Hi Multis

My name is Baurzhan, and I am happy to join Kris’ team as a writer.

I have been a Potential Multibaggers subscriber since 2021, and I have achieved solid results thanks to this service.

Having read a lot of books on stocks, valuation, and economics, and having passed my CFA exams, I realized they didn’t actually provide a real investment approach to picking great long-term stocks. Potential Multibaggers really opened my eyes and my mind and gave me high conviction in the picks.

Today, I am excited to help Kris and support this great service!

This is my first write-up ever for such a wide audience, so I hope you will enjoy it as I did writing it.

On a side note, I am about to finish David Gardner’s new book called “Rule Breaker Investing” (thanks to Kris here as well), and some of the rule breakers’ rules really resonated with me.

I wanted to share some of them, which are quite relevant with regard to Sea Ltd (SE).

One of them states “Let your winners grow”, which means you shouldn’t rush to fix the profits of your winners just because they doubled or tripled. Keep them growing as money trees and add to them little by little to capitalize on their further growth.

Yes, you gain some money in your pocket, but over the longer term, you risk missing disproportionately higher upside. Even Warren Buffett left $50 billion on the table with Apple.

Another Rule Breaker rule is “Add up, don’t double down.” It says another rule, “buy low, sell high,” doesn’t work with multibaggers as they can be “overvalued” for a very a long time. These rule breakers are all about stocks like CrowdStrike, Cloudflare, Sea Ltd,...

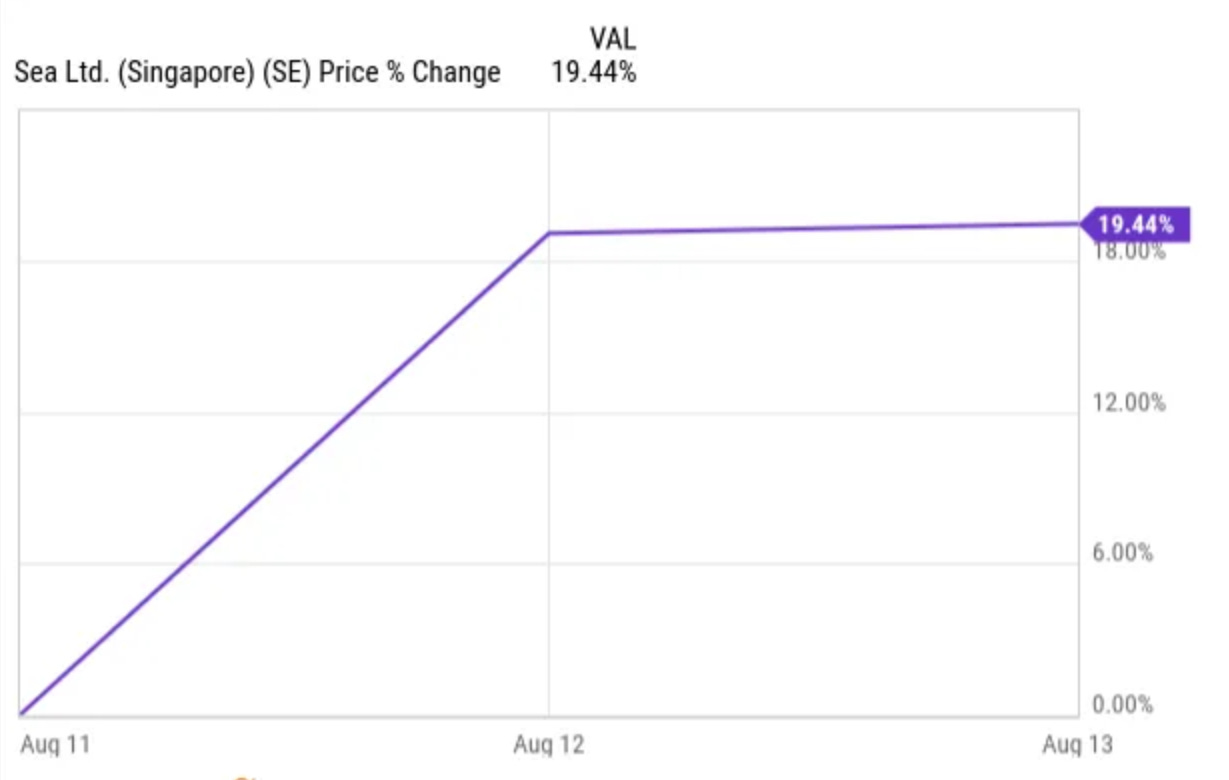

SE reported its Q2 earnings on August 11, and the stock jumped 19%.

