Hi Multis

The week’s over again and that means you get the Overview Of The Week, your weekly moment of clarity. Grab a coffee or a tea and enjoy it!

Articles In The Past Week

This is the fourth article this week.

In the first article this week, I wrote about The Trade Desk. After the 71.5% drop, is it a BUY now?

In the second article, we looked at another stock that’s down significantly: Hims & Hers. Should we worry or is this a buying opportunity?

Datadog had a strange price pattern over the last month. It shot up almost 30% after the earnings, but it’s already down compared to pre-earnings levels. In our analysis, you get insight into the earnings and, based on the PM Quality Score and Valuation, you get to know if it’s a BUY or not.

Memes Of The Week

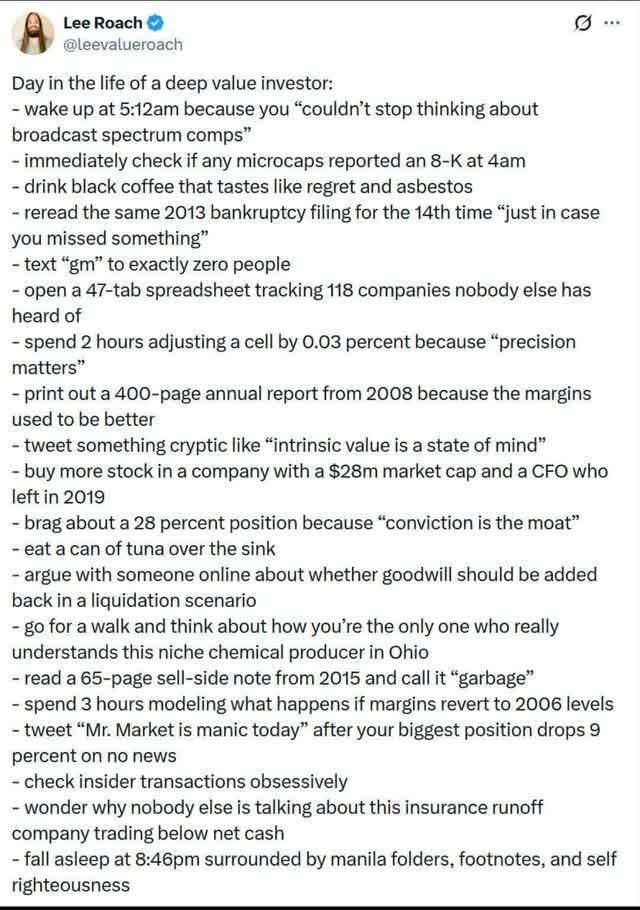

Three memes this week. The first one is a text, not really a meme. But it’s funny.

Multi Bep came with this great one.

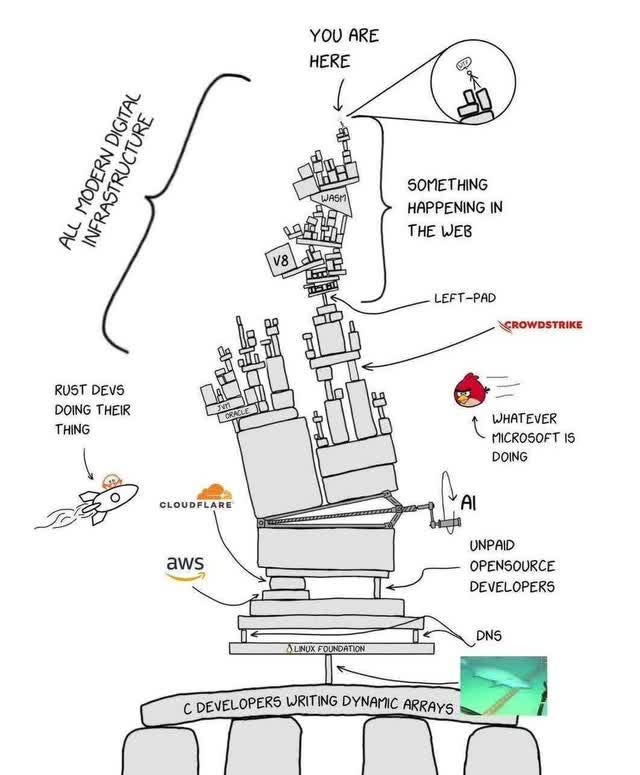

And this one summarizes the whole stack.

Interesting Podcasts Or Books

I haven’t finished listening to this one, but I have enjoyed it so far. Nvidia’s Jensen Huang was Joe Rogan’s guest. You can watch it on YouTube here.

If you prefer Spotify, you can listen here.

