AI: What If This Time "Is Different?"

Forget the bubble talk. AI is already paying off.

I know that the title of this article is provocative and could bite me in a while. "This time is different". Those are some of the most dangerous words in investing. Every bubble believes it's special. Every boom thinks it's built on solid ground.

But at the same time, I want to throw in this tweet that Michael Batnick threw out in 2017.

This is a reference to John Templeton's famous words:

The four most dangerous words in investing are: "It’s different this time.”

Batnick warns that things are never really the same either. Things do change over time. And that might be the case now. We might actually be looking at something new with AI.

Please, be open-minded. I know you already have your opinion after this introduction. But set it aside for now and look at it again after the article.

AI: Is This Time Different?

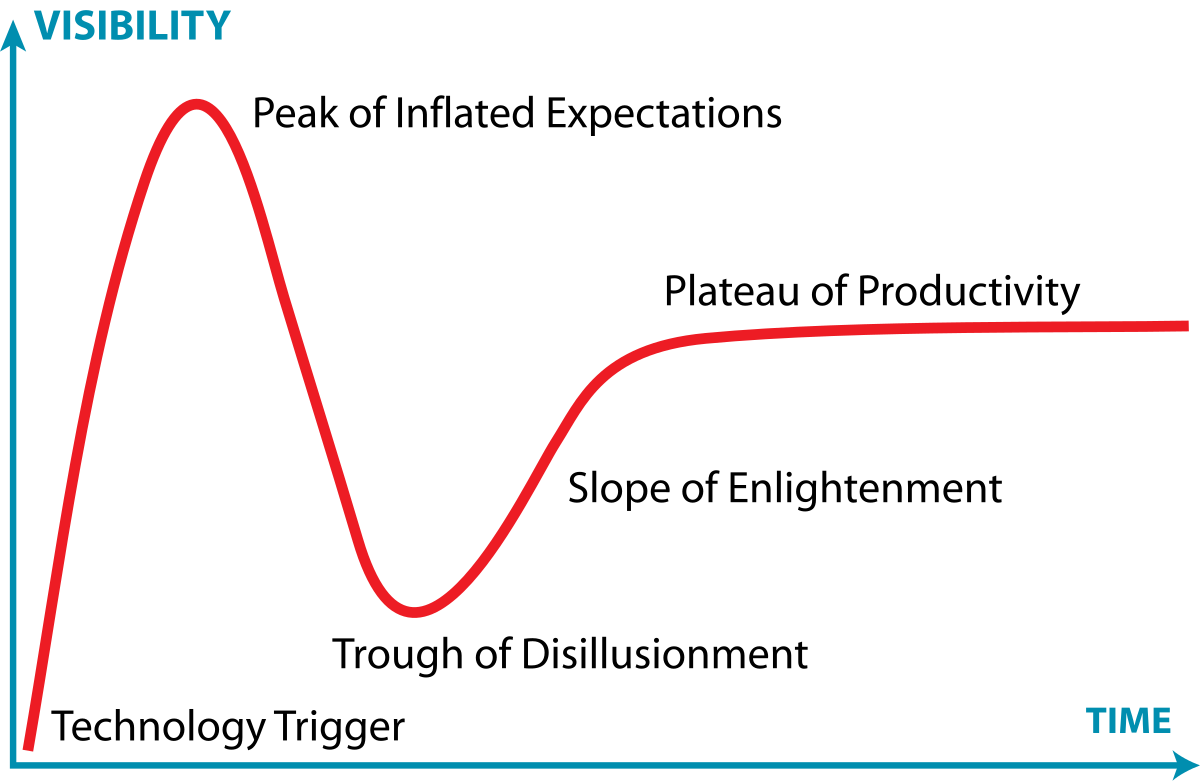

Let me start with the Gartner hype cycle, which many of you probably know. This is how it looks.

Innovation triggers the peak of inflated expectations. Then reality hits, and we tumble into the trough of disillusionment. Eventually, we climb the slope of enlightenment and reach the plateau of productivity. It's a pattern we've seen over and over.

Look at the internet. The infrastructure got built out in the late '90s and early 2000s. Then what? A massive crash. We had to wait until after the 2008 financial crisis, around 2009, 2010, before the killer applications really arrived. That's when SaaS took off. Netflix switched to streaming in 2011. Mobile broadband became ubiquitous. It took a second wave of innovation to unlock the productivity gains we'd been promised a decade earlier.

Here's what's different this time: we're already seeing some killer applications and they are already very profitable.

Take Palantir (PLTR). This is no longer a speculative company. (Mind you, I'm not talking about the stock). It has essentially rebuilt its entire business on AI, and it's clearly working. Palantir's growth is accelerating, not slowing down. For a company that's been around for 22 years, that's very remarkable. Companies that old don't usually start growing faster. But AI changed everything for them.

