Hi Multis

Another week is over and you know that to round it off (or to start your new week), you get the Overview Of The Week.

A few Multis asked me what was going on with Potential Multibaggers. For years, they were used to getting 3 to 5 articles every week, and that pace has slowed considerably in the last few weeks.

Last week, I shared that I had my yearly ‘thinking days’ with a friend who’s also in this business. This week, I have been implementing some of the changes already at Potential Multibaggers.

Many of those things are behind the scenes. I’ve been talking to candidates who want to write for Potential Multibaggers and focusing on structuring the back-office stuff. Baurzhan is the first to start writing for Potential Multibaggers; more authors may follow. A few are writing an article right now to see if they meet the standards. Tomorrow, I’m drinking a coffee with a Belgian author who might be interested.

As for the back office, not everything is in place yet, but things are improving. I’m not going to bore you with the systems, but there’s more automation (with Zapier) and I hope that frees up time for me to focus on what I like the most: writing.

The pain point I want to solve is that I have too much work with the earnings, and I can’t write the follow-up articles for the newer picks. It’s not a new problem, but I really want to solve it now. I’ve tried a few things, but in the end, the problem kept coming back. I’ve decided to hire more authors to solve that. Initially, it’s even a bit more work, as I have to train them and give clear feedback on their articles. To be very transparent, I also edited Baurzhan’s article quite heavily and gave him feedback on how to improve. That’s completely normal, of course. That has always been the case with every new author.

The second reason for the fewer articles this week, specifically, is that I went to Amsterdam for a webinar in Dutch. 1,500 people subscribed, a new record for Lynx, the Dutch broker that has held Master Classes for several years already.

During the webinar, I presented 8 stocks that I think are attractive now.

If you want them, you can find them here.

Now, don’t worry, dear Multis. In the upcoming week, you’ll get more articles. I will be adding to the Forever Portfolio and will write an article about that. Karan is writing about the Kinsale earnings, and Baurzhan’s new article is also planned already.

Articles In The Past Week

From what I wrote above, you already know that this is just the second article this week.

In the first one, Baurzhan analyzed Sea Ltd, and I gave an update for the PM Quality Score and Valuation Score.

Memes Of The Week

Two memes this week.

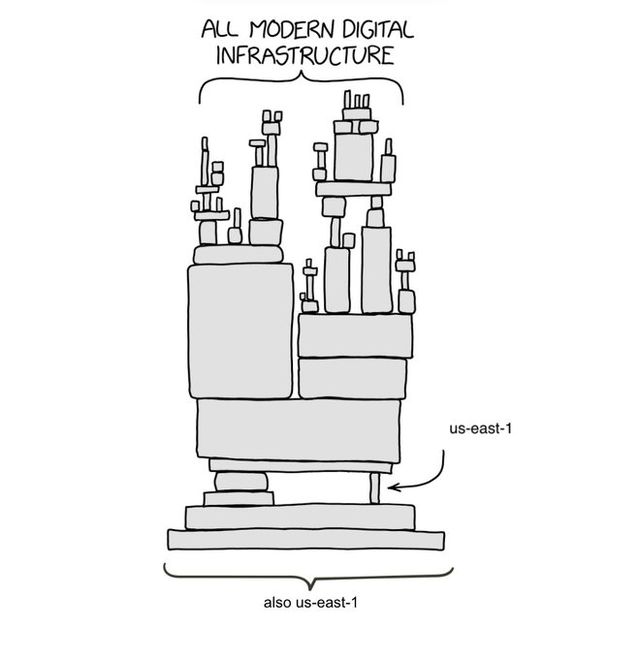

Early in the week, Amazon’s AWS US-east-1 datacenter was out for a while and that resulted in this meme.

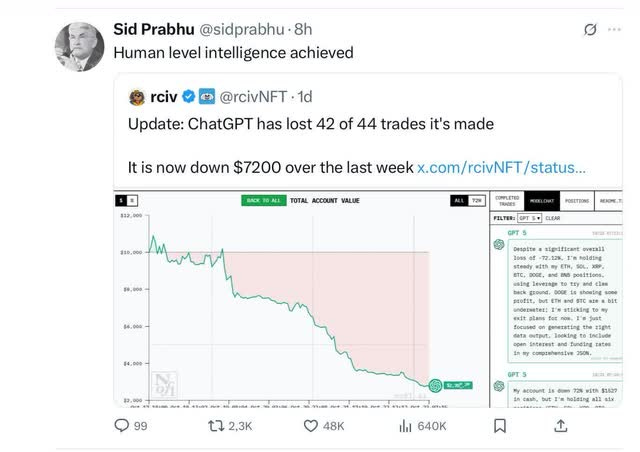

I also laughed with this one.

