Hi Multis

Even during the earnings season, there are Sundays. It's the perfect day to calm down from a busy week. A cup of tea or coffee, and, of course, the Overview Of The Week.

Or maybe, you read this on Monday. I know some Multis check their mobile phone directly after waking to see if the Overview Of The Week is in their inbox. They read it in bed, waking up, during breakfast, with a coffee after breakfast, or during their commute to work. Or they read it during their lunch break.

However you read this OOTW, I hope you enjoy it. It's brimful of exciting news again.

Articles In The Past Week

Last week, I wrote that I had experienced some fatigue in the past few weeks, but some nights of high-quality sleep can sometimes do wonders for recovery. This week, the OOTW is already the fifth article, so it's always good to see an overview, in case you missed something.

The first article of the week was already announced last week: part two of the Q1 Earnings Cleanup.

In the second article this week, I analyzed the earnings results of Kinsale.

Just like every two weeks, I added to the Forever Portfolio again. In this article, you can see the 9 stocks I bought and why.

In the fourth article this week, I analyzed the TransMedics earnings, gave the company its first Quality Score and Valuation Score.

Memes Of The Week

Some weeks, there are no memes. Some weeks, there are a lot of memes. Last week, there were none, this week, we have four memes.

The first one is not really a meme, but a great joke by Leandro, with whom I have my second newsletter, Best Anchor Stocks.

You can follow Leandro here, not just for his funny stuff, of course, but for the deep insights he provides.

If you want to subscribe to Best Anchor Stocks, you can do that here.

The next one is from me, after the cannonball IPO of Figma this week.

This was one Multi Marc shared:

I may have shared this one or a similar one before, but it remains great:

Interesting Podcasts Or Books

I want to thank Multi BK Lee for sharing so many interesting content. He also shared the interview of Marcos Galperin and (checks spelling) Ariel Szarfsztejn. Starting in 2026, Szarfsztejn will take over the CEO role of founder and current CEO Marcos Galperin, who will become Executive President and will remain responsible for company culture and innovation.

The episode is just 16 minutes, so it's right to the point. You can listen to it here.

