Hi Multis

We still have to go over some earnings from the previous quarter, which I haven't gotten updated yet. We’ll start with Roku (ROKU). I'll cover the earnings (shortly), update the quality score (shortly) and dedicate quite a bit of space to the current valuation.

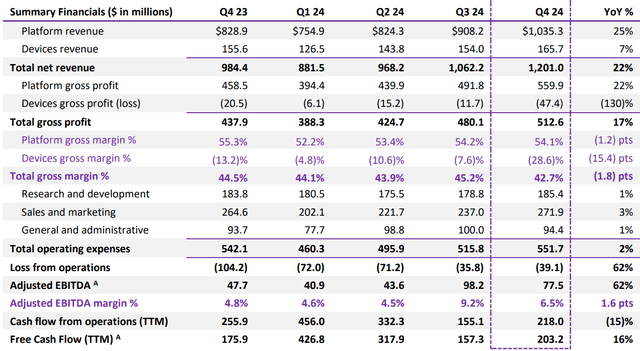

Roku's Earnings

Roku's Q4 2024 earnings exceeded the expectations with $1.201 billion in revenue, beating the $1.15 billion forecast and up 22% year-over-year. That looks really strong (and it is!) but there's a caveat. Q4 2024 had a lot of political spending. Without political ads, revenue growth would have been 15.7%. Still not bad, of course, but quite a bit under that 22%.

On a GAAP basis, there was a net loss of $35.5 million, or 24 cents per share. That was significantly better than the expected loss of 43 cents.

As usual, platform revenue was the biggest revenue driver, with 25% growth. Platform revenue was over $1 billion for the first time in Q4.

Device revenue was up 7% year over year, bringing overall revenue growth down a bit. But overall, these are strong numbers.

What was a bit more worrying is that Platform's gross profits grew by 22%, which is less than 25% of Platform's revenue growth. I would expect the company to have a bit more pricing power.

For the full year 2024, total revenue was $4.1 billion, up 18% YoY, with platform revenue at $3.5 billion, also up 18%, or 15%, excluding political ads.

Of course, for Roku, streaming hours also matter, a lot.

The streaming households were up 12% year-over-year and the streaming hours 18% to 29.1 billion. The ARPU was up by 4%. That may look like a mediocre increase but with the international roll-out, this is normal and even good.

Besides revenue growth, the quarter's most bullish aspect was The Roku Channel. Streaming hours rose 82% for TRC, reaching about 145 million people in the US.

Roku provided stronger guidance for 2025 than the market had expected. It expects Q1 revenue of $1.005 billion (up 14%) and full-year revenue of $4.610 billion. That would mean a revenue growth of 12.4%. That's not bad, but it's not really what I'm looking for. I want higher revenue growth and if that's not possible anymore, I want companies to be more efficient and grow their profitability faster than their revenue growth. Roku is still unprofitable, and its growth is not impressive. It guided for a net loss of $40 million in Q1.

Roku has said it should be operating-income positive by 2026 but that's still not net-income positive.

So, conclusion: I don't think this was a bad quarter at all. If you look at the numbers, it was even a great quarter, but the political spending made the numbers look better than you should expect them to go forward.

Roku's Quality Score

Personal conviction: 7/10 (unchanged)

Profitability: 6/10 (unchanged)

Sales efficiency: 3/10 (unchanged)

I thought the sales efficiency would have increased because of the higher revenue growth, but the score barely budged because of the muted forward revenue growth and lower gross margins.

Innovation: 3.5/5 (unchanged)

Must-have?: 2/5 (unchanged)

Revenue growth: 3.5/5 (up from 3/5)

3.5 may sound harsh for 22% revenue growth, but without political spending, it would have been 15.7% and guidance is even lower than that. Still, I want to honor the strong quarter with an upgrade.

Durability of growth: 7/10 (unchanged)

Management quality: 7.5/10 (down from 8/10)

I still like Anthony Wood, but at the same time, I'm starting to doubt a bit if he's really the visionary CEO I first thought. So, a slight downgrade.

Insiders' ownership: 5/5 (unchanged)

Multibagger potential now: 2.5/5 (down from 3)

The low revenue growth guidance makes me slash off half a point.

TAM & SAM: 4/5 (unchanged)

Financial Strength: 9/10 (unchanged)

Risk (negative): 2.5/5 (unchanged)

Competition (negative): 3/5 (unchanged)

Dilution (negative): 2.5/5 (down from 3.5)

The dilution was 1.67% of the total shares outstanding in the last year.

Scale advantages shared (-5/+5): 3 (unchanged)

Conclusion Quality Score Roku

Roku's quality score goes from 54.5 to 55 but that means it remains quite low. How about the valuation?

Valuation (price: $63.86)

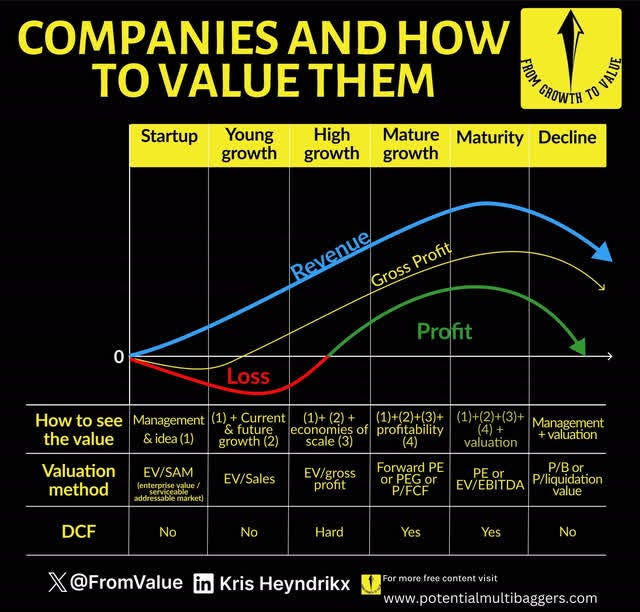

As you probably know, I use this framework.

Roku still operates at a GAAP loss, so we should look at high growth (although you could argue against this with the lower revenue growth prospects).

Based on an EV/Gross Profit, Roku trades at 3.58 times. That's very cheap.

Based on the FCF, though, Roku looks quite expensive at 37.8 times. The forward P/FCF looks more reasonable at 20.2.

I also did a reverse DCF on Roku. I don't often do that, because there are so many assumptions and every assumption can be wrong, but in this case, I think it could be valuable.

(the 18% discount to unlock the full Potential Multibaggers experience is still available. Grab it here while it lasts!)