It continued rising to $190+, then dropped to $160 levels, where I added a bit to my position and said, “Thank you.”

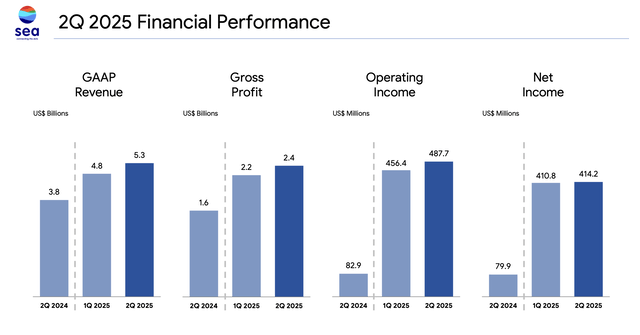

SEA crushed consensus revenue expectations by roughly $300 million, to $5.3 billion, or 6%. For revenue, that’s an impressive beat. Equally impressive: revenue growth of 38.6%.

While it missed the EPS consensus by 4 cents, delivering 65 cents on a GAAP basis, I believe this tiny miss is unimportant, given that the company is now fully focused on growth again and is firing on all cylinders.

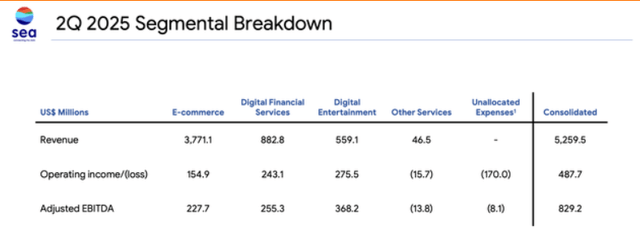

Business Segment Results in Q2 2025

I’d like to point out for you the following comment by Forrest Li, who said during the earnings call (my bold):

Given the high potential of our markets and the stage of our business now, we will continue to prioritize growth.

We still see huge opportunities in our markets to serve many more users and better many more lives with technology. Expanding both our addressable market and capturing more market share will pave the way for us to maximize our long-term profitability.

At the same time, our company has reached a stage where we can pursue growth opportunities while improving profitability. By being disciplined and cost efficient, we have turned all three businesses EBITDA positive since the second half of last year, and we are accumulating cash each quarter as we scale.

We remain committed to growing profitably, with a strong balance sheet that enables us to capture future opportunities.”

The company has delivered another staggering quarter, confirming our conviction in its long-term growth trajectory.

As David Gardner stated in his book, many non-believers were converted after these earnings results on August 12, pushing the price up 19%.

“Let your winners grow and add up”

~ David Gardner.

You bet, I am going to let this 4x bagger grow in my long-term portfolio, potentially forever, as this is a great business with a great brand, a strong founding leader, a great culture and track record, demonstrated discipline, and new waves of growth.

Key Financial Highlights

Gross profit increased 52.1% to $2.4 billion.

Net income surged 418.6% to $414.2 million from $79.9 million year-over-year.

EPS (earnings per share) was $0.68 and fully diluted EPS $0.65, below the expected $0.99 EPS.

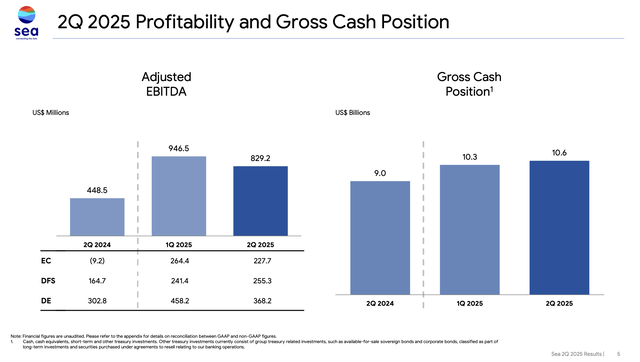

Total adjusted EBITDA was $829.2 million, an increase of 84.9% compared to the prior year. That shows strong operating leverage.