The markets in the past week

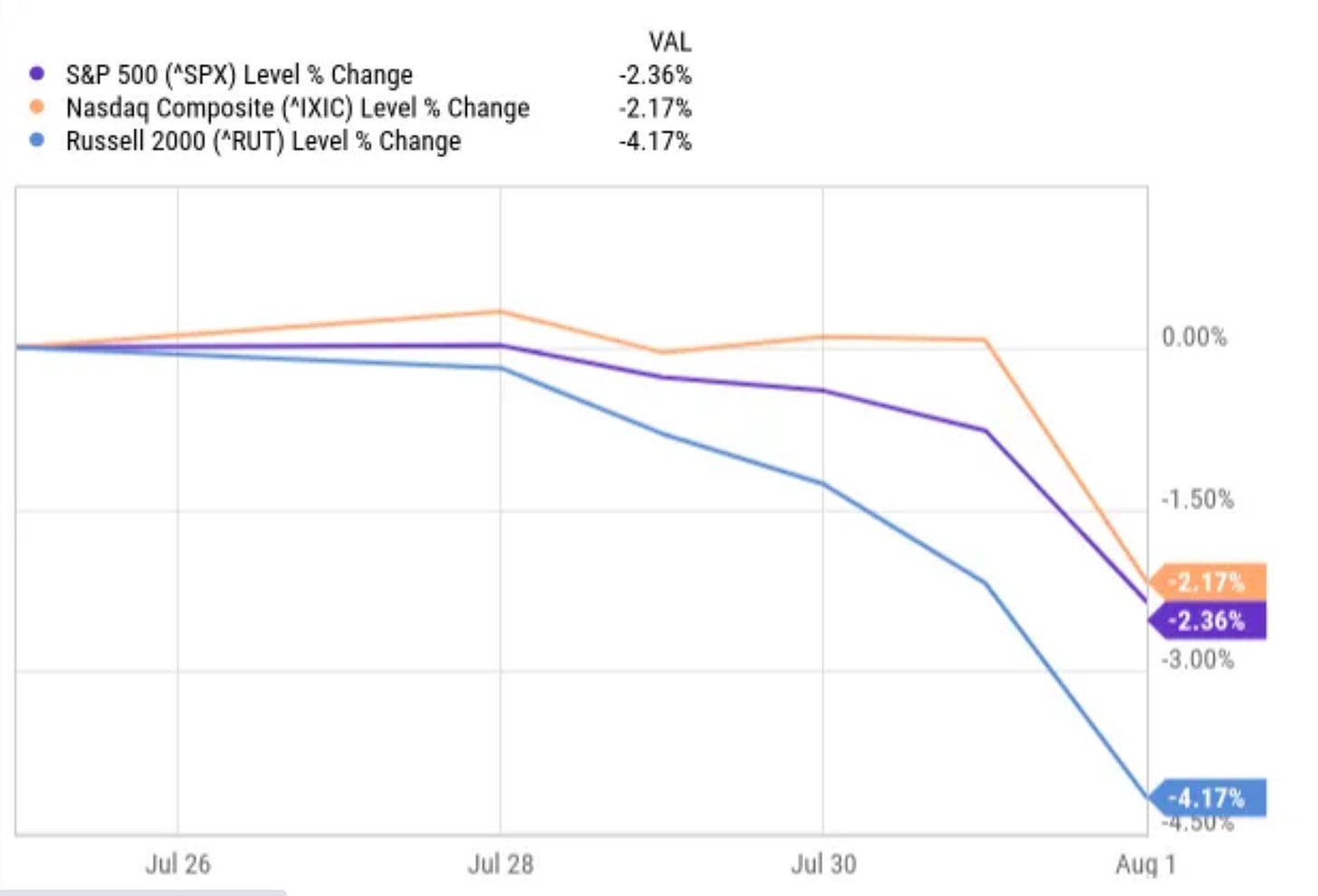

"What was that?" Some who call themselves "investors" already panicked this week, after the markets were down a few days, after months of going up.

The Russell 2000 was down the most, 4.17%, the Nasdaq 2.38% and the S&P 500 2.17%.

Weirdly enough, the Greed & Fear Index dropped from Greed, bordering Extreme Greed, to Neutral in just a week. Quite a move.

The fact that the job numbers were weak was the first reason for the decline. It feels like this could have been in the memes section as well, but it's real.

The second reason was the fact that the Fed didn't lower the interest rates.

The third reason some named was that the markets had run up too much since the April lows. That may be true to a certain extent, but Multi and occasional author Karan shared a great article about this. What follows is my interpretation of that article.

The first thing to know is that earnings and stock market movements go together over the long term.

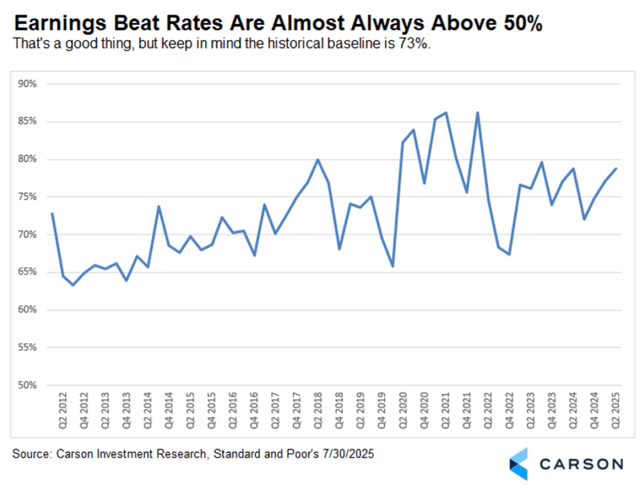

So, how about the earnings so far?

Second-quarter earnings are coming in solid, helping confirm the market’s rally since April. As of July 25, about a third of the companies in the S&P 500 have reported. So far, 80% have beaten expectations, a little better than the five- and ten-year averages.

But the size of those beats has been more muted, coming in 6.1% above forecasts—below the five-year average of 9.1%.

Margins are still strong, above 12% for the fifth straight quarter. Revenue surprises have also been stronger than usual, helping support profitability.

These results don’t signal a blockbuster quarter, but they do show steady strength. High beat rates are the norm, in part because companies often lower expectations just before earnings season. This quarter, only 52% of companies gave negative guidance ahead of time, slightly below the five-year average. That may reflect earlier caution from firms due to tariff uncertainty, much of which now looks priced in.

The key takeaway is that earnings growth is driving most of this year’s market gains. The S&P 500 was up 9.1% in 2025 so far (that was before the drop in the last few days). Of that, 4.9 points are from earnings (1.3% from sales growth and 3.6% from margins) and another 0.8% from dividends. Valuation changes explain the remaining 3.4%. And that part is mostly gone in the last few days.

