Duolingo: The Most Misunderstood Opportunity In Years

Ignore it now, kick yourself later

Hi Multis

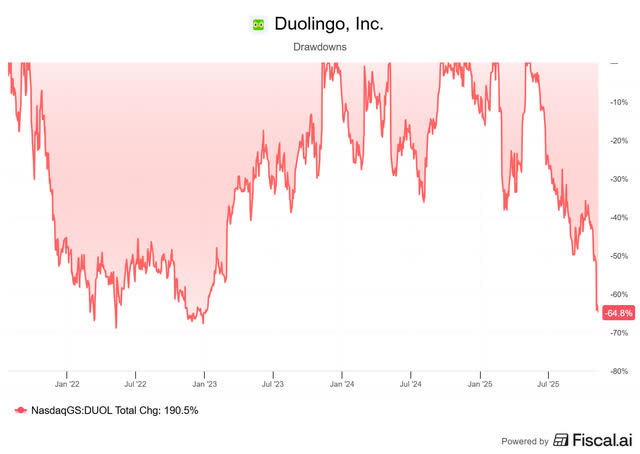

I understand that some of you may be worried about Duolingo. This is the reason.

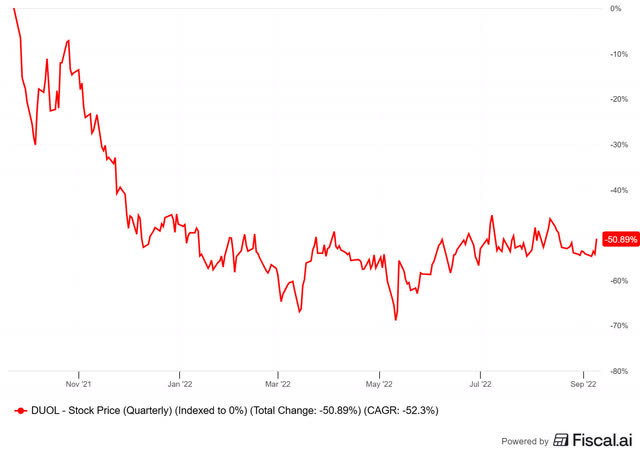

But when I picked Duolingo, the stock traded at $93 and it was down 50% from its top just a year before.

So, this is not new.

Now, how do we know if this is an opportunity or a trap?

Therefore, we analyze the earnings, update the Quality Score and look at the valuation.

And that’s exactly what this article is meant for.

First up, the earnings.

Zack will take those. Take it away, Zack!

Hi all

Your fellow multi Zack is back. This time I have the “privilege” of reporting Duolingo’s Q3 2025 earnings which resulted in the largest single day decline in the history of becoming a public company.

I know you have questions, especially after the price action, so let’s get right into it.

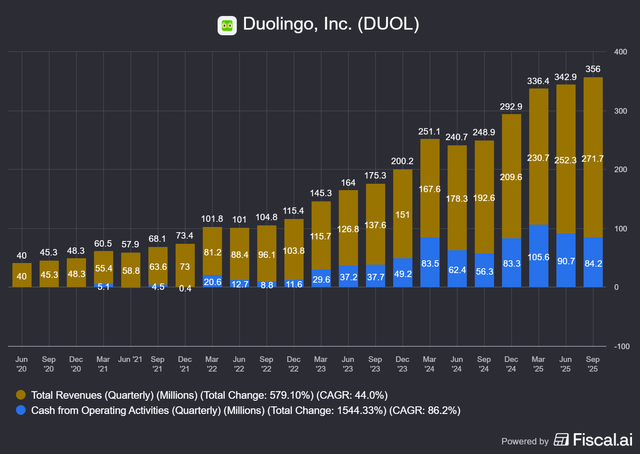

Financial Metrics

At first glance, the numbers look great:

Revenue: $271.7M, up 41% YoY, beat estimates by 4%

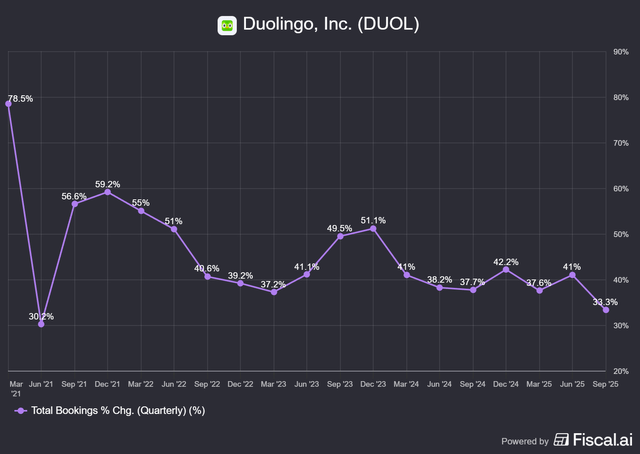

Total Bookings: $281.9, up 33% YoY

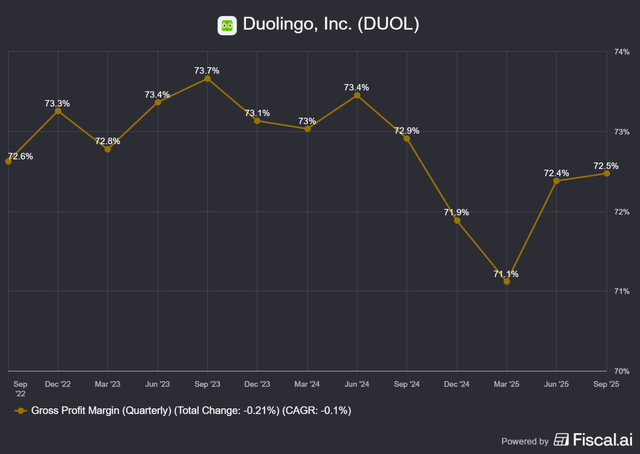

Gross Margin: 72.5%, roughly flat YoY and QoQ

Net Income: $292.2M versus $23.4M LY

Adjusted EBITDA: 80M (29.5% margin) versus $47.5M (24.7% margin) LY

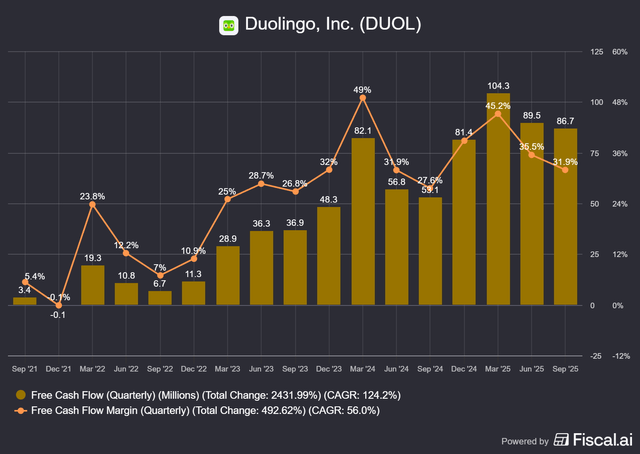

Free Cash Flow: $77.4M (28.5% margin) versus $51.2M (26.6% margin) LY

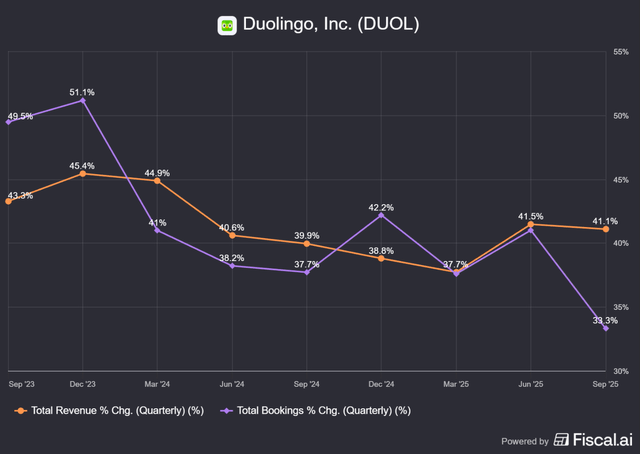

Revenue growth continues its strong trend, with a 41% increase and another estimate beat.

Bookings grew 33%, a notable step down from the previous quarter.

Quick reminder: bookings represent money paid upfront, even if the service has not been delivered yet. Revenue is recognized as the service is delivered. For example: if you pay $120 for a yearly subscription, bookings show $120 upfront, while revenue recognizes $10 per month.