Sales and marketing expenses rose 30.3% to $1.0 billion. That might seem like a big increase, but compared to 38% revenue growth, this still shows operating leverage.

All business segments reported positive EBITDA, signaling improved operational efficiency.

Let’s first look at Shopee.

E-commerce (Shopee)

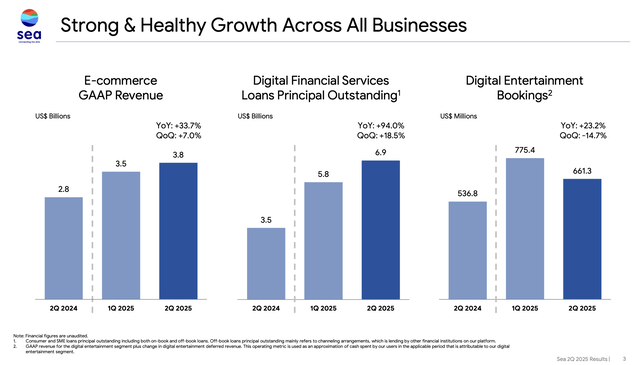

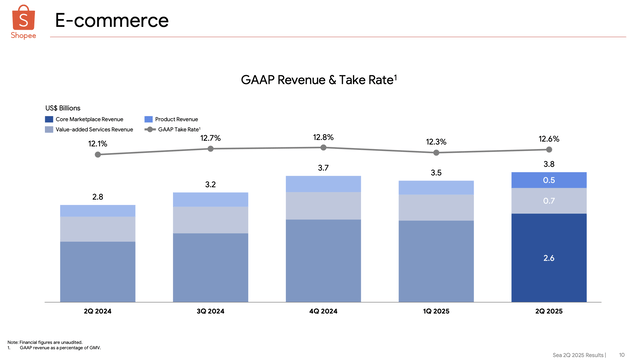

Revenue of $3.8 billion, up 33.7% year-on-year.

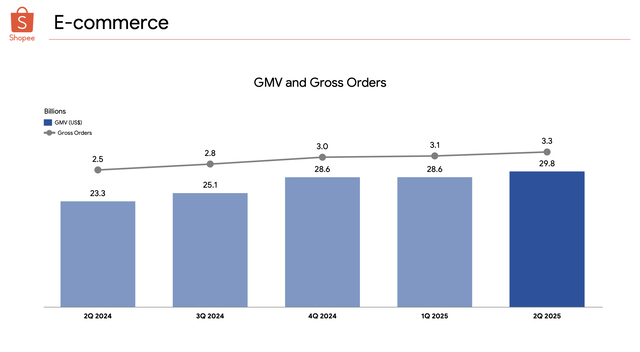

GMV (Gross Merchandise Volume) grew 28.2% to $29.8 billion.

Shopee’s growth was particularly strong in Brazil, where it is the market leader by order volume and is operating profitably.

Core marketplace revenue (from transaction fees and advertising) increased 46.2% to $2.6 billion.

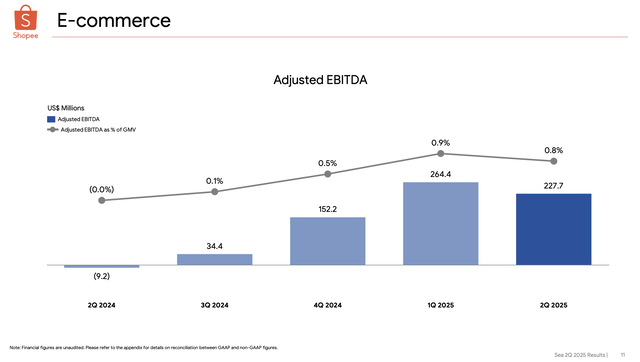

Adjusted EBITDA for e-commerce was positive at $22.7 million versus a loss of $9.2 million in Q2 2024

Shopee celebrated its 5th anniversary in Brazil. It’s crazy to see that it has had the leadership position as the top e-commerce platform by order volume in that market. Now, mostly, those are small orders. But still, it’s an impressive execution.

