Hi Multis

Karan here with an earnings analysis of Adyen. That will be the first part of the article. In the second part of this article, Kris will take over to guide you through the quality and valuation scores.

If you’re here for the headline, this is it:

“Adyen had an excellent 2024 – It aced the landing, now it’s expanding.”

If you’re still not sure what Adyen does and you like to check the stock price first to see if it’s any good, here it is amongst some of the largest public payment companies on the planet since its IPO just under 7 years ago:

That’s right. It’s been the best-performing big payments company since its IPO. It's better than giants like Mastercard and Visa, better than companies with better PR like Block or Paypal, and almost twice the return of even the S&P 500, despite being European!

Are you convinced yet that it’s a winner?

Long-time Multis will know the above statement is a joke since I’ve spent countless hours explaining why we shouldn’t judge a company solely based on its stock price performance (though I’ll happily accept it in this case, for all the other cases where it doesn’t work!)

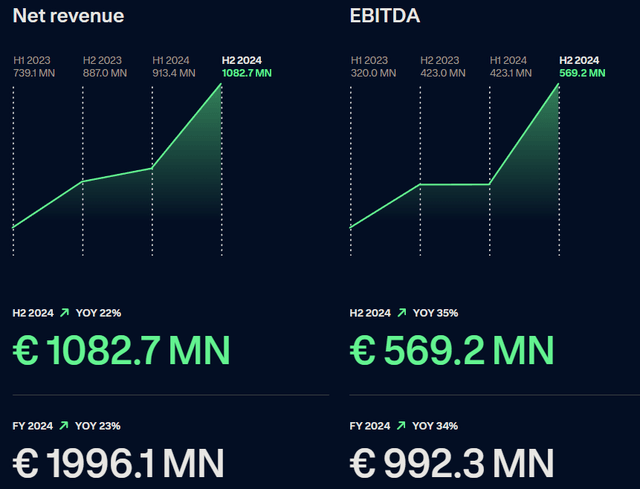

Still need convincing? Here is a pretty chart from the company to help you decide further:

Source: Shareholder Letter H2 2024 - Adyen

Surely someone who can make such a cool-looking chart is worth your investment dollars? ;-)

Alright, fine. If you’ve read so far, you probably want to know a little bit more about Adyen's performance across its key metrics, so let’s dive in.

Revenue Growth: Strong

Adyen’s H2 2024 revenue reached €1.08 billion, a 22% increase year over year. This growth was driven by share-of-wallet expansion with existing customers and new client acquisitions across verticals such as hospitality, healthcare, and technology.

For the full year, net revenue grew 23% to €1.99 billion, and processed volume climbed 33% to €1.28 trillion. Excluding a single large-volume client (likely Cash App), processed volume growth accelerated by 28% year over year, highlighting broad-based demand for Adyen’s solutions.

Total Process volumes (the key metric for payment companies) grew 22% year over year, a 40% CAGR over six years since the IPO. Adyen’s take rate held steady at 16.2 bps, rising from 14.7 bps in H1 2024 due to lower Cash App volumes. Over time, take rates are expected to decline as Adyen scales via its tiered pricing model.

Bottom Line Growth: Strong

Unlike another company in fintech (Block, ahem), which eschews profits for bitcoin R&D, Adyen is very strong when it comes to profitability, with net revenue growth of 22% YoY to €1.08 billion and EBITDA surging 35% to €569.2 million for the second half of the year. This is the first time net revenues crossed 1 billion, a significant milestone for the company. A reminder, though, that Adyen reports half-yearly, not quarterly.

Adyen’s continued focus on operational efficiency also bore fruit, with EBITDA margin expanding to 53% in H2 (up from 48% in H2 2023) and 50% for the full year.

As a reminder,, the EBITDA margin is calculated as EBITDA/Revenue, which mthat eans that for every 100 dollars in reearns 50 dollars indollars as Gr.s Profit. This is extraordinary and easily amongst the best in class across any sector or company.

Also, the EBITDA margin of 53% (as well as operating margins of 47%) was at the highest level since 2021. What’s more, management reiterated its target to achieve EBITDA margins above 50% through 2026, though cautioned that 2025’s margin gains may moderate slightly. I’ll take it.

