Hi Multis

Another week is in the review mirror. To round it off or to start a great next week, depending on when you read this, let’s have another Overview Of The Week.

Articles In The Past Week

This is the third article this week. I’ve been working on a few things behind the scenes, articles you will see in the next few weeks.

In the first article this week, you could see what I added to my Forever Portfolio.

In the second article, you got a mini-deep dive on Shopify and its recent partnerships.

Memes Of The Week

Two memes this week. The first one is from a famous image from the movie Interstellar.

The second one pokes fun at value investors.

Interesting Podcasts Or Books

Often, when there’s something I like, I go deeper for a few weeks. Last week, I shared that I listened to David Senra’s new podcast, with Spotify founder Daniel Ek as the first guest.

This week, I listened to Tim Ferris interviewing David Senra.

I also started reading a new book this week. I’m already almost halfway through and I really like it. As I focus on stocks that can go 10x, the title of this book caught my attention. Pattern recognition is important for successful investing and I feel like this book can help.

The underlying thought is that you have less competition if you go for 10x instead of 2x, which almost everyone wants.

The markets in the past week

This week, the markets were up again. The S&P 500 was 1.09%, the Nasdaq 1.32% and the Russell 2000 1.72%.

The Greed & Fear Index remained in Neutral, going up only from 53 to 54.

Lesson Of The Week

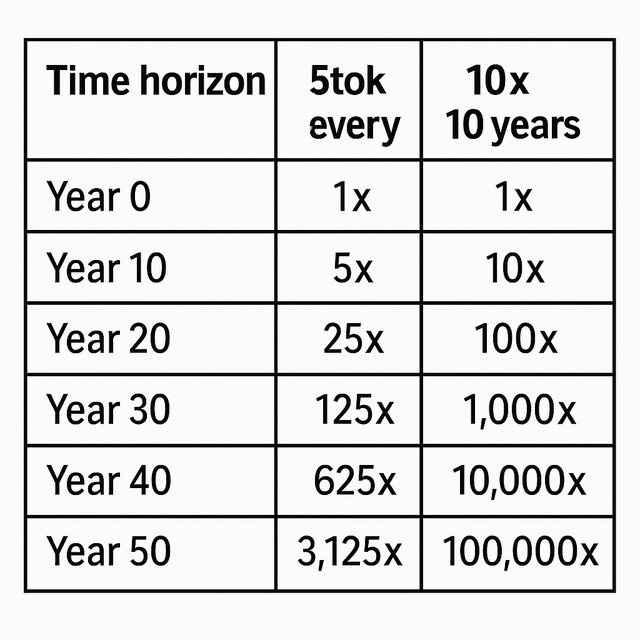

With Potential Multibaggers, I aim for 5x to 10x over the next 10 years. 5x means 17.5% per year. 10x means a CAGR (compound annual growth rate) of 26%.

But what if your investing horizon is not 10 years but longer and you can have stocks that accumulate at that rate? Of course, keeping up such high growth is nearly impossible over longer periods, but still, I want to show you the power of compounding.

I sometimes hear people say, “Who’s got an investing horizon of 50 years?” Then I always say: “We have a portfolio for our daughter, started when she was 2 years old. Her investing horizon is longer than 50 years.”

On top of that, I want to show you the 100x potential over 20 years and the 1000x potential over 30 years.

David Gardner, co-founder of the Motley Fool (together with his brother Tom), picked 7 100-baggers and 2 1000-baggers over the 28 years the Motley Fool has existed. That shows that it is possible. He picked a bit over 200 stocks, because he re-recommended many stocks. That’s a phenomenal track record.

So, don’t say that it’s not possible. It is. Is it rare? You bet, but only by aiming to get these results will you get them. Not by taking profits after a 20% gain. Not by trying to time the market. Not by being scared out of what could be your biggest winners.

By the way, most don’t think about this, but if you have an annual return of just 9.65%, which is slightly under the market average, you multiply your amount by 100x as well after 50 years. If you have children or plan to have children, give them a huge head start and spread this message!