The company emphasized continued growth momentum in Q2, with record-high GMV and order volume. Sea Limited highlighted its confidence in balancing growth with profitability, supported by profitability improvements across all segments. Adjusted EBITDA is still positive, slightly lower than in Q1 but significantly higher on a year-on-year basis.

Shopee’s gross merchandise volume (the dollar amount of all goods sold on the platform) in Q2 2025 grew 28.2% year over year to $29.8 billion.

Brazil contributed more than 15% of Shopee’s total GMV in Q2 2025, with a strong year-on-year growth rate of approximately 45%. Shopee has become the market leader in Brazil by order volume and operates profitably there, with items sold growing by 34% year-on-year in June 2025 alone.

Southeast Asia remains a strong core market. Shopee is the largest regional e-commerce platform by orders and active users. The overall growth was driven mainly by expanding higher-value items, an increase in the number of sellers, and improved logistics services (faster delivery and lower cost per shipped item).

There were about 8 million sellers in Brazil, with 30% of active sellers selling online for the first time. Shopee’s core marketplace revenue also increased strongly, through higher take rates and advertising.

This is what CEO Forrest Li said about this in the Q2 2025 earnings call:

During the second quarter, the number of sellers using our ad products rose by around 20%, and ad-paying sellers’ average quarterly ad-spend grew by more than 40% year-on-year.

Our tech enhancements have allowed us to more effectively optimize Shopee’s GMV and advertising revenue at the same time. We saw an 8% uplift in Shopee purchase conversion rates and improved our ad take rate by almost 70 basis points this quarter, year-on-year.

After that, he reiterated the importance of its leading fulfillment efficiency:

On service quality, our logistics capabilities continue to be an important differentiator for us.

In the second quarter, we reduced logistics cost-per-order and improved delivery speeds across Asia and Brazil year-on-year, in both urban and rural areas.

We continue to roll out new initiatives to address specific customer needs, such as “instant delivery” options in dense urban areas.

This lets some buyers receive their orders within as little as four hours of order placement – our fastest shipping channel yet.

We piloted it in Indonesia, and it proved so successful that we have now rolled it out to Vietnam and Thailand as well.

And Shopee also worked on customer loyalty. The VIP membership, comparable to Amazon Prime, was a big driver here. Again, Forrest Li on the call:

We have also been doing more to enhance buyer loyalty and stickiness.

Our Shopee VIP membership program, a paid subscription service giving buyers exclusive benefits, has shown very good momentum in Indonesia.

Total GMV from VIP members there grew nearly 50% quarter-on-quarter, and VIP members bought a monthly average of around 30% more after subscribing.

VIP members have also shown a roughly 20% higher retention rate compared to non-members.

Building on this success, we have expanded the program to Thailand and Vietnam. At the end of June, total VIP subscribers in these markets reached 2 million. We plan to roll out the program to more markets over the rest of the year.

From the chart, it might seem like e-commerce revenue is stagnating a bit; however, there is always seasonality in e-commerce quarters, so you should only look year over year and never quarter over quarter.

The strong growth came despite macro headwinds like inflation in Southeast Asia and Brazil, currency fluctuations and higher interest rates. There was also strong competition in e-commerce and gaming, with competitors adjusting their pricing and promotions. He mentioned free shipping thresholds. That refers to Mercado Libre, which slashed its free shipping threshold from R$79 to R$19. That is from $14.66 to $3.53. The move was aimed at Shopee and Temu.

Despite these challenges, Forrest Li emphasized that Sea’s diversified market presence, strong brand, and investment in technology and logistics provide resilience. That means the macro headwinds won’t stop Sea from continuing to grow.

I think this also underlines the strong quarter for Shopee, given those macro headwinds.

