Hi Multis

I'm updating the earnings, quality scores and valuations of the companies I had not covered yet. Next up: Shopify (SHOP).

Shopify's Q4 Earnings

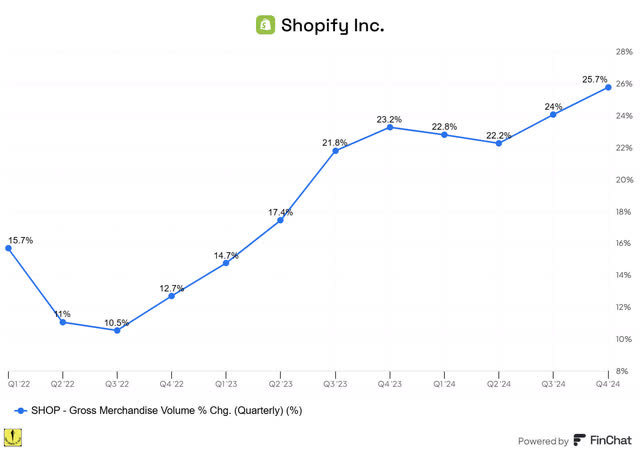

Shopify's Q4 2024 earnings showed strong growth, with revenue up 31.3% to $2.81 billion and GMV up 24% to $94.46 billion. GMV is a crucial number for Shopify. GMV stands for Gross Merchandise Value and it's the dollar value of everything sold on the platform. 24% is the highest GMV growth in the last three years. Here again, we can visualize this with Finchat.

(If you want to make these graphs easily as well, this link gives you a 15% discount)

You see that revenue is up quite a bit more than GMV (31.3% vs. 25.7%) and that's exactly what you want to see. It means Shopify can sell more of its services, take a higher take rate, and provide value for merchants who want to pay that.

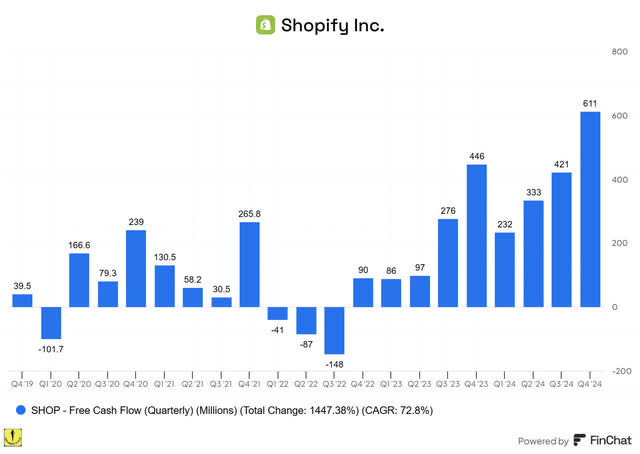

On an annual basis, revenue grew 26% to $8.9 billion, with a free cash flow margin of 18%, up from 13% in 2023. This shows that Shopify is pairing profitability more and more with growth. This chart perfectly shows you how much better cash flows have become since Shopify sold the distribution specialist Deliverr in Q2 2023, just 9 months after the acquisition.

In Q4, which is, of course, Shopify's best quarter because of the holiday season, the FCF margin was even 22%.

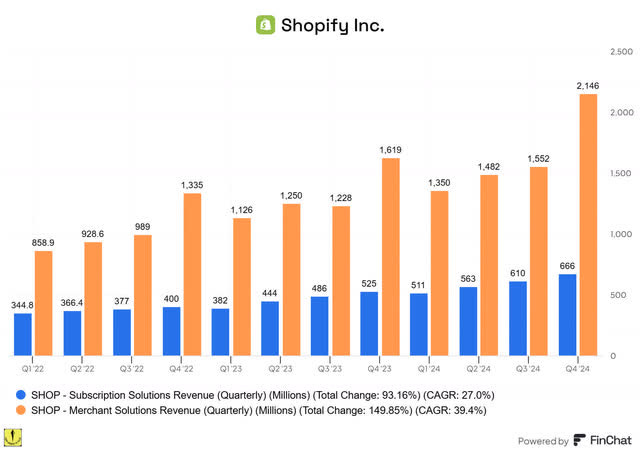

Merchant Solutions revenue grew 33% in Q4. A big boost came from Shopify Payments, which had a 64% penetration for sales or $61 billion, up 35% compared to the same quarter last year. Shop Pay processed $27 billion in GMV, up 50% versus Q4 2023. 38% of the Gross Payments Volume ('GPV') now goes through Shop Pay, up from 33% in 2023.