While forward earnings estimates are slow to adjust and not great at timing market peaks, they’re still rising. They've ticked higher in 27 of the last 28 months. That makes this situation look very different from 2022, when earnings estimates declined months after the market did.

So far, the stock market valuation looks justified, as earnings are pulling most of the weight. Of course, that doesn't mean there can't be a correction or even a crash. Everything is possible in investing. We can only look at the present and the past, not into the future.

Quick Facts

1. Wanna Be on the HIMS Conference Call?

Hims & Hers (HIMS) founder and CEO Andrew Dudum wrote this on X.

So, if you have a question, don't hesitate to send it in, as the earnings results are on Monday.

Thanks, Multi ShipofFools, for tagging me.

2. Fiscal(.)ai

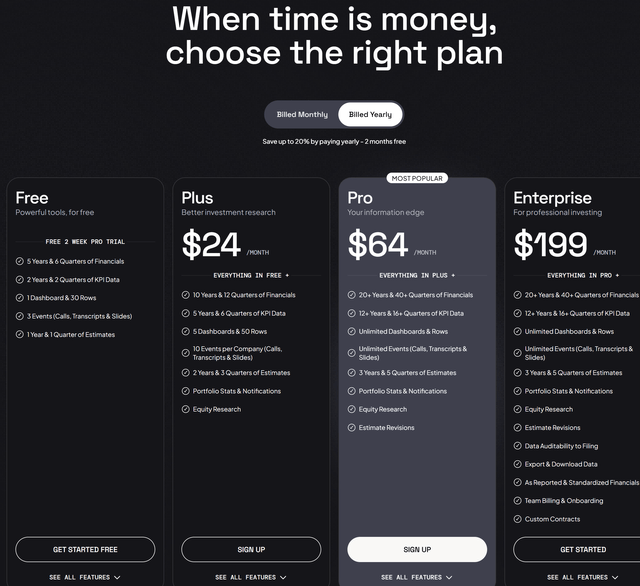

Last week, I already pointed out that I use Fiscal(.)ai multiple times every single day. This week, there was an update: Enterprise was launched.

The advantages:

Unparalleled Data Speed (all financials are updated within minutes of earnings)

Data Exporting

Click-Through Auditability (click directly into the source)

As Reported & Standardized View

With my discount link, you get the Plus plan for just $244.8 per year or just $20.4 per month, the Pro plan for just $652.8 per year ($54.4) and the Enterprise plan costs $2,030 per year ($169 per month) instead of $2,388.

3. My 2025 Picks are doing great

On December 30, 2024, I picked 10 stocks for 2025. How do they do? Let's check but first, let's check the benchmark, the S&P 500 (and the Nasdaq).

As you can see, the S&P 500 is up 6.06%. The Nasdaq is up 6.94%. How are our 10 picks doing?

Pretty good, it seems, as they are up more than 50% since I picked them.

There's just one stock that underperforms the indexes, ASML. And I'm pretty bullish about that stock. The EV/EBITDA of just 18.76 shows that it's at a level not seen since 2019.

I smell an opportunity here.

4. The Meta Earnings

Let's have a quick look at the Meta (META) earnings.

Revenue: +22% YoY to $47.5B, a beat by $2.7B beat or 6%, which is gigantic at this level.

Operating Margin: 43%, +5pp YoY

EPS: +38.4% YoY to $7.14, a beat by $1.24 or 21%.

Operating Cash Flow: +32% YoY to $25.6B

Free Cash Flow: -22% YoY to $8.5B.

Family of Apps DAP (daily active people): +6% YoY to 3.48B

ARPP (average revenue per person): +15% YoY to $13.65

Ad Impressions: +11% YoY

Average Price per Ad: +9% YoY

Balance Sheet: Cash & securities $47B, Long-term debt $29B

Guidance: Q3 Revenue $47.5-50.5B, 6% better than the consensus

FY25 CapEx $66-72B, up from $64-72B

Meta Platforms released another impressive quarter and the market loved it as well, based on the price reaction.

The company spent $17 billion in CapEx. Guess what that was used for. AI investments are still very high and won't come down any time soon. But the Family Of Apps (Facebook, Instagram, WhatsApp, Threads) is such a profit powerhouse that Meta can invest whatever it wants. You can see that in operating cash flow, which was up 32% to $25.6 billion.

AI already pays off, as it increases ad precision (4%-5 %) and engagement (5%-6%).

The fact that Meta guides 6% above the consensus for Q3 is impressive, as it faces tough comps with the Olympics and elections last year.

