Hi Multis

Karan here with the Upstart analysis and Kris will chime in to update the Quality Score and valuation.

The last time I wrote about Upstart (UPST), I ended with this paragraph, covering the Q2’24 earnings

To be honest, I have nothing to dispute the above characterisation. The stock ripped due to an increase in guidance, rightfully so. I don’t think this is the quarter that changes the story after years of disappointment, but that quarter is one step closer.

The nice part about being the patron saint of lost causes, is the satisfaction you get if they eventually find their way.

I’m not claiming victory on a stock that’s still down 90% from its all-time high (even if that was a bubble so be it) but the company hasn’t gone out of business yet, indeed they may finally be on the cusp of becoming a sustainably profitable company with a business model even CNBC traders can understand. I look forward to Q3’24 with the highest confidence I’ve had in a while.

6 months have passed since – let’s find out if I was right.

The Numbers

First, the highlights.

Q4 2024 results, adjusted EPS of $0.26, blowing past the $0.04 consensus, jumped from -$0.06 in the prior quarter and -$0.11 a year before.

Q4 revenue of $219M, also surpassing the $181.9M consensus, climbed from $162.1M in Q3 and +56% from the year-ago period.

Revenue growth accelerated from 28% sequentially in Q3 to 35% in Q4.

“In Q4 of 2024, our business grew dramatically across all product categories, delivered Adjusted EBITDA at levels not seen since the first quarter of 2022, and came within a whisker of returning to GAAP profitability,” said Co-Founder and CEO Dave Girouard.

Adjusted EBITDA of $38.8M, handily beating the Visible Alpha estimate of $6.1M, compared with $1.4M in Q3 and $0.6M in Q4 2023.

Adjusted EBITDA Margin was 18% of total revenue, up from 0% in Q4 2023.

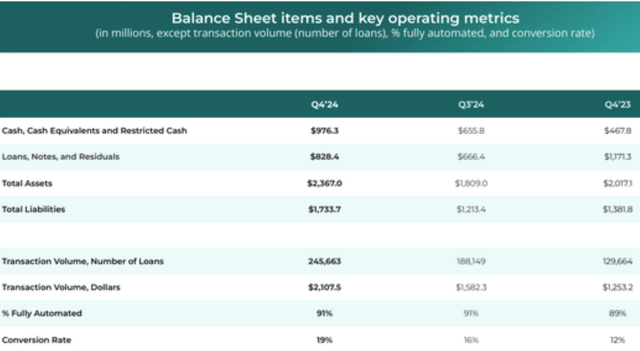

During the quarter, 245,663 loans were originated, totalling $2.1B, up 68% Y/Y and up 33% Q/Q. The conversion rate was 19.3%, up from 11.6% in Q4 2023.

Contribution Profit was $122 million in the fourth quarter of 2024, up 28% YoY, with a Contribution Margin of 61% compared to 63% in Q4 2023.

FY 2024:

(*Checks date to see if I’ve somehow time travelled back to 2022 when Upstart was beating and TTD getting smashed*)

No? It’s February 2025 and UPST has a double beat?? UPSTART?

The former pandemic darling turned zombie company turned left-for-dead object of CNBC jokes? Every single metric is trending in the right direction. What a long way we’ve come since 2023.

And not just a beat, but a blown-out-of-the-water beat.

Wait, what if it was just seasonality? Let’s look at the guidance.

For Q1 2025, Upstart expects revenue of ~$200M (vs. the $184.6M Wall Street consensus); adjusted EBITDA of ~$27M (vs. $10.7M Visible Alpha estimate).

“The company sees full-year 2025 revenue of about $1B, surpassing the $823.1M average analyst estimate, with revenue from fees of ~$920M and net interest income of ~$80M. It also expects adjusted EBITDA margin of ~18% (vs. 13% estimate).

For the first quarter of 2025, Upstart expects:

Revenue of approximately $200 million

Revenue From Fees of approximately $185 million

Net Interest Income (Loss) of approximately $15 million

Contribution Margin of approximately 57%

GAAP Net Income (Loss) of approximately ($20) million. Adjusted Net Income (Loss) of approximately $16 million

Adjusted EBITDA of approximately $27 million

Basic Weighted-Average Share Count of approximately 95 million shares. Diluted Weighted-Average Share Count of approximately 105 million shares

For the full year 2025, Upstart expects:

Revenue of approximately $1 billion

Revenue From Fees of approximately $920 million

Net Interest Income (Loss) of approximately $80 million

Adjusted EBITDA Margin of approximately 18%

GAAP Net Income to be at least breakeven.

1 billion dollars of revenue and break-even on a GAAP basis? You can read the rest of this article with a mental image of me as follows:

Now what the heck is driving such an optimistic forecast?

Origination volume and adjusted EBITDA margins snapped back to their highest levels since 2022. Improving conversion and funding availability were named, because of a better underwriting model and macro improvements.

