Hi Multis

Anand here with the Datadog (DDOG) Q3 2025 earnings result. Datadog reported beat-and-raise Q3 results on November 6, 2025. Sorry for the delay; I was traveling and couldn’t find a chance to write this earlier.

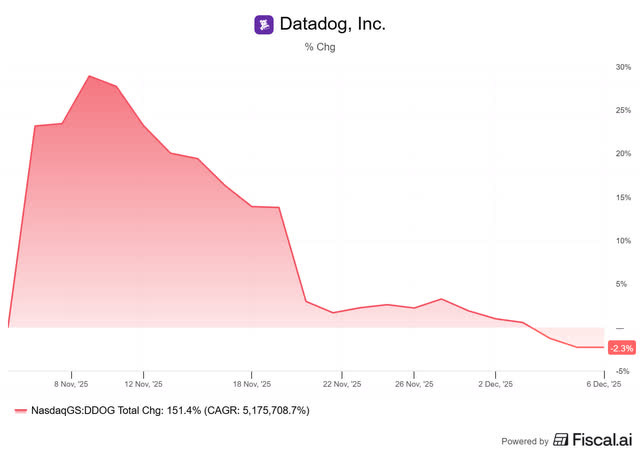

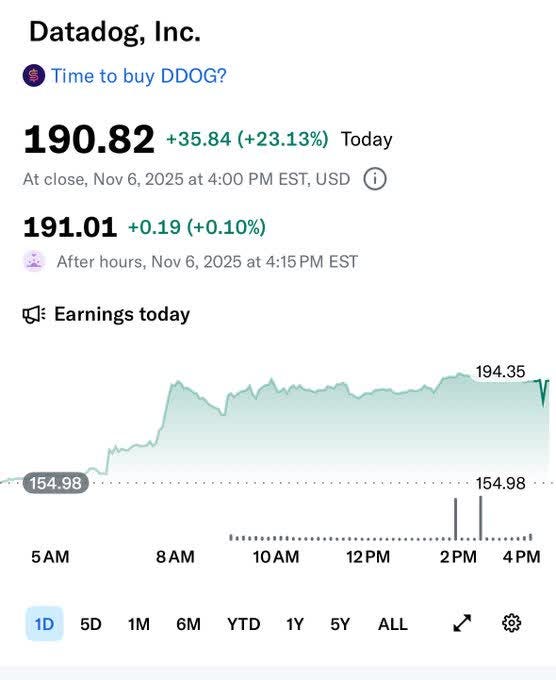

The stock price shot up more than 23% after the earnings and even to 28.9% a few days later. Finally, investors and the market recognized the position of Datadog, it seemed...

But for one reason or another, the stock nosedived again and it’s now even 2.3% below the price before the earnings. The fickle stock market...

We first go through the earnings, and then Kris will take over for the Quality Score and Valuation Score updates.

The Numbers

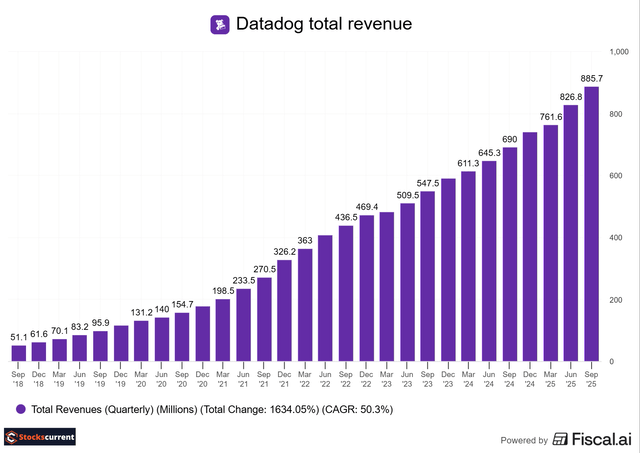

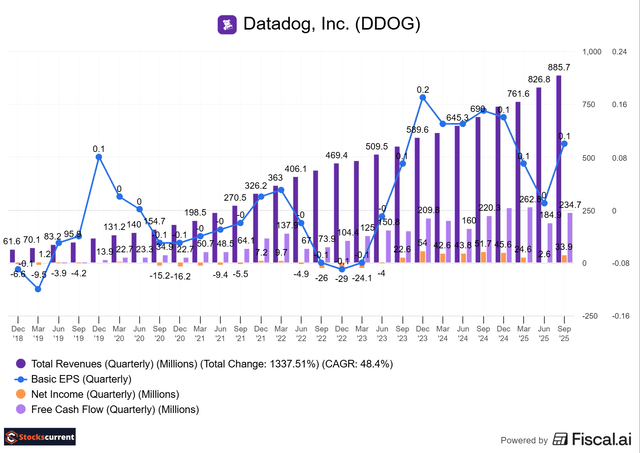

Datadog reported total revenue of $886 million, an increase of 28% year-over-year, above the high end of the guidance range. The main reason was the broad-based positive trends in the demand, with an ongoing strength of cloud migration and digital transformation. It was not just AI. The management team saw year-over-year revenue growth accelerate across the non-AI customers. There is more to double-tap later in the article.

