Cloudflare Is Crushing It, But There's One Big Problem

The analysis, the Selling Rules, the Quality Score and the valuation.

Hi Multis

Anand here with the Cloudflare (NET) Q3 2025 earnings result. Earnings season kicked off really well.

Cloudflare reported strong results, and the stock price was up more than 14%, and reached an all-time high.

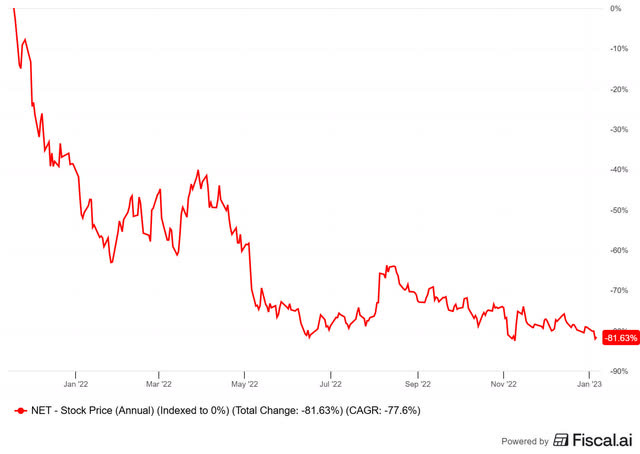

But don’t forget that Cloudflare went from $211 to $39.9, an 80%+ drop.

You can usually read then: from $40 to break even, the company needs to grow by 5x. That makes it sound impossible.

But there are several weaknesses to this bearish argument. First, it supposes everyone bought at the top and only at the top. Secondly, a 5x sounds almost impossible, but that’s because the numbers are skewed when we talk about percentages. The stock just has to go up the same amount it dropped.

And if you look at the result, Cloudflare actually grew more than 6x from that point. That’s an incredible return, but at the same time, that’s the kind of volatility investors need to digest to hold a multibagger. Kris has stressed that multiple times already.

The Numbers

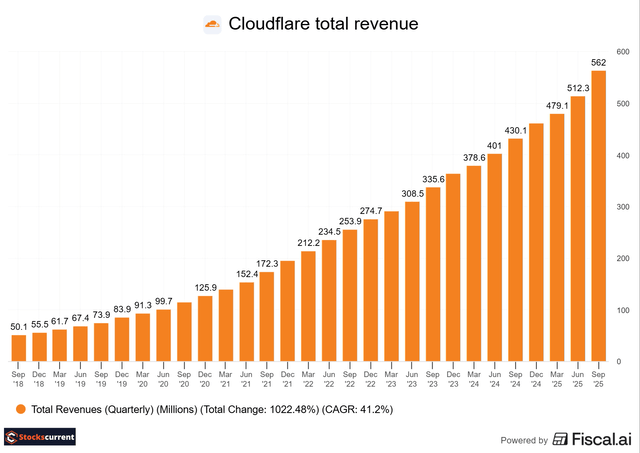

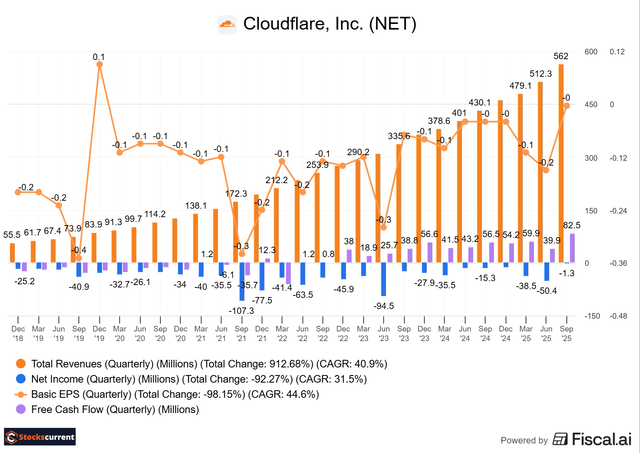

Total revenue reported was $562 million, representing a 31% year-over-year increase and surpassing the consensus by $17 million.

Source: Fiscal.ai

Cloudflare began the year by outlining its strategy to drive accelerated growth. That’s why we continue to see growth in revenue, customer count, and headcount.