The markets in the past week

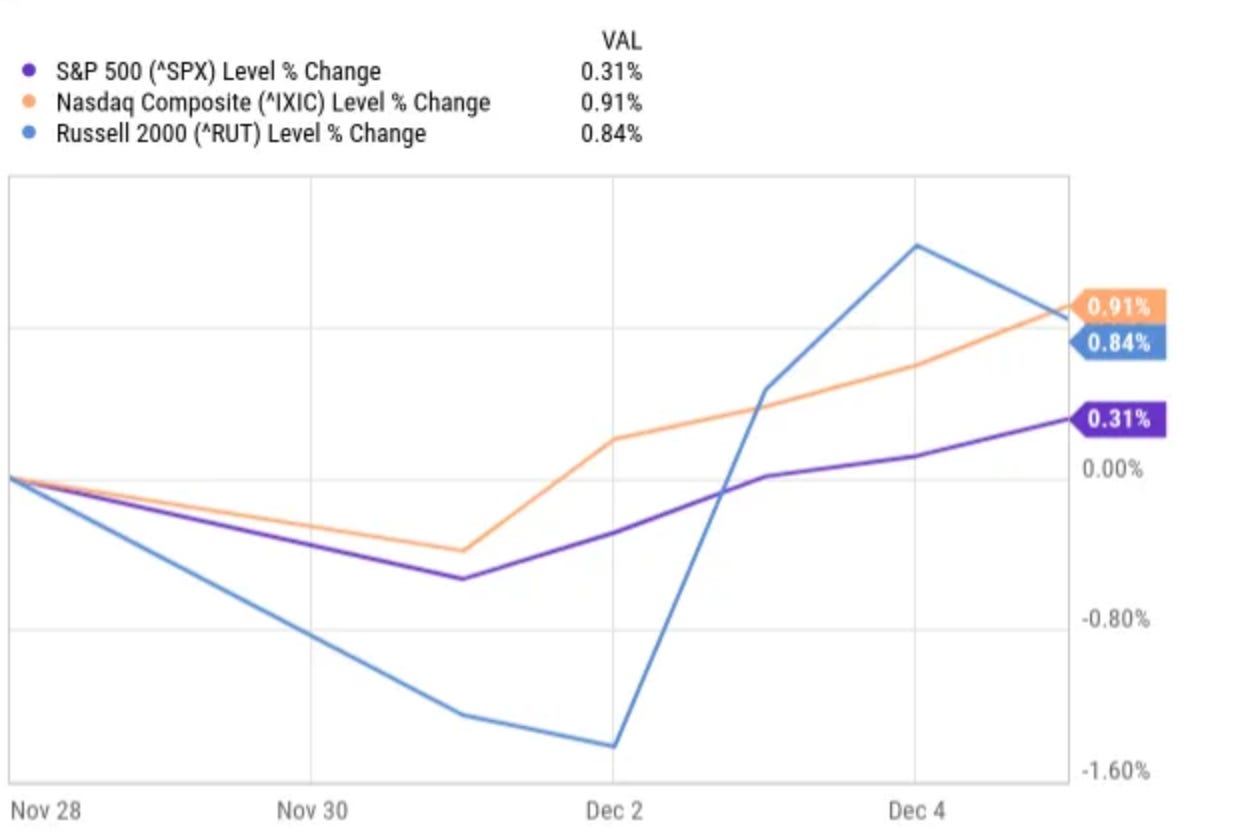

After the blistering returns of last week, the market first cooled off a bit this week, but it ended strongly. The S&P 500 was up 0.31%, the Russell 2000 0.84% and the Nasdaq 0.91%.

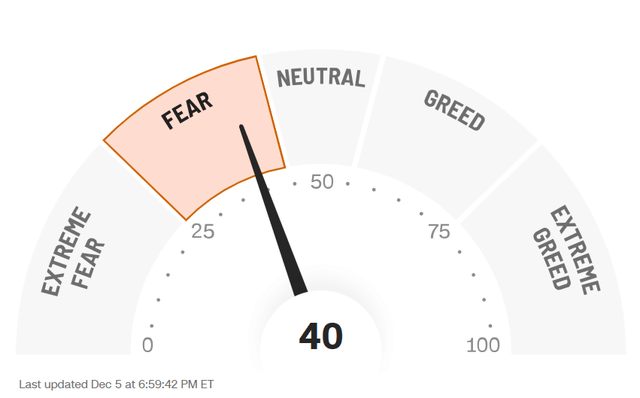

The Greed & Fear Index was still in Extreme Fear last week, albeit it close to Fear. It was no surprise, therefore, that it jumped to Fear, but it was more than expected.

