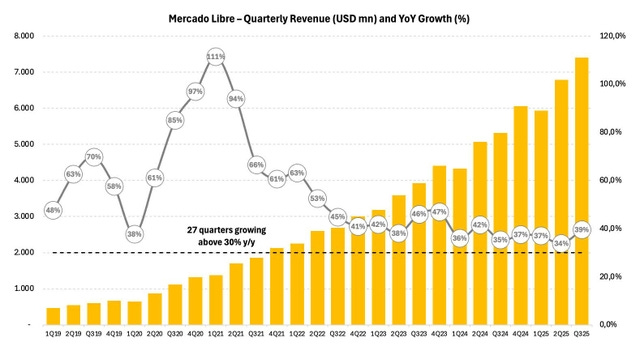

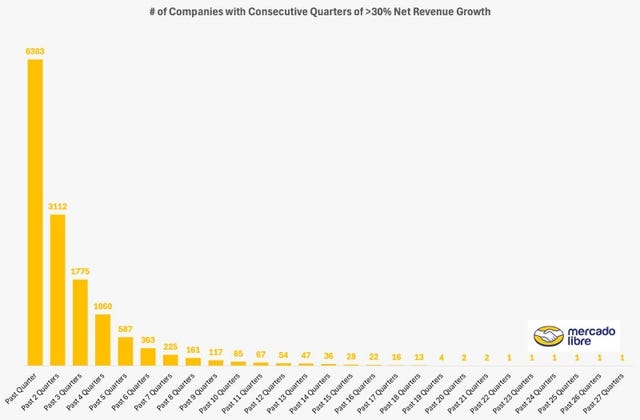

That’s fantastic. Almost 7 years of 30%+ revenue growth. Something very important in investing is the CAP or the Competitive Advantage Period. I think that of Mercado Libre is very long. I have said this before and I will repeat it here: I could see Mercado Libre become the first trillion+ company in Latin America.

That would mean it would be a tenbagger from here, as it has a market cap of around $100 billion now.

Of course, that will take time.

But 27 quarters of 30% revenue growth shows, as the only one of 83,000 publicly traded companies in the whole world, that shows what an incredible beast Mercado Libre is.

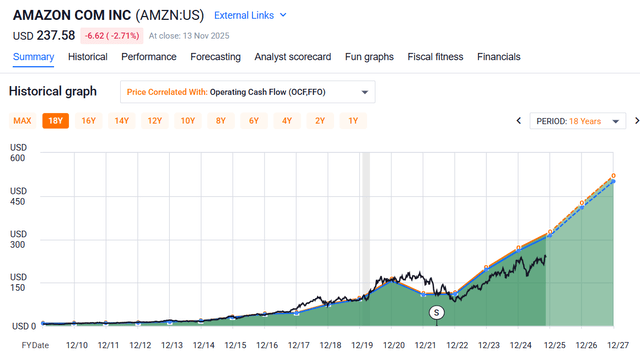

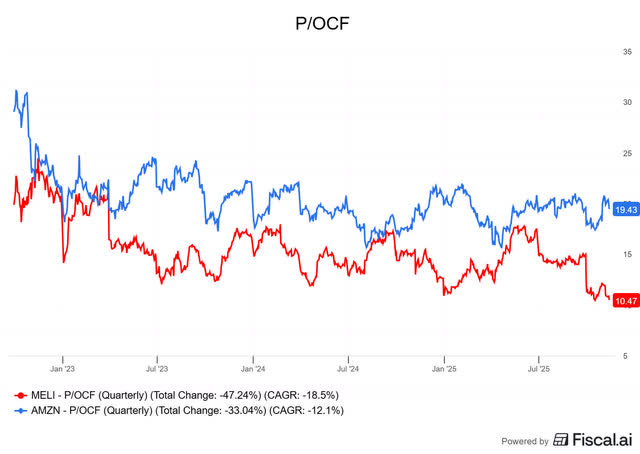

And valuation? Well, price to operational cash flow has always been a great metric for retail companies, no matter their nature.

Just look at this chart, for example.

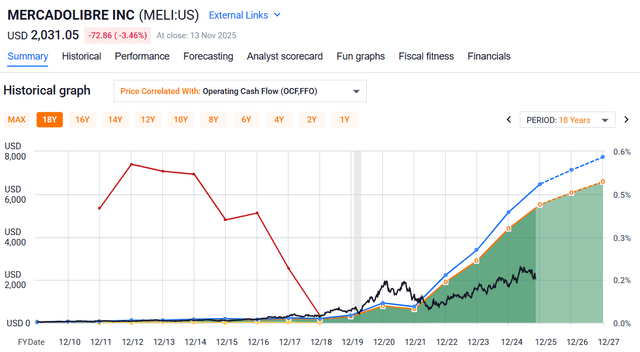

As you can see, Amazon’s stock price has followed its operational cash flow quite closely. And you can also see why I made Amazon a Best Buys Now last month and I still think it’s interesting now. Operational cash flow is expected to surge and if history is a guide, the stock price will follow.