Then there's a company like Lovable, the Swedish startup that wants to turn everyone into a vibe-coding programmer. It was only founded in 2023, but it is worth billions already. Incredible speed and that's something you'll see more and more in the future.

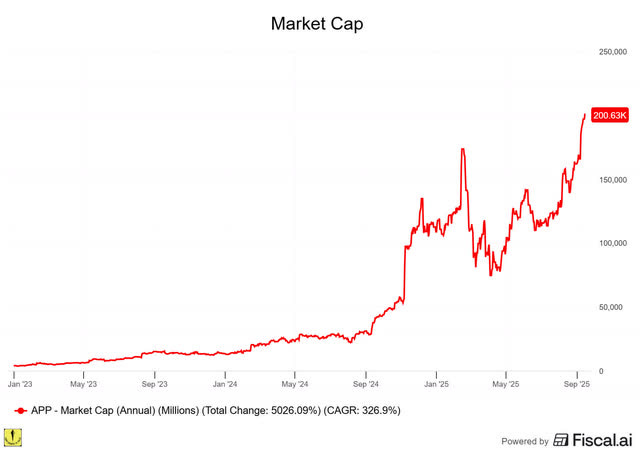

Another example is AppLovin (APP). The stock got crushed just a few years ago, down 92%. Had you invested on January 2, 2023, you'd be up 5,640%, though. WhY? AI.

Applovin completely rebuilt its business around its AXON AI engine and sold off its legacy gaming apps. Now it's processing 2 million ad auctions per second with AI that learns in real-time.

Revenue exploded. In the last twelve months, $5.74 billion in revenue came in. But because of AI, it's also extremely profitable. Applovin has EBITDA margins of 81%. Applovin now has a market cap of $200 billion. On January 1, 2023, that was just $3.9 billion.

Again, the speed at which it reached that size is unprecedented. Prepare to see this pattern return more often in the future.

If we continue to see more companies like this, businesses that are fundamentally built on AI or have successfully transformed themselves through AI, then we might never reach that traditional trough of disillusionment. But that's a big "if."

The timeline matters here. If these killer applications take four or five years to really materialize, then yes, we'll look back on this period as a bubble. The market won't wait that long. But if they keep coming at the pace we're seeing now, we might skip right past the disillusionment phase.

The Infrastructure Spending Isn't Stopping

There's another sign that AI spending is not over yet. Look at how desperate companies are for GPU chips. The biggest corporations in the world are literally begging Nvidia for more capacity. When you see that kind of demand, you know the spending isn't going to stop in 12 or 18 months. It's further out than that.

And this brings me to a crucial point about return on investment. Everyone keeps asking: "When will investors demand to see returns from all this AI spending?"

I think they're missing something fundamental. The return on investment is already there, just not in the way people expect.

