Hi Multis

What a week! The new Potential Multibaggers pick was chosen, I introduced myself (again) for you, earnings reviews...

And the great thing? That will continue in the upcoming week! Tomorrow, you will already get my Best Buys Now, which outperform the market by almost 30% per pick on average in the first three years after the launch.

Articles In The Past Week

This is the fifth article this week.

The first one was about me. I introduced myself and gave more background.

In the second article, I introduced the new Potential Multibaggers pick.

We analyzed the Mercado Libre earnings and looked if the stock was a buy now in the third article this week.

Yesterday, we looked at Duolingo's earnings, the quality and valuation.

Memes Of The Week

No memes this week.

Interesting Podcasts Or Books

David Gardner talked about his book this week in Chit Chat Stocks. I really liked the episode. You can listen to it here (or on your favorite podcast player).

If you don't have enough David Gardner already, you can also listen to his interview in the Investing For Beginners Podcast.

If you want an analysis of David Gardner's investment style, you can listen to this episode of Chit Chat Stocks.

The markets in the past week

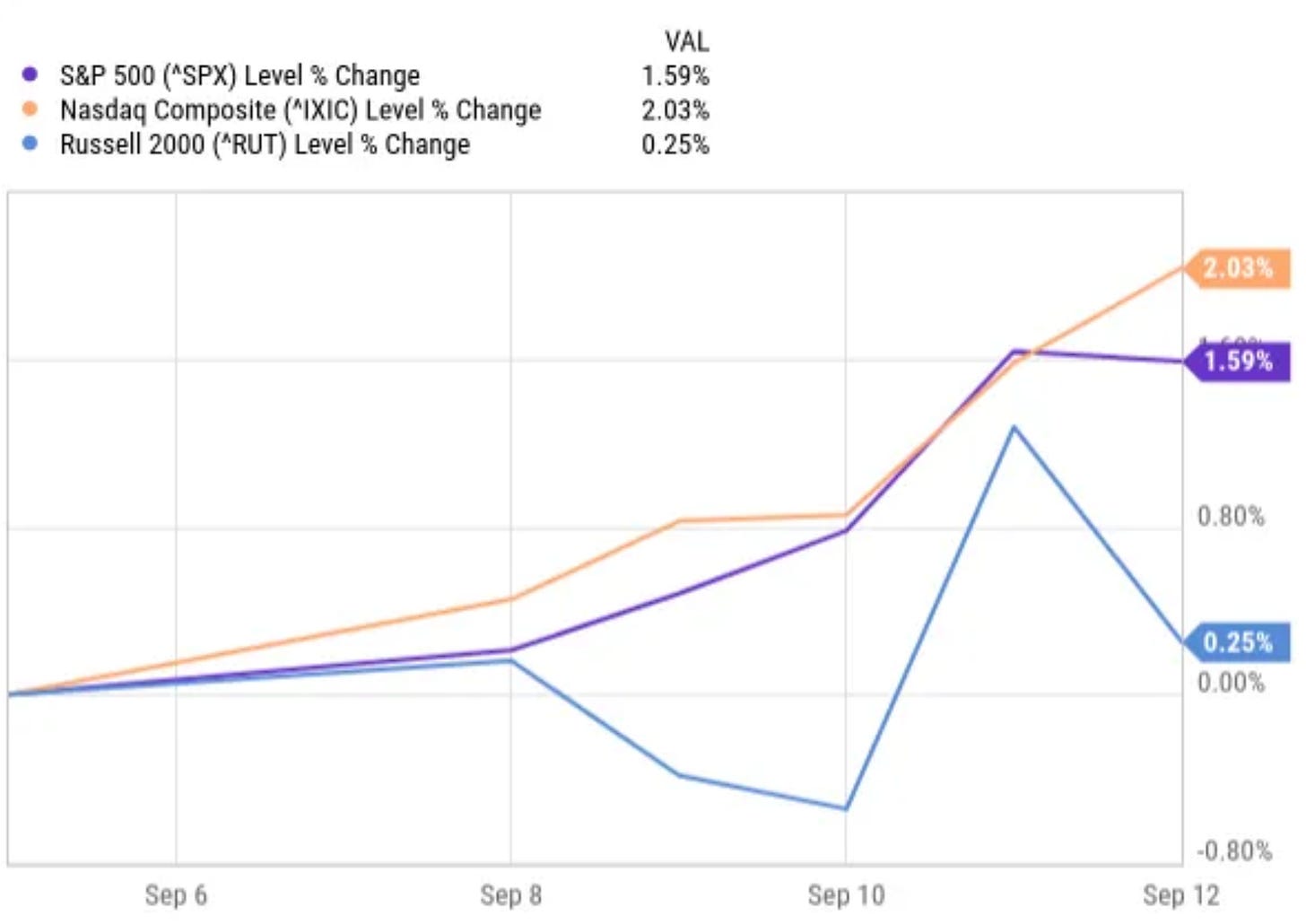

The markets keep going up. While the Russell 2000 was up just 0.25%, the S&P 500 was up 1.59% and the Nasdaq 2.03%.

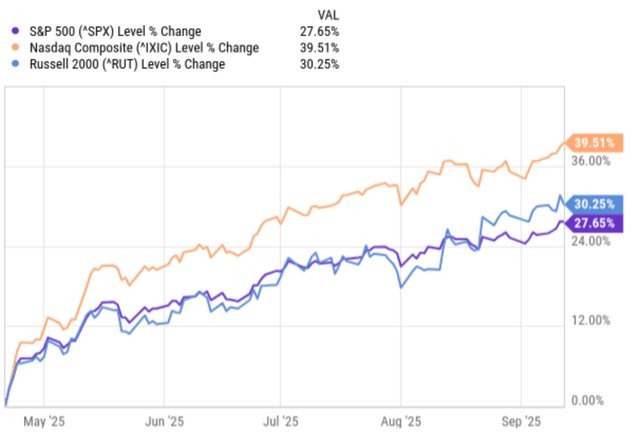

I think it would be good if the market took a breather. The rip since the April lows has been blistering. The S&P is up 27.65%, the Russell 2000 30.25% and the Nasdaq even 39.51%.

It would be healthy for the market to let out some steam at this point. This is not a prediction, because nobody knows what the markets will do. I just say that it wouldn't be bad.

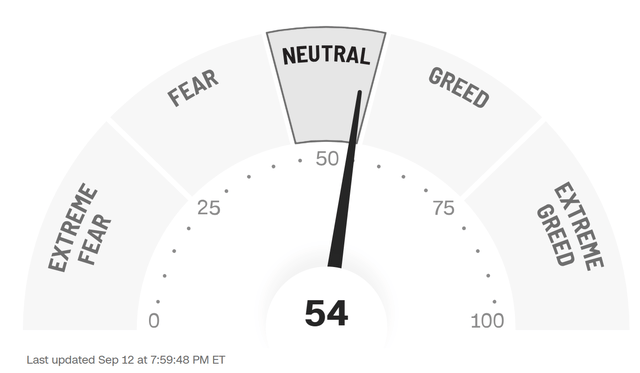

Although the market is up considerably, the Greed & Fear Index remains in Neutral, for the second week in a row.

Lesson Of The Week

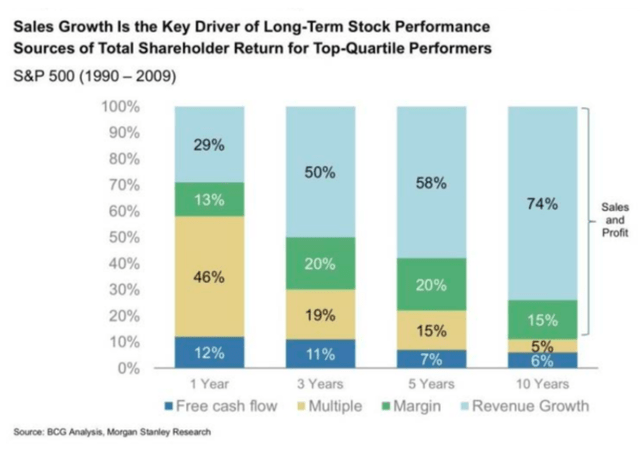

This week, the lesson is a graph.

I've been sharing it for years. It shows that over the short term, valuation is very important. If you look at the returns over a year, 46% of the stock return is determined by the multiple you pay. But that becomes less and less important over time. After 10 years, valuation only accounts to 5% of the returns.

The most important for the long term? Revenue growth.

