Shopify: The Mini Deep Dive

Recent Partnerships With Coinbase & Roblox + Is It A Buy Now?

Hi Multis

Shopify (SHOP) announced its Q2 earnings some time ago; it seems a bit late to discuss them in detail. Therefore, David proposed to focus on other aspects of the Q2 earnings, such as new partnerships and a closer look at the revenue streams. However, that doesn’t mean we don’t review the earnings first. It will just be faster.

Then, we will have some sort of mini-deep dive. For some of you, there will be some repetition, but don’t forget this.

But I’ve picked the stock as the first Potential Multibaggers pick ever, on May 2, 2017 and that’s a long time ago. Many things have changed over that period, so it’s good to go back to the basics now and then.

On top of that, we’ll go deeper into Shopify’s new partnerships, which show that the company thinks proactively and skates to where the puck will be.

For this article, David quickly covers the earnings and then digs deeper. Take it away, David!

Hi Multis!

David here. Thank you for the kind reactions to my first article for Potential Multibaggers. It gave me a lot of energy for the second one, this one.

The numbers

Revenue: BEAT

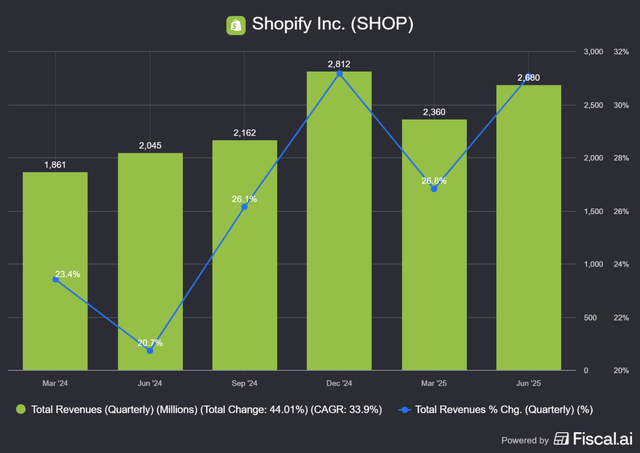

Shopify reported a Q2 revenue of $2.68 billion, trumping the consensus of $2.55 billion by 5%, as its revenue growth continues.

EPS: MISS

Shopify reported a Q2 EPS of $0.27, which was below the consensus, missing by 6.9%.

Gross Profit:

A reported $1.302 million, up from $1.169 million QoQ and up from $1.045 million YoY.

Gross Margin:

Gross Margin was slightly lower compared to the previous quarter and last year; however, Shopify maintained its gross margin in the 50% range.

Revenue streams

Let’s have a closer look at the revenue streams of Shopify. It has two revenue streams: subscription solutions and merchant solutions.

Subscription Solutions

This is the side of Shopify that offers predictable revenue through recurring fees for using the platform. It includes Shopify’s SaaS (Software-as-a-Service) products, such as subscription charges, domain sales, theme and app sales, and similar services.

The revenue is therefore almost predictable in nature as turnover within existing customers remains low and new customers are coming in, more on that later.

Merchant Solutions

The less predictable part of Shopify’s business is called Merchant Solutions.

These are usage-based services that fluctuate with merchant activity, making the revenue streams less predictable over time than Subscriptions.

So what does Shopify classify as “Merchant Solutions”?

In practice, there are four main categories: Payments, Capital, Shipping & Fulfillment, and Markets & cross-border tools.

Payments cover transaction processing, where Shopify takes a percentage of each sale handled through its platform.

Capital consists of loans and cash advances to merchants, on which Shopify collects fees.

Shipping & Fulfillment includes discounted shipping labels and logistics services, where Shopify retains a portion of the margin.

Finally, Markets and cross-border tools are designed to help merchants sell internationally, with Shopify again taking a percentage fee per transaction. This is the part that Global-e (GLBE) fulfills for Shopify.

The revenue here clearly comes from increasing volumes. In other words, if the merchants on Shopify handle more transactions and grow their business, Shopify will generate higher revenues.

Therefore, merchants are an essential part of Shopify, and it is important for them not only to deliver the software but also to continuously improve it, as a significant portion of their revenue depends on how much they utilize the product.

This contrasts with other SaaS providers, where product utilization is not always directly tied to revenue. For example, using your Word or Excel tools only once a year is different from an analyst or author who uses them daily. Microsoft will still charge the same. When it comes to updating its software with new tools, Shopify also needs to take the lead, which it continuously does.

Shopify and its merchants are also perfectly aligned here. The more money Shopify’s merchants make, the more money Shopify makes.

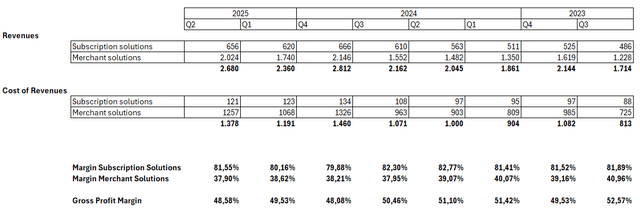

The division of Shopify’s revenue has been between 70-75% for Merchant Solutions, with the rest allocated to Subscription Solutions. To me, this indicates the need to analyze Shopify’s margins for each revenue segment. Shopify does not provide a detailed analysis per item, but it shows it per revenue stream. That’s how I could make this overview.

