Hi Multis

David here with the earnings analysis on Roku (ROKU).

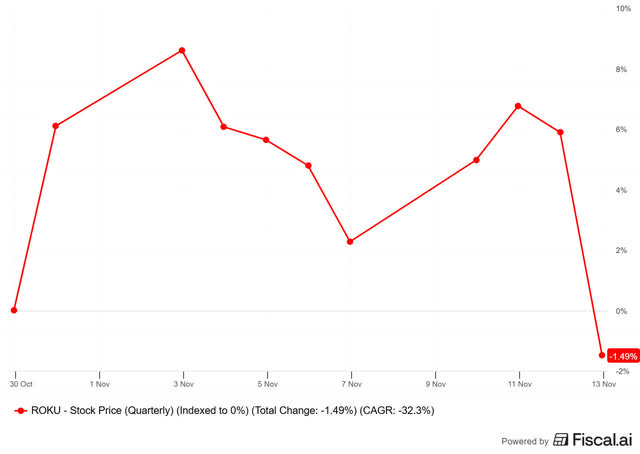

Roku released its quarterly earnings as one of the first Potential Multibaggers on October 30. Analysts showed mixed reactions, and in premarket trading, the stock initially fell 7% to $88 but then the stock shot up. It dropped again and now dropped further, along with the general market. It was a rocky ride for sure.

The reaction is understandable; stocks frequently swing after earnings reports. Fortunately, we are long-term investors. Let’s review the results to see whether this modest pullback is justified. Afterward, Kris will follow up with the updated scores. Enjoy!

Revenue: BEAT

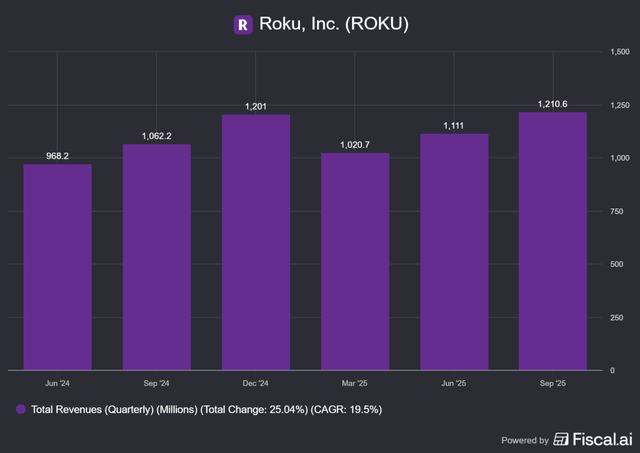

Roku reported $1.211 billion in revenue, up 14% year over year (YoY, from now on). Analysts had expected $1.1 billion. When reviewing quarterly earnings, I like to compare them with prior years to adjust for seasonality. Here, we see that Roku continues to expand revenue at a healthy pace.

EPS: BEAT

Analysts expected $0.09 per share, but Roku delivered $0.16 per share, versus a loss of $0.06 per share a year ago, beating expectations. This marks Roku’s fourth straight quarter topping EPS expectations.

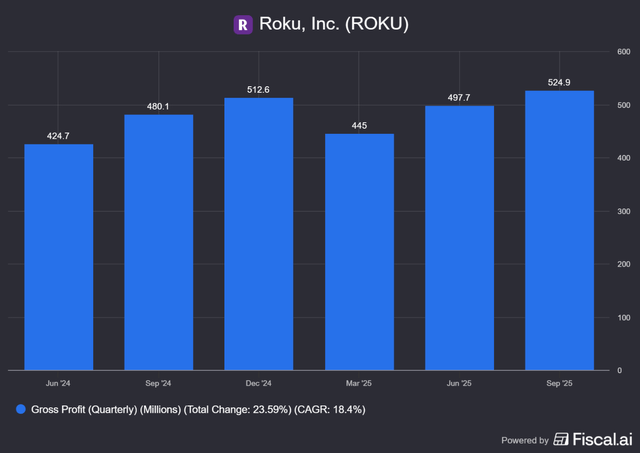

Gross Profit

Gross profit rose 9% YoY to $525 million.