Quick Facts

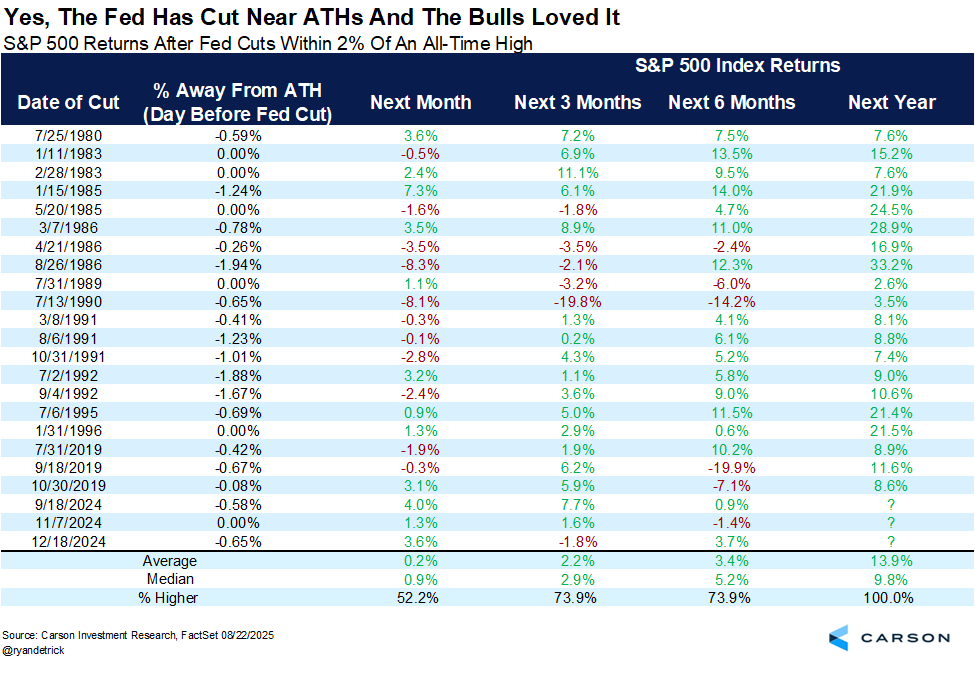

1. What If The Fed Cuts?

The headlines for the upcoming week are all about the potential Fed interest rate cut scheduled for Wednesday. The expectations are that the Fed will cut by 0.25%.

The debate is whether that is good or bad for the stock market. For one commenter, lower rates are always good; another commenter will tell you that the rate cuts show you that the economy is weak and that a rate cut with the market near its all-time highs is dangerous. So, what is it?

This chart shows that the market generally loves rate cuts, even if they are near all-time highs.

Of course, there's no guarantee in investing, but the data are pretty convincing.

2. 10 Lessons from Jeff Bezos

This week, I went through the Jeff Bezos shareholder letters again. I compiled these ten lessons from the founder of Amazon.

If you want to read all of the shareholder letters (from 1997 to 2022), I have collected them all here. They are a business masterclass.

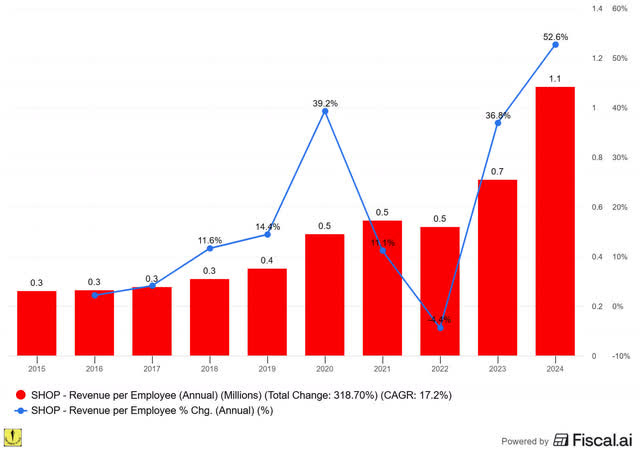

3. My Partnership with Fiscal ai (Shopify example)

Why I'm so enthusiastic about Fiscal ai?

The cost of a Bloomberg Terminal? $24,000/year

Fiscal ai? 95% of the functions of a Bloomberg terminal. With my link, these are the prices:

I use Fiscal ai ( formerly known as Finchat) multiple times every single day. It's where we create financial charts, read, listen to conference calls, and read all the conference call transcripts. I look at presentations of shareholder meetings, conferences, analyst expectations for free cash flow, revenue, free cash flow, EPS and much more. It has Morningstar's, high-quality reports on more than 1700 companies.

