Hi Multis

I know many of you were waiting for an update after The Trade Desk (TTD) released its Q3 earnings. So, here it is.

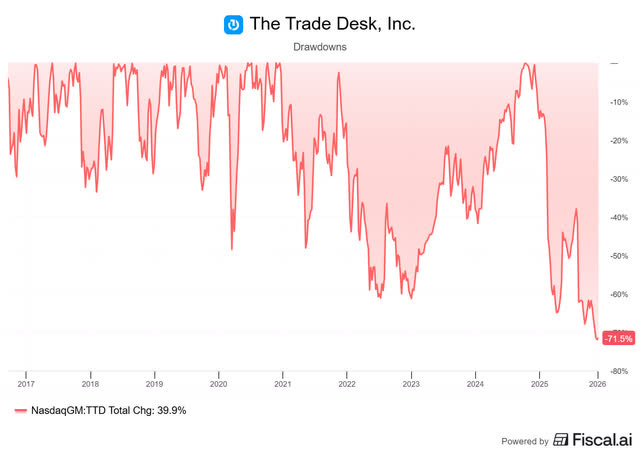

And I understand the urge to know more about the stock. After all, it’s down 71.5%, the biggest drop since it became a public company almost 10 years ago.

Do you want a 15% discount for Fiscal and get the best graphs, earnings calls, screener and so much more? Use this link.

The question many Multis have is: Is this an opportunity or a trap?

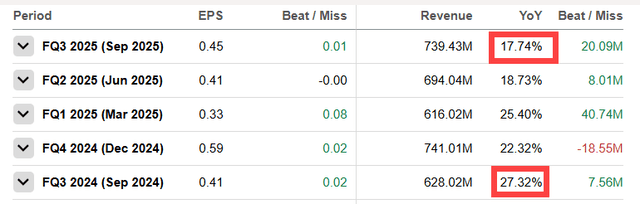

Let’s start with a quick look at the numbers first.

The Numbers

Revenue: $739M, +17.7% YoY growth.

Non-GAAP EPS: $0.45 per diluted share, beating the consensus by $0.01

Adjusted EBITDA: $317M, which means an EBITDA margin of 43%.

Guidance (Q4 2025)

Revenue “at least” $840M, or about 18.5% better than the consensus of $830.9M.

Now, I saw quite a few reactions of Multis (and other people) who were disappointed by the lackluster 17.7% growth. I understand that. It could even be the reason for the big recent drop, next to the Amazon competition (more about that later).

It doesn’t look great. Last year in Q3, there was 27.32% growth. Now just 17.74%.

But political spending plays an important role. If you look at the numbers ex-political spend, you see 22.9% growth in Q3 2024. For the most recent quarter, that would have been 22%. That looks better, doesn’t it?

More Insights From The Call: The AI & Operational Holy Grail

The company has changed its executives in the last year. The Trade Desk appointed a new COO (Vivek Kundra), a new CFO (Alex Kayyal), and a new CRO (Anders Mortensen), who joined from Google a week before the earnings call.

Alex Kayyal, the new CFO, is already focused on ensuring that innovation investments fuel growth and convert into durable free cash flow. He is bringing a “growth mindset” to the CFO role, which I like.

2025 has not only been a year of change for the executive suite but also the year of product innovation for The Trade Desk. We can’t ignore the fact that Kokai didn’t bring what it was supposed to bring for customers. The company acknowledged that and committed to doing better. The numbers back up the product’s better performance. 85% of customers now use the latest update of Kokai.

The performance metrics are what matter, and they are strong. Founder and CEO Jeff Green (Solimar is the previous system, much less based on AI)

Since its launch, Kokai has delivered on average 26% better cost per acquisition, 58% better cost per unique reach and a 94% better click-through rate compared to Solimar.

This performance is fueled by Distributed AI. Simply said, it’s a central model under which all separate AI models are responsible for things like impression valuing, identity management, and supply path selection. This means that there are many more checks and balances. It’s extremely important to have these in any industry, but especially in advertising, which has a history littered with fake impressions. This new structure will also allow The Trade Desk to add new product features faster and in a stable way.

The digital advertising supply chain is the complex path an ad takes from the advertiser to the consumer. Often, there are multiple opaque intermediaries.

This gives you an idea.

The Trade Desk’s product innovations, especially OpenPath, aim to “clean up” this chain by creating direct, transparent connections, which means more efficiency and better price discovery.

Jeff Green claims that the walled gardens (Facebook, Google) keep this intentionally vague to prioritize their own inventory and maximize profit margins. If you think about it, it sounds logical.

That’s why OpenPath grows so fast (’hundreds of percentage points’). A publisher like Hearst sees a 4x improvement in ad fill rates and a 23% revenue increase with OpenPath.

So, to make it clear, OpenPath is not circumventing SSPs, as some claim. It circumvents the resellers because those artificially block ad space to sell it themselves. OpenPath makes the whole system more efficient.

The Trade Desk also launched OpenAds, an open-source auction system designed to raise the bar on auction integrity, with over 20 publishers already committed to integrating. Jeff Green on the conference call:

The market needs a healthy auction and some sell-side players have continually weakened the integrity of the auction. So we’re developing an open source auction that raises that bar.

This shows that The Trade Desk is making the whole system better for everyone. It has always taken the side of advertisers and will continue to do so, but making the whole chain healthier benefits both advertisers and publishers. AI plays a crucial role here.

The Trade Desk also has Deal Desk, which is fully powered by AI. It’s meant to make better upfront deals. So, that’s not the model of bidding on the ad spot on the moment, but big upfront deals.