Net income stayed positive for the second straight quarter. A year ago, Roku posted a $35.8 million loss; this quarter, it earned $24.8 million.

Revenue Breakdown

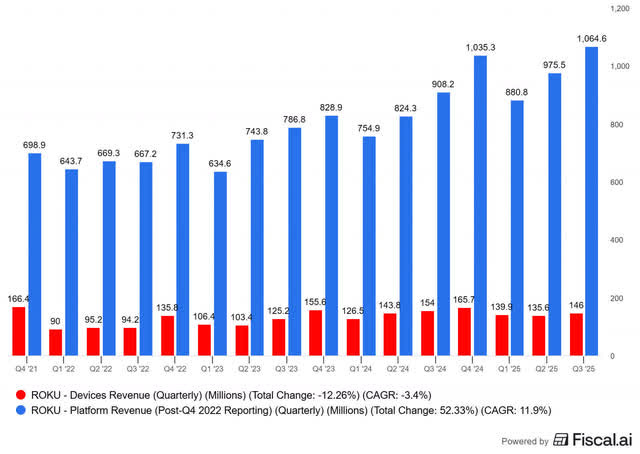

Let’s take a closer look at Roku’s revenue breakdown. Roku operates two main segments: Platform and Devices. Platform revenue reached $1.065 billion, up 17% YoY. Device revenue slipped 5% YoY to $146 million.

Focusing on Platform revenue, Roku slightly exceeded its own outlook. This segment includes advertising sales, content sales, and shared subscription revenue. The gross margin came in at 51.5%, down from 54.2% a year earlier, reflecting Roku’s focus on revenue growth over margin expansion. Platform gross profit rose to $547.8 million from $491.8 million a year ago, a lower margin but higher profit.

Video ad sales grew, in line with expectations and management’s Q2 commentary. Management plans to deepen third-party DSP integrations, as noted in the shareholder letter:

The share of Roku video impressions executed programmatically continues to rise. We’re also seeing strong momentum in Roku Ads Manager, our self-serve platform that services small and medium-sized businesses (SMBs) and performance marketers. The growth of Ads Manager is largely incremental and further diversifies demand.

These DSP integrations broaden Roku’s advertising capabilities.

A key challenge ahead will be measuring the impact of its advertising initiatives. To that end, Roku is adding tools like Appsflyer and Ads Manager, enabling them to measure their impact better.

Roku must also demonstrate strong results and prove its ability to reach advertisers’ target audiences. Roku already outperforms traditional TV, but competition for ad dollars remains fierce. Staying relevant will be one of the keys here.

Roku appears well-positioned to deliver as content offerings expand. For example, the Frndly acquisition and the continued expansion of The Roku Channel illustrate this trend.

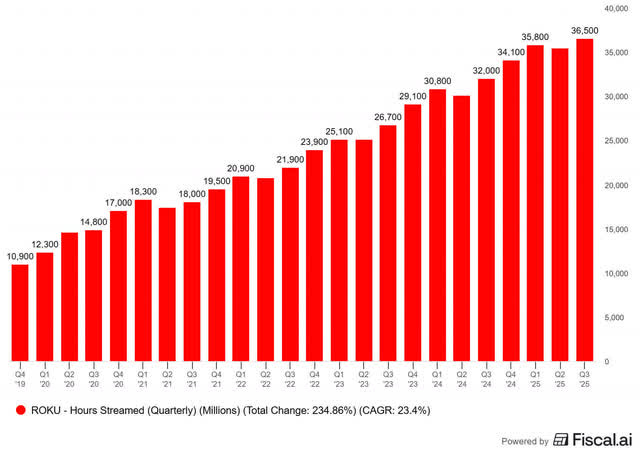

Total streaming hours rose 12% YoY to 36.5 billion, underscoring growing engagement.

So far, the revenue story looked strong. Roku continues to add features, boost streaming hours, and grow platform revenue. So why is overall revenue not stronger?

