Adding To These 9 Stocks

What I bought today.

Hi Multi

Tomorrow is the last day of the month and as you know, I invest twice a month in the Forever Portfolio.

I know some content creators have a theoretical portfolio, but this is my real one. For paid subscribers, I will post the screenshots at the end of this article, so you can see it’s real. I do that every now and then, so everyone knows that I’m not faking it. Only 100% full transparency.

Recently, a new subscriber asked why I didn’t share screenshots, but a Google sheet. The reason is simple: with the Google Sheet, you can view my portfolio at any moment, with a delay of just 15 minutes compared to the real-time prices.

But at the same time, I really understood his question. I see so many fakers. People who seem to have positions in every stock that shoots up and in none of the losers. Fakers with 15 accounts who share only screenshots of the most successful. Traders who only show their one outsized winner, not their 15 losers. And so on.

That’s why I share my portfolio with 100% transparency at all times. Not just when things go well, but also when they go very badly, as in 2022. I always put my money where my mouth is and you can see that.

Of course, I understand if subscribers ask if that portfolio is real. I could give that new subscriber screenshots in just a minute or two. No problem. And I will do it at the end here for you as well. Just to make sure you know that I keep it real.

So, as always, you will get the link to my Forever Portfolio, the portfolio with my real money, but this time, you will also get the screenshots.

Having said that, let’s go to the nine stocks I have bought today. As always, I tinkered with what to buy for several days but some price action this week made me decide to add more to some positions. I dropped Broadcom. Dropped as in: “I didn’t add, while I had planned it.” Not that I sold my position.

So, what did I add more to?

You’ll find out right away, in the biggest additions.

1. Duolingo

This is one of the positions I added more to than I originally planned. This is the reason.

The stock has dropped by more than 15% over the last five days.

If you ask me why, I have no clue. There is no particular news out that I know of.

My guess? There was some report that was sent to institutional investors and funds. Probably with download numbers that weren’t great.

Many will see this as proof that Duolingo (DUOL) is struggling against the competition from AI or other factors (Google, Apple, etc.).

I know many investors who are incredibly smart but still miss a lot. The reason is that they are too removed from reality. Their work is fascinating, mind you, and I thoroughly enjoy their write-ups and learn a great deal from them.

But there’s so much more to investing. Things you “shouldn’t talk about” according to the investing police. Because they are “too ordinary.”

Things like saying a product is “cool.” Normal people do that all the time. But investing professionals? No, that’s not intellectual enough.

Or saying that a CEO is “an incredibly cool guy I admire.” The investing elite will call you a “fanboy” but will celebrate that CEO 20 years later, when the stock has already multibagged.

One such aspect that most professional investors also miss is marketing. They usually completely ignore it. But sales and marketing are the core activities for any company. Without that, no sales, no growth, no profit, and eventually, no company anymore.

The best CEOs are outstanding marketeers and salesmen. Steve Jobs was obsessed with how the Apple products looked, was involved with every single detail when it came to advertising, and spent months designing the packaging box for the iPhone.

But why all of this?

Because of Duolingo. I’m convinced that Duolingo is one of the very best in marketing its product. From the characters to the playfulness, gamification, and social media following, Duolingo has mastered it.

