The Only Insurance Stock to Own

A combined ratio of 75.8% while others stack losses.

Hi Multis

Thursday, Kinsale Capital Group (KNSL) reported its Q2 earnings, as the first Potential Multibaggers pick.

The Numbers

Let's first look at the raw numbers.

Revenue: +22% YoY to $470M, a beat of $35M, or 8%.

Non-GAAP EPS: $4.78, a beat by $0.36 or 8.1%.

Diluted EPS: $5.76, +45% YoY

Gross Written Premiums: +5% YoY to $556M

Net Investment Income: +30% YoY to $47M

Underwriting Income: $96M

Combined Ratio: 75.8%

Expense Ratio: 20.7%

Annualized Operating ROE Q2: 32.5%

Annualized Operating ROE H1: 27.9%

Book Value Per Share: +16% since YE 2024

Float: $2.9B

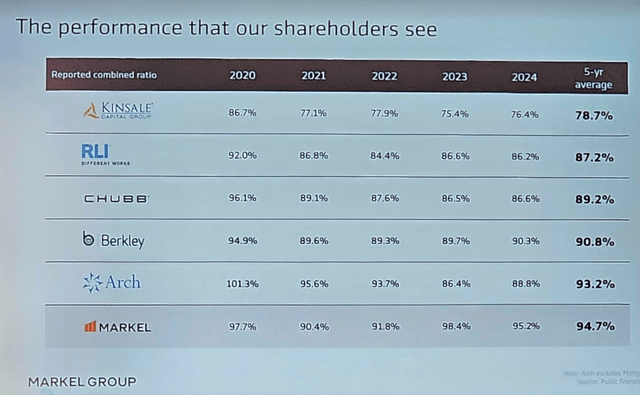

Kinsale Capital Group just delivered another masterclass in E&S insurance. I know, that probably sounds hyperbolic. But it's also what all the experts in the field say. On the Markel Brunch in Omaha, this is what Markel showed:

I'm sorry the quality of this image is not great, but I took a picture of this slide from the back of the conference room (which can hold about 2000 people), so I had to zoom in a lot. But the content is more important than the picture quality, obviously.

The lower the combined ratio, the better. With a combined ratio of 75.8%, Kinsale remains the best-in-class insurer, with a wide lead.

Revenue continues to grow fast too, at 22% in Q2. That was 8% higher than the estimates, which is very impressive for a company like Kinsale.

Non-GAAP EPS soared to $4.78, beating by $0.36, or 8.1%. On a GAAP basis, fully diluted EPS jumped 45% to $5.76. This is another example of non-GAAP metrics adding valuable information. The non-GAAP EPS excludes investing profits, while GAAP EPS includes the investing gains, which were very strong in Q2, with $47 million in gains or 30%.

Oh, you may miss guidance, right? Well, this is Mike Kehoe, and he has a straightforward, no-nonsense approach that I really like.

Previously, he had said growth would be 'somewhere between 10% and 20%.' With this great quarter, an analyst wanted to know if he still thought the same about this.

We don't offer a growth prospect because ultimately, we don't really know what that number is going to be. I think 10% to 20% over the course of the cycle is a -- it's a good faith estimate and it's actually, I think, a conservative one.

When another analyst pressed Kehoe on where we are in the cycle, this was his answer:

We don't really have an opinion on that.You guys are in the business of analyzing companies and prognosticating. So we'll leave that in your capable hands.

I love that. It feels like someone from Main Street made a great insurance company with level-headed thinking, not puffing himself up like so many others in the insurance business. :-)

Kinsale expects to maintain returns on equity in the low-to-mid 20% range going forward. It will continue to return money to shareholders through a dividend and buybacks but it wants to keep enough money to invest in growth and for unexpected market conditions.

Still on the free plan?

This is just a short preview. Subscribers get full access to my deep dives on Kinsale and every stock in my portfolio.

You’ll also get:

✅ Regular new stock picks

✅ Deep dives on every pick

✅ Real-time earnings updates

✅ Valuation breakdowns

✅ Quality scores for each stock

✅ Access to our private discussion group

✅ And much more

Don’t miss what’s behind the paywall.