Tariffs & The Road To Hell

And what about your investing?

Hi Multis

Usually, I don't go into politics because it's a subject that divides people.

It's not that I am not politically interested. I worked in the Belgian Federal Parliament for more than three years. I always say that this period "cured me of politics."

Now, of course, I'm still interested in politics. Having worked in politics, I also see the mechanics of certain moves faster. Overall, though, I'm not as passionate about politics. Or not anymore. On my list of priorities, it's somewhere near the end.

I hope you can read this post as dispassionately as I wrote it. And I want you to know that I love America. Everyone who has followed me for years knows that. Everyone who reads this article otherwise has bad intentions.

I don’t want to ‘convince’ you. I know from experience that you can discuss with someone until pigs fly, but you will never convince them of your point of view about politics if they started from the opposite point of view. So, it's just a waste of time. So, that’s definitely not my intention with this article.

Politics can be such an atmosphere spoiler. Hence, my general rule of no politics on Potential Multibaggers.

But I feel this is a time to break that rule. Not because I'm for or against one party or another or I want to impose my political ideas on you (which would be stupid, see above) but just because politics has taken the front stage when it comes to investing this week. And investing is my real passion.

One thing I learned during my years in the parliament is that there's no place where a specific expression comes to life more than in politics. That expression is "the road to hell is paved with good intentions." You can see that most often in leftish legislation. The intentions are often very good, but the outcomes not so much. I'm afraid that this is the same with what we see now.

I don't think you should doubt that President Trump has good intentions with the tariffs, but if we have learned one thing from tariffs in the past, it's that they don't work. Or, to be more precise, that they work differently than intended. But more about that later.