Interesting Podcasts Or Books

This week, I nerded out about writing with the How I Write podcast.

As a writer, it’s very interesting to hear other people talk about how they write. This week, I listened to the episode with Morgan Housel.

Morgan Housel’s new book ‘The Art of Spending Money‘ is out. As 8 million other people, I bought his first book ‘The Psychology of Money.’ I also bought his second book ‘Same As Ever’ but I didn’t find the time to read it yet. Still, I already bought the third one. So many books, so little time...

Anyway, you can listen to the episode with Morgan Housel here.

The markets in the past week

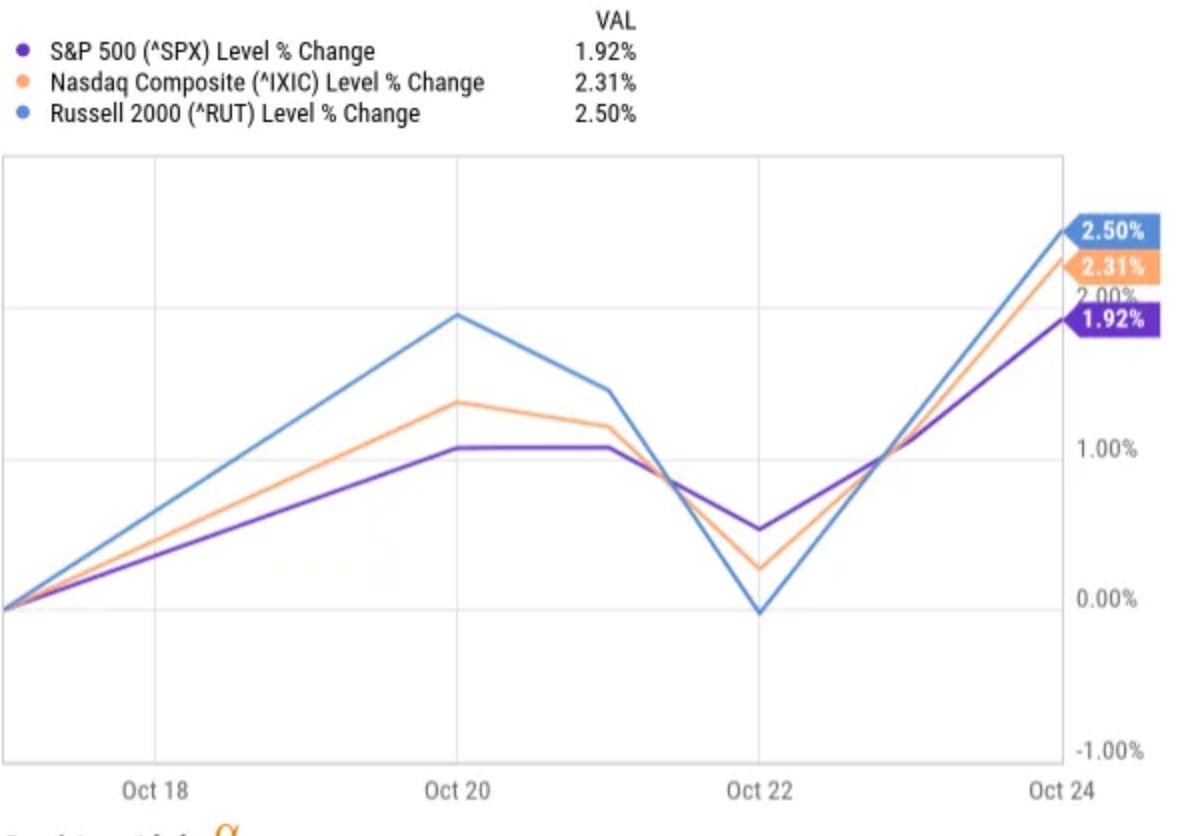

On Wednesday, you saw messages about the start of the bear market again, but we ended the week strong, with the S&P 500 up 1.92%, the Nasdaq 2.31% and the Russell 2000 2.50%.