Bookings give us insight into future revenue. While revenue is still growing at more than 40%, the slowdown in bookings tells us revenue could decelerate in the next few quarters. This is something to keep an eye on. I will revisit this later.

Gross margins stayed flat, which is a win. Margins have been pressured recently because AI usage in the Max tier consumes a significant number of tokens. Flat margins show increased efficiency and lower AI costs per user.

Net income was inflated due to a one-time non-cash tax adjustment. Adjusted EBITDA removes this noise and shows a clean 70% increase YoY. The company continues to flex operating leverage.

Free cash flow remains strong:

The company has generated positive free cash flow for almost three years with rising margins. For a high-growth company, consistently retaining more than 30 percent of its cash every quarter is impressive, as having more cash allows for continued resilience and optionality.

More KPIs

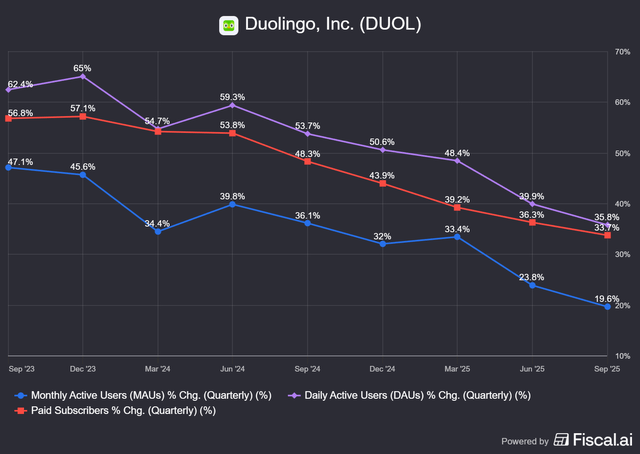

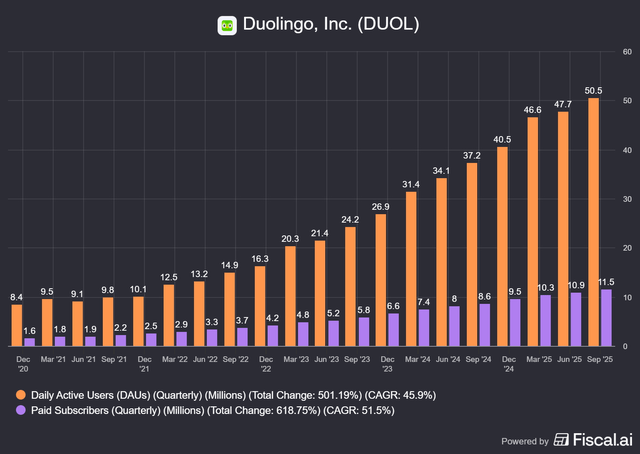

Daily Active Users (DAU): 50.5M, up 36% YOY

Monthly Active Users (MAU): 135.3M, up 20% YOY

Paid Subscribers: 11.5M, up 35% YOY

Paid Subscriber Penetration: 9.0% versus 8.5% LY, flat QoQ

For these engagement metrics, slowing growth is normal. You cannot grow 40 to 50 percent forever. The key thing to watch is whether growth significantly decelerates quarter over quarter. That did not happen this quarter.

Daily Active Users are the most important metric because DAUs show real engagement and retention. DAU growth dropped from 39.9% in the previous quarter to 35.8% in this one, which is acceptable. For the first time ever, Duolingo surpassed 50 million DAUs.

If you recall, there was some social blowback earlier in the year. An internal memo from Luis Von Ahn was leaked. In the memo, he emphased that Duolingo is an “AI-first” company. Some online fans found that disturbing. As a result, Duolingo paused its signature unhinged posts to focus on improving brand sentiment. Fewer unhinged posts led to less viral hits and lower user engagement.

This quarter, Duolingo started posting unhinged content again, which should help with increasing DAUs moving forward. Quote from management:

On the other side, just like we said last time, we paused all the unhinged posts in our social media for a bit because we were listening to our community and trying to build brand love.

And when we don’t post unhinged things, that you know, basically, our posts were much less likely to go viral and, like, because of that, that did have an impact on DAU growth. The good news is that over the last few weeks, we have started the unhinged posts again in our social media accounts.

