Hi Multis

It's already time to look back in the review mirror again, as another week has passed. Let's go to the candy shop.

Articles in the past weeks

This is the sixth (!) article this week. Let's look back at the previous five.

In the first article this week, you got an earnings analysis, quality score update and valuation for Adyen.

I also added to the Forever portfolio and you can read about the additions in this article.

The third article showed you what the latest Potential Multibaggers pick is.

After the big drop in the stock price, I dove into the Hims & Hers earnings.

Finally, in the fifth article, you could read about Upstart earnings, updated quality score and its valuation.

Memes Of The Week

In early May, I will be in Omaha again for the Berkshire Hathaway annual general meeting. So, this chart hit home immediately. :-)

Multi C-Dub-Diamond-Hands shares this meme. I think we all recognize this occasionally, and that's what the best comedy (and memes, of course) do.

This is the third and last meme this week, for the mathematically inclined. But not really. :-)

Interesting Podcasts Or Books

I listened to a podcast episode of Patrick O'Shaughnessy's Invest Like The Best this week. In the most recent episode of this excellent podcast, O'Shaughnessy interviews Dough Leone, who led Sequoia Capital one of the most successful venture capital funds ever. Leone followed up its legendary founder Don Valentine in 1996 together with another big name in VC, Mike Morritz. Together, they grew Sequoia from $150 million to $85 billion.

This was not a new episode, but a classic one. I hadn't heard it before, though.

You can listen to the episode here.

The markets in the past weeks

What did the markets do this week? Let's have a look at the indexes.

I don't think it's a big surprise to see that the index were down. The Nasdaq lost most, with 3.47%. The Russell 2000 lost 1.47% and the S&P 500 0.97%.

The Greed & Fear Index dropped from fear into extreme fear.

Quick Facts

1. The PE Ratio Addiction

I see many investors who only look at the PE ratio to value a stock. Hence this tweet this week.

You think this is a random example? Hindsight bias? Well, look at this graph then.

It's typical that this research firm talks about 'valuations' but only shows the PE ratio. And as you see, there's no correlation between the valuation based on a PE Ratio and the 1-year return.

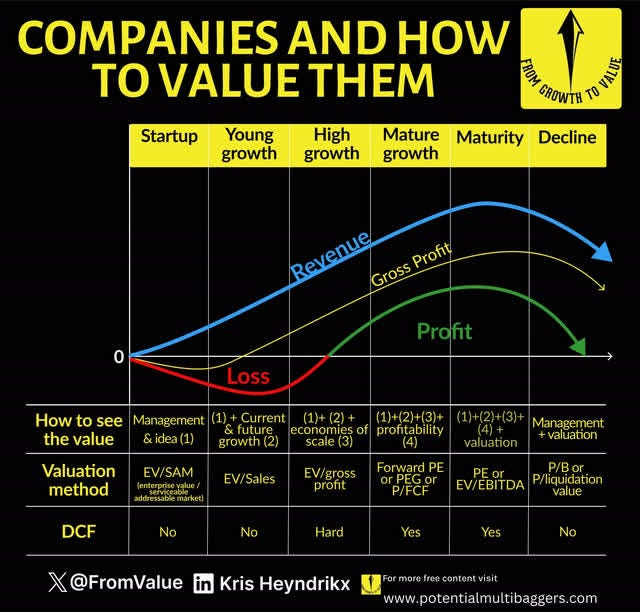

Now, a PE ratio can be handy sometimes... if applied correctly, in the right stage of the company.

I always use a valuation method based on the stage the company is in.