Quick Facts

1. Mercado Libre: What’s Going On?

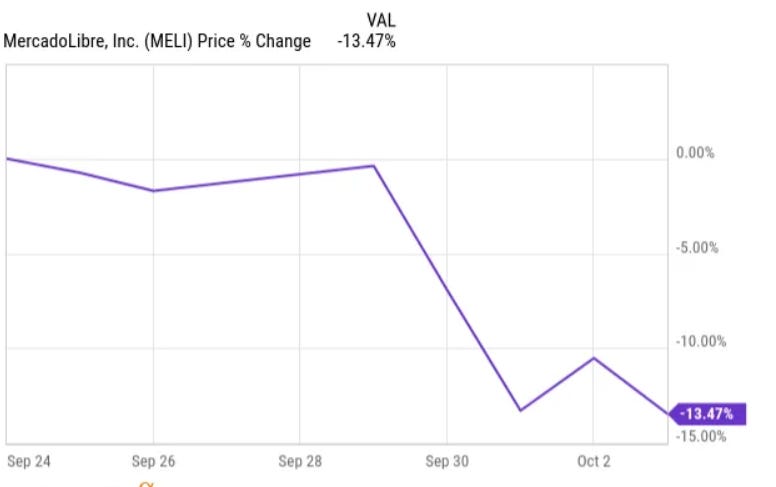

I got this question more than a dozen times this week, both in person as online: “What’s going on with Mercado Libre?” The stock is down 13.5% in the last week and a half.

But look at this.

You can see that the stock is still up 23.5% year-to-date. I would sign for that every single year. Some volatility is normal.

The stock price is not an indicator of fundamental flaws in the short term, but rather a sentiment barometer. Think of the old Benjamin Graham saying: “Over the short term, the stock market is a voting machine, over the long term, it’s a weighing machine.” The long term is at least three years, and MELI is up 146.6% over the last three years.

But when a stock drops, people crave an explanation. We are all explanation junks.

And yes, you see explanations. You always do. For example, Amazon offers a temporary discount for merchants in Brazil, waiving all fulfillment fees for the next few months.

But Amazon has been in Brazil since 2012, and MELI is still by far the biggest. It has beaten Amazon on its own turf, with much better logistics and pricing power. I’m sure Amazon can gain market share from some other e-commerce sites.

I’ve been saying for years that I think it will boil down to 3 big players in Brazil: Mercado Libre, Amazon and Shopee. We see concentration everywhere in the world, with the US being the most extreme example, where Amazon has a market share of more than 50%. But in the rest of the world, two or three players have cornered the market. The same will probably happen in Brazil. So, will Amazon destroy Mercado Libre, as I hear here and there? Absolutely not! It will (again, I should add) take market share of all the rest.

Secondly, I hear that the situation in Argentina is a big problem for MELI. Yes, Argentina asked for US support, but I haven’t been more optimistic about Argentina in years. Inflation is way down. GDP is growing. UNICEF praised Milei for helping more than 1 million children escape poverty.

Don’t forget that Mercado Libre navigated the toughest of times in Argentina. Yes, the country needs financial help now, but it’s to crawl out of the grave it’s in, caused by the previous decade. Those were the real tough times and MELI navigated them without any problem. It’s now darkest before dawn, and that’s why I remain optimistic about Argentina.

Summary on why the stock is down? Noise.

2. Which One Of The Constellation Universe?

Another question I got a lot was which of the three stocks in the Constellation Software universe I would buy.

My answer? All three.

But if I could only buy one? Topicus. And here’s why.

First, there’s the size.

Constellation Software: CAD $80B (USD $57.4B)

Topicus: CAD $12.4B (USD $8.9B)

Lumine: CAD $10.5B (USD $7.5B)

Lumine is the smallest, sure. But that doesn’t automatically make it the best. It operates in the communications VMS market, a narrower TAM (Note: VMS = vertical market software; TAM = Total addressable market).

Fewer fish in the pond means deals get pricier, and growth could slow faster. On the flip side, those businesses are mission-critical, which adds resilience. But resilience isn’t the same as upside.

Constellation? A beast, of course. But at CAD $80B, it’s harder to move the needle. To grow at the same pace, it needs to do way more deals. Mark Leonard saw this coming. That’s why he decentralized M&A. It was a genius move, but there may be a ceiling to how far you can stretch that model, especially now that the architect is stepping down because of health reasons. Now, don’t conclude that this means I don’t want Constellation. I bought another share early this week.