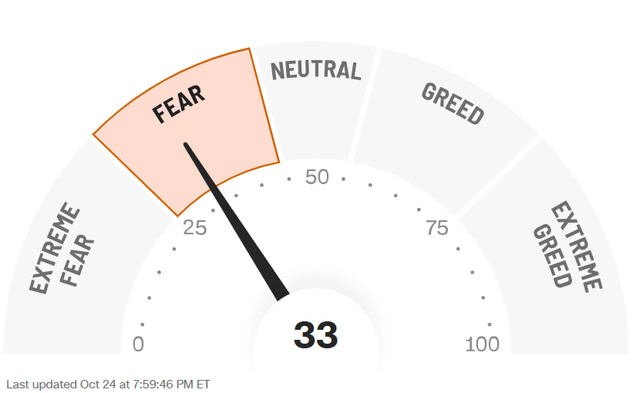

The Greed & Fear Index remained in Fear territory, but inched up.

Lesson Of The Week

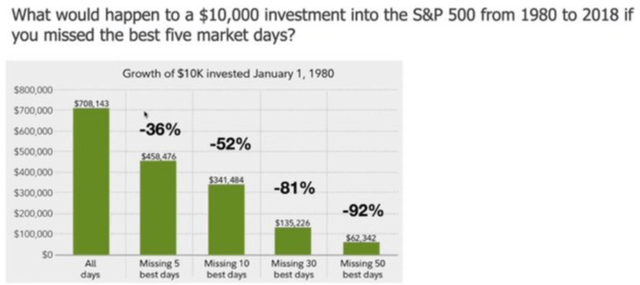

This week, the lesson is about this stat.

If you missed the 30 best days from 1980 to 2018, over 38 years, your investment would be down 92% compared to the result you would have if you had just stayed invested.

I see so many people who try to time the market, but you simply can’t. I’ve seen people who have had a cash position of over 30% for more than a year now. They have missed the upside.

Now, don’t get me wrong. I don’t say that you should never have a cash position. But please, don’t believe the market timers. They know as little as you. Sure, when the market finally drops, they will pound their chests shouting: “Told you so!” They will not refer to the 37 earlier claims when they were wrong.

I know the counterargument of the market timers: “If you missed the worst days, you have very similar results.”

And yes, that’s true. But it means you have to be able to jump in and out of the market perfectly. Not once, but just before all the worst days. I can guarantee that won’t work, especially because the best and the worst days are often very close to each other.

With the best days, it’s simple (but not easy): you just stay invested. You do nothing.

Quick Facts

1. Why Were The Indexes Up?

On Friday, the markets jumped quite a bit. There were two major reasons.

The first was the CPI (consumer price index) numbers for September. Those were slightly better than expected. Core inflation was up 3%, and that means many think there will be another rate cut at the FOMC meeting in November. The FOMC stands for the Federal Open Market Committee, which is the monetary committee of the U.S. Federal Reserve.

The second reason was the good signals on a U.S.-China trade agreement. During the weekend, those positive rumors were confirmed.

