Hi Multis

The first crazy earnings week of this quarter is already behind us. Another one is coming up.

During the upcoming week, I’ll be in Dubai for ValueX Middle East. I really appreciate these conferences, as you get to talk to industry experts, bounce new ideas, and get new insights. It’s a great network to get high-quality information, which I often use for my investing content.

So, I’ll be less available in the upcoming week in our Slack community. If you are a paid member and didn’t get an invitation, this went wrong for some people in the past. Things should be fixed now.

As you have seen, the team is growing, with Baurzhan last week and Zack this week. In the upcoming week, I think I’ll be able to present another new author.

Now, don’t get this wrong. It’s still me editing the articles. I still listen to all conference calls and keep up-to-date. But writing all of the earnings analysis articles just takes away too much time for other things, like completing the series on the new Potential Multibaggers picks, research for new picks and other things.

I think about webinars, for example. I used to do them at Potential Multibaggers, but that’s already a while ago. I want to revive them once the authors can work more independently. I’m creating time for myself to help you even more.

But let’s look at the rest now.

Articles In The Past Week

We are returning to our normal pace of articles, as this is the fourth article published this week.

In the first article this week, we looked at the first Potential Multibaggers picks that released its earnings, Kinsale.

Just like every month, I added twice to my portfolio this month and the second time was this week. In this article, I showed you what I bought and why.

The third article was Zack’s first and many Multis showed their appreciation for Zack’s first article. He updated us about TransMedic’s Q3 results.

Memes Of The Week

Just one meme this week. Google had very strong results and that’s why this meme was applicable.

Interesting Podcasts Or Books

You may have seen the clip where Sam Altman attacks Brad Gerstner, the host of the BG2 Podcast and an OpenAI investor for asking how OpenAI is going to pay for all the data centers. Satya Nadella was also a guest on the podcast.