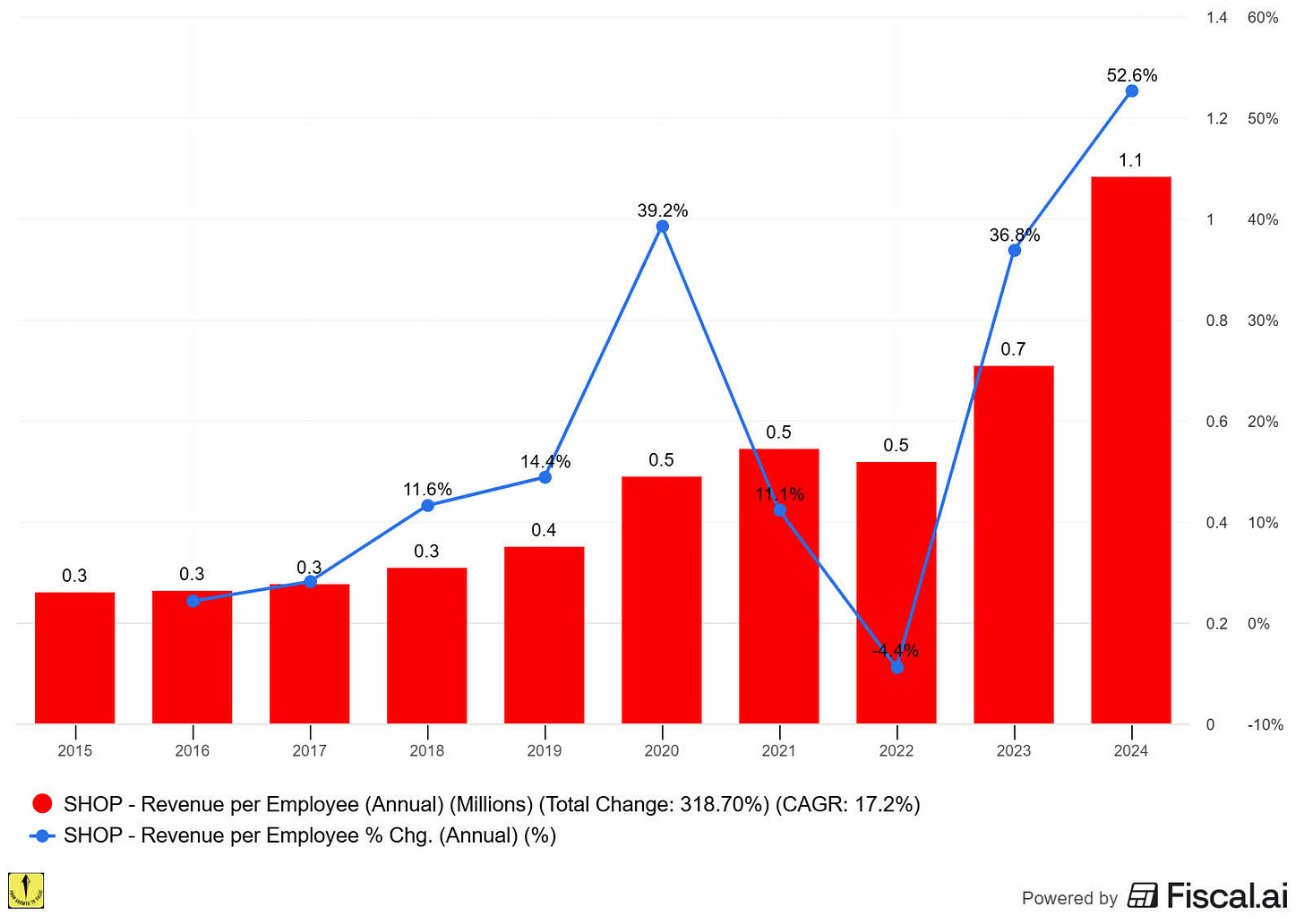

Just look at this Shopify chart.

(If you want to make such insightful charts as well, next to conference calls, the transcripts. I look at presentations of shareholder meetings, conferences, analyst expectations for free cash flow, revenue, free cash flow, EPS and much more. It has Morningstar's high-quality reports on more than 1700 companies. If you use this link, you have a 15% discount (just $20.4 per month!) for the Plus plan.)

In 2023, Shopify adopted an AI-first approach. That means that if you always have to try to solve a problem with AI first and only if that doesn't work, you can hire a human being. As you see, revenue per employee shot up in 2024.

The executives running the biggest tech companies today have all read Clayton Christensen's "The Innovator's Dilemma."

They understand the core lesson: if you don't creatively destroy your own business, someone else will do that for you.

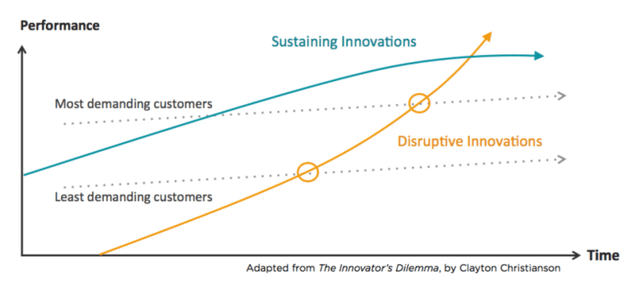

This is completely different from 30 years ago. Back then, if you were a top-10 company by market cap, you were basically complacent by definition. You had your moat, and you defended it and had some sustaining innovations. This is how it works:

The reasons why you only had sustaining innovation and no disruptive innovation were mostly these:

The new technology is initially seen as crappy compared to the older technology

The megacap company earns a ton of money with the old technology and switching would mean giving up tons of profits.

Switching costs can be enormous.

Today's tech leaders know they can't think that way. Satya Nadella at Microsoft understands that if Microsoft is left behind in AI, the company will die eventually, as it almost did before he took over as the CEO. It doesn't matter how profitable they are right now, Microsoft, Google, Meta, Amazon and others will spend like there's no end to not be disrupted by new players. Microsoft even went as far as almost taking OpenAI in-house.

That's why older investors who say "Eventually Microsoft shareholders will demand returns from all this chip spending" are wrong. Nadella knows that not spending on AI infrastructure is a guaranteed path to irrelevance. The choice isn't between spending and profits; it's between slowly dying or survival.

Apple's Dangerous Position

This is exactly why I'm worried about Apple (AAPL). I don't see that same willingness to invest heavily in the far-out future. They're still stuck in incremental improvement mode. You know the formula for the new iPhone: slightly better camera, slightly faster processor and some fancy colors. I'm looking at you, Cosmic Orange. That's the playbook of an incumbent that's about to be disrupted.

Now, I'm not predicting Apple's immediate collapse. Disruption is a gradual process that unfolds over years. But if Apple doesn't jump on the AI train soon, the train will leave the station without them. And once that happens, it's incredibly hard to catch up.