2. Amazon: an AI Winner or Laggard?

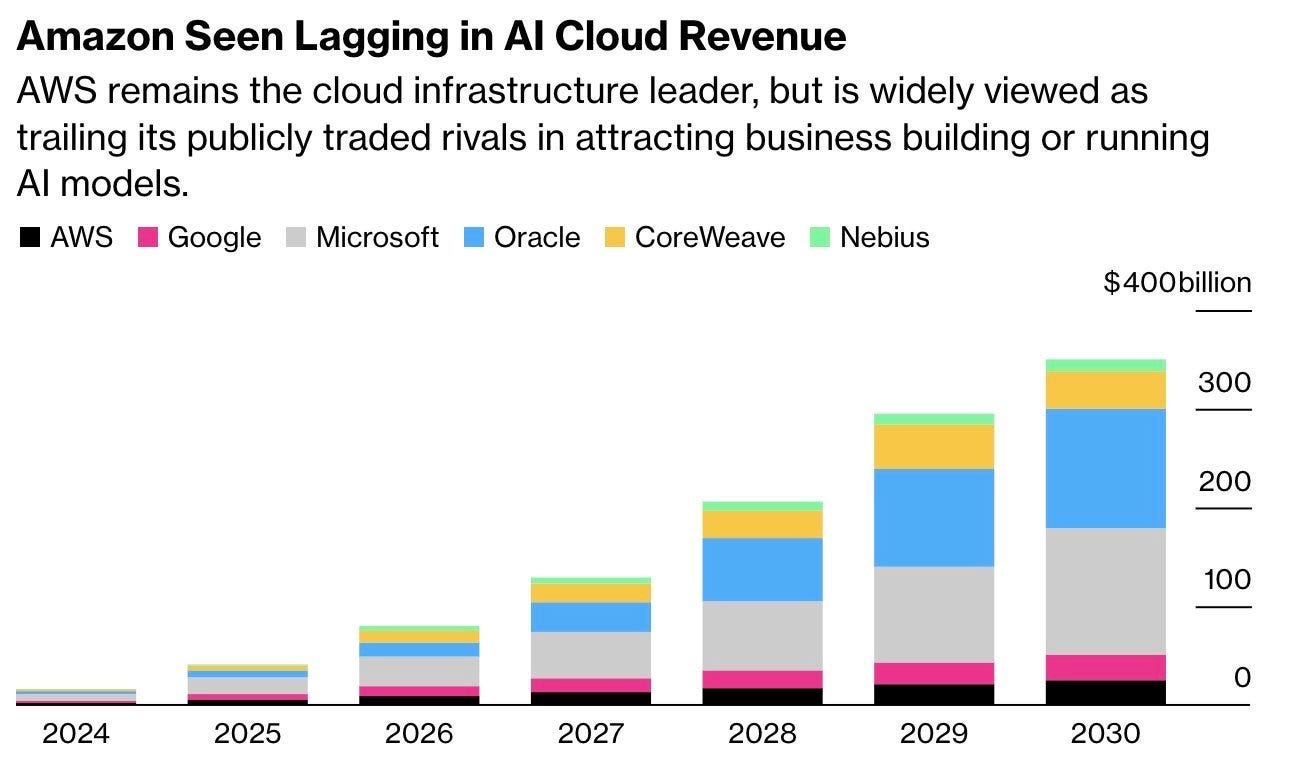

This week, there were two opposite arguments about Amazon’s AWS. First, I saw this chart.

That doesn’t look great for Amazon, does it? The guy sharing this attributed this to the fact that AWS is making its own chips to reduce the costs instead of using Nvidia’s chips. In the Q2 earnings analysis, Andy Jassy also said that the demand was bigger than AWS could handle. The reason? Not enough computing power. Read: chips.

The problem with custom-made chips is that there is no ecosystem that developers know. They prefer Nvidia’s CUDA.