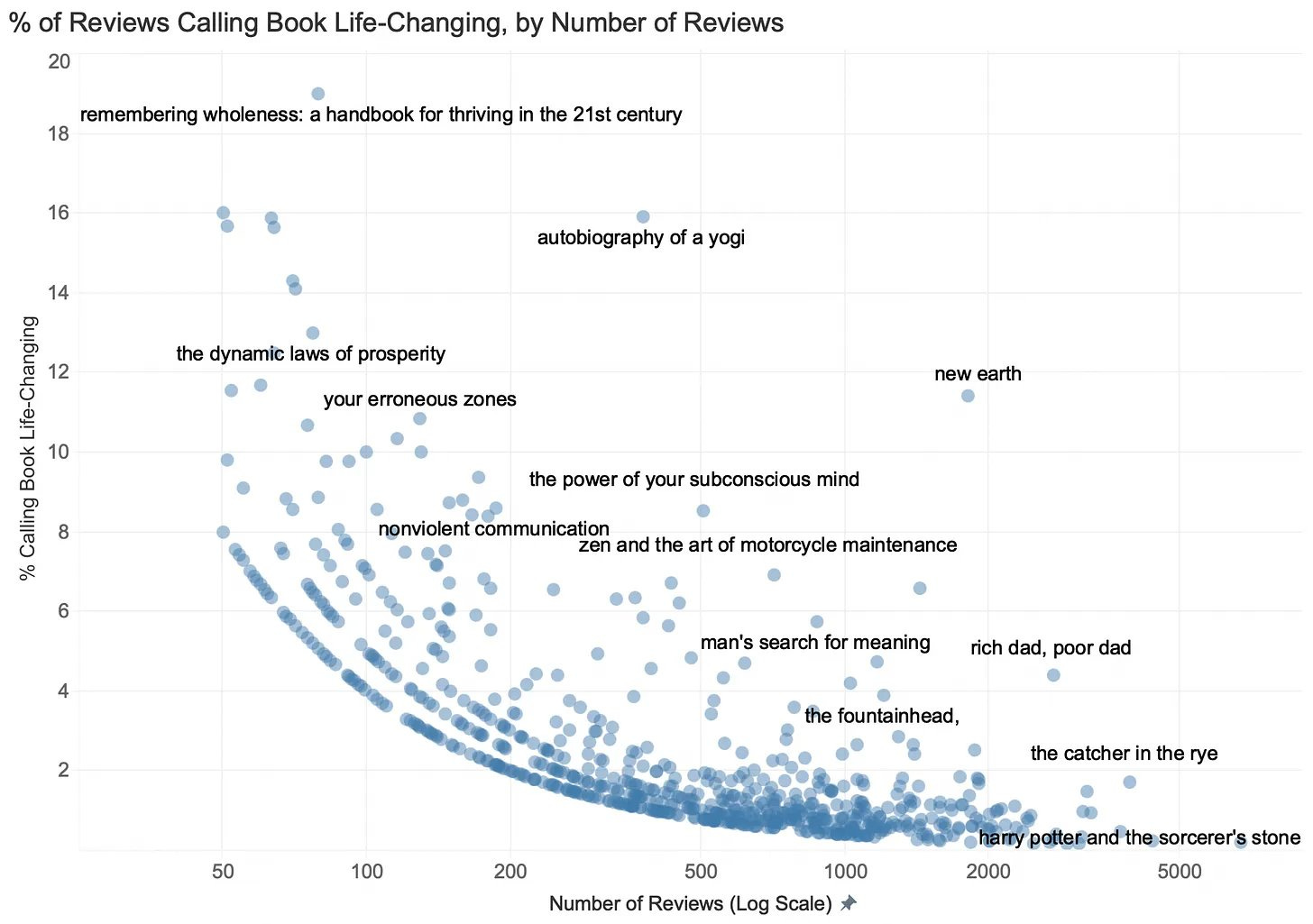

I also found this great book chart. It shows how often the word ‘life-changing’ was used in reviews. Of course, there will be some esoteric books, but you may still find this appealing.

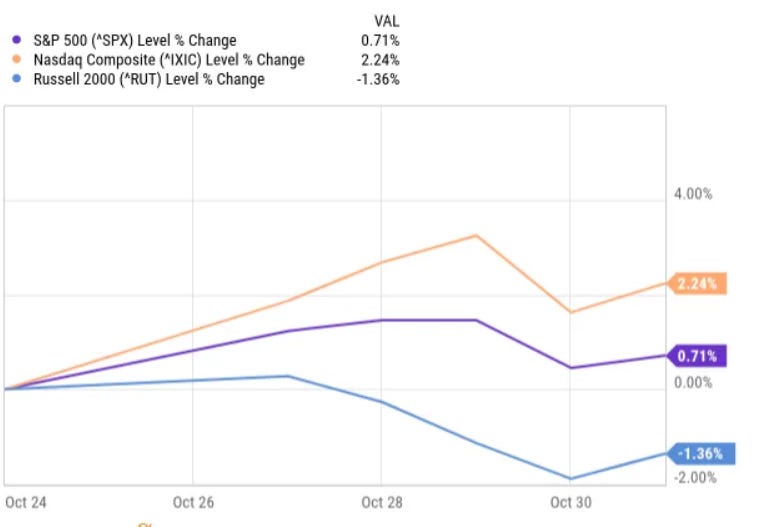

The markets in the past week

Usually, the different indexes move in a similar manner, but this week, that was not the case. While the Russell 2000 was down 1.36%, the Nasdaq was up 2.24%. The S&P 500 was somewhere in between, with a gain of 0.71%.

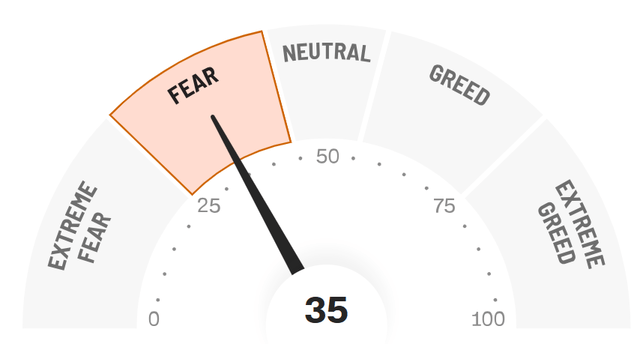

The Greed & Fear Index remained in Fear territory, but inched up a bit again, from 33 to 35.

Lesson Of The Week

This week, the lesson is about this X post.

Robert Kiyosaki is the author of a book that’s also on the book chart I shared above: Rich Dad, Poor Dad. By now, we know that Kiyosaki faked the book, even if he wants it to feel like an autobiography. The Rich Dad never existed, and the Poor Dad (his own father) was not poor at all. He had a high position in Hawaii’s Department of Education.

But this post got 5.6 million views. Why? Because people love negative news. Negative news generates twice as many clicks as positive news.