Source: Duolingo Instagram

Why the Stock Dropped

This statement from CEO Luis Von Ahn sums up the reason:

“In Q3 we decided to shift the balance towards longer-term initiatives.”

Management focuses on three core areas:

Monetization: revenue, bookings, profit

User Growth: DAUs, retention, etc.

Teaching: course quality and engagement

Starting this quarter, Duolingo is prioritizing improving teaching and user growth over monetization.

Why not focus on all at one time? Luis Von Ahn gives an example of how an initiative pushing one metric may be at odds with another:

If right now, a free user gets 25 energy units at the beginning of the day, and every exercise that they do spends one unit. If we were to do an experiment that decreases that from 25 to say 24, that’s one fewer unit of energy per day. We know that would make us more money.

That it’s just us because more people run out of energy, so more people end up, you know, wanting to pay to subscribe.

However, we also know that would decrease daily active users because it would frustrate some of the users.

Improving monetization comes at the tradeoff of jeopardizing user growth.

The shareholder letter elaborates further:

We’re doing this now because we want to keep growing users for a long time, and because of our increasing conviction that AI can fundamentally change what’s possible in how we teach. If we develop an app that is more engaging than, and teaches as well as, a personal tutor across multiple subjects, we think we’ll become a much bigger business in the long term.

As long-term investors, this is what we want. They are playing for the bigger prize and solidifying their competitive position in this space, not cashing in too early while there is still even more opportunity available leveraging AI.

But analysts usually hate this. If you are a shareholder of, let’s say, Mercado Libre, you have seen negative reactions there too, while the company has built out a top-notch distribution network with the investments. But Duolingo went further and brought on analysts’ worst nightmare: there is no clear timeline.

Luis Von Ahn on the conference call:

“As to how long this is going to take, this is, you know, it’s an interesting question. I mean, I think you’re asking something to the effect of, like, well, is this gonna hurt bookings, and is this gonna hurt bookings forever? You know, I don’t think that’s the case. It’s just going to take some time for us to see financial results over these long-term investments that we’re doing.”

Markets hate uncertainty, and the deceleration in bookings growth (the lowest since 2021) adds fuel to the fire.

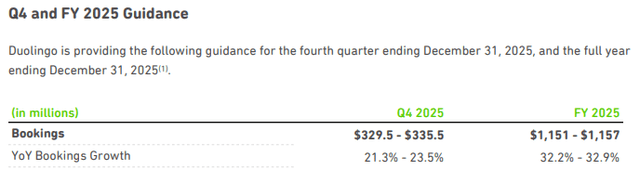

To pile on, Q4 bookings guidance calls for just 22% growth.

Combine that with the noise around the supposed “AI competition” (OpenAI language apps and Apple AirPod translation features), and investors are spooked. Kris has already addressed the AI threat, so I’m just going to copy it here:

The “AI will kill Duolingo” thesis is completely wrong. People miss what makes companies successful: it’s not just the product, it’s distribution, marketing, UI, customer insights, and everything else. Duolingo nailed all that.

Look at e-commerce. Millions of shops existed, but only one Amazon. Why? Great founder/CEO (Jeff Bezos for Amazon, Luis von Ahn for Duolinogo), understanding what customers actually want and need. Duolingo gets this.

Sure, I’m sure better language apps exist content-wise. But if you don’t stick with the lessons, you learn nothing. And you know what? I don’t even know these competitors.

Yes, I looked them up during my research, when I picked Duolingo at $93, but I forgot them, even if I tried a few. Ask people in the street if they know Duolingo and many will. Duolingo made learning fun, addictive, and social. When your friend says “Hey, don’t forget your lesson today,” you actually do it, so you don’t break that friend streak. Way more powerful than some random algorithm trying to convince you.

On top of that, Kris also posted this on X:

Luis von Ahn addressed the issues many investors struggle with head-on. This is a long quote, but I think it’s interesting enough to read it completely, as it debunks the bear cases very clearly:

You know, the we’ve said it before. The main thing that that we do really well, not only do we teach well, but the main thing that we do really well is keep people engaged. And in order to learn a language, you need to be engaged for years.