The Tariffs Are No Tariffs

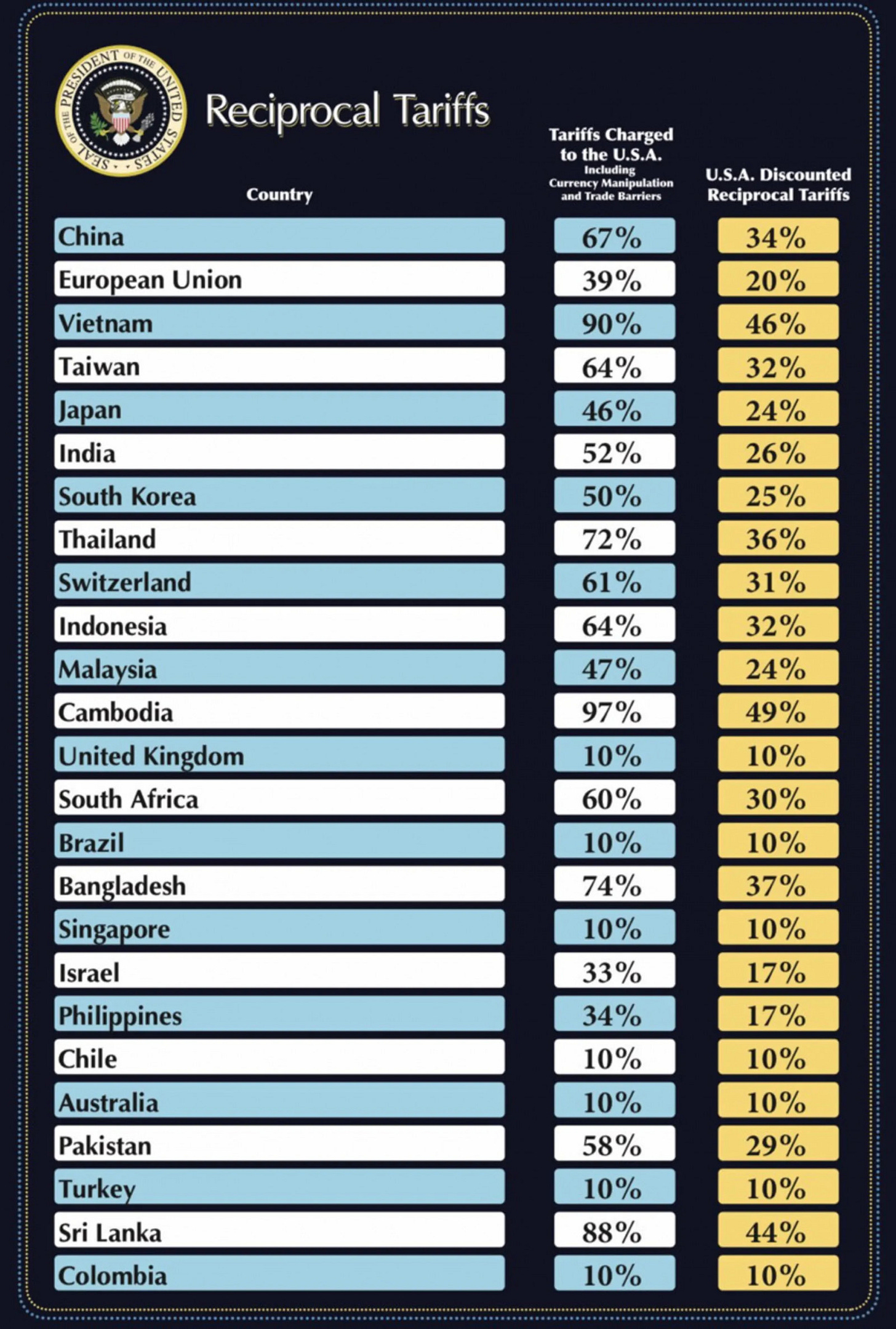

I don't think I have to tell you, dear Multi, that these reciprocal tariffs are, well, not based on tariffs. Let's look at this list, for example.

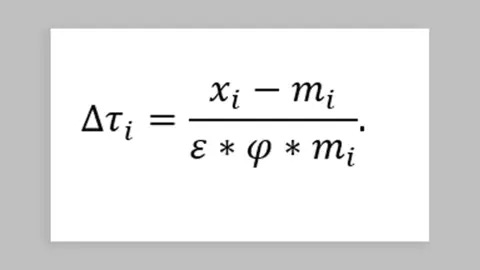

This fancy-looking formula was used.

It looks complicated, but it's simple. Take the trade deficit for the US in goods with a particular country, divide that by the total goods imports from that country and then divide that number by two.

This has nothing to do with tariffs, every economist will tell you. The real tariffs for the EU, for example, are mostly between 3% and 5%. That doesn’t make them right, and I see no problem in “real” reciprocal tariffs, meaning the US charges the same as other countries. I would only think that’s fair.

But these are not reciprocal tariffs. It’s based on trade deficits and you can say a few things about that.

Take Vietnam, for example, the second on this list, with "90% tariffs charged to the US." Vietnam contacted the administration and proposed 0% import tariffs in Vietnam for US goods. White House trade advisor Peter Navarro said that was nowhere enough and he referred to Chinese products shipped through Vietnam, theft of intellectual property and VAT (value-added tax).

Value-added tax is a system used by most countries around the world (around 170) and is somewhat similar to sales taxes in the U.S. The Trump administration’s argument that VAT is a trade barrier is not widely accepted, to say it mildly. Local companies pay VAT as well. How do you think the American people would receive foreign companies that don't have to pay sales tax, while American companies have to pay it? Now reverse it, and you will know this is an unreasonable argument.

But back to Vietnam. Of course, the trade deficit is high. Nike and other American apparel companies use Vietnam as a low-wage country for their production. The factory workers get wages between $135 and $195 per month (!).

In that way, Nike can produce shoes very cheaply, about $15 to $20 per pair. About $0.5 to $1 goes to labor costs. Nike sells its shoes for about 10x in the US. Who benefits from the big trade deficit, then? Vietnam? Or Nike?

But you expect Vietnamese to buy American products in equal amounts? With $135 to $195 per month in salary? Come on. Be serious.

Another remark about the trade deficit comes from the EU (and others). The EU argues that the US takes a one-sided approach by only looking at trading deficits for goods. Yes, there's a trade deficit with the EU when you only look at goods, but we don't live in 1950 anymore. Services have become much more important. If you add those, there's almost a perfect balance. Hence the threat of the EU to retaliate with tariffs on services. Think Apple, Amazon, Netflix, Google, Meta and many others. You can think of the EU what you want but if you'd be on the other side of the tariffs, you'd probably think something along similar lines.

The Tariffs: Why?

