Hi Multis

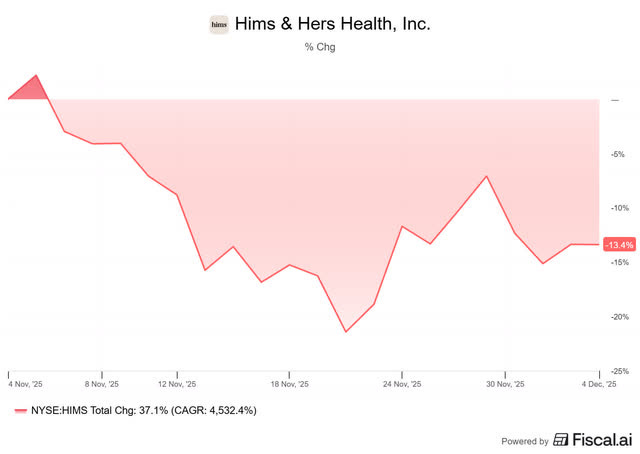

Baurzhan here with an earnings update for Hims & Hers (HIMS). On Monday, November 3, Hims & Hers reported its Q3 2025 earnings and the market didn’t know again how to react to the results, as last quarter.

Let’s quickly recap last quarter’s developments.

The company is also in a transition period for sexual health. It’s shifting from on-demand to premium daily subscriptions. This pressured short-term growth but should improve long-term retention and lifetime value.

Now let’s look into this quarter's results and insights, starting with the key numbers first.

The Numbers

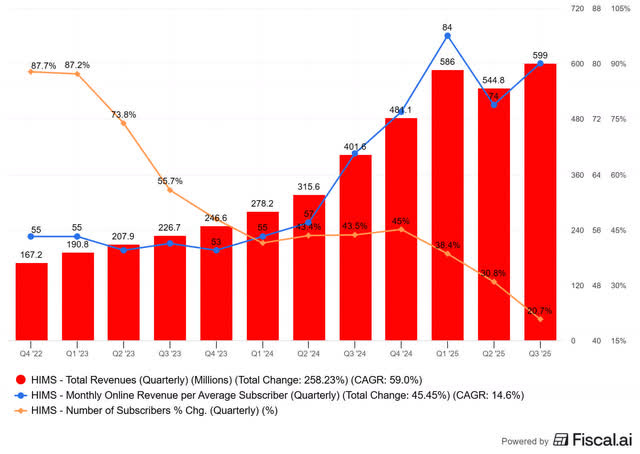

Revenue: $599M, +49% YoY, beating expectations by 2.9%

Operating Margin: 2%, vs 5.6% last year in Q3

EPS: -81% YoY to $0.06, a miss by $0.03

Subscribers: 2.47M, +21% YoY and just +30K QoQ, mainly caused by the GLP-1 headwinds and transition in the sexual health category from on-demand to subscription-based offerings. Excluding that, subscribers grew +40% YoY

Monthly ARPU: $80, up from $74 in Q2 due to growing personalized subscriptions, +50% YoY.

Adjusted EBITDA: $82M vs. $72M expected, 15% EBITDA margin

Free Cash Flow: $79M, flat YoY, 13.2% FCF margin

Guidance:

Q4 $605-625M revenue, $55-65M EBITDA;

FY25 revenue narrowed from $2.3-2.4B to $2.34-2.36

The numbers weren’t spectacular, but the quarter showed resilience and progress through the current transition.

Hims & Hers returned to sequential revenue growth (+10%) and positive free cash flow, just as promised.

If you want to make such beautiful charts as well, you can get a 15% discount here.

In the previous quarter, Q2 2025 (so not the one we are analyzing here), Hims & Hers results showed the first revenue miss since going public, revealing slowing core growth and temporary GLP-1 headwinds after the FDA lifted the shortage status.

That marked the start of a transition period, shifting from on-demand to premium daily subscriptions in sexual health, which pressured short-term growth but should improve long-term retention and lifetime value.