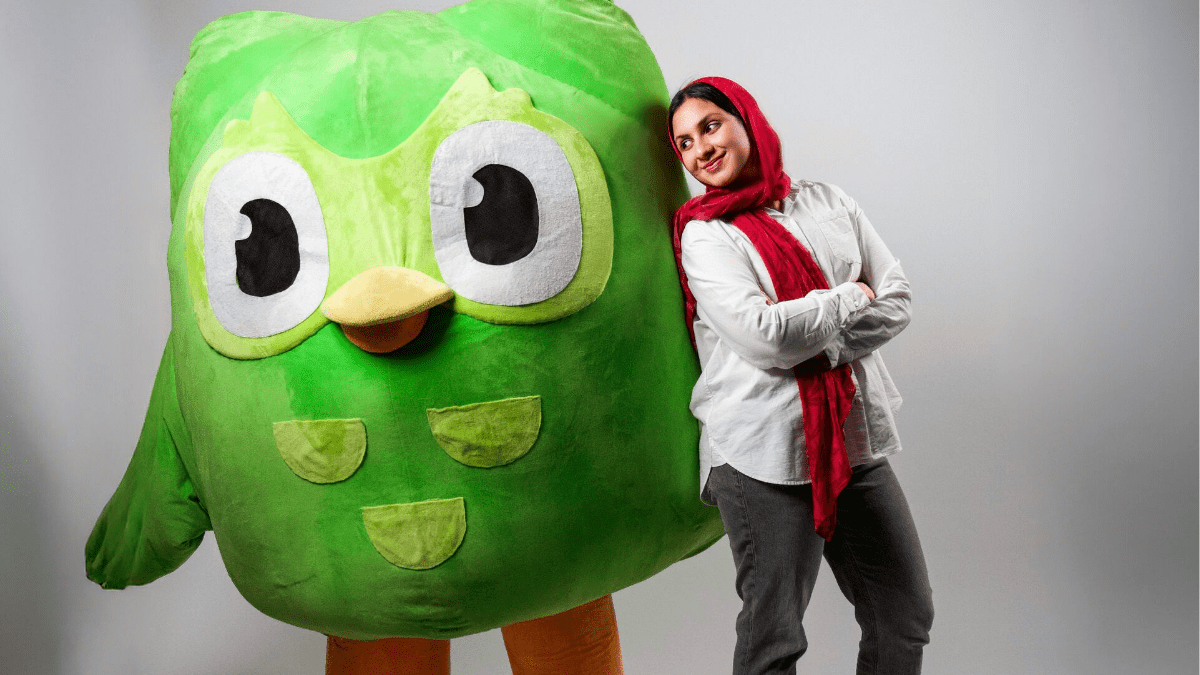

And yes, I know that Zaria Parvez and Kelsey Dempsey left Duolingo in the last few months. Zaria Parvez is only 26 but she started at Duolingo as a Social Media Coordinator in 2020, and became its Senior Global Social Media Manager. She’s credited with a significant portion of Duolingo’s virality.

Zaria Parvez, source

Just after Zaria Parvez left for DoorDash, Kelsey Dempsey, who had created the viral Duo Death social media campaign, also left for Life360.

Now, of course, this is a blow to Duolingo. No doubt about it. But I don’t believe that it marked its death.

Don’t forget that the company had experience with virality long before these two very capable women were made responsible for social media.

I think it’s simple. Duolingo is focusing on finding the next great social media managers. Social media campaigns have always been the main driver for the company. It’s cheap to grow in that way, much cheaper than paying for ads. But while the company is focusing on great hires, it would be logical on something else.

The most logical thing to focus on? User (re-)activation. With chess, Duolingo launched a product that many who gave up on their language learning will love. It’s an ideal product to reactivate users. Even my wife started with Duolingo. While languages didn’t really interest her enough, she loves Chess. But she had downloaded the app before. She just stopped using it after five days or so. Now, she’s a regular chess player.

I’ve been so obsessed with chess myself that my Italian and Latin courses are parked for a while now. This week, I played my first games in real life, after two months of Duolingo practice. In the first two games, he destroyed me in just a few minutes. This friend has been playing chess since childhood and has reportedly played “thousands” of games, in his own words. But in the third game, once I was used to the real-life board and pieces, I could put him under pressure for quite a while. In the end, he still won, but he was impressed that I could play chess that well already after just two months of practice.

Now, I want to make it very clear. That has nothing to do with my intelligence. I won’t deny that I’m somewhat intelligent (that would be foolish), but I’m not a particularly good structural thinker. My brain works more with associations, which is not the best way to think for chess. Duolingo’s course is just really good and I benefit from that. The puzzles are challenging enough. Not too simple, but also not too hard. The strategies are shown clearly.

I picked Duolingo at $92.73.

I want to repeat that, at the time of that pick, my vision was already that Duolingo is not just a language app, but a learning platform. Even now, I think most don’t see that. Chess, music and math are just the start.

I could see Duolingo do programming, investing, memory training, meditation, cybersecurity basics, entrepreneurship, drawing, photography, geography, country-specific culture and much, much, much more.

That’s why I added more to my Duolingo position than I had initially planned. There are clouds, but I think I can see the sun peeping through and the clouds will disappear over time.

If you are a free reader, this is where the content stops for you.

If you want full access to Potential Multibaggers, here’s what you’ll get:

✅ My full portfolio (with every transaction)

✅ All the picks (with two new ones just out)

✅ Access to our private chat group

✅ Best Buys Now (outperforming the market by 30% (!) over 3 years.)

✅ Deep dives on earnings, with a Quality Score and Valuation Score, so you know if the stock’s a buy, hold or sell.

Of course, I know that investing in Potential Multibaggers is spending money. But what if it brings you more money than it costs? That’s called investing. Potential Multibaggers may be a great investment for you.