It achieved all of this with headcount growing just 4% YoY in H2 compared to 26% in 2023—and a renewed emphasis on productivity (through tools like Uplift). And remember, the company only added 37 net new headcounts in H1’2, too, so the company is virtually the same size as it was at the start of 2024 but with double-digit revenue growth since then. Pretty sure they call this “Operating leverage.” Moreover, it's also very important because this is what management promised. It's another sign that Adyen's management can be trusted.

I remember when Adyen’s stock got destroyed in 2023 - the company announced it was aggressively hiring while competitors were laying people off. And yet, this is what happens when you run your company efficiently and countercyclically – you build operating leverage for the future. Average revenue per full-time employee clocked in at 42k euros per month also a high since 2021. Annualized, that's €504K per employee.

This is genuinely a David-sized company delivering Goliath-level performance.

Why is all of this so impressive? Remember Adyen is an INTERNATIONAL payments company, with less than 30% of its revenues coming from the US. When we look at the last 6 months of 2024 and see what the USD did versus every single currency Adyen operates in, it’s truly remarkable. This will turn into a giant tailwind for 2025 if the recent USD weakness continues.

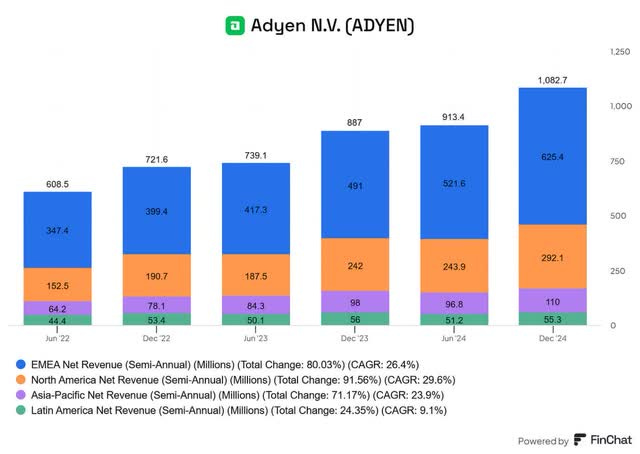

To illustrate this point, growth was achieved in every single region (even LATAM, which was 12% in constant currency but after proper accounting shows as -1%, but we can forgive them since the region is both small and getting over a minor bout of hyperinflation/currency weakness - MELI and NU nod their heads in solidarity.)

Here is another view from Finchat if you like more color

EMEA remained Adyen’s largest and fastest-growing region, with H2 revenue up 27% YoY to €625 million, contributing 58% of total revenue. The region’s growth was fuelled by deepening retail and digital subscription partnerships, including collaborations with major brands like KFC and Thomson Medical. Management noted that even in its most established markets, Adyen is “still at the outset of realizing our market opportunity.” Exciting

North America saw 21% YoY revenue growth to €292 million, driven by market share gains in unified commerce and platforms. During the earnings call, Co-CEO Ingo Uytdehaage highlighted the region’s strategic importance:

We continue to gain market share in North America, giving us further confidence in our double-down approach to this target region”.

APAC grew 12% YoY to €110 million, while LatAm revenue declined -1% (though constant-currency growth was 12%, the same as APAC). FX volatility (such an innocent-sounding word when the USD is just a giant wrecking ball) impacted reported numbers, but investments in Brazil’s Pix instant payment system and partnerships in India signal long-term potential, so let’s watch this space.

Unified Commerce

Adyen has spent significant time and energy telling people about its strategy and opportunity when it comes to unified commerce, and it continues to be vindicated with double-digit growth across the board. The launch of Tap-to-Pay on iPhone in five European markets and New Zealand further strengthened Adyen’s in-person payment capabilities.

