Overview Of The Week 18: A FREE Reverse DCF Model For You!

And of course much more about the markets and your favorite stocks!

Hi Multis

What happens in a week now, often happens in a year. You probably know I have a language background, so I had to think of this Charles Dickens quote from A Tale of Two Cities. Just this week alone, both extremes were there:

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way--in short, the period was so far like the present period that some of its noisiest authorities insisted on its being received, for good or for evil, in the superlative degree of comparison only.

I look to the classics to express my feelings when things get extreme.

But it's equally important not to let extreme things let our emotions swing to extremes. Just follow the plan.

We saw that again this weekend when chips and other computer-related elements were exempt from tariffs (and then maybe not completely, can you still follow?) Things change so fast now. Don't get distracted by the noise and just keep investing.

Articles in the past weeks

This is the fourth article this week.

In the first article of this week, I tried to explain the game behind tariffs. You can read that article here.

In the second article this week, I argued that Roku is cheap, but does that make it a buy?

I also analyzed whether Shopify is attractive now, and in the third article this week, you can read the answer.

Memes Of The Week

The memes keep coming. Bill Ackman got his very own bottom indicator. Up to now, it seems to work again.

This meme also made me laugh.

Here's another one about the dropping markets:

Some people really care about foreign currency rates. Or do they?

This meme shows how the on-off tariffs create uncertainty. Of course, this is a joke, but the best jokes have a bit of truth in them.

The last one for this week points out another pain point.

Interesting Podcasts Or Books

Last week, I mentioned the book Brain Energy. I finished it this week.

Multi Gorki pointed out that there was a podcast with Dr. Palmer in Andrew Huberman's podcast. It was an interesting talk that lasted more than three hours, but I would still recommend reading the book first.

This is the link to the podcast.

FREE INVERSE DCF MODEL

In my articles about Roku and Shopify, I used a reverse DCF model. A few Multis asked me to share the model, so they could use it themselves.

You can get it for free!

Important: You should make a copy (file ==> make a copy).

The markets in the past week

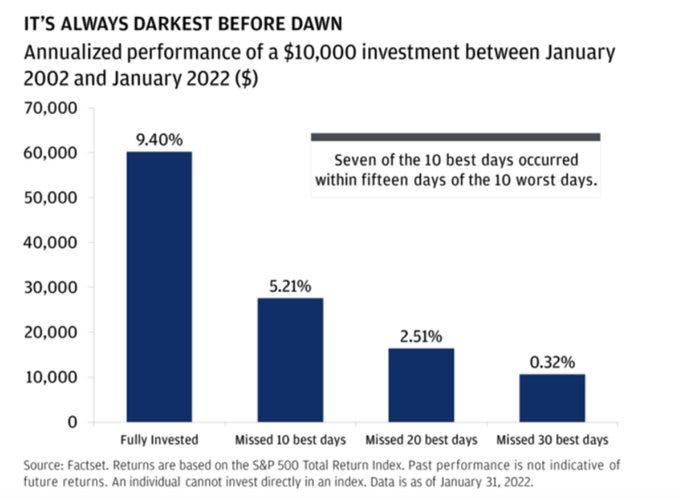

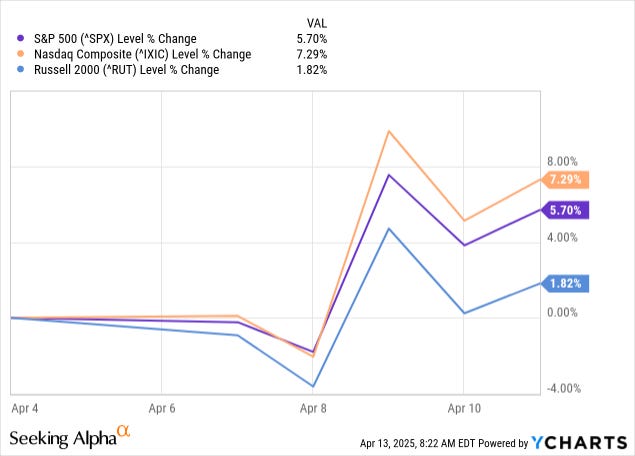

After the big drops, this week we had a big surge. This shows again that the biggest upmoves come after the biggest drops and it's impossible to time this.

You should never forget about this graph.

If you just missed the 10 best days, your returns already suffer. And still, so many try to time the market. Now, if you miss the 10 worst days, you have similar results. But the difference is that to miss the 10 worst days, you should time perfectly. Each and every time. That's totally impossible. Not missing the 10 best days is simple: just stay invested.

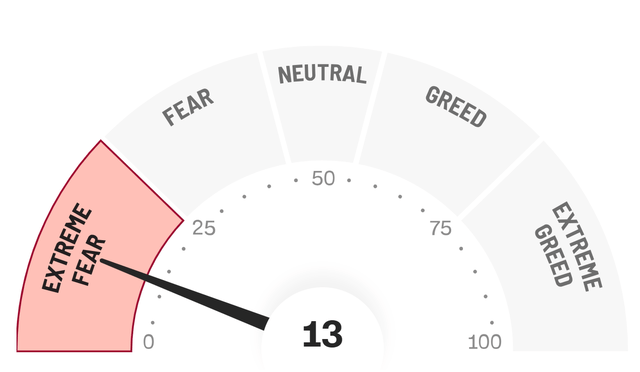

The Greed & Fear Index remained in Extreme Fear, but it's up from 4 to 13.

Quick Facts

1. Historic Up Day

CNBC shared that Wednesday was the 3rd-biggest one-day gain since World War II. If you missed that day, ouchie.

2. Don't time (part two)

Suppose you bought 'the dip' too early. Is that a problem? No, it's not. Normally, you would have 10% returns per year. If you bought after a 10% drop, you have, on average, 11% per year. Sometimes, investing can be delightfully simple.

Your returns in the first years will generally be even better, although there are no guarantees, as with everything in investing.

(H/T to Thomas Chua for pointing out this Oakmark graph)

The Returns of the Potential Multibaggers

This week should be better than the last few weeks, to use an understatement. Let's see how the Potential Multibaggers did this week.