Hi Multis

It’s time to introduce a new author, Zack. Many of you will know Zack already from our Slack community for paid members, where he has been an active contributor for years.

But I’ll let Zack introduce himself.

Hi all,

My name is Zack, but many of you will know me as Kappachino in our private Slack channel.

I currently live in the United States, and my professional background is in performance marketing. Although it is in a different realm than stock investing, I’ve found many parallels while doing both (e.g., allocation of capital, focus on ROI, and deep analysis of results), which is probably why I’ve developed such a keen interest in this subject.

I’ve been a Potential Multibaggers subscriber since 2021, riding the rollercoaster from the euphoric 2021 market peak to the depths of the 2022 lows. Needless to say, I’m still here and held strong thanks to the great analysis provided by Kris and the team.

I’m now taking it to the next level by sharing my own analysis with our community. With that, I’m excited to share my take on TransMedics’ Q3 2025 earnings.

If you were following Transmedics (TMDX) last year, the price reaction for Q3 2024 was not pretty.

Despite management’s warnings about seasonality and aircraft maintenance, investors and analysts still weren’t prepared to see the decelerating growth.

For context, Q3 is the summer season - people go on vacation. That defers transplants to later months, reduces national transplant volume, and lowers Transmedics revenue as a result.

So, how was Q3 this year? Was it a replay of last year? Read on to find out.

Financial Results

Diluted EPS: $0.66, up 450% YoY, a strong $0.30 beat versus analyst estimates.

Revenue: $143.8 million, up 32% YoY, a minimal $1 million miss versus analyst estimates

Gross Margin: 58.8% versus 55.9% LY

Operating Income: $23.3 million versus $3.9 million LY

Operating Margin: 16.2% versus 3.6% LY

Net Income: $24.3 million versus $4.2 million LY

Transmedics made great progress on all fronts since Q3 of last year, and the YOY comps reflected that across top line, margin, and bottom line metrics.

As expected, seasonality was a factor, resulting in an 8.8% sequential decline in revenue from Q2 2025. For comparison, last year’s Q2-to-Q3 revenue drop was about -5%.

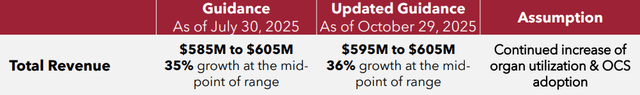

If there’s one thing to take away from this earnings report, it’s the 2025 guidance - its midpoint was raised, showing further confidence from management.

From my perspective, that means everything is well on track. If you’re just interested in the numbers, you can sleep well at night knowing Transmedics is humming along.

However, as investors, we also want to understand how the business is performing under the hood. So let’s dive into the details.

Revenue Breakdown

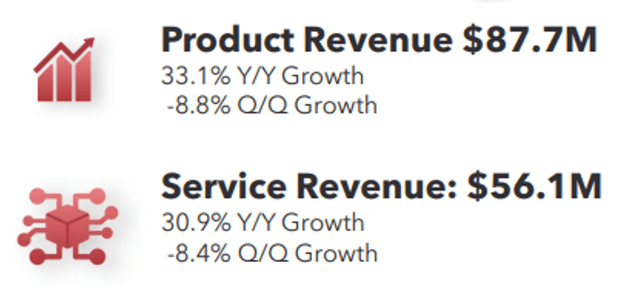

First, let’s look at the composition of revenue this quarter:

Product revenue continues to make up the majority of total revenue. However, this is the first time in company history that product revenue growth has exceeded service revenue growth. To clarify, it’s more like product revenue held steady while service revenue slowed down. Keep in mind that service revenue is relatively newer and grew from a smaller base.

So why does that matter?

If you break out gross margins by revenue segment, product revenue margins hover around 80%, while service margins are in the high 20%.

Product revenue keeping pace with service revenue is a positive sign. If service revenue were to grow significantly faster than product revenue, that would be a yellow flag since it’s a lower-margin business and doesn’t scale as efficiently.

That said, service is an integral part of Transmedics, and there were additional updates on that front in the next section.

Logistics Updates

Founder and CEO Waleed Hassanein shared the following on the call:

Throughout 3Q, we owned and operated 21 aircraft before adding our 22nd aircraft in October, which we were targeting to end 2025 with 22 owned aircraft. In 3Q, we maintained coverage of approximately 78% of our National OCS Program missions requiring air transport, compared to approximately 61% in 3Q of 2024.

