5 Stocks Screaming OPPORTUNITY!

The Best Buys Now (beating the S&P 500 by 30% per pick since 2022)

Hi Multis

It’s the 15th of the month, and if you have been here for a while, you know what that means: The Best Buys Now.

If you are new, don’t make the mistake of thinking that I select these stocks to hold them for a little while and sell them again. All of these are meant to hold for the long term.

No buy low, sell high but buy low and hold for a very long time. Ideally, until it’s a multibagger multiple times over.

And the system works. The Best Buys Now were started in May 2022. In the first years, the picks have outperformed the Nasdaq by 14.61% and the S&P 500 by a whopping 30.1% per pick.

I can’t guarantee that I can keep up that pace. Of course not. And also don’t forget that many of these initially didn’t do much. That’s exactly the pattern, actually. It took a while before the sentiment caught up with the fundamentals. In the stock market, being right can feel wrong for a surprisingly long time.

Having said that, let’s go to the Best Buys Now for October. This time, I ordered them by market cap, from big to smaller.

1. Amazon

Price: $215.57

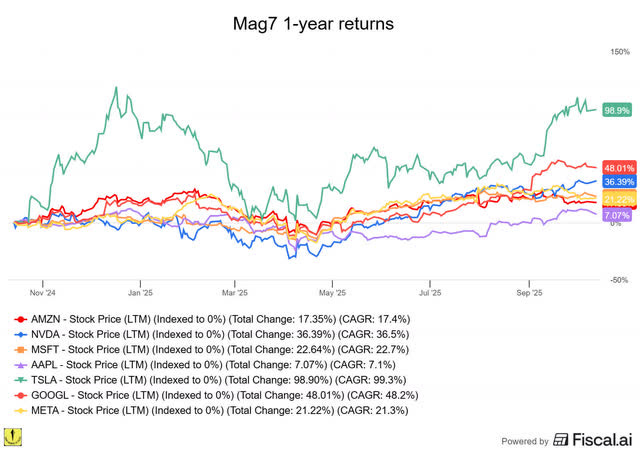

This may be a surprise to some, but I’m very bullish on Amazon (AMZN). Apart from Apple, it’s the worst-performing Mag7 stock over the last year.

But I think investors underestimate Amazon now like they underestimated Google for a long time.