It really is a complete research platform for investors. If you use this link, you will automatically get a 15% discount.

An example? This Shopify chart. It shows revenue per employee. Do you see the big jump in 2023 and especially 2024, when Shopify implemented its 'AI first' policy, meaning that you first have to try to solve the problem with AI before hiring someone.

This is the kind of insight you can get with Fiscal.

My partnership with Fiscal allows me to give you a 15% discount with this link.

4. The Forward Rule Of 40

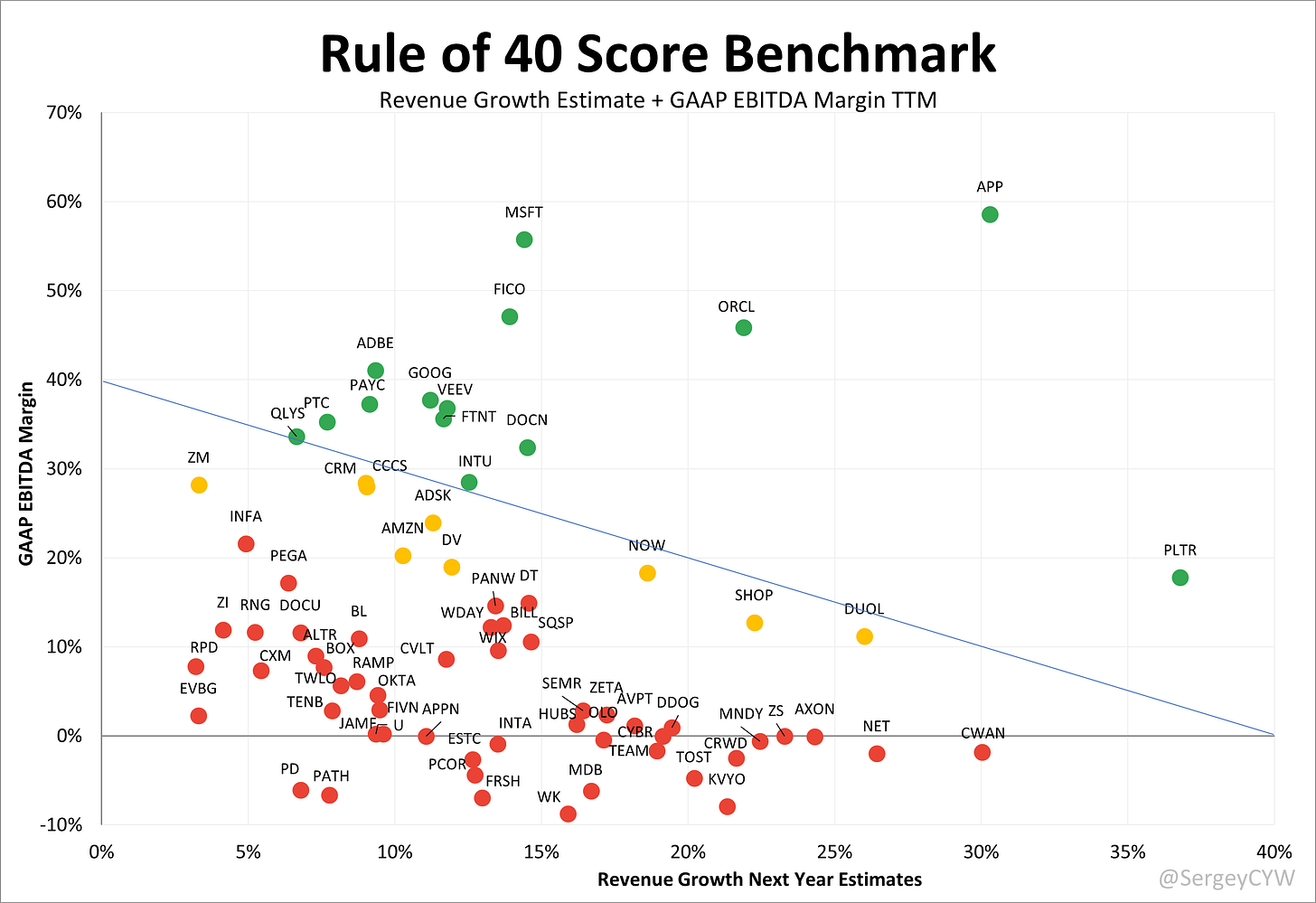

SergeyCYW posted a very interesting chart that I wanted to share with you. For years, I've used the Rule of 40 to assess companies. It's not a valuation metric as such, but one that covers the quality of a company's earnings. It adds the percentage of revenue growth to the FCF margin. If the number is above 40, you have quality growth.