Deal Desk facilitates these deals but it also uses The Trade Desk’s vast dataset and AI models to predict how a specific deal will perform. These insights help buyers set expectations and avoid committing to poor-performing inventory. And the proof is, again, in the results. Deals on Deal Desk are performing 35% better. Avoiding bad deals can be very valuable for customers.

The summary is simple: The Trade Desk uses AI efficiently, not just for itself, but also for its customers.

The Competition Issue

Next to the optical (but not real) revenue growth slowdown, the other issue is the competition.

In general, Jeff Green continues to frame the advertising market as a battle between the Open Internet (where The Trade Desk operates) and the conflicted walled gardens. The Trade Desk’s objectivity is its North Star and greatest weapon.

He summed up what the competitors focus on:

Google is clearly focused on search, their AI chatbot Gemini and YouTube.

Amazon’s primary advertising efforts are focused on growing sponsored listings and then secondarily on Prime Video. Both are putting Amazon owned and operated inventory first.

Facebook continues to focus on monetizing Instagram and Facebook as destinations and TikTok the same.

None of these companies are focused on monetizing the open Internet.

In other words, it’s no real competition for The Trade Desk. Green highlighted that with something he had remembered from the Google anti-trust process:

Exhibits and industry experts estimated that in 2019, the open Internet and owned and operated inventory on YouTube were equally split in share of wallet on DV360. However, between 2019 and today, roughly all of the incremental dollars and growth from DV360 has gone to YouTube. YouTube spend increased by about 800%, while Google’s buying of the open Internet stayed essentially flat for the same period of time.

This confirms Green’s core thesis: Google has largely abandoned the Open Internet, and that has created a vacuum that The Trade Desk can fill.

And what about the other big names? Amazon, Apple, Facebook, and TikTok are all focused on growing and monetizing their inventory. Or to put it differently, they all want to monetize their own content as much as possible through ads. That’s precisely what a walled garden is.

Green’s position is that The Trade Desk does not (and can’t) compete with the walled garden for their own supply. That’s also why The Trade Desk emphasizes that it buys the whole internet. From the earnings slides deck:

I think Jeff Green’s right about this.

The Amazon Issue

But how about Amazon specifically? That’s seen as the second The Trade Desk’s bear case, next to the ‘slowing’ revenue growth.

These are the first words of his answer when an analyst asked about it.

Really appreciate the question. Honestly, I was hoping that we’d get to talk about this because I get this question a lot, especially in the last couple of months. So I’m happy to explain.

It’s always a pleasure to hear CEO Jeff Green speak. He’s open, candid and happy to talk about everything, as you can see. He continues about Amazon:

Amazon has done an amazing job in advertising in recent years. But I think it’s worth taking a minute to double-click and look at what they’re doing. This year, they’ll do -- if we’re just using very round numbers and back of the napkin math, about $70 billion-ish in advertising.

From all of our market triangulation, there’s about 90% that is in sponsored listings at least. In fact, it’s probably more like 95% plus. So sponsored listings, in my view, are competing with Google Search and even the emerging AI search.

In other words, Green says that Amazon’s own webshop is by far the biggest source of ad revenue. Of course. Prime is number two. In other words, 95%+ of Amazon’s ad revenue is from its own inventory, be it on TV (Prime) or in the web shops.

Then there’s Amazon’s DSP, around which the bear case circles. Jeff Green:

97%, 98%, 99% of advertising efforts are about monetizing owned and operated inventory and what’s left goes to the open Internet. In advertising, Amazon first competes with Google and then it competes with Netflix and Disney. Very little time and money is competing with us. So the reality is we’re playing in a very different sandbox.

Our focus is in decisions data-driven buying across the open Internet, especially in high-growth areas like CTV. And I would argue that we deliver capabilities that they just can’t match, things like UID2 for identity, deep integrations with retail data, third-party data marketplaces, all the things that we talked about in our innovations earlier in the call.

In 10 years, I don’t think Amazon has a DSP as we define it. I think they will have tools to buy owned and operated, and they play in advertising the way that Facebook does today and the way that I think Google likely will in the future.

This is quite convincing to me. I made The Trade Desk a Potential Multibaggers pick in May 2019 but I had followed it already for a while. During that long period, Jeff Green made multiple predictions and I’ve never heard him make a prediction that didn’t become a reality. Even risky bets like ‘Google will at least delay the abolishing of third-party cookies,’ he nailed them.

So, why wouldn’t I believe this man? I see no reason.

But people see

1. Amazon’s ad revenue growth accelerated

2. The Trade Desk’s revenue growth decelerated a lot (optically, as discussed above).

They think that 1+ 1 = 2, but correlation is not causation.

Overall, the tailwinds are still intact. Video is the biggest source of revenue for The Trade Desk, with 50% of revenue but its growth is still faster than the overall growth. The growth in Europe and Asia-Pacific continues to be faster than that in North America. With 60% of the TAM outside of the US, this is very promising.

The long-term thesis is still intact. I think the market may underestimate The Trade Desk’s future growth at this point.

Conclusion

This was a strong quarter. Many things have to be put into context, especially revenue growth. But the thesis for The Trade Desk is fully intact.

The next questions to answer then are the following: what’s the evolution of the company’s quality and how does its valuation look like?

That’s what we will check now.

The free part stops here. If you want full access to Potential Multibaggers, here’s what you’ll get:

✅ My complete portfolio (with every transaction)

✅ Deep insights through quarterly earnings deep dives

✅ The Quality Score and valuation updates every quarter.

✅ Access to our private chat group

✅ Best Buys Now (outperforming the market by 30% over 3 years!)