1 New Position, 4 Other Buys

What I bought for my portfolio (the new position revealed)

Hi Multis

Every two weeks, rain or shine, I add to the Forever Portfolio. That’s what steady, long-term investing looks like. My buys are based on my conviction and the current price.

Yesterday was the last day of September, so I added to my portfolio for the second time. If you are on Slack or Seeking Alpha chat, you already saw what I bought. I had intended to publish this article yesterday, but I spent too much time researching the new position in my portfolio and couldn’t complete it in time. That’s why you get it today.

This time, I found five stocks trading at what I believe are attractive valuations. One of the five is a new position; the others are additions to my existing positions. One of them even became my biggest position, based on the original allocation. That’s how I always rank my positions because I don’t want to reward the losers and punish the winners.

In this article, I also explain why I bought these shares. And there’s a very clear theme this time.

You’ll discover it along the way.

Before I reveal my new position, if you don’t want to miss these updates, feel free to subscribe.

My “New” Position

Multis who have been following me a bit longer know why I put the quotation marks around “new.”

In October 2024, I started a new portfolio, the Forever Fund. The previous portfolio, the PM Future Fund, held Lumine (LMN:CA), but I had not bought it yet for the Forever Fund.

Just to make sure, I invest about 65% of my portfolio in Potential Multibaggers, but not everything. This is a non-Potential Multibaggers stock I added to my Forever portfolio.

Lumine spun off from Constellation Software in February 2023. Although Constellation still controls them through a super-voting share, it maintains around 61% ownership. The communications and media portfolio actually began in 2014 within Constellation’s Volaris Group, before becoming its own entity.

Since 2014, Lumine has completed around 30 acquisitions across 11 countries, primarily the United States, United Kingdom, and Sweden. Today, Lumine’s portfolio includes 30+ companies serving more than 1,000 customers across more than 50 countries. The spin-off hasn’t dramatically accelerated their pace; they’ve been acquiring steadily at 3-5 companies per year.

Why Lumine Was Spun Off

Lumine wanted to buy WideOrbit, a US media software company, for $490 million. That deal was too big to finance as a subsidiary of Constellation. Spinning Lumine out as a separate public company gave it access to debt, cash, and stock to fund the acquisition.

The other reason: better incentives. As a standalone company, Lumine employees own stock tied directly to their performance, not tied to Constellation’s other divisions.

Of course, the company has a playbook that it adapted from Constellation Software, but it has also developed specific metrics tailored to the communications industry.

Lumine specializes in carve-out deals. That’s when a large company sells off a division it no longer wants. These deals are often very complicated: with different systems, nervous employees, and complex contracts. Most buyers avoid them.

Communications and media software runs on global standards, which means a product that works in Sweden can work in Singapore. It’s tech-driven, mission-critical, and constantly evolving. That makes it a very interesting industry.

This software keeps the communications world connected. Telecom operators use it to manage networks. Broadcasters use it to deliver content. It’s infrastructure, not nice-to-have software, but very essential.

Lumine thinks it can become the global leader in this space. Given Constellation’s track record with Topicus and its own operating groups, I think this claim could be true.

Lumine is not very picky about the size or geography of the acquisition, but quality matters. It looks for:

High recurring revenue (subscriptions, maintenance contracts)

Mission-critical software (switching costs).

If a company isn’t profitable yet, Lumine knows how to help it become profitable. They use the “Lumine Playbook,” which contains more than 250 best practices.

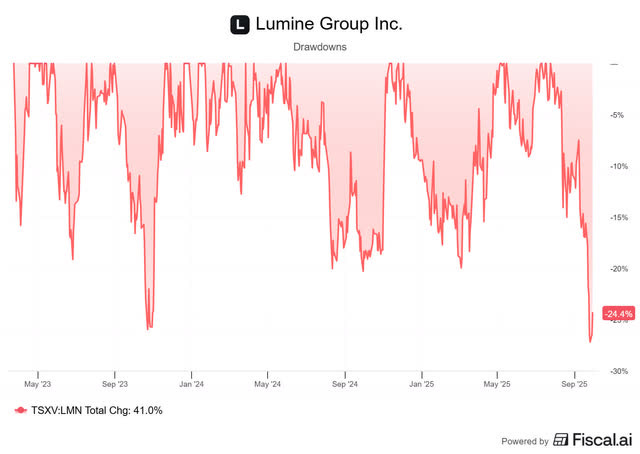

Right now, Lumine has had its biggest drop since it was split off.

The reasons why the stock is down this much? I don’t think I have to tell you: AI and the unexpected resignation (for health reasons) of Constellation Software founder Mark Leonard.

Let me ease your worries, though.

This is not software that can be vibe-coded with AI. This is critical software that forms the backbone of a country’s communications infrastructure. That means that new software will have to go through years of safety and compliance procedures. The switching costs would be huge as well. So, I think in this case, AI will definitely be a tailwind because the companies can implement it safely, not a headwind through disruption.

As for Mark Leonard. He was a visionary when he started Constellation Software. But he is not really involved with Lumine, so his resignation won’t affect Lumine that much.

That’s why I started a position in Lumine.

On to the next stocks, including my new biggest position.

If you are a free reader, this is where the content stops for you.

If you want full access to Potential Multibaggers, here’s what you’ll get:

✅ My full portfolio (with every transaction)

✅ All the picks (with two new ones just out)

✅ Access to our private chat group

✅ Best Buys Now (outperforming the market by 30% (!) over 3 years.)

✅ Deep dives on earnings, with a Quality Score and Valuation Score, so you know if the stock’s a buy, hold or sell.