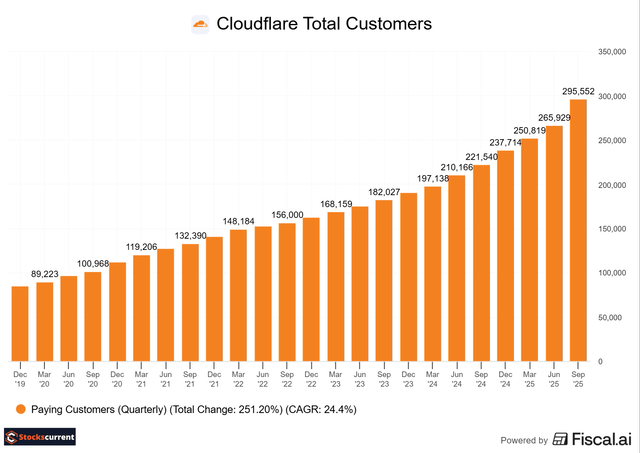

Cloudflare reported a total of 296,000 paying customers, representing an addition of over 30,000 paying customers quarter-over-quarter (+11%) and a year-over-year increase of 33.40%. There were 4,009 customers with ARR (Annual Recurring Revenue) exceeding $ 100,000, representing a 22.78% year-over-year increase. Those are strong numbers.

Source: Fiscal.ai

Revenue contribution from these large customers increased to 73% of total revenue during the quarter, up from 67% in the second quarter of last year.

Cloudflare’s management team again saw particular strength with the largest customers for four consecutive quarters, those that spend over $1 million and $5 million annually. The management team confirmed that the new pipeline attainment exceeded expectations and grew at the fastest rate in more than two years.