The companies with deep pockets, Microsoft, Google, Amazon, and Meta, just to name a few of the biggest, can invest like crazy and still remain extremely profitable. Apple has deeper pockets than almost anyone, but they seem reluctant to place big bets on transformational technology. That's dangerous.

Market Reality Check

None of this means we're in a risk-free environment. Stocks aren't cheap right now. We've had a crazy run since April, and honestly, I think we're due for a correction. That would actually be healthy for the market.

I want to see some air let out of this balloon. Not because I'm bearish on AI – quite the opposite. A pullback would give us time to see more killer applications emerge. Right now, there are still very few companies whose entire business model is built on AI. We need more of them, and we need them fast.

If those applications don't materialize quickly enough, then yes, we could see a big deflation and tumble into that trough of disillusionment for a few years. The market won't wait forever for the productivity gains to show up.

The Speed of Progress

Here's what gives me hope: look at how fast the large language models have improved. The general launch of ChatGPT was in November 2022, less than three years ago. The progress since then has been incredible.

However, and this is important, we haven't yet seen quantum jumps in productivity. The tools are better, the capabilities are expanding, but most businesses are still figuring out how to actually use this stuff effectively. That productivity boom has to come, and it has to come soon. There are signs, Shopify, Palantir and Applovin, as I mentioned, but there needs to be a broader movement to avoid the trough of disillusionment.

The models need to become much more efficient and applicable to real-world business problems. Right now, we're still in that phase where AI is impressive in demos but harder to implement in practice. That gap needs to close.

What This Means for Investors

So where does this leave us as investors?

First, I think we avoid that classic bubble pattern if (and only if) the killer applications keep coming at a rapid pace. Companies like Palantir, Lovable and Applovin need to become more common, not the exception.

Second, the infrastructure spending is going to continue much longer than most people expect. The returns aren't going to show up in traditional quarterly earnings reports. They're showing up in competitive positioning and long-term survival odds.

Third, watch out for companies that aren't adapting. The incumbents who think they can sit this one out are setting themselves up for disruption. Apple is the obvious example, but they won't be the only one.

Conclusion

Innovation is moving faster than ever before. The traditional hype cycle might not apply this time because the gap between infrastructure and applications is shrinking.

A correction would be healthy and give more time for those applications to prove themselves. The question isn't whether AI will be transformative; it already is. The question is whether it's happening fast enough to justify the current valuations.

I'm cautiously optimistic. The pieces are falling into place faster than in previous technology cycles. The companies with huge capital resources are making the right bets. And most importantly, we're already seeing real businesses built on AI foundations, not just demos and prototypes.

The future is inherently unknowable, but if I had to bet, I'd say this time really might be different. Just don't let that optimism blind you to the risks along the way.

In the meantime, keep growing!

PS: If you want my latest stock picks, full portfolio access, and entry to a subscriber-only platform, upgrade here.

PPS: If you liked this article, it would be great if you shared it on your social media.

Great article Kris! The capex spending seems obvious. They take more risk not spending than just spending. On the application winners, l do wonder if Palantir, Applovin and Shopify are not the outliers. The internet amplified the winner takes all model by introducing a network effect. The result, a power law. It seems that AI strengthens this power law. Maybe with fewer winners, but they'll win big and faster than ever.

Kris, I really think it would be worth pausing for a minute on Apple to hear some alternative perspectives. Apple needs to offer agentic AI to its users: AI that can perform useful tasks based on how much Apple knows about them. “Siri, buy another 100 shares of NVDA in my Roth IRA…”

The AI platforms to support this aren’t there yet but they are coming. We will see if Apple is ready by then or not.

Partnership is a fine way for them to start. Time-limited, with Apple maintaining control of the user and having full access to the data acquired. They preserve the option to replace the partner with their own technology if that becomes important. Meantime users are kept wrapped in the Apple cocoon with that nice tap into their wallet.

Perhaps you mean to suggest that if someone else succeeds in building generalized AI, then Apple will be screwed. Ok, yes, possibly.

But if you think there would be no deal feasible between that yet-to-be-named overlord of AI (as tight as the competition is right now, why do you think there would only be one player to reach that goal? Wouldn’t the next be weeks at most behind?) and Apple? I would disagree on a “buy vs build” calculus alone. Cheaper to do a deal with Apple and get all those users quickly than to try to woo them over to your ecosystem/device that’s every bit as fully built out as Apple’s.

I get your impatience with Apple. The first generation iPhones would be old enough to be in college, for chrissakes, and Apple has had nothing major to show since then. But there are multiple ways to play this out, and for Apple in particular, I think there’s a good shot at using the iPhone franchise to pull themselves into the AI era with much less sweat and more grace than the other MAG7.