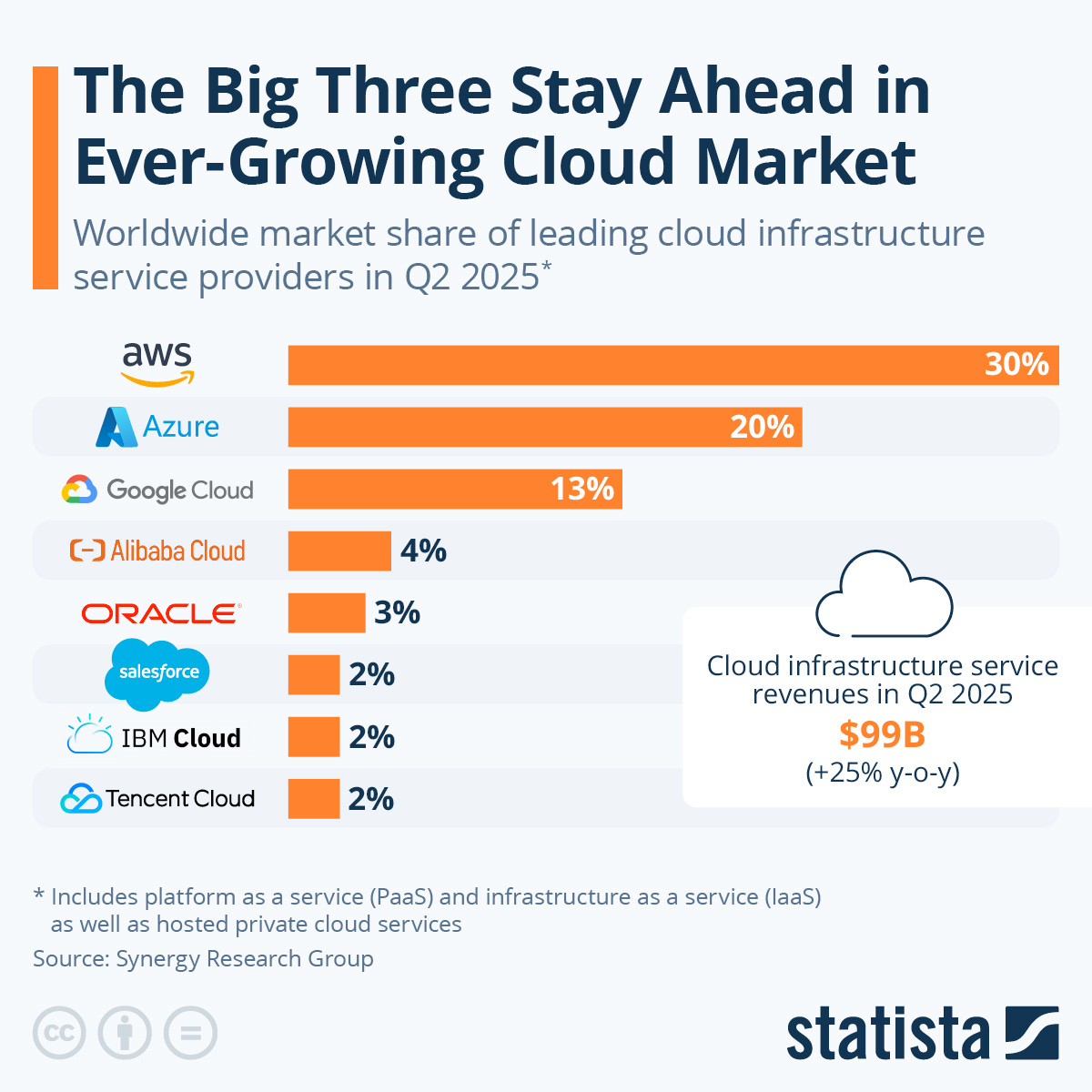

Don’t forget that Amazon still has the biggest cloud with AWS, which has a market share of about 30%, far before Microsoft’s Azure, at about 20% and Google Cloud at about 13%. The rest’s not even on the picture. I know what you will say: Azure and Google Cloud are growing faster. But Amazon was very clear in its conference call: the company had more demand than supply. In other words, more customers would have used more AWS, but compute and energy shortage made it impossible to fulfill this demand.

AWS generates $116 billion in revenue, which is just 17% of Amazon’s $670 billion total, yet it contributes 56% of the operating income: $42.8 billion of $76.2 billion. And you should expect 20%+ growth for years to come.

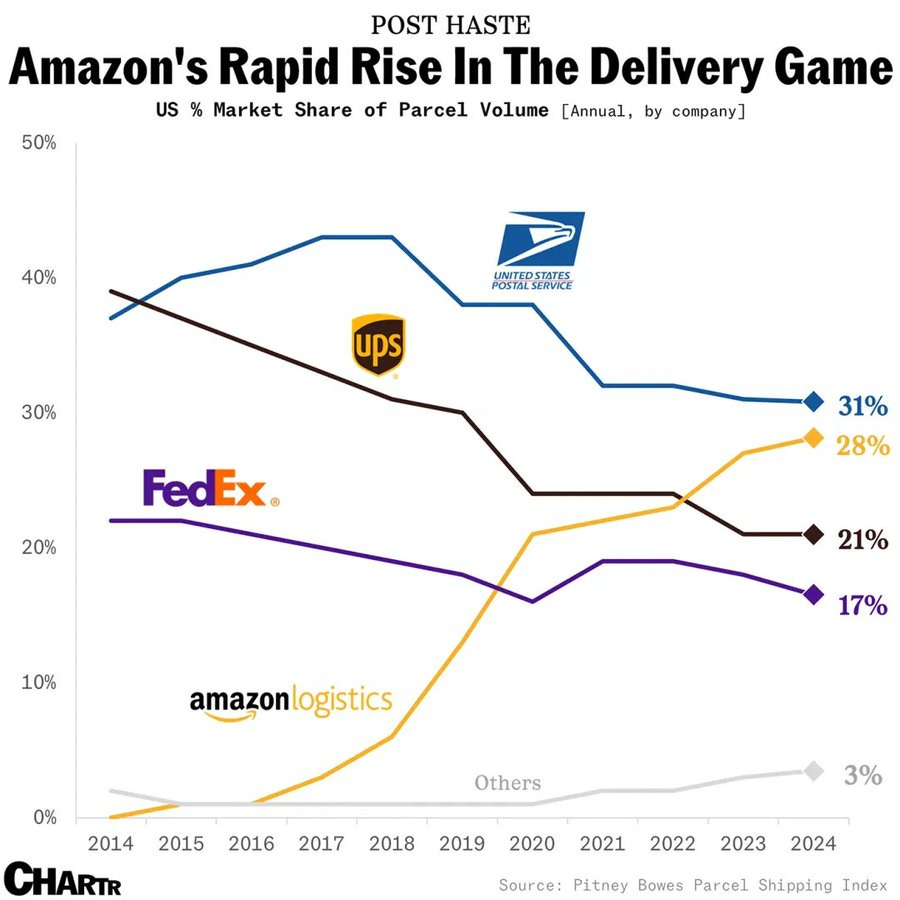

But Amazon has more than just AWS to make investors happy. Think of its logistics, which give it an insurmountable competitive advantage. Amazon now has 28% of the US market share and it will soon be the biggest.