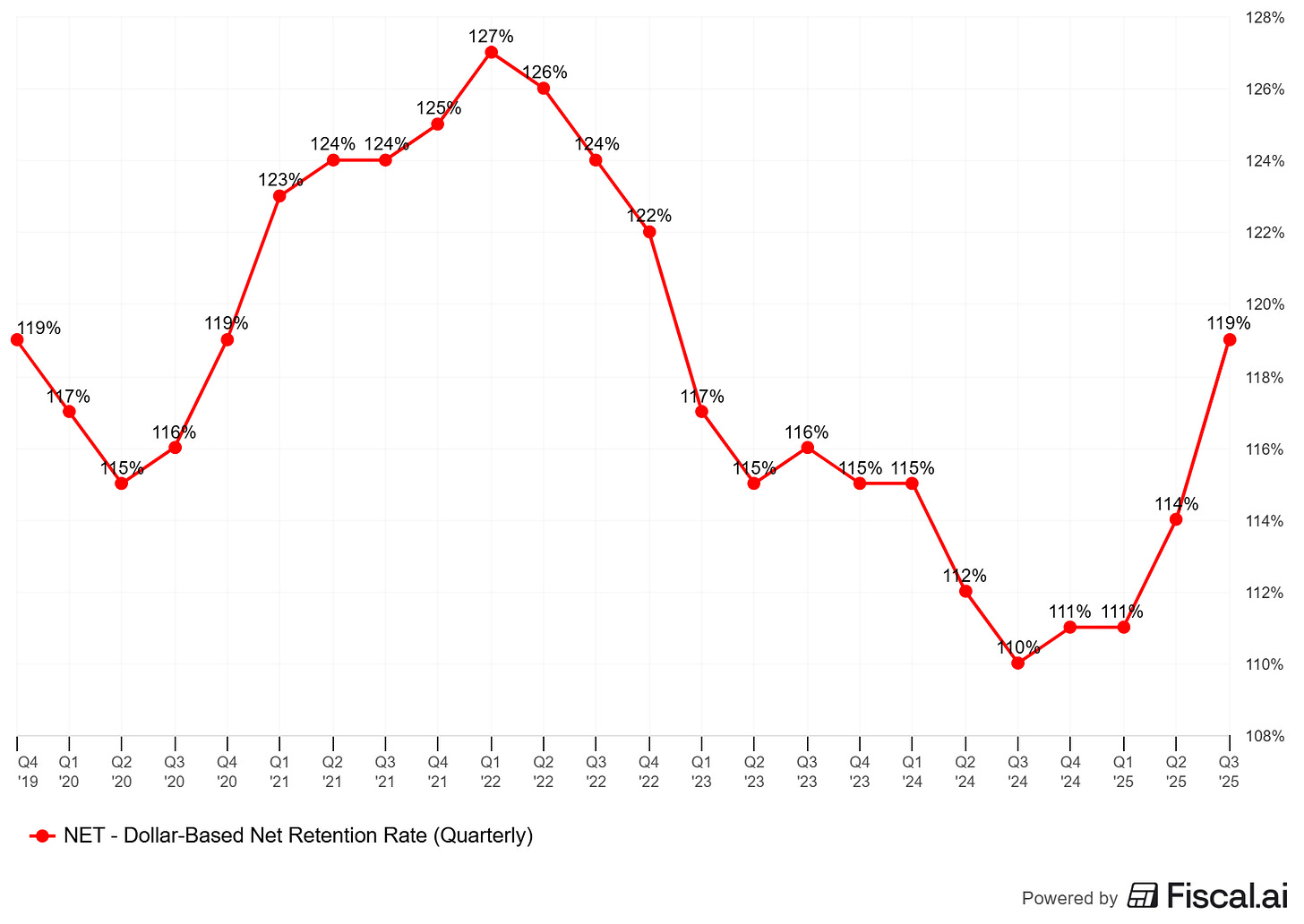

The dollar-based net retention rate has increased to 119%, up from 114% in the previous quarter. In the last quarter, we saw it tick up, but this quarter confirmed the upward trend. There was a downward pressure on dollar-based net retention as the management team rolled out the pool of funds system. As those pools are now getting consumed, you can see the dollar-based net retention is ticking back up.

Source: Fiscal.ai

The company posted an operating profit of $85.9 million, representing an operating margin of 15.3%, and generated free cash flow of $75 million during the quarter, exceeding expectations. The momentum continued into Q3 2025.