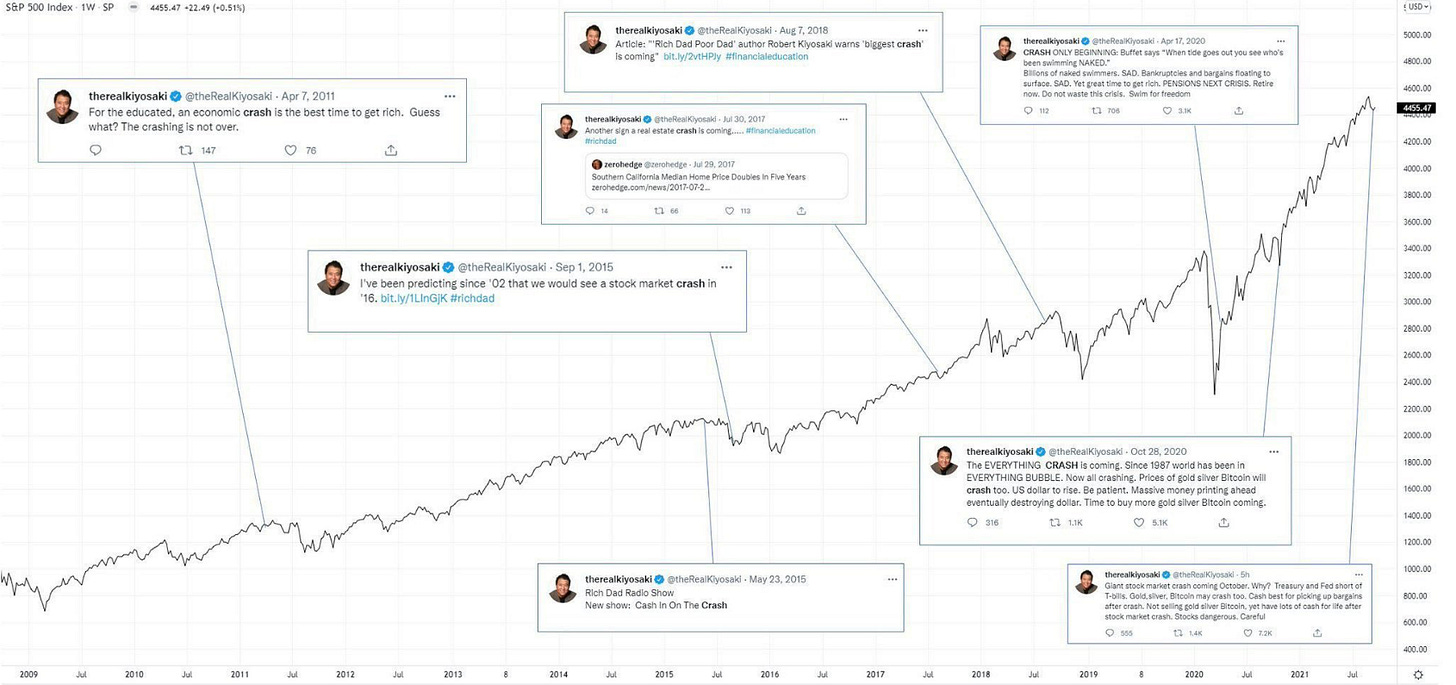

If you are optimistic, people feel like you are selling something. If you are negative, they think you warn them. Do you still think that after you have seen this chart?

I’m not sure if you can read everything. But the chart is simple. It’s the S&P 500 and each time Robert Kiyosaki posted that there would be a huge crash. This chart is from a blog called A Wealth Of Common Sense by Ben Carlson. Carlson writes:

To this day, you still see headlines like this:

TRADER WHO PREDICTED THE 2008 CRASH THINKS SOMETHING ELSE WILL CRASH

These people are still living on being right once in a row, even though basically none of them have been right ever since. Seriously, how many of the people who “predicted” the 2008 financial crisis have been right about any market-moving events since?

And he’s right. Michael Burry still lives from his correct 2008 call. In the meantime, he has predicted 17 crashes. Full disclosure, I don’t know if that number is correct, I just read it somewhere, but I have seen multiple of those.

One day, he will be right again. Of course. Even a broken clock is right twice a day.

Please ignore such doomthinkers. They only ride for themselves, not for you.

Quick Facts

1. What if Constellation Software disappeared?

This week, I got a comment on a Constellation Software post that the company has crap software. Why? Not because the individual had first-hand experience, but because organic growth for Constellation Software’s products is in the low to mid-single digits.

I tried to explain to this guy that vertical market software is not the same as horizontal software, which should indeed grow, preferably as fast as possible. But Vertical Market Software (from now on VMS) is different. It caters to customers with extremely specific needs. And those customers don’t increase fast.

That’s also why Constellation can buy these businesses for low multiples.

But the software is also very critical. I made a thought experiment.

Let’s suppose Constellation and all of its subsidiaries disappeared from this world. What would go wrong in the US?

1. Cities couldn’t process property taxes and that would result in local revenue collection collapsing.

Police dispatch systems would go offline.