Really, it takes years to learn a language coming every day, and we need to keep you engaged actually doing it. And not only that, we also need to have curriculum for years for you to do that.

So, you know, with ChatGPT, can go there and can ask it to teach you a few words here and there, but, you know, it’s not like you can have really curriculum for years, that that that teach that. So we’re not particularly worried about that aspect.

And then the other thing that people, you know, have said that they’re worried about is, oh, well, nobody’s gonna wanna learn a language because, you know, the we’re gonna have simultaneous language translation and also not worried about that.

You know, I believe in 100% of the Google IO conferences over the last ten years, they have showcased simultaneous language translation. They do it every single year, and it’s good. It works.

But this has been happening for the last ten years, and we have not seen the desire to learn a language go down at all. In fact, it has come up. And I think the biggest reason for that is because if you look at our users, they fall into two big categories.

One big bucket is people who are learning a language as a hobby.It kind of doesn’t matter whether a computer can do that because -- they’re the same with chess, by the way. Computers are way better than humans at chess, but still we have millions of people wanting to learn chess. So it doesn’t matter if it’s a hobby.

The other big group of people that are learning a language with us are people who are learning English and they actually want to learn English. Like that is -- for them, being able to have like a phone that they have to hold out, it’s just kind of -- that’s not what they want to do. So we just -- we’re not particularly worried about that. It just so happens that people like to tweet about that. We’re not worried about it.

I believe this reprioritization is a position of strength, not weakness. Their full-year bookings guide, set earlier, was maintained. Yes, growth is slowing, but slowing is not shrinking. All core metrics are still growing way more than 20 percent.

Other Highlights

The Max tier (the highest-cost plan) is now 9% of active subscribers, up from 8% last quarter.

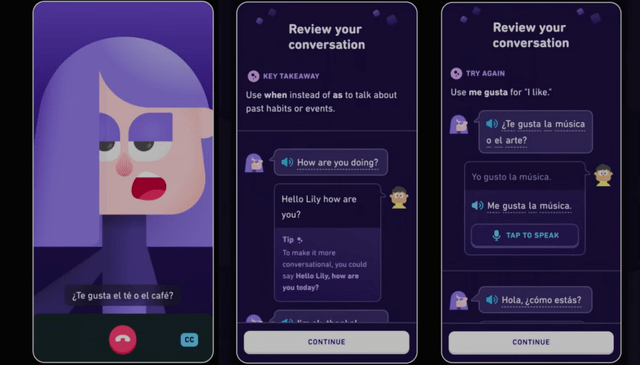

Source: Duocon 2025

Max has doubled bookings YoY, although management admitted adoption is not where they hoped. They continue to improve it with bilingual guided video calls to reduce friction for early learners.

ARPU (average revenue per user) has risen mid-single digits each quarter this year, driven more by Max mix than by price points, and they will keep testing pricing up and down, including lighter, lower-priced packages.

They are also continuing to expand Max to more countries, highlighting China which is the fastest growing country but currently hampered by regulations:

“We are, of course, doing very well in China. I believe it’s our fastest growing country. It is our second largest country in terms of DAUs and growing fast. It’s still not, you know, that large of a fraction of our business. It’s about 6% of our business at the moment, but it is growing and it is growing very fast. And the engagement is very high. Retention is high. Max in China is being tested at the moment.

The chess course has emerged as the fastest-growing course, surpassing math and music in user adoption and exhibiting slightly higher retention than language learning. Player-versus-player (PVP) functionality is planned to be available to every device in the coming months.

More Insight

The post-earnings price drop was tough to watch. Could this be the beginning of weakening fundamentals? Anything is possible. Future investing results are based on probability, not certainty.

Do you trust management’s ability to deliver results in the long term and believe in their reasons for doing so?

Or do you think their actions are a knee-jerk reaction to their falling growth and it will continue to degrade quarters ahead?

I choose to look at history as my guide.

Pulak Prasad, in What I Learned About Investing from Darwin, argues that history is a better guide than forecasts.

Forecasts rely on narratives and assumptions. History reveals real patterns of execution and management quality.

Taking the perspective of history, let’s look at a couple of financial and KPI metrics for the past 5 years:

Based on past results, management has a history of executing quarter after quarter. Short-term deceleration may happen, but I trust management’s focus on long-term value creation.