This is very impressive. It’s a physical moat and those are very strong. It gives Amazon a cost advantage and much bigger speed, both of which are crucial in e-commerce.

There’s also advertising. It is now the third-largest advertising platform, after only Google and Meta. And just like AWS, this is high-margin revenue. With its huge collection of data, with 300 million Prime subscribers, of which Amazon can see all they buy, search for, watch, and put on their watchlist, Amazon can target ads very effectively.

Those 300 million Prime subscribers also provide predictable revenue with very low churn.

Something that’s also not appreciated enough about Amazon, in my opinion, is its huge expertise in robotics. The company has deployed more than 1 million robots in its fulfillment centers. That makes it the world’s largest manufacturer and operator of mobile robotics. It could be several years out, but I think AI-driven robots (think of Tesla’s Optimus) will be the next big breakthrough. With all of Amazon’s expertise, I would be surprised if the company doesn’t lead the way there too.

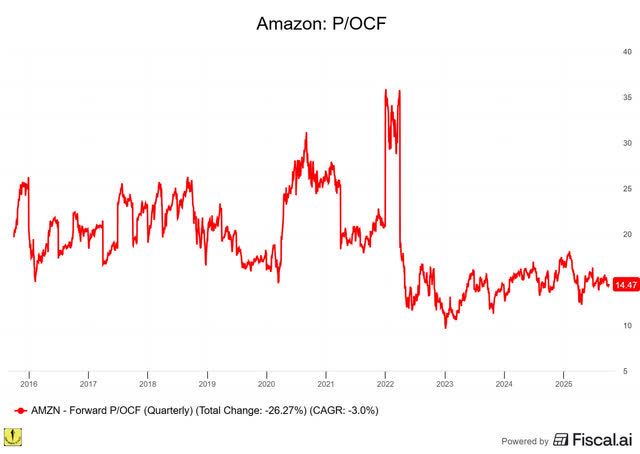

And yet, Amazon trades near the lows of its historic valuation. This is the forward P/OCF (price/operational cash flow, which has historically been a good way to value retailers, including Amazon).

I like Amazon at this price and tomorrow, I’ll add to my position. Right now, I think Amazon is the most compelling Mag7 stock.

2. Mercado Libre

Price: $2048.32

I’ll warn you. In a few months, you might regret this.

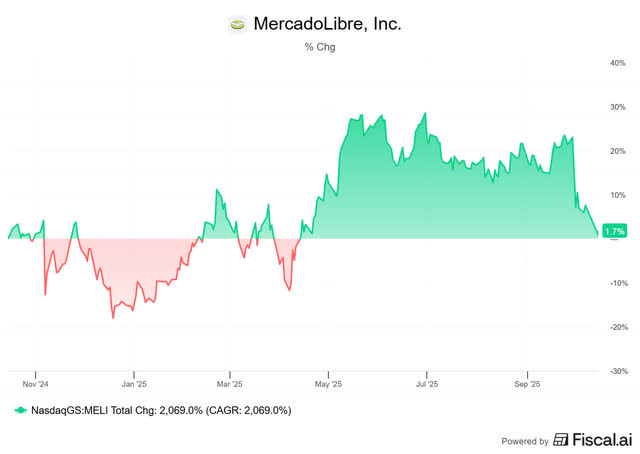

I’ve seen the pattern so often. A stock trades sideways for a long time and even generally patient investors lose their patience. It goes up a bit and then drops again, often on no news. The stock’s essentially flat from a year ago.

In the same period, the S&P 500 is up 13.8% and the Nasdaq even 22.5%. That’s the stuff investors get really nervous about.

But it’s also the stuff that makes the Best Buys Now outperform the S&P 500 by 30% per pick on average.

Often, my Best Buys Now picks underperform in the first few months... Until they don’t. Suddenly, they explode and don’t look back.

That’s when investors lament that they didn’t buy, didn’t buy more or even sold. I think that could be the case here too. That’s why wanted to start with this warning. I’ve seen the pattern so often in the past. The formula is simple.

A GREAT COMPANY + WEAK PRICE ACTION = OPPORTUNITY

Mercado Libre (MELI) has been a phenomenal company for a very long time.

Maybe investors are a bit more pessimistic about the Q3 numbers that will be released in two weeks (on October 29). After all, Mercado Libre cut its free delivery threshold from R$79 to R$19 (about $3.5) and that will definitely eat into the company’s margins. On top of that, Amazon is aggressive in Brazil, waiving merchant fees for three months, including the crucial holiday period.