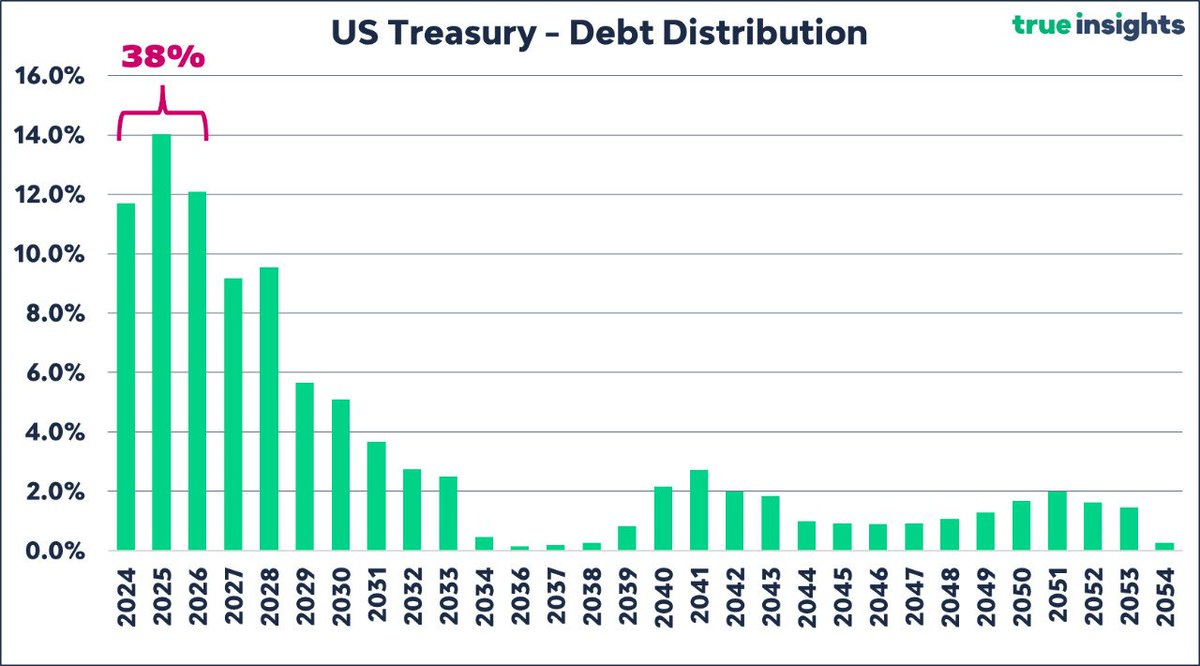

The reason why Trump introduced these tariffs is the big pile of debt the USA has built up over the years. Of that pile, $9.2T must be refinanced in 2025. If we take 10-year bonds as our measuring stick, every 0.01% drop (one basis point) in rates saves about $1B per year. So, a 1% drop would mean $1T saved over a decade.

(Source)

There are a few ways to achieve lower rates. The easiest one is the Fed cutting. But the inflation beast is not forgotten yet. It's sleeping but not dead. That's why the Fed is cautious to cut too fast, to Donald Trump’s frustration.

The other possibility is making bonds more attractive. More demand means lower rates. If there's a lot of uncertainty, investors want the certainty of the bond rates. If there are many buyers, the bond issuers will offer lower rates and those will still be bought. Logical, right?

How do you make the market uncertain? Well, these exaggerated tariffs are one way to do it. As you have seen, stocks have plummeted. And this came on top of that or caused it.

Now, I know it's fashionable in investing to laugh at "retail investors," a term I hate in itself (I prefer "individual investor."). Hedge funds are often seen as part of the "smart money." But you shouldn't forget that these hedge funds are usually heavily leveraged and they are obliged to sell because they get margin calls.

They don't calculate such extreme moves in their leveraging, so the margin calls come fast. I saw several messages that the number of margin calls was the highest since 2010 or even 2008, when Lehman Brothers fell.

Next to margin calls, there are two other reasons for hedge funds to sell so much. Many hedge funds have risk management rules. These rules dictate that stocks are sold if they are in the red by a certain percentage.

The third reason are redemptions. If customers panic and they want their money back, hedge funds have to sell to give customers back their money. I have often said that individual investor underestimate the many advantages they have on the condition they don't use leverage. I NEVER use it.

So, what's happening with that money? Well, you expect it to flow to safe havens like gold, silver and bonds.

Initially, everything went as foreseen, with the 10-year yield plummeting. But as you can see, it already went up again.

(Source, my arrows)

Why is that?

Here, there are probably three main contributing factors: jobs, the Fed and the market. The job report on Friday was strong and that may have eased the worries about a pending recession a bit. But probably, that will not have been the main contributor to the jump, as everyone knows that unemployment is a lagging factor for a recession.

The Fed coming out with a statement that there are no immediate plans to cut interest rates will have been much more important in the uptick.

Finally, the bond market does not seem to believe Trump’s plans.

So, Trump wants to renew the debt due in the next few years to have better conditions and save hundreds of billions of dollars.

On top of that, tariffs also bring in additional income. The first estimates are about $700 billion, at least from this source reported about in the Wall Street Journal.

