Insurance Chaos? Kinsale Just Posted a 25% ROE Anyway

Earnings, Quality and Valuation: Is Kinsale A Buy now?

Hi Multis

Karan here with an update on the Kinsale (KNSL) earnings. As usual, Kris will then update the Quality Score and the Valuation Score to decide if Kinsale is an interesting buy at the moment.

Last week, Kris made this point about Kinsale in our private chat community:

And he’s right, I’ve discussed before why that might be the case. You can read my previous write-up, of course, but to put it simply, insurance is BORING. And then there’s Kinsale, which takes a boring thing and makes it more complex and harder to understand, thereby making it “ickier” for investors to try and figure out.

I like it for exactly those reasons, let it compound so consistently and be so boring that it keeps the meme boys away.

A word of caution, though, Kris pointed out it’s the “new” silent PM. The previous one? Paycom, which also had a simple, predictable business model of just being a payroll software provider. That was until this happened.

Paycom suffered a horrendous 75% drop from ATH (since Nov’21) and is still 64% below where it was roughly 4 years ago, needing more than a double just to break even for those unlucky enough to buy at the top.

That’s the thing about boring compounders, they can lull you into a false sense of reliability and sleepiness and then surprise you when you aren’t looking.

So if Kinsale is indeed the successor to Paycom, we should be hyper-focused on its risks during these quarterly check-ins, because if those can be managed well, the stock will take care of itself on the upside.

The truth is, Kinsale has gone nowhere over the past year, having delivered a price return of -3%, which of course, makes the stock even more boring, especially in this roaring bull run.

So, are we about to experience another Paycom-style swan dive?

Or is Kinsale doing its best to struggle through muddy waters, in a dark time for the insurance industry as a whole? Let’s find out.

Profitability

Another quarter, another masterclass from Kinsale: disciplined growth, sharp underwriting, and fat profits in a messy market. Here are the numbers.

Revenue: $497.5M (+19% YoY, +$50.9M vs. estimates)

Net income: $141.6M ($6.09/share)

Operating earnings: $121.2M ($5.21/share)

Gross written premiums: $486.3M (+8.4% YoY)

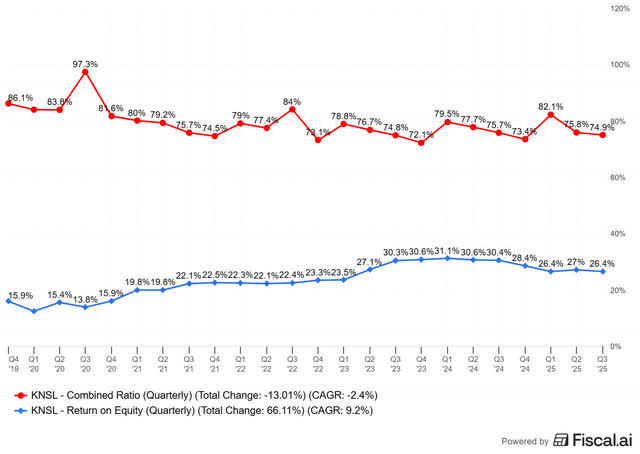

Combined ratio: 74.9%

Operating ROE: 25.4%

Still best-in-class, even in this ugly environment

This continues to sustain its best-in-class profitability, despite ongoing headwinds in commercial properties and the hangover from catastrophe losses across the industry.

PS: all these graphs are made with Fiscal AI. Kris has a link and a 15% discount if you use it.

We can see that Kinsale’s Return on Equity has now declined for 3 straight quarters, but is still higher than at any point over the last 10 years.

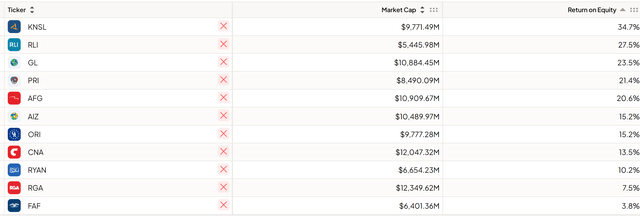

To be clear, this is still best in class across the entire insurance industry (also a nice Fiscal feature):

We can say with confidence that it’s not that Kinsale suddenly got worse; in fact, it showed improvement across the board compared to Q3 2024.

I’m sharing the key highlights as a summary for those who want to skim through.

Financial Highlights

Book Value per Share: $80.19

Annualized Operating ROE (9M 2025): 25.4%

Float (as of Q3 2025): $3 billion (up from $2.5 billion at 2024 year-end)

After-Tax Catastrophe Losses: $1.0 million (Q3)

Commercial Property Premiums: Down 7.9% YOY, YTD down 15.2%

Other Divisions: Ex-Property, gross premiums up 12.3% YOY

Net Investment Income: $49.6 million (+25.1% YOY)

Net operating earnings:$121.2 million, Y-o-Y above 20%.

