Hi Multis

The new year is about to start. It's 2025 already. I liked this meme about it.

I already want to wish you a great 2025, a year to remember. Above all, I wish you and your loved ones good health, great experiences, and good relations. Cheers!

But, of course, you are here for the stocks, right?

Because we also count down on New Year's Eve, I wanted to start with number 10, not number 1. To be clear, they are in reverse alphabetical order, not in order of conviction.

10. Taiwan Semiconductor (TSM)

If you look at the high-end chips, the ones that power the ongoing AI revolution, they are almost all made by TMSC. It's the only chip maker that can make them. Samsung might be licensed by Nvidia next year, but that's still uncertain and even if they would be, TSMC is way ahead, especially with ASML's High NA EUV machines in their factories. Now, don't get me wrong, these machines are no plug-and-play, and it will take a year before they are fully functional, but Samsung will be later, no matter what.

Also, I think TSMC is still quite fairly priced despite the 97% gains over the last year.

Source: Seeking Alpha

I know, you will hear bears say that we are at the top of the chip cycle, but this is my reaction to that.

If you listen to producers like Nvidia, TSMC, ASML, customers like Tesla, X, Microsoft, Google, Meta, Amazon and observers like Cloudflare and The Trade Desk, you come to one conclusion: we haven't seen anything yet. And TSM will manufacture the chips that power this revolution we all see under our very eyes.

Masayoshi Son, Softbank's visionary founder and CEO, said in October that $9 trillion in capex would be needed for the AI revolution. He thinks that by 2035, artificial "superintelligence" could be there and calculates it will be 10,000 times more powerful than the human brain. However, there has to be an investment to buy more than 200 million GPU processors to achieve this. He says that if this would even add just 5% to GDP, that $9 trillion in spending would be earned back in just 2 years. Here's the clip. It's just 3 minutes and it's worth watching.

If this is even remotely true and with TSM's near-monopoly in manufacturing these high-end chips, there's a ton of upside left.

Of course, there's the geopolitical risk that China might invade Taiwan, but the US won't let that happen. In the meantime, TSM is building out its infrastructure in the US as fast as it can to diversify this risk.

9. TransMedics (TMDX)

The company recently narrowed its revenue guidance from $425 million to $445 million previously to $428 million to $432 million. The consensus stood at $432.7 million.

That's still 77% to 79% revenue growth compared to 2023 and up 35% in Q4 at the midpoint of the new guidance. However, it would also mean that revenue would be more or less in line with the previous quarter, so there would be no or barely any quarter-over-quarter growth. The reasons were the same as before: a slower organ transplant market in general and TransMedic's airplanes still in repair.

We all know that most analysts are focused on the short term. Given Q4's lackluster guidance, the short-term bull case seems difficult, especially since the impact could continue in the first half of 2025. However, the second half of next year should be strong.

The second reason the stock dropped was that the CFO was suddenly replaced, which is always a bad surprise to financial markets. And admitted that this was somewhat strange and sudden.

Some thought Stephen Gordon was paying the price for not meeting the company's financial goals. But the departure is not hostile. Gordon will stay on board as a non-executive until the end of March 2025 to guarantee a smooth transition. Additionally, he will remain a consultant for TransMedics for another 12 months after that.

In the Seeking Alpha comment section of this news, I found this an interesting thought.

This could make sense and explain the very amicable transition. It will be either this or another, bigger, company that lured him away, I think. And this is certainly an investor who does a lot of research, because he also dug up this video of CEO Waleed Hassanein in Italy, where he announced that TransMedics will open a center there. The center will serve as an R&D center and production facility.

The video was from several weeks ago, but as far as I know, this was not covered anywhere, except maybe in the Italian media. You can go to the settings and set the language of the captions ('CC') to English, so you can understand what Waleed says.

The company immediately announced a new CFO, Gerardo Hernandez. He has 25 years of experience. He is the former head of FP&A (financial planning and analysis) at Shire, which Takeda bought for a whopping $62 billion.

(Source)

On X, this was shared:

DCD stands for declared circulatory death (irreversible heart failure), and DBD stands for declared brain death. The second one is controversial, and there are ethical and cultural concerns about defining death with DBD. While brain death means the irreversible cessation of all brain activity, the body can still exhibit signs of life, like a beating heart, through artificial support. This raises philosophical, religious, and diagnostic questions, especially in the context of organ donation. That's why TransMedics does much less DBD.

Some X accounts follow TransMedics in every detail. They even report about flights (347 up to December 15).

All in all, the consensus seems to be that TransMedics will end up at the upper range of their guidance or even beat that.

And again, this is a stock that looks cheap on a PEG basis.

You look at a 2025 PEG of 0.93 and a 2026 PEG of 0.46. This looks like an opportunity to me.