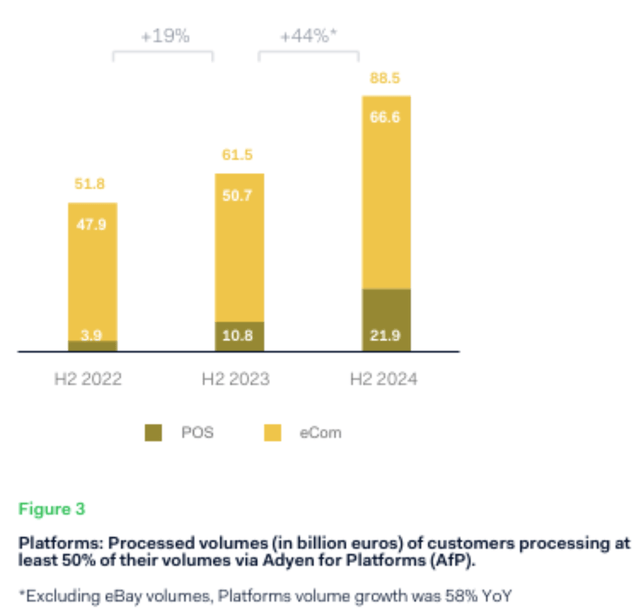

Unified Commerce (in-person payments) grew 35% YoY in H2, supported by record Black Friday volumes and the launch of the SFO1 terminal, which enhances retail customer experiences. Meanwhile, the Platforms segment (serving SaaS marketplaces) skyrocketed 44% YoY, becoming Adyen’s fastest-growing pillar. Platforms now represent 13% of total volume, up from 9% in 2023, driven by a 67% increase in business customers during H2.

The Digital segment, which facilitates online and subscription payments, processed €783.4 billion in volume for FY 2024 (+29% YoY). Key drivers included Adyen’s AI-powered Uplift tool, which boosted client conversion rates by up to 6% through optimized payment routing. However, Digital’s share of total volume dipped to 58% (from 62% in 2023) as newer segments accelerated.

The gains in e-commerce were more pronounced amongst their largest clients, signaling increased confidence in Adyen's ability to process a greater share of their payments.

Capital expenditures remained stable at 5% of net revenue, funding data center expansions and office upgrades. Free cash flow conversion remained robust at 88% in H2, providing flexibility for strategic initiatives like entering the Indian and Japanese markets. The net cash balance ended at around €3.3 billion.

What a luxury it must be to print so much cash you can enter a market like India with self-funded growth. If it succeeds there, APAC could become on par with North America in terms of volume.

During the earnings call, executives highlighted three priorities:

1. Deepening platform functionality through AI and embedded finance tools (Obligatory shoutout to AI but I’ll allow it).

2. Accelerating North American market share gains via localized solutions (Largest market in the world, so good to see).

3. Monetizing investments in emerging markets like India, where Adyen builds infrastructure for long-term growth. (Creating growth opportunities to preserve their long-term future, makes total sense).

It’s simple, intuitive, and totally logical – you can see why it’s a good company.

We observe Adyen at full speed, the number 1 player in Europe (where PSD2 and other regulations have essentially driven out new competitors – just try launching a payments company in Europe nowadays, VCs will blacklist you) and using its cash-positive business model to invest heavily in market share gains in NAM and APAC, while still retaining 50% profit margins.

Conclusion

I could spend another 1000 words diving into the shareholder letter and conference call but I will learn from Adyen and keep this simple and to the point (Also Kris might actually kill this if I keep going): Adyen continues to be a model of predictability, stable, double-digit growth. It’s growing with existing customers, gaining new customers in new regions, investing in AI, not burning money on pointless hiring and in pole position to capture a leading role within the $2.6 trillion digital payments market.

As CFO Ethan Tandowsky succinctly put it:

We remain confident about delivering on our financial objectives in the years ahead.

I mean, what else is there to say except, “Job well done; see you in six months?”

Is the Stock Attractive now?

Kris, here. I'm taking over this article to see if the stock is attractive to buy now at the current price of €1,769.4 (on the Amsterdam stock exchange) or $18.34 for the ADR (ADYEY).

As you know, I always look at the quality through the PMQS (Potential Multibaggers Quality Score) and the valuation to get to the QPI (Quality-Price Index). That system allows us to balance out quality and the valuation and not look at valuation alone, as so many do.