Also, Kris shared this in the Overview Of The Week last Week:

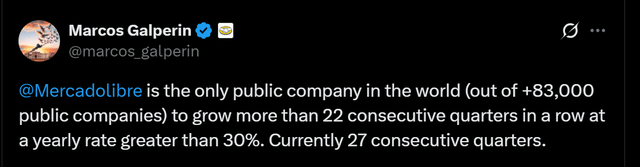

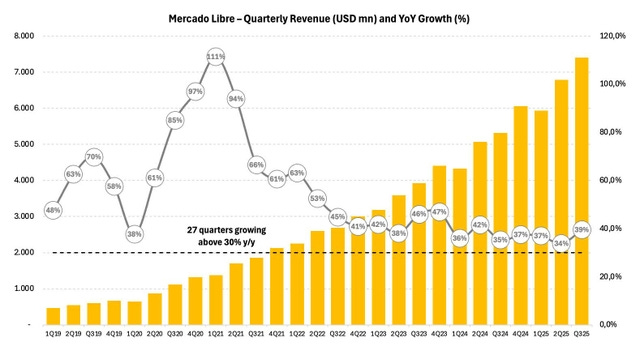

Marcos Galperin, the founder and (still) CEO of Mercado Libre (until the end of this year), posted this on X.

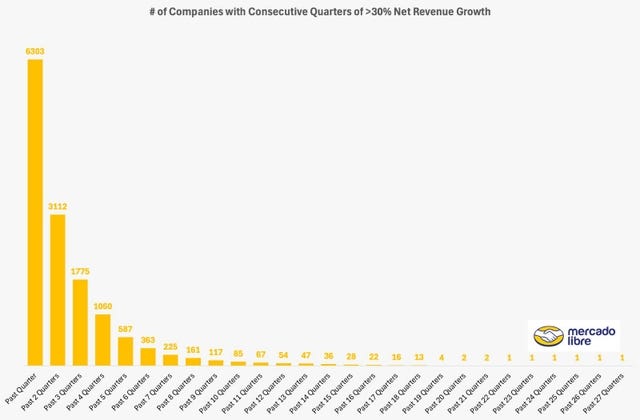

That’s fantastic. Almost 7 years of 30%+ revenue growth. Something very important in investing is the CAP or the Competitive Advantage Period. I think that of Mercado Libre is very long. I have said this before and I will repeat it here: I could see Mercado Libre become the first trillion+ company in Latin America.

Now, you may wonder what the other outperformers are. Ryan Reeves looked it up. He found just 2 other companies with a streak that’s still running. Not a coincidence, but these two are also Potential Multibaggers (and big winners since they were picked). The names? Hims & Hers and Duolingo. Both have 22 quarters of 30%+ growth.

Before the third quarter 2024, Cloudflare had 26 quarters in a row and recently it has reaccelerated to 30% revenue growth again.

One company blew it out of the water until Q4 2021: ServiceNow, with 39 quarters of 30% revenue growth.

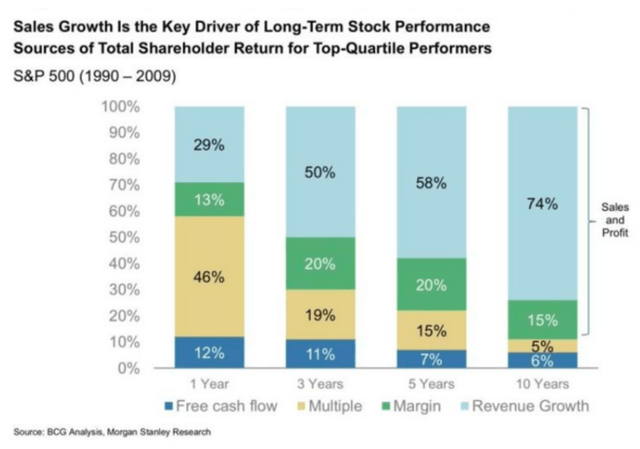

And don’t forget this chart.

The conclusion of this chart is simple. Revenue growth is by far the most important contributor to long-term successful investing.

So, worldwide, Duolingo is the only company to have a streak of 22 consecutive quarters of 30%+ revenue growth, alongside Hims & Hers, and trails only Mercado Libre. From 83,000 companies.