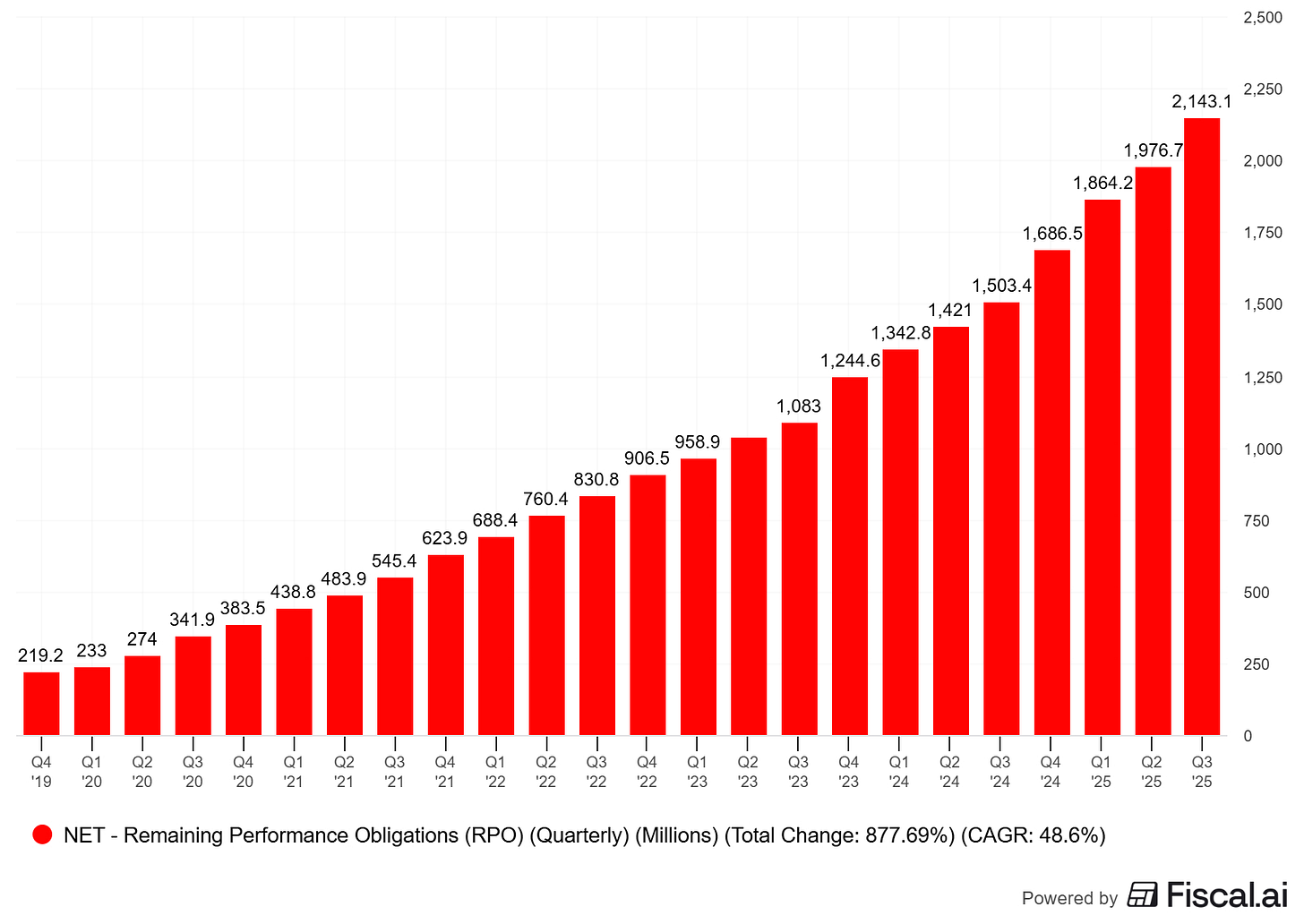

Remaining performance obligations, or RPO, totaled 2.14 billion, an increase of 8% sequentially and 43% year-over-year. The current RPO was 64% of the total RPO.

Source: Fiscal.ai

The gross margin was 75.3% within the management’s long-term target range of 75% to 77%.

Cloudflare’s non-GAAP income from operations was $85.9 million, or 15.3% of revenue, compared to $63.5 million, or 14.8% of revenue, in the third quarter of 2024.

GAAP loss from operations was 37.5 million, or 6.7% of revenue, compared to the loss of 30.8 million, or 7.2% of revenue, in the third quarter of 2024.

Non-GAAP net income was $102.6 million, compared to $72.6 million in the year-ago quarter. Non-GAAP net income per diluted share was $0.27, compared to $0.20 in the third quarter of 2024.

Cloudflare’s GAAP net loss was $1.3 million, compared to a loss of $15.3 million. The losses are decreasing and are close to being in profit. GAAP net loss per share was $0 (breakeven), compared to $0.04 in the third quarter of 2024.

Cloudflare reported a free cash flow of $75 million, 13% of revenue, compared to $45.3 million or 11% of revenue in the same period last year.

Source: Fiscal.ai

Guidance

Management guided revenue between $588.5 million and $589.5 million, representing a 28% increase. Non-GAAP operating income is expected to be between $83 million and $84 million, which translates to non-GAAP EPS of $0.27.

Full-Year 2025 Outlook

For the full year, management guided revenue to be between $2.142 billion and $2.143 billion, up from $2.113 billion to $2.115 billion in the last quarter. Non-GAAP operating income is expected to be between $297 million and $298 million, up from $284 million and $286 million from last quarter, which translates to non-GAAP EPS of $0.91.

The company increased the full-year guidance and is showing strength in the go-to-market strategy and with big customers. The management team also confirmed that the new pipeline attainment exceeded expectations and grew at the fastest rate.

On the investor day, the management team set the goal of achieving $5 billion in annualized revenue by the fourth quarter of 2028.

CFO Thomas Seifert mentioned:

We expect to reach a $3 billion annualized revenue rate in the fourth quarter of 2026 on our journey to $5 billion and beyond.

Highlights from the conference call

Here, the free part ends. But you may want to upgrade to paid.

If you do, you will get:

✅ Deep insights through quarterly earnings deep dives

✅ My complete portfolio (with every transaction)

✅ The Quality Score and valuation updates every quarter.

✅ Access to our private chat group where I (or other Multis) can answer your questions.

✅ Best Buys Now (outperforming the market by 30% over 3 years!)