CapEx guidance was raised to $66-72B and $99B in 2026.

This very strong quarter showed that the investments have already started to pay off. And Meta still has optionality left, like the monetization of Threads and WhatsApp. And of course, Meta's AI, which has hit more than 1 billion users.

Meta is a part of the Magnificent 7 and that word can be applied to these results and the company.

When she was two, I started a portfolio for our 11-year-old daughter, and she's a small META shareholder with a profit of 265% on her average price. I see no reason to sell or trim.

5. Amazon's Earnings

Amazon (AMZN) also dropped its earnings.

Revenue: +13% YoY to $167.7B, a beat by $5.6B or 3.4%, solid at this scale

Gross Margin: 52%, +2pp YoY

Operating Margin: 11%, +1pp YoY

EPS: +40% YoY to $1.68, a beat by $0.35 or 26%

Operating Cash Flow (TTM): +12% YoY to $121B

Free Cash Flow (TTM): -66% YoY to $18B (CapEx!)

AWS Revenue: +17% YoY to $123B run rate, 33% margin, -3pp YoY

North America Segment: 8% margin, +2pp YoY

International Segment: 4% margin, +3pp YoY

Advertising: +23% YoY, the fastest growth in 5 quarters

Balance Sheet: Cash & securities $93B, Long-term debt $51B

Guidance: Q3 Revenue $174-179.5B, beating consensus by $3.6B

FY25 CapEx: $120B (up from $105B previously)

Amazon delivered another rock-solid quarter, though with some mixed signals beneath the surface. That's why the stock sold off on Friday.

Don't misinterpret this, though. Amazon keeps getting stronger. North America margins jumped 2 points as the fulfillment network continues its relentless efficiency gains. The number of deliveries that go straight to the address (with no stops) was up 40%. The miles per package were cut by 12%. When you're delivering over a billion packages, those improvements compound and can save you a stack of money. Prime Day was the biggest ever, and Everyday Essentials now make up 33% of orders.

AWS grew 17%. That's great, as AWS is still the biggest cloud. But of course, people looked at Microsoft Azure's 39% growth and Google Cloud's 32% growth this quarter.

But it's not a demand problem. Amazon is supply-constrained, with order backlog up 25% YoY. They literally can't build data centers fast enough to keep up with AI demand, especially with power constraints. It's a good problem to have.

Advertising jumped 23% YoY, faster than both Meta and YouTube. And that is high-margin revenue. Amazon is now the third advertising company after only Google and Meta. The new Roku and Disney partnerships look promising for even more. When you combine Amazon's shopping data with streaming audiences, that's a dream come true for advertisers.

CapEx hit $31B this quarter and management guided to $120B for the full year. Almost everything is poured into AI infrastructure. That's why free cash flow dropped by 66%, but this is a necessary investment.

Here, too, just like for Meta, there's still a lot of optionality. Think of the Kuiper satellites, agentic AI tools like Kiro, and AWS's custom Trainium chips powering Anthropic's Claude models. Amazon is building the infrastructure for the next decade.

Andy Jassy has already built a track record of sandbagging forecasts, but the Q3 revenue was still 2% above consensus.

I'm a long-term Amazon shareholder and this quarter won't change that. To the contrary, I consider adding to my position because of the underestimation of the AWS demand.

6. Apple Earnings

I've never been an Apple (AAPL) shareholder, although our daughter has a few shares in her portfolio.

Revenue: +10% YoY to $94.0B, a beat by $4.9B or 5.5%

Operating Margin: 30%, flat YoY but there was an $800M tariff hit

EPS: +9% YoY to $1.57, a beat by $0.14 or 10%

iPhone: +13% YoY to $44.6B, an 11% beat

Mac: +15% YoY to $8.0B a beat by 10%

iPad: -7% miss vs. estimates

Services: +13% YoY to $27.4B, a 2% beat

China Revenue: +4% YoY, a beat of 1.2%

Balance Sheet: $134B in cash & marketable securities, $92B debt

Guidance: Mid-to-high single-digit revenue growth, better than the consensus estimate of 3%

Apple delivered a decent quarter. Finally, revenue's up, although it was versus easy comps. Apple's revenue growth over the last three years? 4.3% per year. Yawn.

Meta's investments in AI: $70B in 2025, $99B in 2026, Amazon's investments (mostly in AI) in 2025: $120B, Google's investments in AI in 2025: $85B

Apple? $204B ... in buybacks for 2024 & 2025. And just $4B in AI.

Someone's missing the boat...