911 calls couldn’t be routed properly.

Court cases and warrants couldn’t be tracked, so the justice system would collapse.

School attendance and payroll systems fail, which means chaos for millions of staff and parents.

2. Healthcare administration would collapse.

Constellation subsidiaries run software used by hospitals for billing, scheduling, and patient record management.

Medical labs also use software for test order tracking.

Long-term care facilities use Constellation software for patient and staff management.

Regulatory compliance (HIPAA reporting, etc.) would become impossible.

3. Real estate and utilities would be disrupted

Constellation owns companies that handle water billing, sewer, waste management, and property management systems. Many small and mid-size towns depend entirely on these systems. Without Constellation, you would have to dispose of your waste on your own.

Rent collections and maintenance ticketing would vanish.

Late fees, shut-offs, and reconnections can’t be processed.

4. Specialized professional software disappears

Think of every niche industry:

Funeral homes (management and record systems).

Veterinary clinics (practice management).

Auto dealerships (service scheduling).

Construction and engineering firms (project bidding, permitting, compliance).

Libraries

Zoos

Transport operators, etc.

These businesses would lose their only functioning system overnight, because these are small markets with no alternative providers. A business disaster for hundreds of thousands of SMEs.

5. Financial reporting and compliance failures.

Many of these systems feed directly into state and federal databases. Without them: Compliance reporting halts (EPA, IRS, SEC).

Local governments can’t transmit the required financial data.

Auditing trails disappear, creating legal chaos.

I could go on, but the conclusion is clear. Tens of millions of Americans depend directly or indirectly on these systems.

Thousands of local governments, hospitals, police departments, jails, fire brigades and agencies would grind to a halt.

Not just for a day. It would take years to build everything again. That’s critical. And AI won’t disrupt this.

If you think that a piece of vibe-coded software will be used to run jails, police departments, tax collection, and so many more critical things in society, you are naive or AI drunk. And this comes from a big AI believer from the start.

2. Did OpenAI kill jobs?

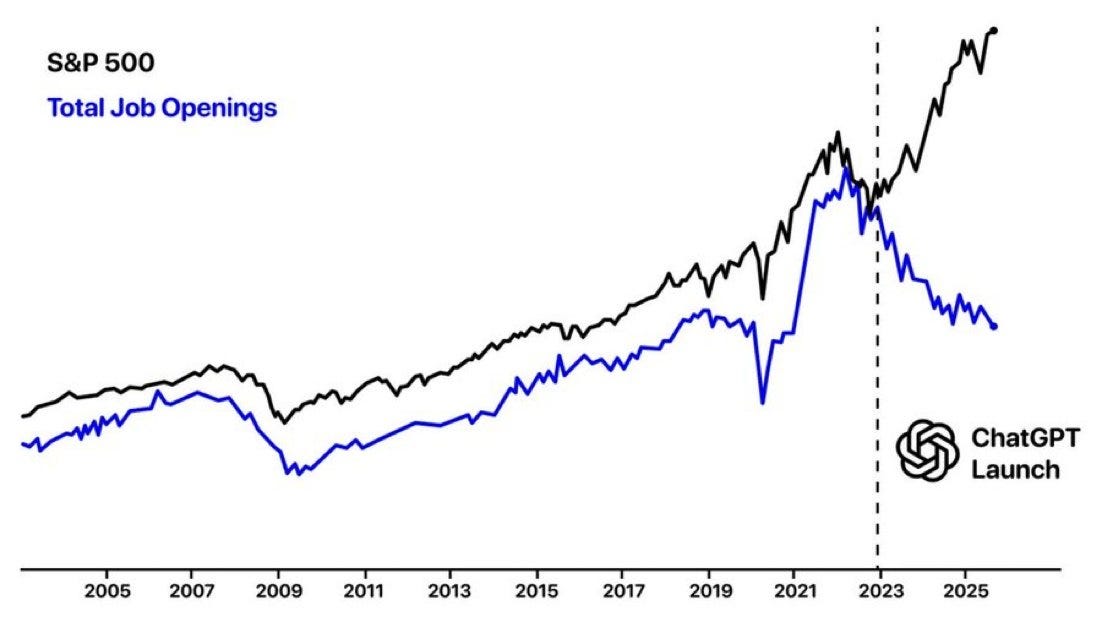

This chart went viral this week.

Many start panicking that AI is killing our jobs. Or that the S&P 500 is in a bubble.

Hold your horses.