So, the Q2 results made me want to monitor the rebound in core revenue, GLP-1 revenue, and early traction from new initiatives, such as hormone therapy and AI-driven healthcare tools.

Important, management also reaffirmed its $725M full-year 2025 GLP-1 revenue target. It reported strong adherence and low churn among its GLP-1 patients. Based on this trajectory, Q3 GLP-1 revenue likely landed near $205 million.

The company is investing heavily in vertically integrated, FDA-registered compounding facilities to control quality. The scale should make it cheaper for Hims & Hers and its customers at the same time.

In early November, the Trump administration announced agreements with Novo Nordisk and Eli Lilly to lower prices for GLP-1 drugs and expand access. For example, via Medicare, you pay as low as $50 co-pay, cash-price programs around $350/month, and oral versions starting at ~$150/month.

The price-and-access shift means the cost base and competitive dynamics for GLP-1 weight-loss therapies are changing. If the company’s infrastructure investments aim to help scale and reduce costs, then they may be better positioned in this new landscape.

On the other hand, the pressure on drug pricing could squeeze margins or force faster cost improvements, which makes the company’s claims of “greater efficiency” and “verticalisation” more relevant. But there’s also more pressure to deliver.

But if we look at Hims & Hers, that execution seems to be good. Online revenue grew to $589.1m, +50% YoY and +10% QoQ. That’s strong.

The core business, excluding GLP-1, was up an estimated 5% to 10% QoQ to an estimated $385–395 million. The “sexual health rotation” that depressed growth earlier in the year began showing payoff.

As founder and CEO Andrew Dudum stated:

At the end of the quarter, subscribers using personalized solutions grew 50% year-over-year, helping drive nearly 50% in year-over-year revenue growth.

ARPU (average revenue per user) increased to $80 from $74 last quarter, driven by growth in premium subscribers across specialties.

Gross margin declined to 73.8%, down 5 points year-over-year and about 2 points sequentially, as shorter GLP-1 shipping cycles reduced per-order revenue.

Investments across specialties also pressured the operating margin this quarter to 2%. It was down 3.6 pp from 5.6% last year in Q3 and down 3 pp QoQ.

As commented by CFO Yemi Okupe:

G&A costs were also pressured as a result of the Zava integration as well as additional expenses related to the hiring of new leadership talent. G&A as a percentage of revenue increased 2 points year-over-year. A similar dynamic was seen in operations and support costs. Technology and development costs as a percentage of revenue increased nearly 2 points year-over-year to 7%, reflecting ongoing investment in engineering and product talent across the organization.

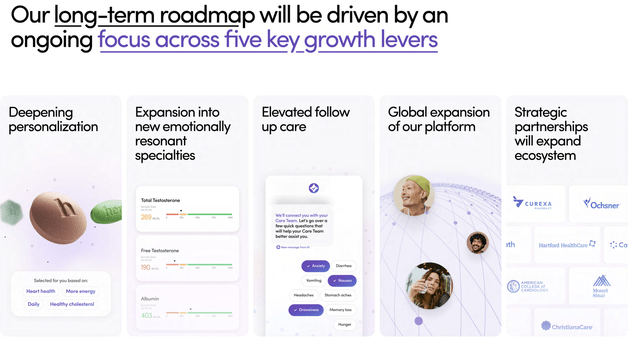

As HIMS stated in its last quarter presentation (for Q3, unfortunately, no presentation), the 5 pillars of HIMS’ future growth are deepening personalization (strengthened with home diagnostics), expansion into new specialties, elevated follow-up care, international expansion, and strategic partnerships.

Hormone Therapy Rollout Begins

Hims launched its hormone-therapy lines this fall. Men’s low-testosterone treatments were launched in September and women’s (peri)menopause care in October 2025.

International Expansion: ZAVA Integration

The integration of ZAVA continues, expanding Hims’ reach across the U.K., Germany, France, and Ireland; the acquisition added over 160 million adults to the company’s addressable market.