I know this is sometimes confusing, so I want to explain it. Shopify Payments is a payment processor that handles transactions for merchants, while Shop Pay is an accelerated checkout feature that lets customers save their details for faster purchases and offers a Buy Now, Pay Later option. I have used Shop Pay multiple times and I love it. It's as simple as Amazon's one-click buy, in my opinion.

Subscription Solutions increased 27%. That was the result of more merchants and more variable fees.

Shopify now holds 12% of the US e-commerce market share, which I find very impressive. But the company grew convincingly internationally as well, with 33% revenue growth outside North America. Europe, the Middle East, and Africa ('EMEA') was the fastest-growing international market, with 37% growth year-over-year.

The company signed deals with Reebok, Champion, Westwing, BarkBox, and FC Barcelona and others. That legendary football/soccer team was already a customer for its e-commerce site, but it expanded the deal with unified commerce and POS systems. So, that includes the brick-and-mortar shops it has (between 15 and 20).

Overall, Shopify's offline GMV grew 26% in Q4. Shopify was proud to announce something we had highlighted in the Overview Of The Week: that a recent Ernst & Young report praised Shopify POS for its efficiency, achieving 22% lower cost of ownership and 20% faster implementation.

But back online. There, Shopify partnered with Roblox, YouTube Shopping, and signed deals with PayPal, Perplexity, and Oracle.

I've stressed this before, but the power of Shopify is in its app ecosystem. The company paid out $1 billion to app developers. Over 3,000 new apps were added in 2024 and that brings the total to more than 16,000.

The Shop App saw GMV rise 84% YoY. Shop App is the app that lets you discover shops, like a portal website, almost like Amazon. There are features like personalization and cart syncing (so your cart is on different platforms).

Operating expenses as a percentage of revenue dropped to 32% in Q4 2024 from 36% in Q4 2023. That's great to see. There was even something more remarkable. Shopify reduced its headcount from 8,300 to 8,100 people.

Very important for a Potential Multibaggers pick (since May 2017) is constant innovation. Maybe you saw the leaked memo? Tobi Lütke, Shopify's founder and CEO, decided to distribute it himself this week.

You can read the full memo (it's not that long) here. But, in summary, it says that Shopify wants everyone to start using AI as much as possible. It’s not optional, it's expected and evaluations will be made based on AI usage. Want to hire people? First prove that AI can't do it.

I loved this quote from the memo.

In a company growing 20-40% year over year, you must improve by at least that every year just to re-qualify. This goes for me as well as everyone else.

Shopify already rolled out Sidekick in 2024. It's is an AI-powered assistant that helps merchants automate tasks, manage their online stores, and make data-driven decisions through a chat interface.

On top of that, it launched several more features:

Shopify Bundles: Lets merchants sell product combos with enhanced reporting and POS integration.

Customer Metafields: Custom fields to store customer info for personalized experiences.

Enhanced Shopify Inbox with AI: AI-powered messaging for instant, personalized customer support.

The company will continue to double down on AI and roll it out for its merchants.

The last thing I want to highlight is the growth in B2B (business to business). B2B GMV grew 132%, making it the 6th consecutive quarter with 100%+ growth.

Guidance

Shopify guided for "mid-twenties" revenue growth, which is their usual guidance if they give it at all. For FCF margin, they expect it to be "mid-teens" compared to 12% in Q1 2024.

Conclusion

Shopify's Q4 2024 earnings were very strong. I'll just let Harley Finkelstein, Shopify's President, do the talking here:

This is the best version of Shopify that I've seen in 15 years since, well, since Tobi hired me.