The strange thing is that the more the tariffs succeed, the less they will bring in directly. What I mean is that if there is indeed a reallocation of manufacturing to the US, this will mean fewer products get these tariffs. That could be offset by more taxes coming in.

With the lower debt rates and tariffs, you could say there is a potential upside of $1.5 trillion. Nothing to sneeze at, right?

Internal Damage

We call a tariff a protective measure. It does protect. It protects the consumer very well against one thing. It protects the consumer against low prices.

~ Milton Friedman

Alright, we have seen the why of the tariffs now. If it's that easy to get $1.5 trillion, why not, you may wonder? Simply put, because this is an extremely risky game to play. Let's start with the internal consequences.

Whatever you hear from a small but loud minority, there is no way that prices won't shoot up.

This is what Morning Brew came up with for Apple, for example.

These are the costs of goods, not the retail price. And you could argue that Apple has a lot of money and that it could shrink its margins. But it would make the biggest company in the world much less profitable.

Of course, there's also Apple's promise to invest $500 billion in the next 4 years in the US. But reallocation takes time. You can't change such huge supply chain in a few years. In a very optimistic forecast, it would take 5 years or so. And even then, it's hard. Many parts are unprofitable if manufactured in the US because the margins are already low and labor in Asia is just so much cheaper. I'm pretty sure that even with high tariffs, some products will still be more profitable to produce in Asia. And I'm not even talking about the know-how that has been built up there over decades.

This article is not specifically about Apple. It's about tariffs. I just use Apple as an example.

The counterargument is that robots will replace cheap labor. But they are not ready for that. I'm very bullish on Tesla's Optimus over the longer term, but the broad adoption of them is probably ten years out. Of course, there are already some robots taking over human labor, but the percentage of jobs that are possible is still limited.

I don't see how inflation will not shoot up with tariffs. Of course, the example of the iPhone is an extreme one and probably it's even a bit exaggerated. But even with "just" 5% inflation, which I think is even optimistic, it's a shock to the system.

It's the same political trap again: good intentions pave the road to hell. They might like a way to "protect American jobs" or "punish unfair trade," but they come with real pain for the American people. It's simple. If you bought a $100 product and there's a 25% tariff rate, that product will now cost $125. Lower and middle-class people will be hurt the most, as fundamental things like food, clothing and electronics are heavily reliant on foreign countries.

Andy Polk of the Footwear Distributors and Retailers of America (‘FDRA’) published under the title "Where Are We Headed with the Current Trade War?"

It compared the current trade war under President Donald Trump in 2025 to five previous high-tariff periods: 1828, 1890, 1922, 1930, and 2018-2019.

Ten takeaways from the paper:

Tariffs often hurt farmers by reducing exports and raising costs.

Consumers typically face higher prices for goods due to tariffs.

Other countries usually respond with retaliatory tariffs, affecting U.S. exports.

Political parties implementing tariffs tend to lose voter support in elections.

Proponents frequently justify tariffs with narratives of fairness and protection.

Large tariffs can disrupt global currency markets, leading to economic instability.

Tariffs may fuel nationalistic tensions and shift global power dynamics.

Debates over tariff authority often arise, involving constitutional issues.

Populist and ideological pressures often overshadow economic evidence.

Leaders proceed with tariffs despite knowing the potential negative impacts.

You can read this interesting paper here.

The overall lesson from history is clear: Tariffs don't work. Historical evidence shows that it hurts American consumers.

External Damage

The US has been seen as the leader of the free world for a very long time now. At least since World War II, it has been the economic, ethical, and trade example, leading by example.

However, trade is based on confidence, and this shakes the confidence in the US and the whole world. The EU and the US have been allies for 80 years but that relationship is under more and more pressure.

Prime Minister of Singapore Wong gave an impressive speech that summarized this well. Here's a passage:

We are entering a new phase, one that is more arbitrary, protectionist, and dangerous. For decades, the US was the bedrock for the free market economies of the world and LED efforts to build a multilateral trading system.

To be clear, the system is not perfect. Singapore and many others have long called for reform. But what the US is doing now is not reform. It is abandoning the entire system.

I couldn't agree more with this. Yes, reforms, please. But don't throw away the whole system that has served everyone so well, including the US. If it turns out this is a basis to negotiate, this may turn out to be positive. The EU has already said it wants to talk about zero-for-zero tariffs.

As you can see, the EU also threatens with retaliation tariffs if the Trump administration continues with the proposed tariffs. Let's hope the zero-for-zero tariff negotiations and 'the art of the deal' prevail.