But look at the P/OCF ratio for Mercado Libre and Amazon.

As you can see, Amazon is almost double as expensive as Mercado Libre, which only trades at 10.5 times operational cash flow.

Or, with another chart, you can see the stock price and the operational cash flow for Mercado Libre and how undervalued it looks.

Mercado Libre looks to be in hibernation around that $2000 level it trades at right now. That’s great for knowledgeable investors with patients. And isn’t that the definition of Multis? :-)

2. Sea Limited

Price: $138.93

Another one that returns.

The most recent earnings were very strong for Sea Limited (SE). The analysis will follow soon.

Why the price dropped? First, there were definitely people taking profits and secondly, it just followed the general market.

I’ve been holding the stock since it traded at $54, 5.5 years ago. It’s one of the most impressive companies I have seen in my investing career, but also probably one of the most misunderstood.

Sometimes, I read The Straits Times, a Singaporean newspaper. It’s the most popular newspaper in Singapore and for being the most popular one, it’s remarkably high quality.

But when I read about Sea Ltd. it’s clear that they don’t understand the company. To my knowledge, there has never been a company from Singapore that acts like Sea Ltd. It is focused on the long term and is not shy about investing. That means, of course, that it’s not optimizing for profitability.

In the newspaper and with some of the people I talk to who live in Singapore, I see skepticism about the company’s performance. The mainstream investor in Singapore seems to want very high profitability at the cost of growth, preferably with a dividend on top of that.

Now, many people in Singapore don’t agree with this, but I don’t read their voices in The Straits Times. But many Multis are from Singapore and they are some of the best and most loyal Multis. So, a big shout-out to you all! The next time there’s a Multis get-together in Singapore, I’ll try to be there, I promise.

These Singaporean Multis often know more about investing than the mainstream press. I even think that’s the case worldwide, but in Singapore, the gap may be even bigger. They know what Amazon has done and what it took Amazon to get where it is today. And they see that Sea is implementing the same strategies in another part of the world. But that requires long-term thinking, unfortunately, not something many (press) people are capable of nowadays. Lee Kuan Yew built Singapore through a long-term vision and see how it thrives. Sure, you could criticize some of the elements, but don’t miss the forest for the trees. He brought Singapore from the Third World to the First.

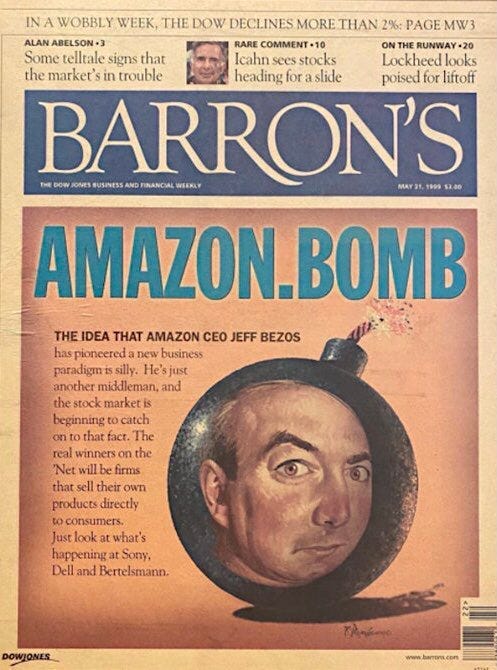

To me, Forrest Li stands at the same level as Jeff Bezos. Of course, Bezos is much more well-regarded now. But at the time, he was often controversial too. You may remember this headline.

That text too:

The idea that Amazon CEO Jeff Bezos has pioneered a new business paradigm is silly. He’s just another middleman, and the stock market is beginning to catch on to that fact. The real winners on the Net will be firms that sell their own products directly to consumers. Just look at Sony, Dell and Bertelsmann.

This is what I sometimes think when I read the articles of the mainstream press about Sea. To put it mildly, they are very uninformed.

And one of the things you see many investors grab to (often supported by the mainstream press) is that SEA has a high PE because that’s the only valuation metric they use.

And yes, SEA has a PE of almost 60.

For a company in maturity, they would be right. However, they lack the expertise to value growth stocks. This is my framework.