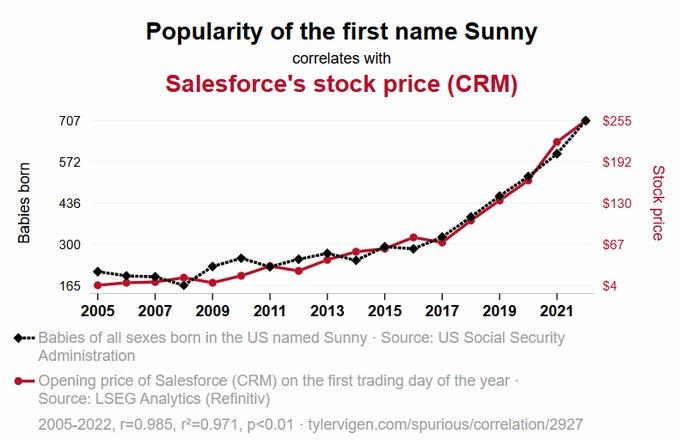

One of the most important things to remember in investing and life is that correlation is not causation. This is an example.

Do you really believe that the stock price of Salesforce is caused by the babies given the name Sunny? Of course not.

But if it ties into something that has been all over the news, you do? Be very critical.

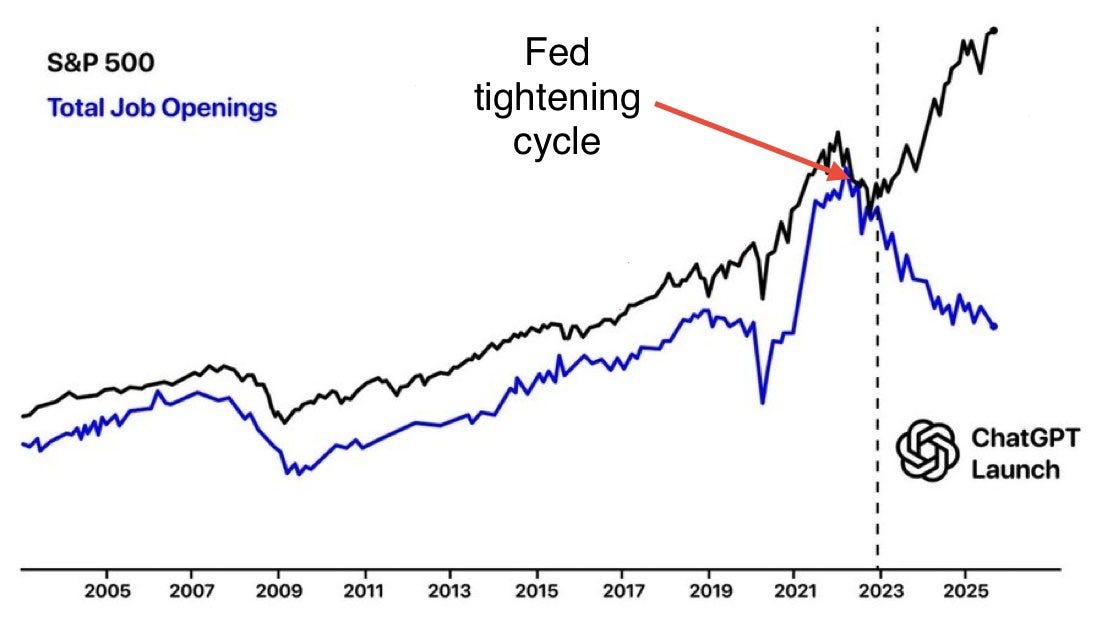

How about this? It’s the same chart, with a different explanation. Now, this actually makes more sense than ChatGPT. Why? If you examine the underlying statistics, you will see that mining, logging, and durable goods manufacturing experienced steeper declines than the tech sector. Do you really think ChatGPT caused that? Always be careful with fast conclusions.