We notice that the margins for subscription solutions are extremely high and consistently around 80%, indicating very healthy margins.

This is logical. This goes back to the core of subscription solutions, which is to use the platform and leverage its offerings. After being in business for several years, Shopify has this aspect figured out.

I spoke with some friends who recently set up their own online shops using Shopify. Keep in mind, these are small shops, and none of them had prior experience building websites; they relied on custom templates and tools provided by the platform. All of them had a positive experience: “easy to use,” “fast to set up,” and “even a child can integrate this” are some of the quotes I collected.

Not bad for a service that would have required professional help a few years ago. Ease of use, simplicity in setup and alignment. Great setup.

As I sip my morning tea, I glance at the second part of revenue generation: merchant solutions.

Here you can see a different story. The margins are significantly lower at about half of those of Subscription. On top of that, they show a slight declining trend, even with increasing overall revenues.

I started doing some research, and what is noticeable is Shopify’s product offerings. Shopify is continuously expanding its reach by introducing international offerings, which in itself incurs additional costs.

Couple this with a deepened PayPal partnership and an Adyen partnership, which will undoubtedly lower margins but increase overall revenue, and we have a classic trade-off between growth and profitability.

Shopify is expanding its offerings, broadening the possibilities for merchants in the future, but this comes at a cost in the short term. Shopify increased its merchant solutions revenue by 16% and costs by 18%. With everything Shopify is adding, it’s a trade-off I don’t mind seeing in the short term. We will need to monitor this figure closely in the future to track the evolution of this segment, as it accounts for the majority of Shopify’s revenue.

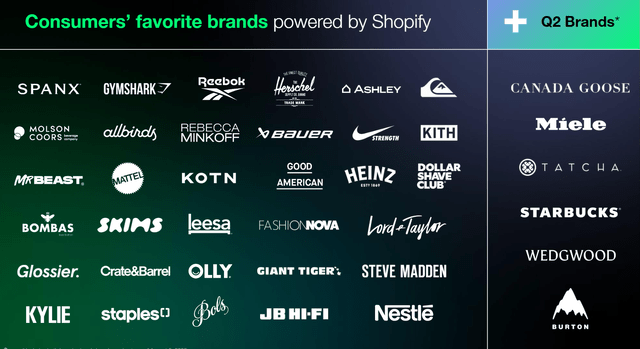

Customers

We saw earlier that Shopify is expanding its customer base, particularly among major brands. Notably, it was able to include Starbucks, Canada Goose, and Burton Snowboards in Shopify’s growing merchant portfolio. Not bad names to include.

Shopify's customers are a diverse group of companies. As mentioned above, my friends all have different businesses, all with different views on how to implement Shopify. The main thing here is that they are using it independently of their type of business. One thing we notice is that the customer base is diversified to mitigate potential future shocks in overall market segments. Imagine the apparel business is going through a difficult time; it will likely have an impact on Shopify's revenue, specifically if big brands are struggling to sell their products online. However, Shopify will likely remain stable overall.

Why do these different companies all come together on Shopify’s platform? I ponder on this question while taking another sip of my tea, and when I notice their offerings, the suite of products Shopify is offering, and the ease of use, I can only conclude that when I am ready to launch an online shopping experience, it will be for sure with Shopify.

Easy integrations with other websites (so-called APIs) are readily available, which bodes well for larger companies that have legacy systems and want to integrate applications and software without requiring a rebuild of their current setup. Consider this an add-on to their current business practices, which, especially for large merchants, can be a key to successful collaboration with Shopify.

Payment Options

We mentioned before that Shopify increased its partnership with PayPal and partnered with Adyen. Additionally, Shopify expanded its payment options to new markets (16 in total), primarily within Europe.

Launching payments into Europe is a challenging task, as rules & regulations, as well as languages, vary by country, and customers also have different spending patterns. Shopify is implementing a slow but steady rollout, aiming to maintain its momentum.

As for Adyen, Kris already reported about this in the Overview Of The Week. Shopify’s merchants insisted on Adyen.

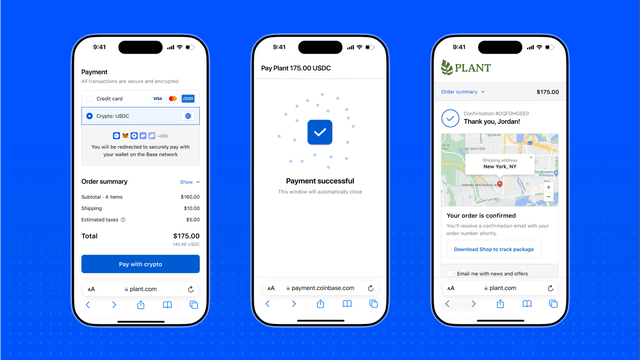

A more surprising partnership is maybe that with Coinbase. Shopify and Coinbase are working on what they call the future of commerce on-chain. They are developing on-chain payments between merchants and customers.