Source: Fiscal.ai, follow this link to get a 15% discount.

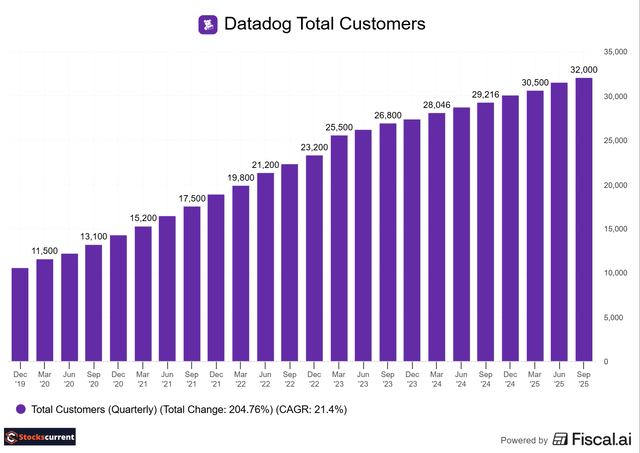

Datadog ended Q3 2025 with about 32,000 total customers, up about 9.5% from about 29,216 a year ago.

Source: Fiscal.ai, follow this link to get a 15% discount.

There were 4060 customers with an ARR (Annual Recurring Revenue) of $100,000 or more, an increase of 16.3% from 3610 a year ago. These customers generated about 89% of annual recurring revenue. Management didn’t provide numbers for the total number of customers with more than $1 million in ARR.

Source: Fiscal.ai, follow this link to get a 15% discount.

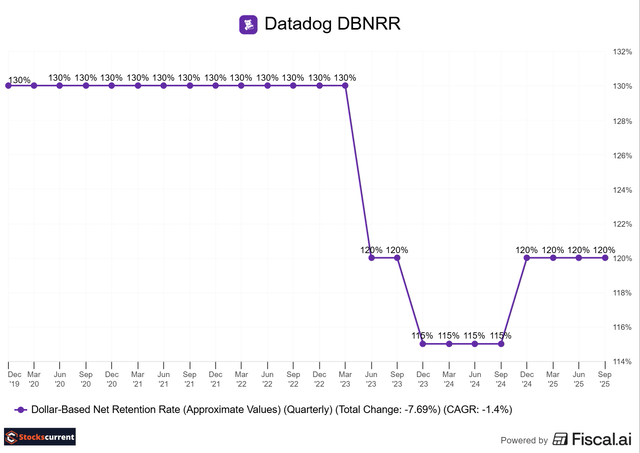

The dollar-based net retention rate remains steady at 120%, a positive indicator; expansion into existing customers seems to be at a normalized level.

Source: Fiscal.ai, follow this link to get a 15% discount.

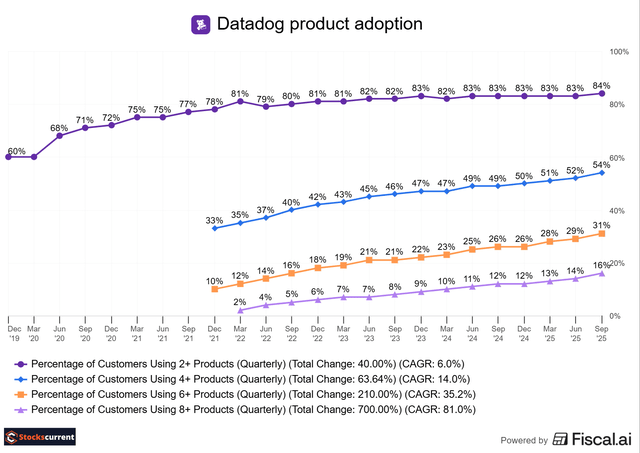

Datadog’s platform adoption is growing steadily. Datadog’s land-and-expand model is working as management expected.

By the end of the third quarter, 84% of Datadog’s customers had adopted 2 or more products, up from 83% a year ago. Furthermore, 54% of Datadog’s customers used 4 or more products, up from 49% a year ago. 31% of the customers were using 6 or more products, an increase from 26% a year ago. Finally, 16% of the company’s customers were using 8 or more products, up from 12% last year.

Source: Fiscal.ai, follow this link to get a 15% discount.

Datadog reported a GAAP net income of $0.1 per diluted share, while the non-GAAP net income was $0.55 per diluted share.