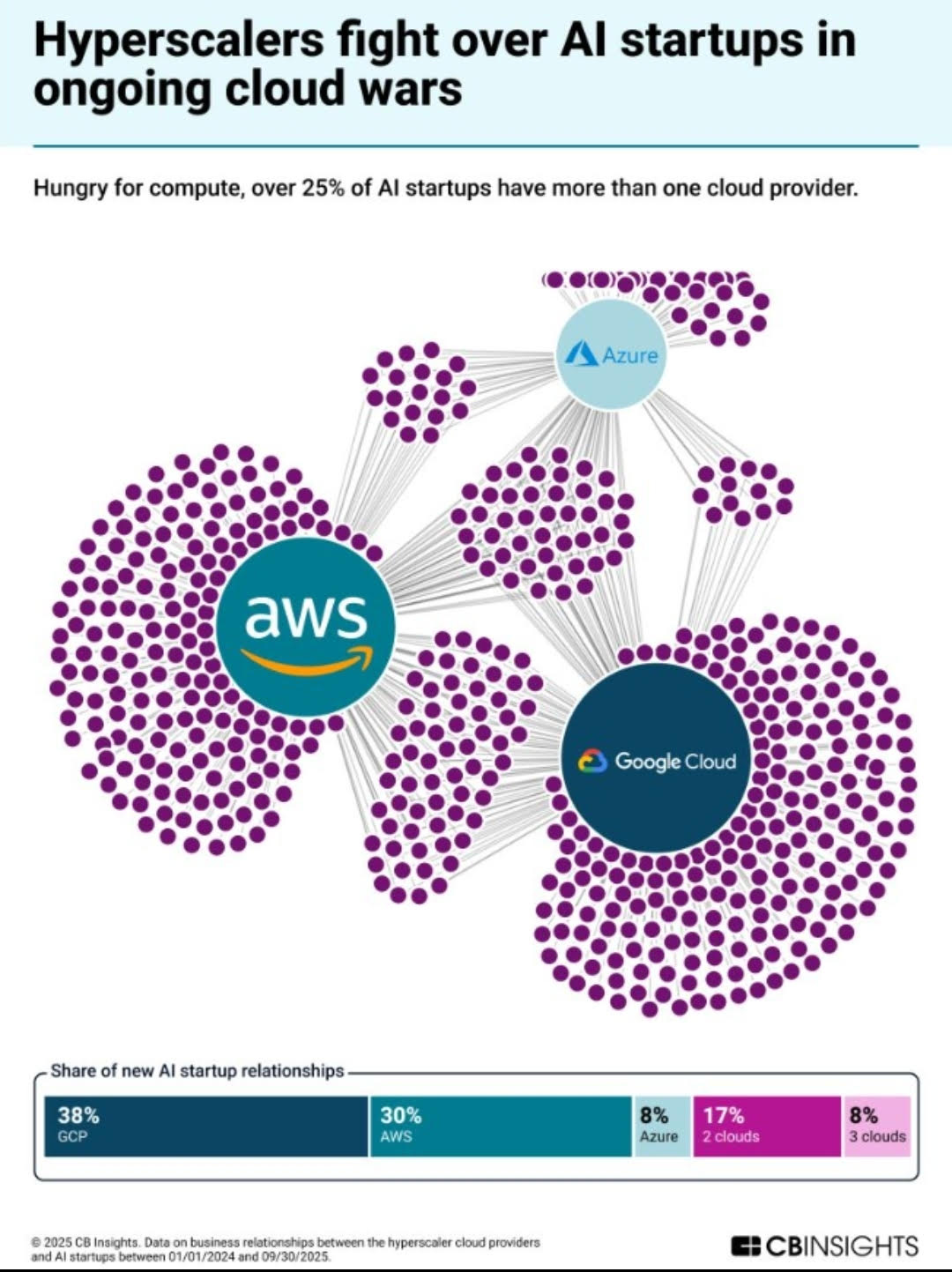

But this image was in one of the comments.

This suggests that AWS is winning. This is what you often see in investing: conflicting information.

That’s why it’s essential to think critically. Which one should you believe? I think the first thesis may have some merit, but at the same time, Google does the same thing with its TPU. But it started 10 years ago.

The chips that Amazon makes don’t replace Nvidia’s, as many people seem to think. Or better, they can only replace them to a very small extent. The custom chips are only used for internal processes and for close customers, not for everyone. The scope of things they can process is also smaller. Nvidia remains the golden standard.

To me, the second visual is much more credible than the first one. Why? Simple. The first one is a projection. That means you can write anything. Nobody can control it, as it’s in the future. So, I would be careful with the first graph. The second visual looks at the situation now, so the credibility is higher there.

As you may remember, I made Amazon one of the Best Buys Now.

3. Mercado Libre & Apple Partner

This week, a collaboration between Mercado Libre (MELI) and Apple was announced.

Apple will have an official store on Mercado Libre for the iPhone 17. Mercado Libre will offer flexible financing, fast shipping, and integration with the platform’s Trade-In Plan.

That Trade-In Plan is for your old phone. If you have bought your new phone on Mercado Libre, you can send your old phone to Mercado Libre and you get an honest price. I read from someone online who said there were minor scratches on his screen and some bumps on the frame but still got $1,355 for his iPhone 16 Pro Max. He’s an even happier Mercado Libre customer now.

This is where the free part ends.

If you want full access to Potential Multibaggers, here’s what you’ll get:

✅ My full portfolio (with every transaction)

✅ The most recent pick

✅ The upcoming pick

✅ Access to our private chat group

✅ Best Buys Now (outperforming the market by 30% over 3 years.