Coinbase is mostly known for its crypto capabilities, but it also has expertise in smart contracts and programmable money to have flexible and secure payment flows. Cryptocurrency is slowly coming to commercial features, and merchants will soon be able to receive USDC. USDC is a stablecoin that is pegged at 1:1 to the U.S. dollar.

Before we look further at this partnership, let’s briefly look at what a stablecoin is. A stablecoin is a type of cryptocurrency designed to maintain a stable value, unlike a typical crypto coin. This stability often comes from pegging it to another currency or a commodity.

Think here of pegging it to the USD or a commodity such as gold or silver. A stablecoin does not have to be pegged another currency, such as EUR or USD, but can also be backed by other cryptocurrencies or can be algorithmic. That means it is uncollateralized and is not backed by any real or virtual assets.

Important to note is that the coin is mostly created by companies and not by governments, but governments are looking into it and both the US and Europe have already announced they are interested in creating their own stablecoins.

Why are stablecoins created? Simply to provide a bridge between cryptocurrencies, which are often volatile in nature and not backed by real assets, and traditional stable forms of money.

Coinbase is talking about their USDC, which is pegged 1:1 to the USD, meaning that it can be converted to dollars at any time, and the stability is generated by collateralizing the coin with different US Treasury securities. USDC was created by both Coinbase and Circle (another payment platform) in 2018.

Returning to Shopify, this means that merchants within the Shopify platform can offer their customers a wider range of payment options. That’s a good thing, as this makes transactions nearly borderless, with availability in more than 180 countries.

I have personal experience with how difficult it is to have multiple payment options outside of the USA or Europe, and this can be a catalyst for Shopify.

Cryptocurrencies and stablecoins are gaining traction, especially in younger age groups and in countries where access to USD or EUR payments is not always possible.

Customers can now choose to pay via the Coinbase embedded application with a faster settlement of mere minutes, 24/7.

Merchants will receive the payments in their default currency, but they can also opt to keep USDC without incurring foreign exchange fees on cross-border transactions. Something we should not put aside for large merchants, as this makes their balance cleaner (no conversion losses) and it makes it easier to provide their products to a larger group of customers without the hassle of having to perform the conversion either themselves or through another payment provider.

It shows Shopify wants to make payment handling as easy as possible for its merchants. By doing this, it will be able to expand more easily towards new markets, while also increasing the sales reach of its current merchant base. It remains to be seen whether it will contribute to Shopify’s future growth.

The payment options of Shopify don’t stop there; the shopPay function has increased GMV (Gross Merchant Volume) by +65% YoY, reaching $27 billion in Q2 2025.

ROBLOX INTEGRATION

In mid-May, Roblox and Shopify announced a partnership; as of now, Shopify merchants can create experiences within Roblox.

Roblox is an online platform that allows users to create and play games. There are over 97 million daily active users. To put that in perspective, it is comparable to Reddit or Pinterest but lower than, for example, Instagram (2 billion), TikTok (1.6-1.9 billion), or Snapchat (800 million). Not bad, however, for a platform that is only geared towards the Gen Z audience, as most of my gaming friends are aware of Roblox but not active on it, unless they have kids. Content on the platform is primarily created by users, who are provided with the tools to do so by Roblox.

For Shopify, this means that merchants will be able to create products within the Roblox ecosystem. Merchants can sell to numerous customers without additional production costs.

See it as follows: Nike designs a t-shirt that can be used in the Roblox environment. The sleek t-shirt only needs to be created once in this environment and can then be replicated without any additional costs, as they don’t need the fabrication of the actual material.

Roblox already offers this functionality; however, merchants were stuck with Robux (the digital coin of Roblox) and will now be able to receive real currency, making it overall more interesting for merchants. Thinking even bigger here, Roblox is a platform where everyone can create their own game, and with this, the creators will be able to have an easier way of monetizing their hard work.

Conclusion

In this quarterly review, it is clear that Shopify wanted to highlight its reach to Gen Z customers who are more tech-savvy and are looking for ways to incorporate tools quickly to enhance their entrepreneurial drive. Think here of the incorporation of cryptocurrencies. It’s just the start, but Shopify is definitely prepared. The Coinbase partnership is a great way to be on the edge of innovation.

Roblox is trying to expand its platform by including different brands, and Shopify can help. This looks like another win-win partnership.

Merchant solutions remain Shopify’s bread-and-butter, and it is wonderful to see that it keeps including ways of increasing this revenue now and in the future.

After providing strong Q2 numbers and an even stronger guidance for 2025, the stock reacted positively.

And with this, I finish my tea and give word to Kris for the Quality and Valuation Scores.

If you are a free reader, this is where the content stops for you.

If you want full access to Potential Multibaggers, here’s what you’ll get:

✅ My full portfolio (with every transaction)

✅ All the picks (with two new ones just out)

✅ Access to our private chat group

✅ Best Buys Now (outperforming the market by 30% (!) over 3 years.)

✅ Deep dives on earnings, with a Quality Score and Valuation Score, so you know if the stock’s a buy, hold or sell. Like Shopify here. From an expert who has held the stock since May 2, 2017.