They’ve reached their goal of 22 aircraft. In addition, they “maintained coverage” of 78%. That means 78% of missions used their own aircraft instead of outsourcing to more expensive and less efficient charter planes. Coming from 61% last quarter, that’s solid progress. In prior calls, they’ve mentioned that long-term utilization will likely peak around 80% to 85%.

Organ Segments

Moving on to performance by organ:

There was strong YoY organ growth, but negative QoQ growth due to seasonality.

Liver still drives most of the revenue, but there remains a major opportunity in both the heart and lung markets through their next-generation OCS (Organ Care Systems). Here’s the latest update from the call:

Meanwhile, our team is actively working to complete our responses to the remaining FDA questions and expect that all IDE conditions for both trials will be satisfied by early next year. We’re very excited about initiating these two programs to demonstrate the potential positive clinical impact of our Gen2 modification on heart and lung transplantation in the U.S. Importantly, we hope that these programs will catalyze significant OCS heart and OCS lung adoption in the U.S. in 2026 and beyond.

In a separate comment, Hassanein mentioned that they’re ahead of schedule and expect to generate some revenue from these trials before the end of the year, although not enough to impact near-term guidance.

The new next-gen OCS is expected to deliver better patient outcomes (fewer complications) and extend organ preservation time. This should increase utilization and enable more incremental transplants rather than simply cannibalizing existing transplants.

International Expansion in Italy

In September, Transmedics announced plans to expand its product and service offerings to Italy, the company’s first international expansion.

Transmedics will collaborate with Mercedes-Benz to deploy a fleet of purpose-built vehicles dedicated exclusively to organ transport.

The initial hubs are expected to launch before the end of 2025 and will be equipped with OCS units for heart, lung, and liver transplants.

This is big news and a major piece of Transmedics’ growth story. Europe accounts for roughly 40% of the global transplant market, but the challenge lies in navigating the complex reimbursement environments.

This expansion will serve as proof of concept internationally and pave the way for further European growth. As Waleed Hassanein said on the call:

If it works in Italy and it works well, this is going to propagate across Europe. If it works in Italy, it will work anywhere in Europe, just given how the Italian environment is very complicated and has a lot of needs.

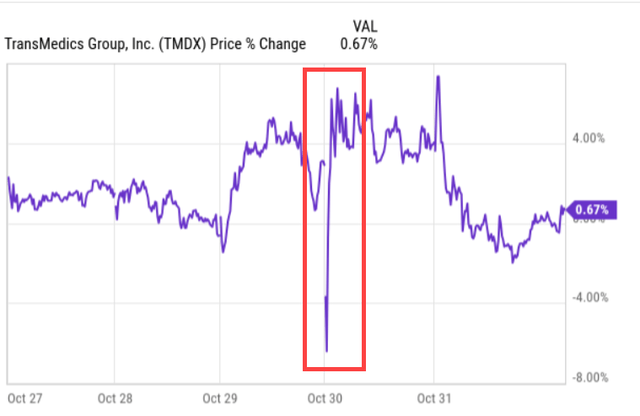

The Stock Price Reaction

An analysis wouldn’t be complete without some commentary on price action - because at the end of the day, price is all that matters, right? (Kidding, of course.)

When I first started writing this on the day of earnings, I had a detailed explanation of the sell-off: short-term algos reacting to the slight revenue miss and unrealistic expectations from independent analysts and accounts tracking flight data. Some posts even estimated over $150 million for the quarter.

But by the next day… A huge swing back to positive as you can also see on the chart. This is why it’s often better to focus on business fundamentals rather than short-term price moves. Once analysts had time to actually review the numbers and fundamentals, sentiment clearly shifted.

As a result, I decided to shorten this section, as an investor myself, I know that we require less explanation when the price goes up.

Conclusion

As mentioned earlier, Transmedics is humming along. This quarter brought only positive news; the thesis remains strong, and I’m excited to see Transmedics finish the year strong and carry that momentum into 2026.

Now handing it over to Kris for his PM Quality Score and Valuation.

If you are a free reader, this is where the content stops for you.

If you want full access to Potential Multibaggers, here’s what you’ll get:

✅ My full portfolio (with every transaction)

✅ All the picks (with two new ones just out)

✅ Access to our private chat group

✅ Best Buys Now (outperforming the market by 30% (!) over 3 years.)

✅ Deep dives on earnings, with a Quality Score and Valuation Score, so you know if the stock’s a buy, hold or sell.

Of course, I know that investing in Potential Multibaggers is spending money. But what if it brings you more money than it costs? That’s called investing. Potential Multibaggers may be a great investment for you.