Lesson Of The Week

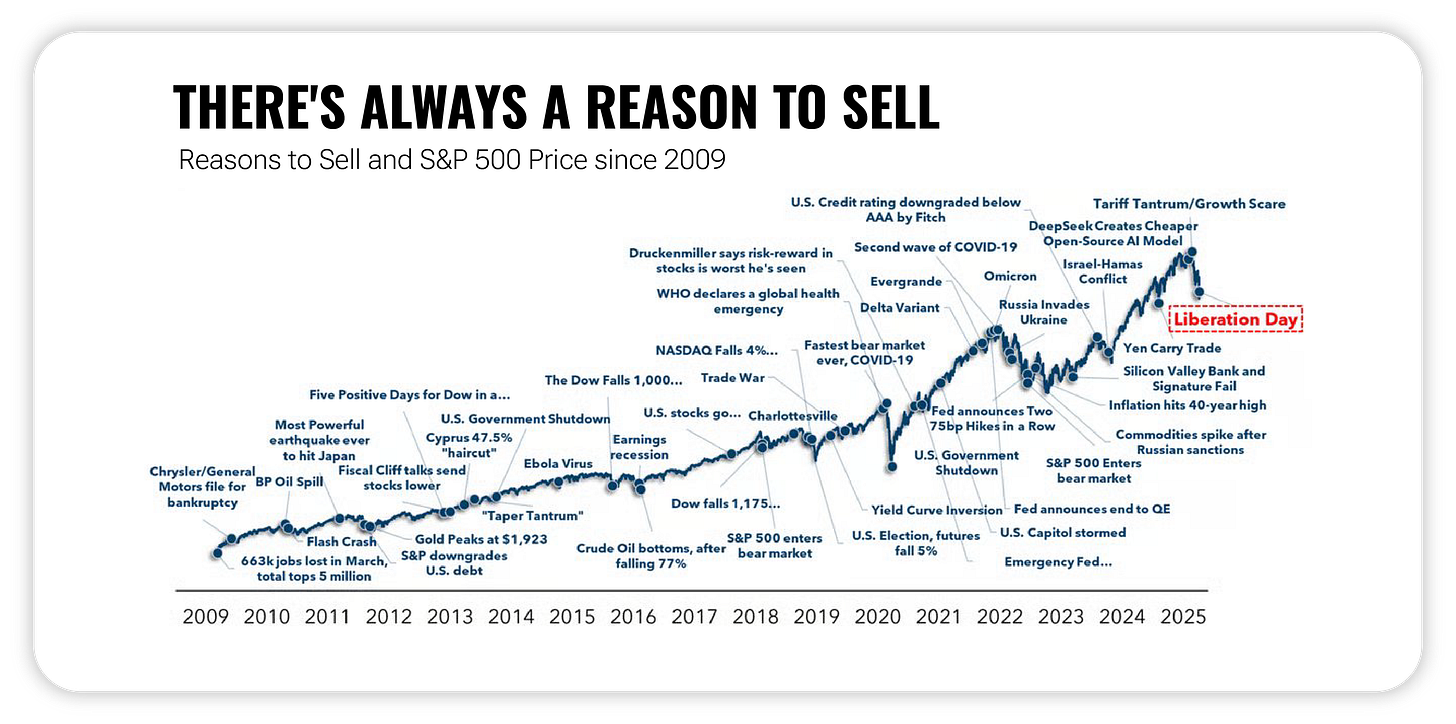

There’s always a reason to sell, and usually the reasons look very compelling and well-argued. This is an overview from 2009 to April this year.

There will always be a loud, scary reason to sell. Every day. A global pandemic. A war. The highest inflation in 40 years. An oil price shock. The news media, analysts, and that knot in your gut are all working together to convince you that this time you should sell. Only to get punched in the gut, making that knot in your gut a precursor to what’s coming because of your own action. Fear is a terrible financial advisor.

The S&P takes a 14% dip on average per year. Each and every time, there are bears howling that it’s the end of the world as you know it. On average every year or 6, 7 (don’t show this to your teenagers, or they freak on the 6,7) the market drops by 20% or more. See it as an opportunity, not a problem. Because every single bear market looks like an opportunity looking back. But still most act as if it’s the end of investing in the stock market.

Many confuse sounding smart with being a good investor. Many prefer sounding smart. You will see that again in the predictions for 2026.

When people ask me what I think the market will do, I always say I think it’s going up. I’ll be right more than most. Why? It’s simple. Nobody has any idea what the market will do. You will hear all kinds of predictions, but they are just wild guesses disguised in a suit of reasoning that sounds convincing. But two years out of three, the market goes up. That’s why I always predict that the market will go up.