But Topicus is the sweet spot. It’s smaller than CSU, operating in Europe’s fragmented software market, expanding into Asia, and now taking material stakes in companies without full takeovers. I’m talking about Asseco.

All three can beat the market. But if I had to choose just one? Topicus. No doubt.

3. How Many Stocks Should You Own?

I think the discussion on how many stocks to own is often answered too simplistically in general. Especially people who think you should have a very concentrated portfolio (5 stocks or so) are very vocal about this. But it’s very personal and that should be the case.

It’s like children. My wife and I have one; my best friend has three. And that fits both our families. My wife and I couldn’t handle 3 children, but my best friend and his wife easily can and they could have more if they wanted. Our daughter stays there when my wife and I are abroad. Then they have 4 and they say it’s even easier than 3. I would go crazy with 4.

We have another friend with three children, and it’s just too much for them to handle. They are constantly complaining. It depends on your personality.

As for my own portfolio, with around 35 positions usually, I have anchor stocks, positions in big companies like Nvidia, Amazon, Alphabet, Mastercard, TSMC, Broadcom, Hermès, Berkshire Hathaway and Constellation Software, for example.

To me, these are like the older children, who don’t take too much handholding. If there’s something wrong with them, you’ll hear about it from others, and you can still see what’s going on then. In other words, I don’t look at these very often. Quarterly earnings? I just take a quick look over the results and unless I see something really worrying, I don’t go any deeper.

Then you have the teenagers, AMD, CrowdStrike, Cloudflare, Shopify, Mercado Libre, Kinsale,... They still need monitoring, but not like the younger children, the Potential Multibaggers.

Acting as if all positions need equal attention is just not realistic. Everyone should decide on the number of stocks they can handle.

That’s exactly my point: it’s a very personal choice, and I think it’s strange that some people say that if you hold more stocks, you can’t follow them up. THEY may not be able to follow them up, but I can.

Or even worse, that if you own more than 20 stocks, you are a closet indexer. That’s probably one of the most ridiculous statements in investing and there’s no shortage of those. Peter Lynch averaged 29.2% per year at Fidelity’s Magellan Fund from 1977 to 1990, managing over 1,000 stocks. Walter Schloss, another legendary investor, who consistently delivered great performances, typically held more than 1,000 positions.

Now, I don’t say you should take 1,000 positions, of course. I just want to point out that it’s a personal choice.

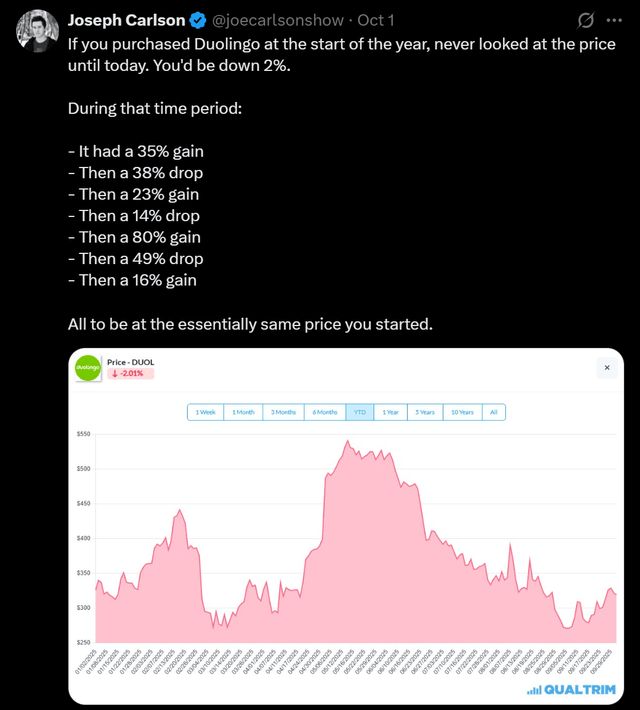

4. Duolingo’s Stock Price

I liked this post by Joseph Carlson, who has a good YouTube channel about investing.