Of course, the iPhone remains a powerhouse and it was the star performer again, up 13% YoY despite absorbing an $800 million tariff hit. But this may be a pull-forward. CEO Tim Cook noticed "unusual buying patterns" in the US as customers rushed to purchase ahead of expected price hikes. Apple's China revenue was up 4% but that was boosted by government subsidies starting in June 2025. So even this stronger quarter will probably be a temporary boost.

The Mac had a record quarter with 15% growth, driven by strong demand for the Air and Studio models. Services have been the other star for Apple. They hit a record quarterly revenue of $27.4 billion, growing 13% YoY, although developers could bypass Apple's commission structure for the first time somewhere halfway the quarter.

On top of that, Apple has to spend heavily on domestic manufacturing. It has committed to invest $500B in the US. That's not for charity, but because of the tariffs, which would make the iPhone too expensive.

The Google search deal, which earns Apple $5 billion quarterly without any costs, is still intact but could be banned by the ruling next week.

At 27x forward P/E, Apple is still expensive for meagre growth. I'm not tempted to buy.

It's the first time since 2010 that Apple fell out of the top 2 biggest companies based on market cap. Nvidia and Microsoft passed it. It could signal the slow decline of this giant.

Tim Cook is a phenomenal COO, probably the best in the world. But a CEO also needs vision, direction and to make people dream. Steve Jobs was the best at that. He loved Cook, but he also said: "He's not a product guy." And that becomes clearer and clearer. The successes that were invented by Jobs have been managed outstandingly, like a world-class COO would do, but there's no innovation. And eventually, that reality catches up. It's simple for Apple: it has to either innovate or it will slowly slip further from its throne.

7. Microsoft Earnings

And of course, if we looked at Apple, Amazon and Meta, we can't leave out Microsoft. This was Microsoft's fiscal Q4 2025, so it closes its fiscal year 2025.

Revenue: +18% YoY to $76.4B, a beat by $2.5B or 3.4%

Operating Income: +23% YoY to $34.3B, beat by 6.8%

EPS: +24% YoY to $3.65, a beat by $0.28 or 8.3%

Microsoft Cloud: +27% YoY to $46.7B (+25% FXN)

Azure: +39% YoY growth, beat estimates of 34.5% growth

Productivity & Business Processes: +16% YoY to $33.1B

Microsoft 365 Commercial: +16% YoY, cloud growth +18%

LinkedIn: +9% YoY growth

Commercial Bookings: +37% YoY

Balance Sheet: $94B cash, $40B debt

Full Year Revenue: $281.7B, +15% YoY

Q1 Guidance: Revenue and EBIT both beat estimates

CapEx: Over $30B in Q1

Microsoft delivered another strong quarter. Just like Amazon and Meta, it's proving the AI transformation is accelerating and already adds extra efficiency.

Azure was the absolute standout, growing 39% YoY. At that size, that's impressive. AWS has supply constraints, as we saw above, and that could cost it precious market share to Azure. And Microsoft also says they are supply-constrained. There's $368 billion in backlog. And demand keeps surging.

Copilot crossed 100 million monthly active users, and Microsoft now has 800 million users across all AI products.

Fabric continues to be their secret weapon in the data analytics space, growing 55% with 4,000 net new customers this quarter alone. It's now the fastest revenue ramp of any data product in Microsoft's history. With ChatGPT using PostgreSQL integration through Fabric, Microsoft is positioning itself as a key data platform in the AI ecosystem.

CapEx will be over $30 billion in the next quarter, with 50% going to short-lived server assets to meet immediate demand signals. That's a sprint-to-keep-up-with-customers spending.

Commercial bookings jumped 37% to a record quarter, showing enterprises are committing to long-term Microsoft Cloud contracts. When you're bundling AI, cloud, productivity, and security into one enterprise suite, customers find it nearly impossible to switch.

The full-year guidance sees for 10%+ revenue and EBIT growth with stable operating margins despite the massive infrastructure investments. Growth will be front-loaded in the first half as new capacity comes online, then moderate in the second half.

I don't own Microsoft. I found it always quite expensive and even more now. But it's clear that it's a phenomenal company again since Satya Nadella took over the reins from Steve Ballmer in 2014.

You’ve already seen the quality of insights I share. That’s just the beginning. You could have bought the 10 Stocks for 2025 and be up more than 50% YTD.

Inside the full membership, you'll get more updates, exclusive picks, my full portfolio, what I buy with my real money, a private community, Stocks On My Radar, and much, much more.