The answer might be found in the Devices segment. Device sales fell 5% YoY to $146 million from $154 million. Device gross margin decreased to -15.7% from -11.7% a year ago.

Suppose you are on Roku’s management team tasked with charting the next steps for Devices. You have a clear view of the current business and are well-versed in the company’s strategy. You want to monetize what you have been building, aiming to have a Roku device in every household, or even more. Data shows that once people own a Roku device, they tend to use it, resulting in increased ad revenue. What would you advise your fellow management team?

Consider a strategy from the past that remains relevant today. A strategic model called the “razor-and-blades”. The model was made famous by Gillette. Sell razors to as many people as possible, even with low or negative margins, and generate consistent profits from accessories. For Gilette, this was, of course, the blades.

We can see this clearly in the management message:

The monetization of our platform is built upon our significant scale, which we continue to grow by distributing the Roku OS through the sale of streaming devices. In Q3, Devices revenue was $146 million, down 5% YoY, and gross profit was ($23) million, representing gross margin of (16%), which was inline with our outlook.

Roku mentioned that they are currently in more than half of broadband households, and I see no reason why they would not sacrifice their margins on devices to boost their potentially higher platform revenues in the future.

Upon researching the prices of Roku devices, I noticed that they were indeed significantly lower compared to a few months ago. However, we are now already seeing holiday expenditures for Thanksgiving, Halloween, and Christmas. Roku’s management is working with TV OEMs (Original Equipment Manufacturers) to enhance the experience they can offer viewers. Combine this with the already lowered prices, and they want to be included in shopping carts before the holiday rush begins.

I see no reason why Roku’s management wouldn’t continue this strategy for the rest of the year and might even lower the prices further. In Q4 last year, the margins on their devices dropped even further to -47.4%, likely due to the holiday season and people wanting to gift Roku devices to their loved ones. I recall a similar story from my past, where I received a comparable gift from a friend: “With these prices, it would be stupid not to own one now. So I gifted you one!”

Now, going back to the earlier question, you are part of the management team. Would you make any different decisions?

Operating Expenses

Operating expenses held steady YoY at $515.4 million and declined sequentially. General and administrative costs fell both YoY and QoQ. Sales and marketing spending was flat YoY but should rise in Q4 with holiday campaigns, similar to last year.

Roku posted positive operating income of $9.5 million, its first in years.

Full year guidance

Roku raised its full-year Platform revenue outlook to $4.11 billion, from $4.075 billion.

My Take

Investors may have hoped for a larger earnings beat and more upbeat guidance.

The main drag was weaker-than-expected device revenue and margins. Management may have cut prices too aggressively. Part of investors’ concern is that they may have overestimated their opportunities now and might need to lower prices even further in Q4 to encourage more people to buy Roku’s products during the traditional holiday period sales.

From a strategic standpoint, lower device pricing fits Roku’s long-term goal of platform expansion. In Roku’s overall strategy, it makes sense to lower device prices; you want to have a device in every household.

Did they lower prices too early? Possibly, but I view it differently. The reason is that Platform has a much higher impact and margins.

In short, I’m not worried about their devices or the margins they make here; their main goal is to reach more households and potential viewers on the Roku platform.

What I do expect in the coming months is an increase in platform growth, driven by the sale of more devices and greater household penetration.

Don’t forget that Roku generates significantly more revenue from Its Platform than from Devices.

A key metric is total hours streamed, which came in at 36.5 billion, slightly below the 37 billion analysts expected.

We continue to see this metric increase every quarter. Don’t look quarter-over-quarter, as there’s seasonality in TV seasons.

Overall, I remain neutral on Roku from these earnings. They look good, but are they good enough?

Now, over to Kris with the Quality Score and the valuation!

Here, the free part ends. But you may want to upgrade to paid.

If you do, you will get:

✅ The rest of this article.

✅ Deep insights through quarterly earnings deep dives

✅ My complete portfolio (with every transaction)

✅ The Quality Score and valuation updates every quarter.

✅ Access to our private chat group where I (or other Multis) can answer your questions.

✅ Best Buys Now (outperforming the market by 30% over 3 years!)