Digital Financial Services (Monee)

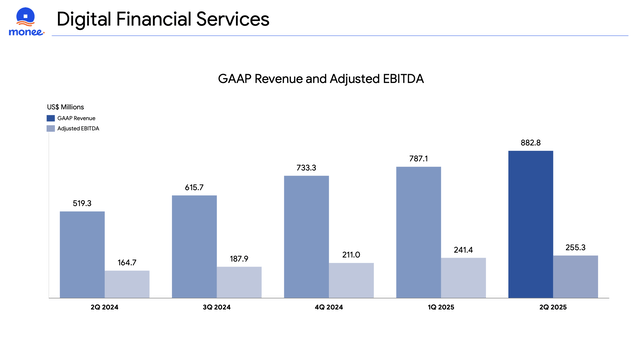

GAAP revenue reached $882.8 million, a 70% increase year-over-year.

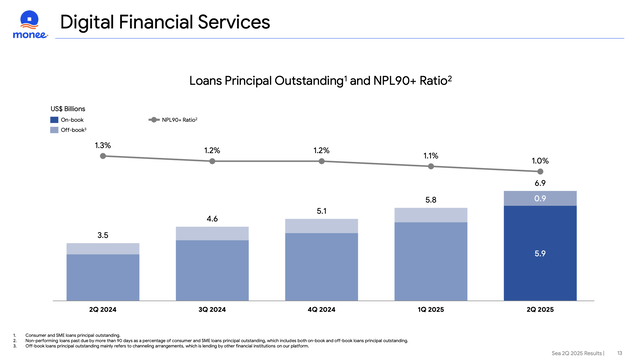

Consumer and SME loans outstanding grew 94% to $6.9 billion.

The credit business expansion was the primary driver of growth.

Monee key highlights in Q2 2025

Sea Limited’s digital financial services segment, known as Monee, experienced significant loan growth in Q2 2025, with consumer and SME loans principal outstanding reaching $6.9 billion, marking a 94% year-over-year increase. The non-performing loans (’NPL’) ratio past due by more than 90 days remained stable at 1.0%, reflecting good credit quality and risk management.

The growth in loans was supported by rapid customer acquisition, with active users growing steadily. Monee also expanded across multiple markets. Malaysia’s loan book has surpassed $1 billion, joining Indonesia and Thailand as markets with significant loan portfolios. The adoption of credit products like SPayLater and personal cash loans drove Monee Brazil’s strong growth.

Monee’s growth strategy leverages three core advantages:

Integration with Shopee’s ecosystem.

Large and growing user base building credit history.

Use of AI-enhanced credit models to improve underwriting and risk management.

This is the recipe for such magical loan portfolio growth and at the same time a decrease in non-performing loans.

In Q2 2025, the digital financial services segment generated GAAP revenue of $882.8 million (a 70% increase year-over-year) and adjusted EBITDA of $255.3 million (up 55%). The segment continues to expand its credit product offerings, including on-Shopee SPayLater, off-Shopee SPayLater, and cash loans, with strong profitability and loan book growth. Monee became a key driver of the company’s quarterly growth.

Forrest Li commented on its performance in Q2 2025:

“In the second quarter, our loan book grew over 90% year-on-year to reach 6.9 billion dollars, driven by both our expanding user base and our wider range of products addressing more user needs.

We added over 4 million first-time borrowers during the quarter, and our newer cohorts are scaling well with positive unit economics.

At the end of the quarter, active users for our consumer and SME loan products exceeded 30 million for the first time, representing more than 45% year-on-year growth.

This management is doing all the right things you want it to do: leveraging the AI wave and synergies between the platforms.