Sea had 38.3% revenue growth. Would you classify that as a company in maturity? Because, that’s the only time a company should be judged on a PE basis.

I would argue (and if you don’t agree, you should have very convincing arguments) that SEA is still in high growth. Or back in high growth is probably more accurate. It saw that the market wanted profitability in 2022, it turned around impressively in two quarters. It went from losing $1B per quarter for high growth, to GAAP profitability in just two quarters. That’s still the most impressive thing I’ve seen any business leader do. It took Jeff Bezos 2 years to do the same when the public wanted proof Amazon could be profitable in the dotcom bust. Forrest Li beat Jeff Bezos by 6 quarters. Impressive, yet many still don’t know this.

Then, when it was profitable, Sea turned again and announced that it would invest in growth again, but remain profitable. And again, they did. I mean, 38.3% revenue growth at that size? That’s again top-notch execution, and again, most miss it.

That’s why I don’t care for the company’s misses on EPS. I want it to invest as much as possible. If they see opportunities, turn on the money faucet. And mind you, the company remains impressively profitable (yes, again, on a GAAP basis as well).

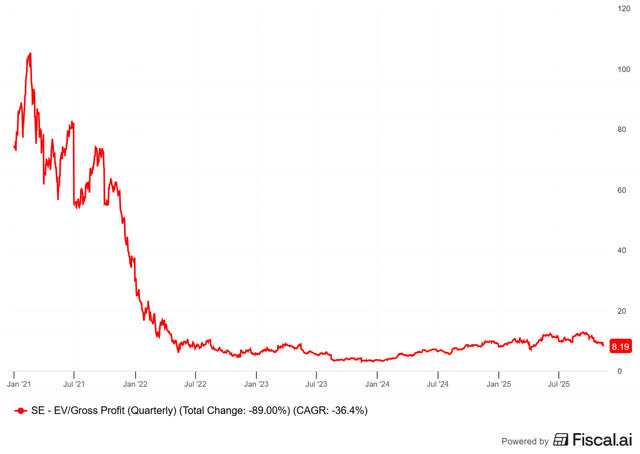

So, let’s judge it on EV/Gross profit, the best metric for the high-growth stage.

At just 8 times EV/Gross profit, Sea looks cheap.

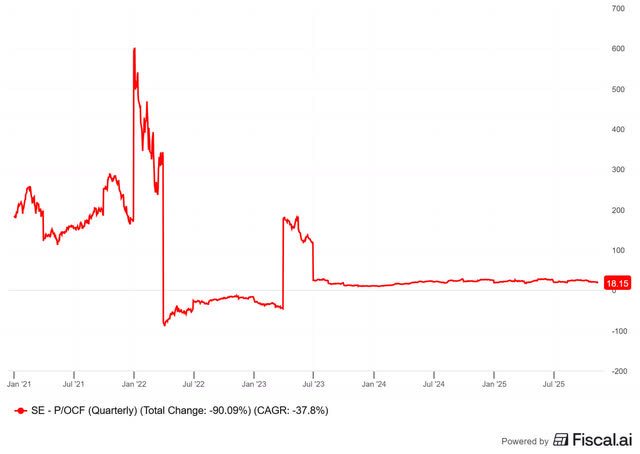

But, it’s also a retailer. So, let’s judge it on P/OCF, as we did with Amazon and Mercado Libre earlier.

As you can see, it’s a bit more expensive on this metric. But I consider 18x OCF for this high growth still very reasonable.

But, unlike Mercado Libre and Amazon, Sea Limited has not been OCF profitable for a long time, just two years. So, it’s not optimized for that yet.

Overall, I’m happy the market sells off Sea Limited again and I’ll add to my position. I don’t know what it will do over the short term, but with such fantastic management, that controls its business so well, I’m convinced that it’s still an excellent investment for the long term.

On to the next three companies. They are more or less of the same size, quite a bit smaller than Mercado Libre (with a market cap of $100 billion) and Sea Limited (which is worth about $75B).

But I want to be clear. I think that all 5 of these stocks still have 10x potential.

If you are a free reader, this is where the content stops for you.

If you want full access to Potential Multibaggers, here’s what you’ll get:

✅ My full portfolio (with every transaction)

✅ All the picks (with two new ones just out)

✅ Access to our private chat group

✅ Best Buys Now (outperforming the market by 30% (!) over 3 years.)

✅ Deep dives on earnings, with a Quality Score and Valuation Score, so you know if the stock’s a buy, hold or sell.

Of course, I know that investing in Potential Multibaggers is spending money. But what if it brings you more money than it costs? That’s called investing. Potential Multibaggers may be a great investment for you.