8. Nvidia (NVDA)

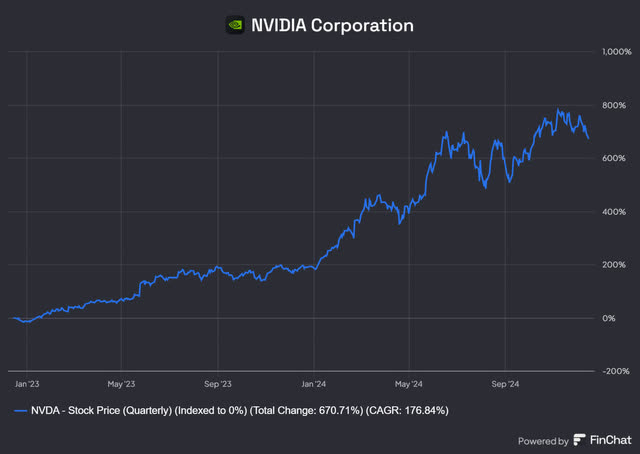

What? Nvidia, the largest company in the world already? According to some value investors, the AI hype king after the stock is up 670% in the last 2 years?

Source: Finchat, the best AI-powered stock platform, for research, charts, transcripts, estimates, a huge number of KPIs for companies, stock screening and much, much, much more. Grab your 15% discount here!

Isn't this the new Cisco? Or the new Intel? Do you want to invest in a $3.3T company? Kris, are you really out of your mind???

Well, maybe I am out of my mind. I'm probably not the best judge, haha. But I still think there's a strong investment case for Nvidia over the next decade.

We are still very early in the AI cycle. This is like the internet in 1998 or so. Some will claim that a 2000-2003-like crash will also come this time, but right now, I don't see the overextended valuations from back then. Yes, there are pockets of bubbles. I wouldn't buy Palantir (PLTR) or IonQ (IONQ) now. While I think they could have a fantastic future, especially Palantir, their valuations have already priced in years of high growth.

However, if the expected growth numbers are in the ballpark, I think Nvidia is still priced fairly or even cheaply.

As you can see, the stock trades at 31 times 2025 EPS (even though it's a month later), with expected EPS growth of 50%. That puts Nvidia at a 2025 PEG of 0.62, which is very low for such a premium company. Granted, growth is expected to slow down in 2026, with "just" 26%, but even that, if true, still looks on the cheap side with the 2026 PEG of 0.94. And that's without Nvidia's huge earnings beats.

I think the risk-reward for Nvidia is still solid at this point.

7. Nu Holdings (NU)

Again, I was very impressed with Nu Holdings' results. OK, optically, revenue growth slowed down considerably. In the filings, you'll see 38%, which is, of course, nothing to sneeze at. But if you strip out the currency fluctuations from the Brazilian real to US dollars, you see that revenue growth was actually 56%. This is often indicated as FXN (foreign currency neutral).

You can read Karan's take in this article.

Let's look at the forward PEG here as well.

Do you see that? A PEG of 0.46 for 2025 and 0.35 for 2026. That's just plain cheap. And for such a great company, that's often all you need to know, so let's not make this longer than necessary.

Of course, I know about the Brazilian crisis, but you get a margin of safety for Nu. More about NU also in the part of the next pick.

6. Mercado Libre (MELI)

Some pointed to the weak real (the Brazilian currency), and they are right. It's down 20% year-to-date compared to the dollar (see the first chart). In the meantime, Nu's revenue is up almost 40%, that of Mercado Libre 28%, and FCF even more, although you can't really use that because of their loan business.

But all in all, I think that the results show that Mercado Libre and Nu do pretty well despite the dropping real.

But suddenly, commenters start to write this:

It was in the news, so everybody jumped on this. The fall is "endless" now.

And, of course, a weaker Brazilian currency is a headwind. Don’t get me wrong. But it's not as if that's the first time for Mercado Libre. Just look at this.

Until a few years ago, Argentina was Mercado Libre's second-biggest market after Brazil. (Now, Mexico is second, and Argentina is third.) Some think the drop in the Brazilian real (down 5% in the last month) is a new problem, haha. As you can see, the Argentine peso was down 99.16% over the last decade. Over that period, Mercado Libre was up 1,250%.

For Nu, there's no such track record, but I think the company is as strong as Mercado Libre and will navigate this environment as well.

Fede Sandler, the former Investor Relations Officer of both Mercado Libre and Nu posted:

Nu was founded in a recession, then went through an impeachment, then the worse recession in 100 years and then a pandemic. Yet it still grows like gangbusters and execute like a world class company.

BTW because it is the lowest cost producer and generates competition while it digitalizes cash it generates more tax revenue so left and right leaning governments lean on them.

Concerned zero.

Now, there's no denying that the currency headwind is strong for both Mercado Libre and Nu Holdings because they report their earnings in dollars (because they trade in the US).

So, the weaker Brazilian real is a buying opportunity, in my opinion. Of course, on a dollar-base, Mercado Libre and Nu may miss their Q4 consensus, and who knows, maybe the stocks could drop more then. But I will then use it as an extra buying opportunity. World-class companies don't often trade for such low valuations.

As a long-term investor, noise can be great!