All product categories contributed, with auto and HELOC originations both up 60% quarter-over-quarter, and small-dollar relief loans showing 115% growth. (HELOC = home equity line of credit, so a loan secured by your house).

The launch of Upstart's Model 19, which introduced the Payment Transition Model ('PTM'), resulted in more accurate underwriting.

In the HELOC business, this gave Upstart more than 1,000 loans and no defaults. The HELOC business operates in 36 states covering 60% of the U.S. population.

CEO Dave Girouard highlighted that these products now represent over 35% of total volume, diversifying revenue streams beyond personal loans.

Don’t be too scared by the 115% of small dollar loans surging, it represents only 3% of origination dollars since these loans are capped at $5k anyway.

With this kind of origination growth, Upstart's superior credit model must still be holding up to attract more volumes, let’s check in:

Yep, the best risk grades are still much better than FICO equivalents and Upstart can still find good borrowers amongst the untouchables from FICO’s data sets.

How about the capital situation?

CFO Datta noted an upsized $1.3 billion commitment from capital partners and a $150 million personal loan warehouse facility, which underscored growing confidence in Upstart’s platform.

How about those pesky balance sheet loans?

Down across the board. One word: excellent!

Where does this leave UPST as a company?

Operating expenses grew just 7% YoY despite 56% revenue growth, driving the adjusted EBITDA margin expansion to 18%. Upstart ended 2024 with $788 million in unrestricted cash and reduced balance sheet loans by 28% to $806 million, lowering capital intensity.

Contribution margin, similar to gross margins, remained robust at 61%, supported by pricing power in fee-based revenue streams. Both came in at multi-year highs. This might be the furthest Upstart has been from bankruptcy since it came public. What a turnaround!

Highlights from the call

I’m also sharing a summary of some of my key takeaways from the conference call.

AI Model Enhancements

The launch of Model 19 introduced three critical upgrades:

Payment Transition Model (PTM): Improved risk separation by 14% and model accuracy by 8%, enabling better borrower outcomes.

APR Integration: Enhanced ability to match borrowers with optimal rates, reducing defaults.

Economic Resilience: Better performance across interest rate environments, as evidenced by 25% improvement in delinquent borrower repayments within 14 days of contact.

Upstart AI Day and Product Roadmap

The upcoming May 14, 2025 AI Day will showcase new developments in embedded finance and cross-platform lending capabilities. Management telegraphed plans to:

Expand Auto Retail Lending: Partner with dealership networks to capture point-of-sale financing

Launch Credit Card Solutions: Leverage existing bank partnerships for revolving credit products

International Pilot Programs: Initial focus on Canadian and UK markets

So, we have finally arrived at the dawn of the two narrative drivers – credit cards and international expansion. How these proceed will determine if Upstart sees a triple digit stock price again (without short interest).

However you look at it, this is not bad news by any means. If Upstart can crack the US credit card industry, we have a whole new ballgame on our hands, even if it takes 5 years.

Macro Tailwinds

The company estimates every 25 bps rate decline drives 5-7% incremental originations. We can clearly see this in the boost to volumes in Q4 alone as the 2024 rate cuts passed through. If we get more in 2025, it would be relatively straightforward for Upstart to trounce guidance again. Upstart’s refinance-focused products are currently 40% of volume and could explode higher as rates come down, fully reversing the headwinds from 2022.

Conclusion For The Quarter

Is it too early to take a victory lap? Probably.

An errant tweet from a certain person could dissolve the Fed tomorrow and Upstart might once again collapse 40% overnight, who knows, really.

But I’ve spent 2 years looking at this company’s business drivers and I’ll be damned if I let go of the opportunity to celebrate hanging in there.

I said in Q4 2023, that if UPST were to survive this period, it would print money on the other side. We’re on the cusp of the other side now; if you’ve been waiting to right size your position or take profits, the moment shall soon be upon us, but likely so will be the upswing back to triple digits, invest wisely.

Upstart’s Q4 results to me were a watershed moment, demonstrating what the company CAN achieve with the right tailwinds. Its AI-driven underwriting models can drive profitable growth at scale. The combination of 60%+ product growth in auto/HELOC, expanding EBITDA margins, and $1 billion revenue guidance suggests the company is transitioning from recovery phase to sustainable expansion. With the possibility of credit cards and international expansion, we see something we haven’t seen in a long time for Upstart: Optimism. Finally.

Maybe I should only write about Upstart once every 6 months from now on?

I’ll leave it to the community to decide.

But let's go to Kris now for the rest of this article.

PM Quality Score

Did you hear that?

You thought it was the wind, right?

Or a man with respiratory problems somewhere around you?

No, it was Karan's sigh of relief. As the Patron Saint Of Lost Causes, it's good to have a miracle every now and then to prove you are what you claim.

As you know, I always look at the quality, through the PMQS (Potential Multibaggers Quality Score) and the valuation to get to the QPI (Quality-Price Index). That system allows us to balance out quality and the valuation and not look at valuation alone, as so many do.