You heard it here first: my 2026 prediction: the market will go up. :-)

Quick Facts

1. Amazon’s Trainium3 AI Chip

This week, Amazon announced that its Trainium3-based UltraServers are now available to train and deploy AI models. At the same time, it also revealed that Trainium4 will support Nvidia’s NVLink Fusion. That means AWS chips to work seamlessly with Nvidia GPUs.

Trainium3 has a 3nm architecture, 4.4x performance gains over Trainium2, 40% better energy efficiency, and claims to be 50% cheaper than Nvidia’s GPUs.

According to The Wall Street Journal, Decart benchmarked AWS’s Trainium3 chips against leading competitors, including Nvidia’s processors. The results showed Trainium3 consistently delivered four times the frame rate for video generation compared to the other chips tested. But I’m skeptical. Why “leading competitors” and not the H100 or Blackwell?

That means Amazon hopes to lure companies looking for a bargain. Trainium chips can power the intensive calculations behind AI models more cheaply and efficiently than Nvidia’s GPUs.

But there’s a trade-off. Amazon’s chips don’t have the deep software libraries Nvidia has. That means it is much harder to use them. CUDA remains a key advantage Nvidia has over all the competition. ASICs (Application-Specific Integrated Circuits) like Google’s TPU and Amazon’s Trainium will help these companies, especially for inference. They are meant for a specific job. The Trainium chips are good news for Amazon itself, but Nvidia has a market share of 90% and CUDA is used in 80% of AI papers. You can’t disrupt that just by hardware.

2. Nvidia Invests $2B in Synopsys

This week, Nvidia (NVDA) announced that it bought a $2 billion stake in Synopsys as part of a strategic partnership. Synopsis is an EDA (Electronic Design Automation) company. It’s widely used inside of AMD, Intel, and Nvidia, for example.

With the partnership, Nvidia will co-develop tools that will make it easier to shift tasks that are now still done on CPUs to Nvidia GPUs.

It’s another way for Nvidia, next to CUDA, to build out the vertical stack.

3. S&P 500 Rebalance

This week, S&P Dow Jones Indices announced that three companies will be removed from the index: LKQ Corp (auto parts), SolarEdge (renewables) and Mohawk Industries (flooring, home goods).

They will be replaced with Carvana (car e-commerce), Comfort Systems USA (industrial HVAC) and CRH (building materials). The change will happen on December 22.

4. Netflix Buying Warner Bros?

On Friday, Netflix issued a press release together with Warner Bros Discovery, announcing that Netflix would buy WBD for $72 billion, or $82.7B in enterprise value (including the $10B debt). For every share, shareholders would get $23.25 in cash and $4.50 in Netflix shares. The WBD shares now trade at $26.08, up 170% over the last six months.

Here’s what Netflix would acquire:

Studios: Warner Bros. Pictures, Warner Bros. TV, New Line Cinema, DC Studios

Streaming: HBO + Max (100M+ subs)

Key IP & Franchises:

Harry Potter

Game of Thrones + spin-offs

DC Universe (Batman, Superman, etc.)

Lord of the Rings, The Matrix, Dune, Friends, The Sopranos, Succession

Full Warner Bros. 100-year film/TV library ( about 17,000 hours)

This deal would exclude CNN, TNT, Discovery Channel, HGTV, and Food Network, which will be spun off into a separate “Discovery Global” company.

Now, this is not certain yet. There are still quite some regulatory hurdles to take and there are rumors that the Trump administration is not enthusiastic about the deal.

On top of that, Paramount is reportedly preparing a hostile bid for Warner Bros of $30 a share, all cash.

I am not a Netflix shareholder, but our 11-year-old daughter has 10 shares in her portfolio.

Usually, I don’t like big acquisitions like this. In most cases, they destroy shareholder value. That’s why I will probably sell half of our daughter’s stake. She has been watching less Netflix lately, in favor of YouTube. But of course, I will talk to her about it first.

The Returns of the Potential Multibaggers

This week, there was just one stock that had a price move of more than 5%, but it was a great one. Rubrik jumped 24.5% this week, after great earnings.

Are you sick of missing stocks like Rubrik? If you want full access to Potential Multibaggers, here’s what you’ll get:

✅ The rest of this article

✅ My complete portfolio (with every transaction)

✅ Deep insights through quarterly earnings deep dives

✅ The Quality Score and valuation updates every quarter.

✅ Access to our private chat group

✅ Best Buys Now (outperforming the market by 23% over 3 years!)

Don’t hesitate. Don’t miss the next multibagger opportunity!