For Q2 2025, the company’s operating cash flow was $251 million, with a free cash flow of $214 million and a free cash flow margin of 24%.

By the end of Q2 2025, Datadog had cash and cash equivalents totaling $4.1 billion.

Source: Fiscal.ai, follow this link to get a 15% discount.

Guidance

Q4 2025 Outlook:

Management guided for revenue between $912 million and $916 million, up more than 24% year over year. I still think it is conservative, and the company will beat the guidance. That’s more or less a tradition for Datadog. But 24% is already strong, of course. Non-GAAP operating income is expected to be between $216 million and $220 million, which translates to non-GAAP EPS from $0.54 to $0.56 per share.

Full-Year 2025 Outlook

For the full year, the management team guided revenue to be between $3.386 billion and $3.390 billion, or 25% up year over year on the midpoint. The company raised its full-year revenue guidance range $3.312 billion to $3.322 billion from the last quarter. Non-GAAP operating income is expected to be between $754 and $758 million, which is an increase from the previously guided range of $684 to $694 million. Non-GAAP net income per share ranges from $2.0 to $2.02, increased from $1.80 to $1.83.

At the beginning of the year, the management team indicated that demand is growing and that they are seeing a positive trend. We can actually confirm that, in all three consecutive quarters, the numbers have been better than expected, and guidance has been raised each quarter.

Insights from the conference call

Product Updates:

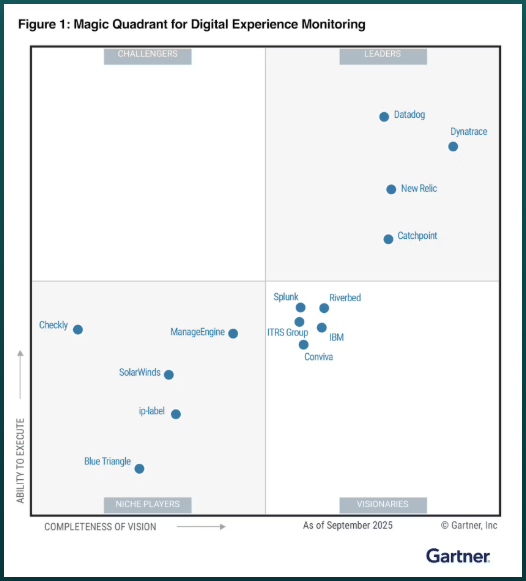

Digital experience product suites are where the rapid pace of innovation is delivering tangible value to their customers.

Datadog digital experience products include RUM, or real user monitoring, to observe and improve application behavior in mobile and web apps, synthetics, to simulate user flows and proactively detect user-facing issues, and product analytics, to help users connect application behavior to business impact.

These digital experience products together exceed $300 million in ARR. It is one of the fastest-growing product analytics platforms, with more than 1,000 customers already adopting it.

For the second year in a row, Datadog has been named a leader in the Gartner Magic Quadrant for Digital Experience Monitoring.

Source: Datadog investor presentation

Datadog’s security suite of products is executing well and accelerating growth. Co-founder, CEO and Director Olivier Pomel on the earnings call:

Security ARR growth was in the mid-50s as a percentage year-over-year in Q3, up from the mid-40s we mentioned last quarter. We’re starting to see success in including Cloud SIEM in larger deals, and we’ll get back to that in a bit in our customer examples.

And we’re seeing positive trends beyond Cloud SIEM, including fast uptake of good security and an increasing number of wins in cloud security. Overall, we saw year-over-year growth acceleration in each one of our Security products.

Datadog’s security agent product is in preview but gaining traction. Security agent looks at vulnerabilities and looks at security signals, and does triage, basically trying to investigate what might be benign or what might be a real issue. These innovations and mature products are helping the company win some large lenders for our Cloud SIEM products.

Datadog announced Bits AI agents at the DASH user conference in June. The management team is seeing high customer interest in Bits AI. They have now onboarded thousands of customers for preview access to the Bits AI SRE agent.

That’s not just about Bits AI, Datadog is double-tapping on the Bits AI opportunity. They are seeing significant demand for the Bits AI, and wanted to go further into the resolution. The team is working on the breadth of the product, making sure it is trained on many more types of data, many more types of sources, and sometimes even systems that are not observed by Datadog. Olivier Pomel:

As one customer recently told us, with Bits AI SRE being on-call 24/7 for us, the mean time resolution for our services has improved significantly. For most cases, the investigation is already taken care of well before our engineers sit down and open their laptops to assess the issue. This is not an isolated comment.

That’s a jaw-dropping customer feedback and a real-life use case of agentic AI. I see the potential here for agents to radically transform observability and operations. Many executives simply use the term “agentic AI,” while Datadog is integrated into the product, providing real benefits to its customers.