But Amazon has been trying to break Mercado Libre’s market leadership for 12 years already, and it hasn’t succeeded. Why do you think it would succeed now? I’ve been saying this for years already, but the Brazilian e-commerce market will be dominated by three players: Mercado Libre, Amazon and Sea’s Shopee. All the rest will be small or even disappear.

And, dear reader, Mercado Libre is cheap right now.

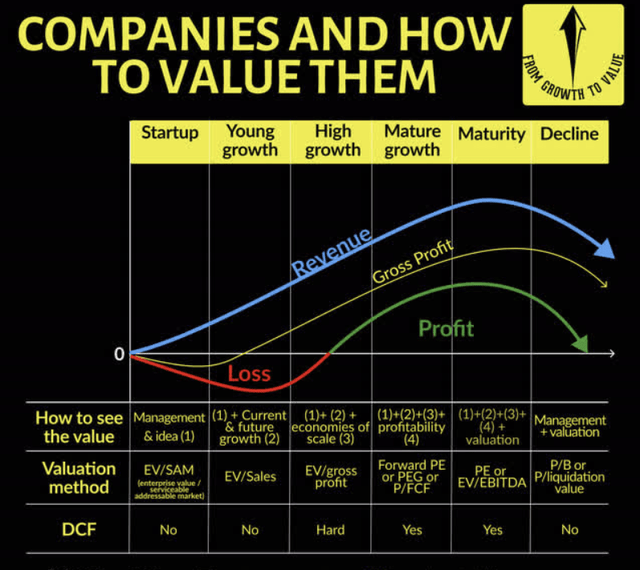

This is how I value stocks, depending on the stage they are in.

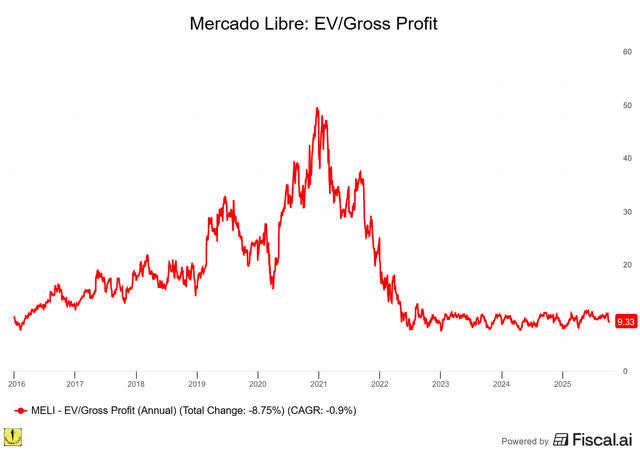

With a company that grew its revenue by 34% in the previous quarter and expected to have 35%+ revenue growth in the next two, it’s not a stretch to argue that Mercado Libre is still in high-growth mode. So, let’s first look at EV/gross profit. This is the chart.

(PS: if you want to make similar insightful charts, you can do that with this 15% Fiscal discount)

As you can see, the EV/Gross profit is just 9.33. That’s cheap. You could argue that it has been cheap since the big tech drop in 2022. Remember that the Nasdaq was down 36% then. I could only say that’s correct.

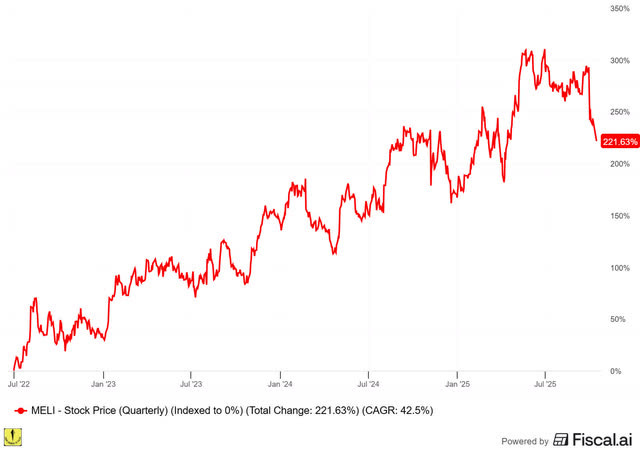

Your conclusion may be that this is a sucker stock. But look at what the stock has done since 2022, when it first got this valuation.

So, sear this into your brain: this stock is up 222%, but the valuation has more or less stayed the same as when the whole market, and especially the Nasdaq, where Mercado Libre trades, was in a bear market. To me, this screams opportunity. I’m happy to make MELI my biggest position at this valuation.

If you are a free reader, this is where the content stops for you.

Want the full analysis of the Best Buys Now?

Join the Multis community and unlock the full article.

FYI: the average Best Buys Now pick performs 30.1% better than the S&P 500 (from May 2022 to May 2025). So, an investment in Potentials Multibaggers could pay off.