This shows again that too many investors are just too focused on short-term noise. This kind of volatility is normal for high-growth stocks. But many want to add too much drama.

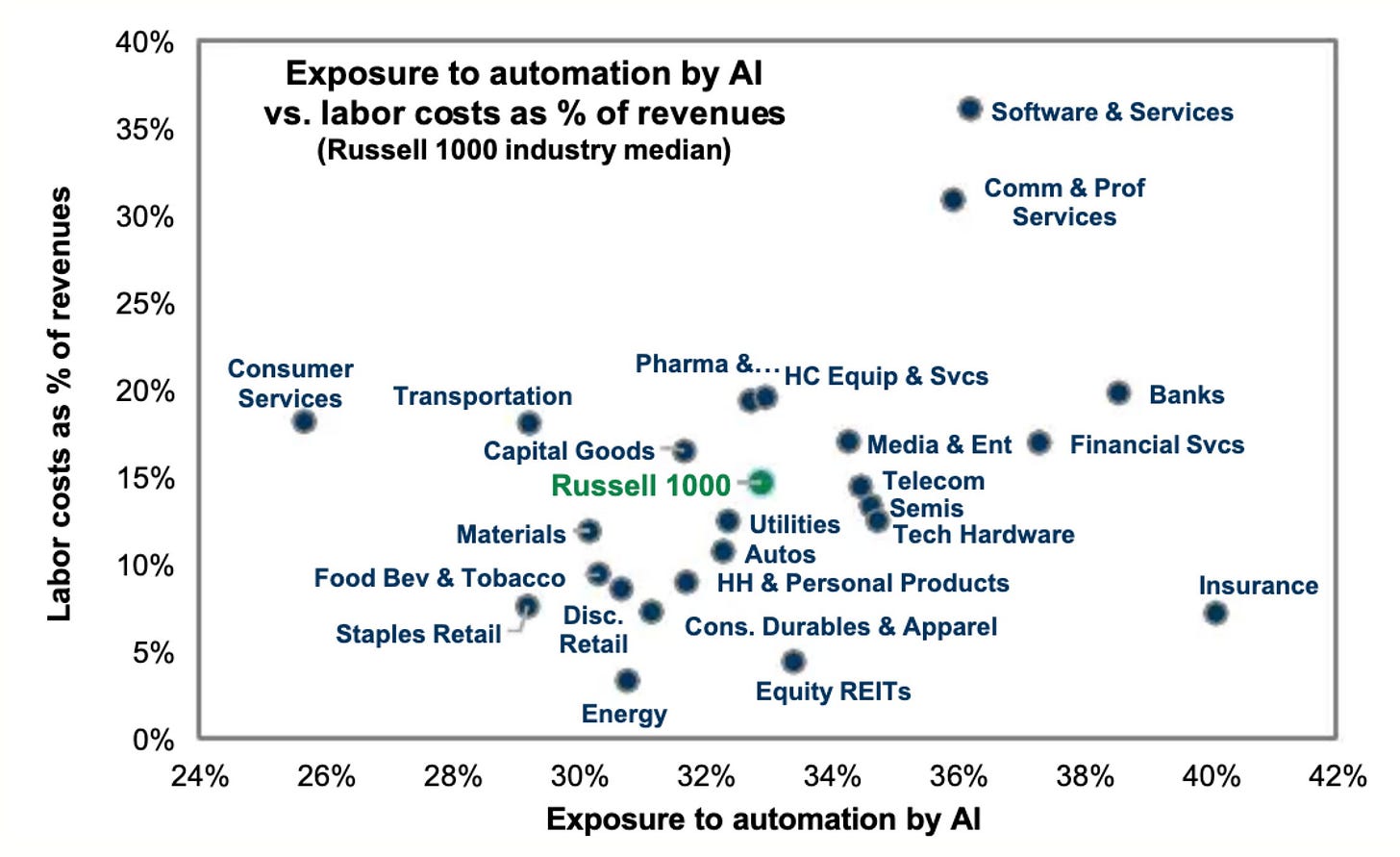

5. Industries With Most Impact From AI

This week, I came across a chart that I found interesting, so I wanted to share it with you.