3. Buying or renting a house?

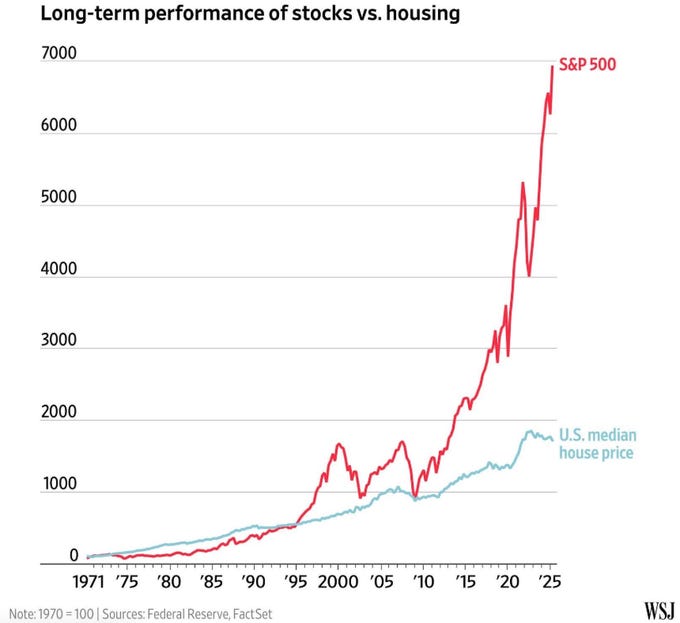

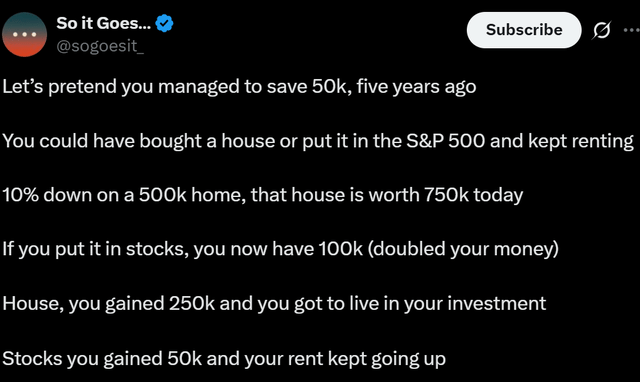

This is an old discussion. However, it resurfaced due to this Wall Street Journal chart.

As so often, there are black and white opinions on both sides.

Some say that you shouldn’t buy a house to invest the money in the stock market. Renters made victory laps.

On the other side, there were also posts like this.

As so many things in life, especially the most interesting things, the real answer is: “It depends.”

If you want flexibility, lower upfront costs, and to maximize your investments elsewhere (such as stocks or building your business), then renting will be the best solution for you. A house is not very liquid, more cash is.

But if you know you are going to settle somewhere for a long period or maybe forever, I think buying a house can be a great decision.

Is it the best investment? Well, that depends.

First, you can live in it, which is not too bad.

Secondly, it provides security. You are the boss (at least as long as you pay the mortgage) and you can’t be evicted. You can create a real home, without having to fear that it can all be taken away suddenly. Psychological comfort is very important.

If you examine what makes people happy, research shows that self-control is the number one factor. Self-control is the ability to have control over your own life. As Morgan Housel wrote in The Psychology of Money:

The highest form of wealth is the ability to wake up every morning and say, ‘I can do whatever I want, when I want, with who I want, for as long as I want.’

Thirdly, and not unimportantly, a house if for a majority of the people the only investment they don’t think about buying and selling often. 95% of investors can’t hold for the long term. But many people pay off a house for 20 or 30 years without selling. Even if the yearly growth rate of that investment is lower, it will probably be higher than that of the average investor who buys and sells stocks too often.

I know I dedicated more arguments to buying than to renting. That’s just because for me, this was a very early and clear decision. I wanted to rent as long as I was not sure about a stable relationship and such. But I also knew that I wanted to settle when I was sure enough about the stability of my relationship that I wanted to marry and buy a house in the town where I was born (even though I had left it 15 years before I came back). Roots are essential to me.

But again, it’s a very personal choice. And there’s no clear right or wrong. There’s a context that only you can decide on and and no one else is in your shoes.

4. Adyen Q3 Business Update

Adyen released its Q3 business update this week. As a European company, it officially reports only twice a year. However, since 2024, the company has been providing quarterly business updates, which are similar to quarterly earnings reports.

Adyen’s Q3 2025 results showed continued strong execution.

Net revenue was up 20% year over year to €598.4 million (+23% at constant currency). This growth was once again driven by higher wallet share among existing customers, and strong expansion across all regions.

Processed volume reached €346.9 billion, up 8% year over year, or 19% when excluding Block’s Cash App, which had only a limited impact on revenue.

In the Digital segment, revenue grew 10% to €335 million, supported by strength in content, subscriptions, delivery, and mobility. While processed volume declined 5% due to lower Cash App activity, it increased 12% excluding it.

The Unified Commerce segment continued to outperform, with revenue climbing 32% to €194.8 million. Growth was especially strong in retail, hospitality, and entertainment, with processed volume also up 32%. The company now counts 589 customers processing across multiple regions (+30 YoY) and 459 customers transacting across channels at scale (+77 YoY). The company now has 420,000 payment terminal units, a 121,000-unit increase from the same period last year.

The Platforms segment posted another strong quarter, with revenue rising 50% to €68.6 million. Processed volume rose 23%, or 53% when excluding eBay. Adyen now serves 31 platform clients processing more than €1 billion annually (up from 25 last year) and 212,000 platform business customers, compared with 126,000 a year ago.