Even if this will be the outcome, the US lost a lot of credibility in the rest of the world. If the tariffs had been based on the principle of an eye for an eye and a tooth for a tooth, every country would have understood. If you want to put extra pressure on China, everyone would also understand that. But the way in which this game is played right now is confidence-undermining.

You also see that Elon Musk, Trump's best buddy for a while, clearly didn't want this and he already said there should be a zero-for-zero trade contract between the EU and the US. That's not just because of the damage to Tesla, as some say.

It's quite simple. If you look at the world, there are two powerful countries: the USA and China. They are in a fight for world dominance. Up to now, there was no competition because the US was supported by its allies, most prominently in Europe. But there are already planned talks between some European leaders and Xi Jinping. Now, I don't claim that the EU will change camps anytime soon (that would be utterly stupid), but what I mean is that the attitude with which this is done can alienate allies. While the USA obviously did a lot for its allies, in a way the allies also contribute(d?) to the world dominance of the USA.

And how to invest now?

That's the big question, of course. The simple answer is that nobody really knows. Don't underestimate how fast the stock market indexes could shoot up with the tiniest sliver of good news. We already saw that today.

Today, the market moved more than 10% in just a few minutes based on one tweet that later seemed to be fake (that the tariffs would be postponed by 90 days). The market exploded higher and dropped again when it became clear that it was fake news.

Investors are often unintentionally funny. When the stock market goes up, they think it will always go up. When it drops, they see no end to the drop.

Look, I have no crystal ball, but there are some clues.

First, the extremely low Fear & Greed Index.

In 2020, it bottomed at 2 and that was 11 days before the bottom.

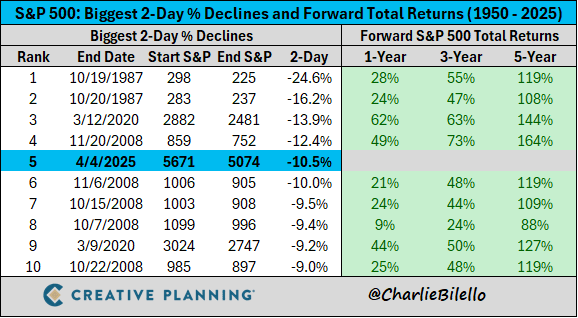

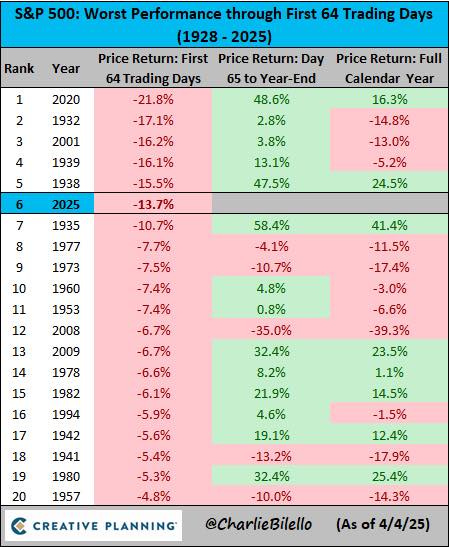

This chart is also interesting.

As you can see, the return after such violent drops are generally good for longer-term investors.

Even for shorter-term investors, there's good news. If you look at the first 64 trading days of the year, 2025 was in 6th place. In 74% of the years, the returns were positive for the rest of the year. In 42% of the cases, the full year (so after the big drop) was still positive.

Of course, the past doesn't have predictive powers. But usually, there's something to learn from it.

Overall, I will just continue with my plan of dollar-cost averaging. That means that I invest about 30% more right now. And it could be at 50% more soon.

Of course, everyone has his or her own situation. Even my own situation has changed since I made this.

Right now, I have enough money on the sidelines not to have to look where the money should come from, but I did this for years.

Suppose you are closer to or in retirement and you have a closed portfolio (meaning no additional money comes in anymore), you could sell your lowest-conviction positions to use this period in your advantage. But I would definitely not go crazy. There could be more downside.

The real question is not: "Will I catch the absolute bottom?" but "Do I think the markets will go up from this point during my investment horizon?" For me, being a long-term investor, the answer is fully yes.

You can read what I invested in here.

In the meantime, stay calm and keep growing!

Best article I've read up until now on the current 'situation'. Always the optimist, I'm betting on a deal between the countries. But you're right, damage has been done. Building trust takes years, and we've seen it can take a big hit in a matter of days. Seeing even businesses that only sell services (no tariffs) go down 20% or more shows you the market does not like uncertainty at all...