Sure that streak could break. It broke for Cloudflare after 26 quarters. But it reaccelerated revenue growth back above 30% recently.

But you don’t get 22 consecutive quarters of 30%+ revenue growth by coincidence. It shows that this is a great company.

With that, I hand it over to Kris for the Quality Score. I’m curious: would it drop? And how about the valuation?

Here, the free part ends.

But what if this time, you finally act?

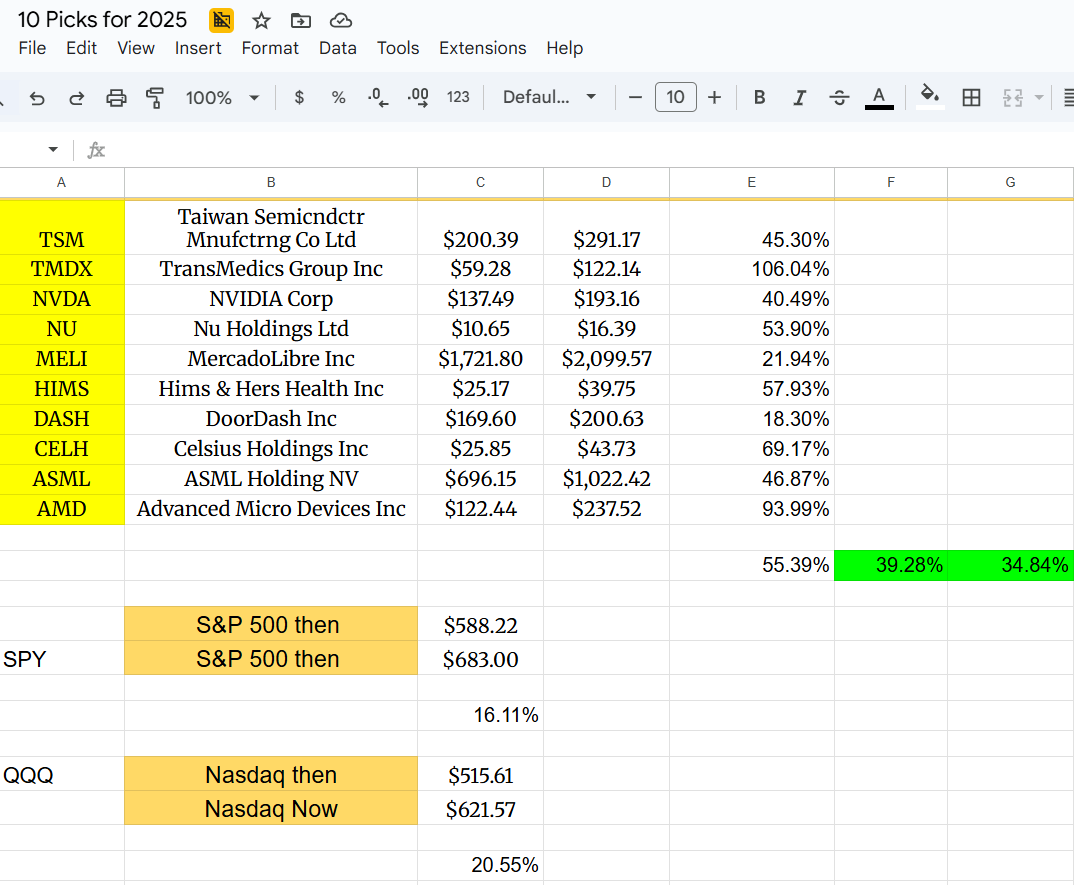

You missed so much already. My Best Buys Now beat the S&P 500 by 30% per stock on average. My Best Stocks for 2025 are up 55.39%, beating the S&P by about 40% and the Nasdaq by 35%.

As a Multi, you see this before you read the results here so many months later.

You can buy Duolingo based on the title of this article, but how convinced are you really? That’s where Potential Multibaggers helps. You will get:

✅ Deep insights through quarterly earnings deep dives

✅ My complete portfolio (with every transaction)

✅ The Quality Score and valuation updates every quarter.

✅ Access to our private chat group where I (or other Multis) can answer your questions.

✅ Best Buys Now (outperforming the market by 30% over 3 years!)