Management confirmed its financial outlook for the year, with net revenue growth in the low- to mid-20 % range for both this year and the next, an EBITDA margin above 50% by 2026, and capital expenditures below 5% of net revenue.

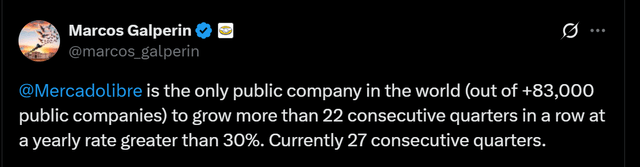

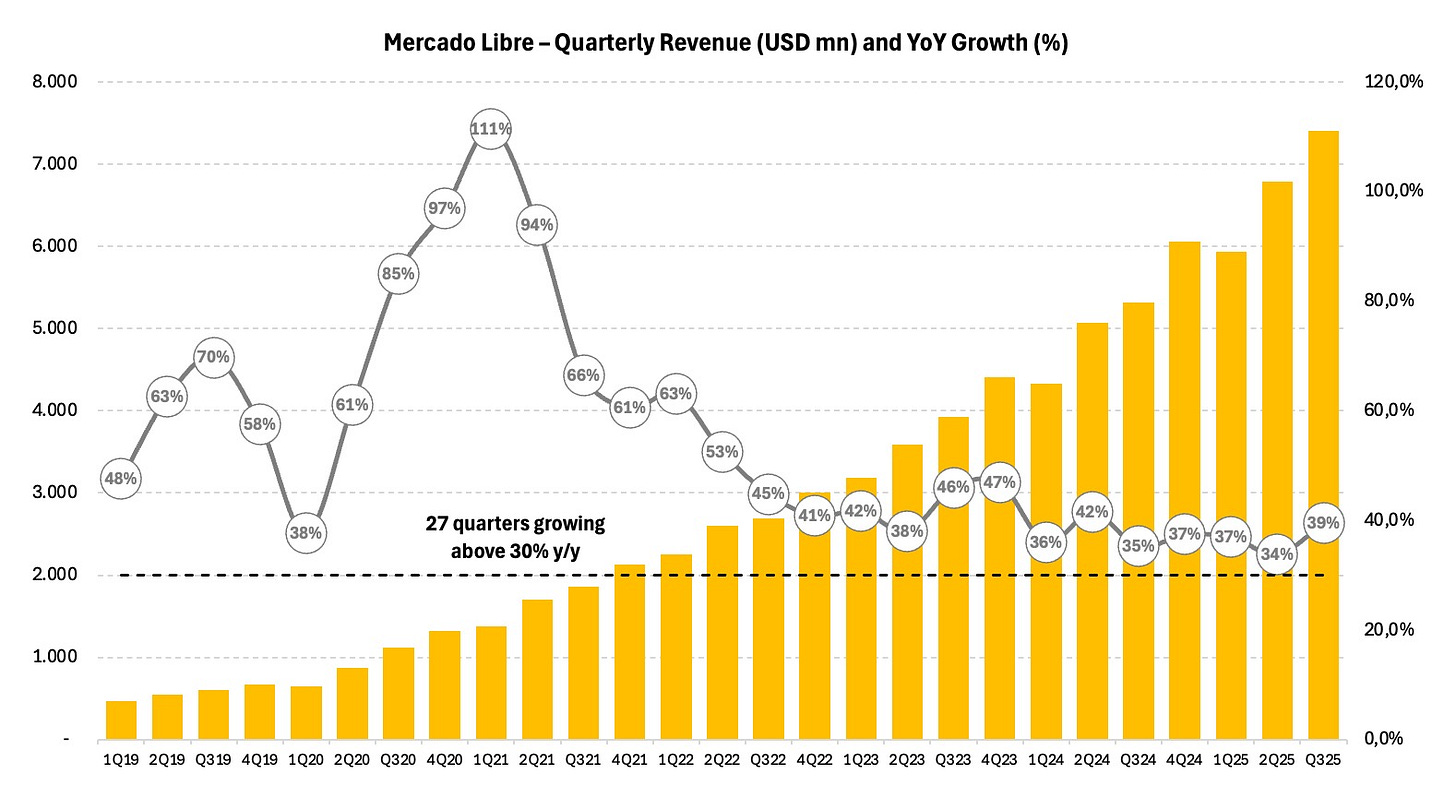

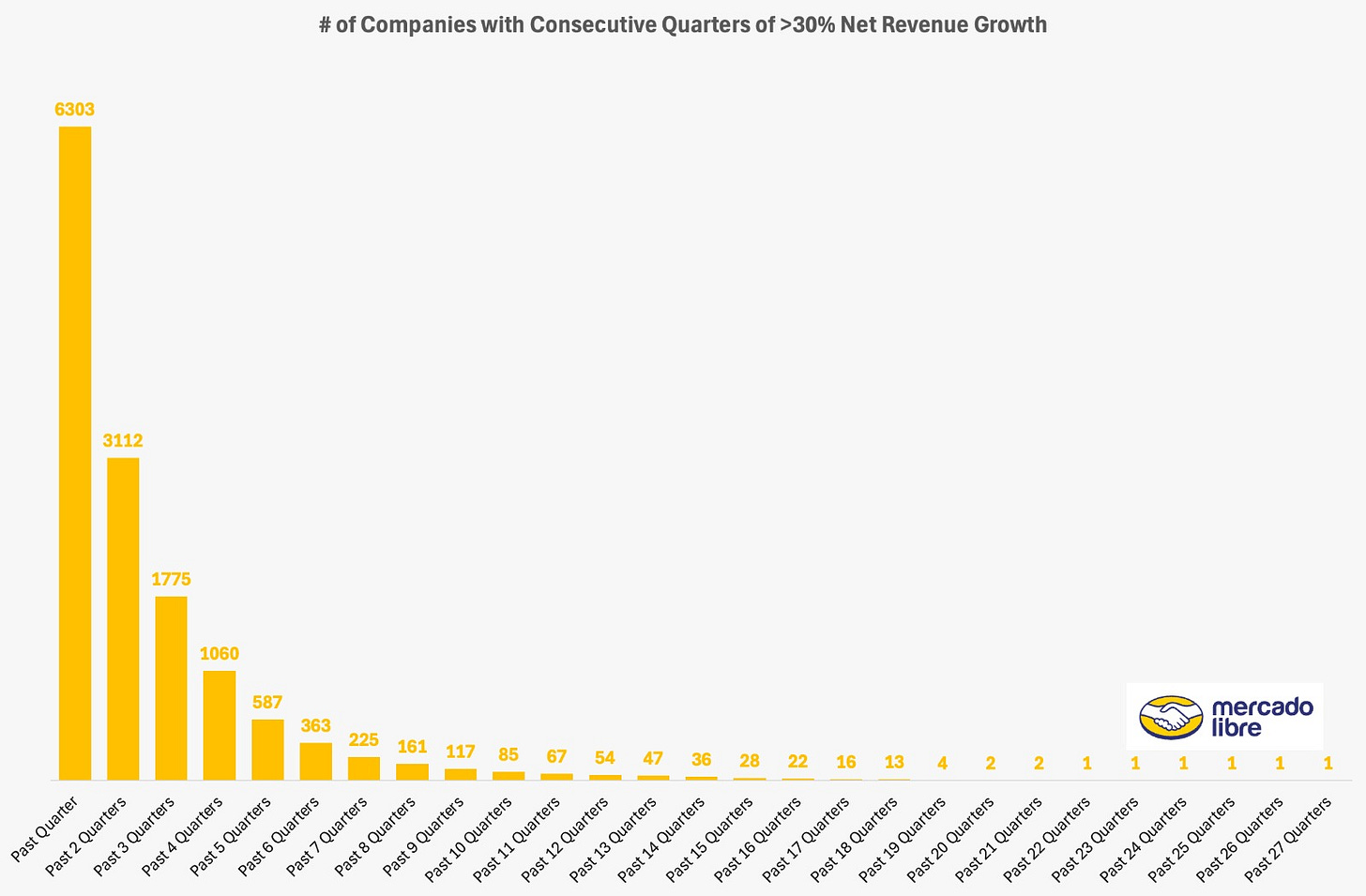

5. Mercado Libre: 27 Quarters of +30%

Marcos Galperin, the founder and (still) CEO of Mercado Libre (until the end of this year), posted this on X.

That’s fantastic. Almost 7 years of 30%+ revenue growth. Something very important in investing is the CAP or the Competitive Advantage Period. I think that of Mercado Libre is very long. I have said this before, and I will repeat it here: I could see Mercado Libre become the first trillion+ company in Latin America.

This is where the free part ends.

If you want full access to Potential Multibaggers, here’s what you’ll get:

✅ Which other companies have 30% growth with an active streak

✅ My complete portfolio (with every transaction)

✅ Deep earnings analysis, with Quality Score and valuation updates every quarter.

✅ Access to our private chat group

✅ Best Buys Now (outperforming the market by 30% over 3 years!)