6. Nvidia is NOT Cisco. Here’s Why.

You may have seen this image pop up on your social media feed or a friend or colleague may have sent it to you if you are a Nvidia shareholder. I got it from multiple people.

To me, the comparison is lazy.

Cisco and Nortel didn’t just sell networking equipment in the late 90s. They financed it. They loaned billions to broke startups so those companies could buy routers and optical gear they couldn’t actually afford. When the bubble popped and those customers all went bankrupt, Cisco got stuck holding worthless IOUs and warehouses full of equipment nobody wanted. It was more a credit crisis that looked like a demand crisis.

Nvidia doesn’t really finance anything. Customers pay their orders cash upfront. About 95% of their sales are paid before the product ships. There are no vendor loans and no receivables on the balance sheet. The fundamental risk that killed Cisco and Nortel doesn’t exist here.

Look at who’s buying. Cisco’s customers were mostly VC-funded dot-coms with no revenue burning through cash at a fast pace. When funding dried up, orders vanished overnight. Nvidia’s biggest customers are Microsoft, Amazon, Google, Meta, and sovereign wealth funds building national AI infrastructure. These aren’t speculative startups hoping to secure the next funding round before their money dries up. They’re profitable companies and governments with deep pockets.

Of course, there are many AI startups now as well, but they don’t buy directly from Nvidia. They rent GPU computing power through the cloud providers. The money goes from VCs to startups to AWS or Azure to Nvidia. Someone else carries the credit risk at every step. Nvidia just collects payment.

On top of that, Cisco sold hardware boxes. That’s totally different than Nvidia’s GPUs. Nvidia tracks GPU utilization in real time through CUDA and cloud partnerships. They see the workloads and if there’s a slowdown in usage, they can adapt their production.

Of course, demand could slow down at some point. I would even say there will be a slowdown. And yes, Nvidia’s stock will drop at that moment. I don’t think this will be very soon. But there will be no collapse. When the dotcom bubble burst, unprofitable companies couldn’t pay their bills and simply went bankrupt. Even Amazon only survived because it had raised a big sum just before the crash. That stash and increased attention to efficiency and profitability helped it weather the dotcom crash. Without raising money, the company wouldn’t have survived.

If AI investment cools, Google, Amazon, Meta, Microsoft, X and all the other big customers will order fewer chips for a few quarters. That wouldn’t be the first time. Nvidia also saw a slowdown when the Bitcoin mining craze ended in 2018-2019.

So, the comparison sounds smart in a tweet. It falls apart when you look at the actual business models.

Now, of course, there is some hot air in the market; I don’t deny that. Palantir’s valuation looks unsustainable to me. It trades at a price/sales multiple of 120. Never in history, it ended well for a stock trading at those multiples. It was already expensive a year ago, at 31 times sales. But 120 times is just ridiculous.

Now, don’t get me wrong, I think Palantir’s a great company and I would be interested if the stock dropped enough. But not at this price.

A second bubble may be in venture capital that now seems to be throwing money at startups that do “something, anything, with AI.” But I already explained above that Nvidia is not directly exposed to that market. Indirectly, it is, of course, and a slowdown for Nvidia could cause a general market drop. For now, that doesn’t seem to be a problem. But letting out some air would be good for the market’s health.

I have written more extensively about my thoughts on AI and a market bubble in this article.

7. Cloudflare’s Executives Talk With All New Hires

Today, Multi bep shared this post from Dane Knecht, Cloudflare’s CTO (Chief Technology Officer) in our private chat group. Thanks, bep.

Eastdakota is the X handle of founder and CEO Matthew Prince and Zatlyn is Michelle Zatlyn, founder, COO and President of Cloudflare.

There was a reaction from a former employee that immediately showed this was not just at the time of hiring.

I know that at Adyen, executives also have the final call on all hires. At many companies, that’s not the case and I think there a lot of companies slipping into mediocrity because of that. So, I really liked what I saw here.

This is where the free part ends.

If you want full access to Potential Multibaggers, here’s what you’ll get:

✅ My full portfolio (with every transaction)

✅ The most recent pick

✅ The upcoming pick

✅ Access to our private chat group

✅ Best Buys Now (outperforming the market by 30% over 3 years.