Comprehensive updates on AI-native and non-AI customers

The management team gave comprehensive updates about its customers and demand.

Datadog supports over 1,000 integrations, an unparalleled number in the observability space.

Datadog’s customers are highly interested in next-gen AI observability, with over 5,000 customers sending AI data through one or more of our AI integrations to the Datadog platform. More than 32,000 customers use more than 50 integrations on average, while customers spending over $1 million annually with us use more than 150.

It’s not practical to actually go and manage those integrations separately. A consolidated, unified platform is mandatory, not optional. Those are really commendable numbers, and that also shows why switching costs will be higher as the tech stack is evolving.

The management team continues to see the AI-native group grow in both number and size, with more than 500 AI-native companies in the group, about 100 of which spend more than $100,000 annually with Datadog, and more than 15 of which spend more than $1 million annually with Datadog.In Q3, the AI-native group represented 12% of the revenue, up from 11% last quarter and about 6% in the year-ago quarter.

Datadog’s year-over-year revenue growth also accelerated amongst our non-AI-native customers. In Q3, the revenue growth, excluding the AI-native customer group, was 20% year-over-year, accelerating from 18% year-over-year in Q2.

The management team saw sequential usage growth from existing customers in Q3 that was higher than expectations and the strongest in 12 quarters in the non-AI native customer base. In Q3, Datadog’s revenue growth, excluding the AI-native customer group, was 20% year-over-year, accelerating from 18% year-over-year in Q2.

The market opportunity in cloud and AI is expected to grow rapidly into the trillions of dollars, and companies of every size and industry are looking to adopt AI to deliver value to their customers and drive positive business outcomes. Datadog is a direct beneficiary and ready to capture the demand.

Updates on LLM observability

Datadog recently launched LLM experiments and playgrounds for general availability, helping customers to rapidly iterate on LLM applications and AI agents. They also launched a custom LLM as a judge evaluations for general availability, which lets customers write evaluation prompts to assess application quality and safety. In the past three months, the number of customers adopting LLM observability has more than quadrupled.

Conclusion

Datadog reported strong quarterly results, beat earnings expectations, and raised full-year guidance. I am confident that the Datadog team will deliver strongly. Datadog is a GAAP-profitable company with large opportunities ahead. AI is the fastest-growing segment, and scale is massive. They are investing in capturing growth, delivering new products, and remaining profitable. That is the recipe for success, and that’s what investors love about Datadog.

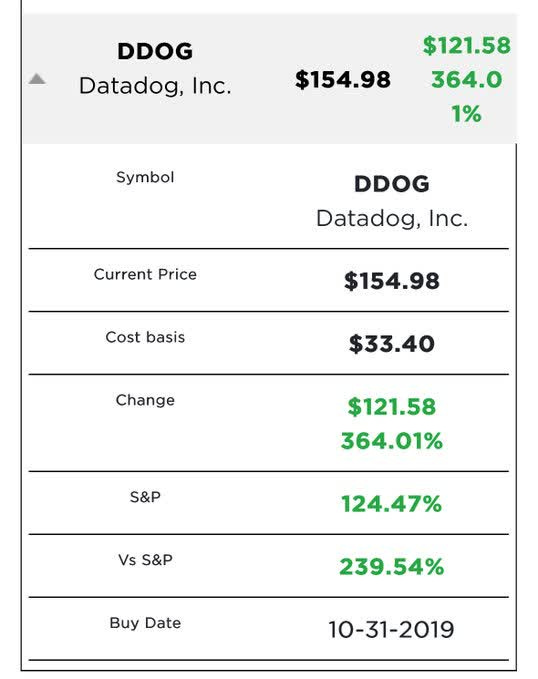

PS: I don’t like to brag about my winners, and I don’t feel overly sad about my losers. Investing is a long game, and there will be days when I am right and days when I am wrong.

I just wanted to share humbly. I got a spiffy pop for a Datadog. For those who don’t know what a spiffy pop is, it’s a term that Motley Fool co-founder David Gardner gives to a stock that jumps more on one day than your (initial) cost basis.

Disclosure: I personally own the shares of Datadog ( DDOG) since October 2019.

If you like the article, please share your feedback in a comment on the article and follow me on X@anandkhatri.

Now to Kris for the PM Quality Score and the valuation.

The free part stops here. If you want full access to Potential Multibaggers, here’s what you’ll get:

✅ The rest of this article, with the Quality Score (which is surprising for HIMS!) and the valuation, so you know if the stock’s attractive or not.

✅ My complete portfolio (with every transaction)

✅ Deep insights through quarterly earnings deep dives

✅ The Quality Score and valuation updates every quarter.

✅ Access to our private chat group

✅ Best Buys Now (outperforming the market by 30% over 3 years!)

Don’t hesitate.