Management also reiterated plans to explore Brazil and Canada as next-stage markets, aligned with future generic GLP-1 entry. In the meantime, Canada started yesterday.

Looking Ahead: Q4 and 2026

Guidance for Q4:

Revenue: $605–625M (+1–4% QoQ, +27% YoY at mid point)

EBITDA: $55-65M (implying 10% margin at mid point)

Subscribers: >2.7M expected, implying 9% growth QoQ and 23% YoY

This guidance reflects expectations for another transition quarter.

But with hormones ramping, AI tools scaling, and international expansion contributing, 2026 could mark the reacceleration phase after this year’s “plateau of patience.”

Apart from the key numbers guided by the company, what I would expect from HIMS in Q4 and 2026:

Whole-body diagnostic testing launches before year-end, with a longevity specialty coming in 2026.

The company’s facility footprint will expand from 400,000 to over 1 million sq ft by year-end 2025

International operations (via the ZAVA acquisition) are contributing meaningfully and expanding into Brazil.

Gross-margin pressure is expected to normalize by mid-2026 as verticalization improves efficiency.

Conclusion: Transformation in Motion

Q3 showed incremental but real progress on three fronts:

Core business stabilization after the Q2 rotation drag.

Regained momentum in GLP-1 and subscriber growth.

Execution on new verticals and technology integration.

Long-term investors should appreciate the steady progress and transformation Hims & Hers is going through. Yes, margins are a bit under pressure but that comes because the company prioritizes the long term over the short term.

The improving revenue quality, stronger retention, and higher ARPU suggest the underlying business model remains strong. This positions Hims & Hers for future operating leverage once the transition phase is complete.

Kris will continue with PMQS and valuation updates.

Hi Multis

Kris here. Thanks, Baur, for the analysis. Before we go to the Quality Score and the valuation of Hims & Hers, let’s first look at the Selling Rules.

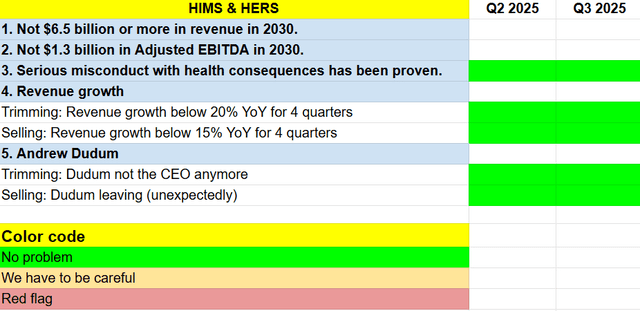

Selling Rules

These are the Selling Rules I made for Hims & Hers.

The first two rules are based on what management has promised. I want management to execute on their promises. But of course, we can’t evaluate them right now.

The third is important to me. If Hims & Hers has serious misconduct that causes health problems for its customers, it will lose customers’ trust and then it will be almost impossible to gain it back. Beware, I’m talking about a serious issue here, not a minor problem.

Revenue growth is always extremely important for growth companies, of course, so that’s the fourth criterion. You may wonder why I take four quarters. The reason is that I don’t want a one-off. Q1 this year was particularly strong because of the shortage of GLP-1 drugs, so HIMS could sell its compounded version freely. That means Q1 2026 will have extremely tough comps and revenue growth will probably be under 20%.

Andrew Dudum has the profile of a visionary CEO: whip smart, unconventional, slightly arrogant, willing to change his mind, ready to jump on every opportunity, etc. That’s why he’s crucial for me in the investment thesis.

Up to now, there are no Selling Rules violated.

The free part stops here. If you want full access to Potential Multibaggers, here’s what you’ll get:

✅ The rest of this article, with the Quality Score (which is surprising for HIMS!) and the valuation, so you know if the stock’s attractive or not.

✅ My complete portfolio (with every transaction)

✅ Deep insights through quarterly earnings deep dives

✅ The Quality Score and valuation updates every quarter.

✅ Access to our private chat group

✅ Best Buys Now (outperforming the market by 30% over 3 years!)

Don’t hesitate.