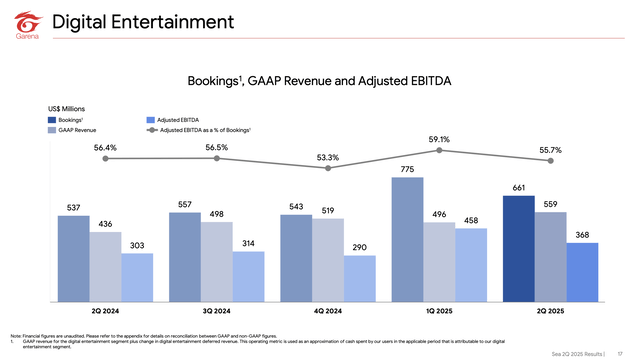

Digital Entertainment (Garena)

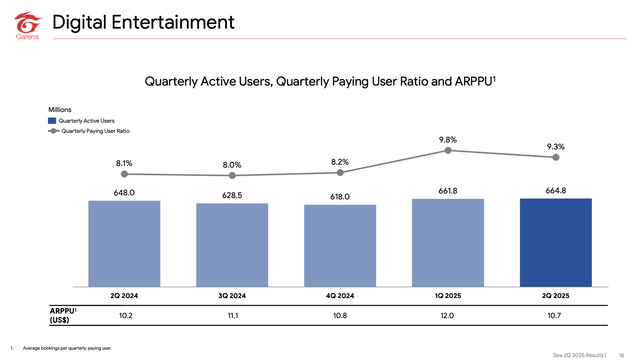

GAAP revenue rose 28.4% to $559.1 million.

Bookings increased 23.2% to $661.3 million.

Growth supported by user base expansion and increased paying user ratio.

Digital entertainment key highlights in Q2 2025

Once the weakest link, Garena rebounded this year. It delivered another solid quarter with slight year-on-year revenue growth. Quarterly Active Users increased compared to the previous quarter and also higher on a year-on-year basis. ARPU demonstrated similar performance, lower QoQ but higher YoY, which is what you should really look at, as in gaming as well, there is seasonality.

GAAP revenue rose 28.4% to $559.1 million. Bookings increased 23.2% to $661.3 million. The growth was supported by user base expansion and an increased ratio of paying users.

Forrest Li was quite optimistic about Garena’s performance, as it rose from the ashes like a phoenix:

After a flying start to the year, Garena continued its strong growth momentum into the second quarter. Bookings were up 23% and adjusted EBITDA was up 22%, year-on-year. Multiple key titles delivered double- digit growth in the second quarter, including Free Fire, Arena of Valor, EA Sports FC Online, and Call of Duty: Mobile.

Free Fire continues to be at the core of Garena’s strong performance, sustaining its massive global user base of more than 100 million average daily active users.

Free Fire remains the basis for Garena. Even after 8 years, it continues to grow. And FreeFire continues to innovate, with new maps, new camera modes and content collaborations like with Netflix’s Squid Game and the anime series NARUTO SHIPPUDEN Chapter 2.

It’s great to hear how management maximizes the value of this all-time hit. Personally, though, I am more tied to Call of Duty Mobile, which is much more widely adopted among my friends. Creativity and localization make a perfect formula for international expansion. I am personally a huge fan of Naruto and also liked Squid Game, so I think those initiatives are great and it should appeal to a vast fan base.

Hopefully, we will also see some new games released in the coming years. The CEO maintained these hopes for us:

In summary, Garena has delivered a very strong performance in the first half of this year. We believe Free Fire has established itself as an evergreen franchise, both sustaining its user engagement and growing its appeal in more markets globally.

We are also committed to trying out new genres and new markets, and testing the boundaries of future game experiences by embracing AI. Given all of this, we are raising our full-year guidance for Garena, and expect bookings to grow more than 30% in 2025, year-on-year.

In short, Sea demonstrated outstanding performance and proved to be a high-quality investment, especially if you’re looking for exposure to technology in Asia and around the world.

Next, Kris will update his PM Quality Score and valuation to assess if SEA is a buy right now. My guess? I think it is.

This is where the free part ends.

If you want full access to Potential Multibaggers, here’s what you’ll get:

✅ The rest of this article (with the Stocks On My Radar)

✅ All the picks, with two very recent ones.

✅ My full portfolio (with every transaction)

✅ The most recent pick

✅ An archive with insightful articles

✅ Access to our private chat group

✅ Best Buys Now (outperforming the market by 30% over 3 years.)

✅ 7-day money-back guarantee, no questions asked.