What are the key takeaways for us as investors? Here’s a quick take.

Combined ratio improved, even with higher expenses.

Loss ratios: lower QoQ and YoY.

Investment income: up now, likely softer ahead as rates fall.

Commercial property still the weak link, but rate declines are stabilizing.

Catastrophy losses? $1 $1M, basically nothing.

So, how ugly was Commercial Property?

The commercial property division faced continued normalization, with gross premiums down 7.9% YOY in Q3 and 15.2% year-to-date.

Excluding commercial property, other segments booked a healthy growth of 12.3% YOY. That’s why overall growth still came in at 8.4%. This is the benefit of having a diverse underwriting scope and balancing risk profiles across divisions.

Management Commentary & Outlook

This is essentially a copy-paste answer every quarter (BORING) but that’s the point. Consistency is gold in insurance. If they ever change this script, that’s a yellow flag.

For completeness, Kinsale’s leadership remains focused on underwriting discipline, margin protection, and selective growth. The company’s low-cost, technology-driven approach maximizes efficiency and profit despite macro volatility and evolving market trends.

So the only question I have left is, what drove the higher expenses?

The 21% expense ratio for the third quarter was higher than the prior year due to lower ceding commissions and higher retention levels.

Understandable and consistent with what they’ve repeatedly told us about the competitiveness of the market. To be fair, In Q2’25, the ratio was already at 20.7%, so it’s not a huge increase QoQ.

We also want to know about growth potential, beyond traditional markets and here they indicated they’re experimenting with new, esoteric lines of business:

I would say some of our newer areas that we’ve developed recently would be the Transportation segment and the Agribusiness segment...there’s still a great opportunity in Casualty...high-value homeowners and our Personal Lines, it is an area we’re putting a lot of emphasis into.

Takeaways

If you’ve made it this far, congratulations. You’ve survived the insurance talk.

To express my appreciation, I’ll share my views on the report now.

Going in, I expected the worst because the insurance players have been taking it on the chin one by one.

Take Progressive, the poster child of compounder insurers. It’s the best-run publicly traded auto-insurer. Even Buffett, who owns Progressive’s competitor GEICO, regularly speaks in admiration of Progressive.

There, you’ll hear the same commentary around competitive dynamics, alternative funding sources and squeezed margins, and the strain is showing the stock too:

PGR is currently in its worst drawdown in 10 years, even worse than COVID (!) when the stock was down 21%. When a bellwether for the industry is getting kicked like this, you know things are bad.

It’s the same story across the insurance industry as a whole. Here’s a drawdown chart of KIE, the Insurance ETF, currently in an almost 8% drawdown over the past year.

Suddenly, the -3% price return for Kinsale doesn’t look so bad, does it?

If you skimmed your way here (no judgment), here’s the short version:

Insurance is not in great shape at the moment, with margins squeezed, expenses rising, and investment income expected to decline as the Fed cuts rates.

Kinsale specifically called out increased competition from new players entering the industry that have double the loss ratios and none of the discipline, but they are giving large discounts to get business, which hurts revenue growth for disciplined players like Kinsale.

These things are more pronounced in “large” markets like commercial property so a downturn there affects everyone.

Despite that, Kinsale continues to be disciplined, profitable, focused on efficiency and prudent underwriting and the primary thesis of being the best insurance company today very much holds.

Someone recently asked if the new age of Insurtech startups like Lemonade, Root, Hippo Holdings are hurting Kinsale directly. My understanding is that they compete in different lines of business, so not directly, but there are certainly ripple effects as legacy providers are forced to give up margins to compete on price with newer, more agile players, which squeezes the pie for everyone.

However, most of these companies are catching UP to Kinsale, which remains best in class and primed to weather this cycle.

Kris taking over here. Thanks, Karan. Another sharp analysis.

I just wanted to point out the insurance cycle.

We are now somewhere in phase 4 or 5. A catastrophic event would definitely weed out unprofitable competitors. It’s inherent that we don’t know when they come, but they always do.

Let’s look at the PM Quality Score Update first to decide if Kinsale before we go to the valuation to see if Kinsale is a buy now.

This is where the free part ends.

If you want full access to Potential Multibaggers, here’s what you’ll get:

✅ My full portfolio (with every transaction)

✅ Access to our private community

✅ The most recent picks

✅ Access to our private chat group

✅ Best Buys Now (outperforming the market by 30% over 3 years).