Sergey took a variation of this by looking at the revenue growth estimate + the GAAP EBITDA margins. I think that's an interesting take. Now, to be sure, EBITDA is not a GAAP term. But if you see it used like this, it’s usually a shorthand for “EBITDA calculated directly from GAAP income,” not adjusted for extra items. In other words, stock-based compensation is not excluded from this (meaning it impacts the numbers). Personally, I wouldn't use this, but I still think Sergey put in some very interesting work.

So, to read this well, you should add up the number on the left-hand side and the one on the bottom. That means that Palantir (most right) has a Rule of 40 score of about 37 + 18 = 55, outstanding. Applovin has 60 + 30, which is 90, an extremely high score.

Focusing on "GAAP EBITDA" makes it harder to be above the line (which is 40) and it favors more mature companies with lower growth and higher EBITDA. Younger companies still have a lot of stock-based compensation and are not focused so much yet on profitability as more mature companies.

5. Two Interesting Mercado Libre Charts

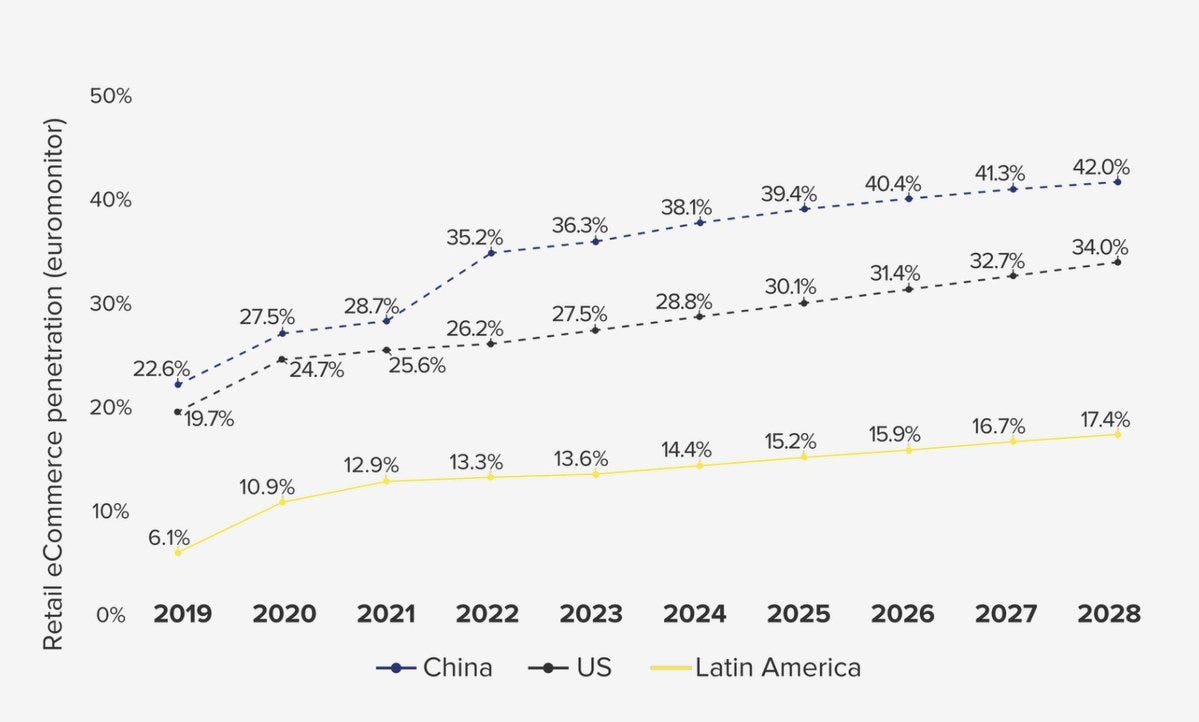

And there were two more interesting charts I found on X. This one's from Wolf of Hardcourt Street.

So, with just 15% penetration in Latin America, Mercado Libre still has a long runway ahead of it.

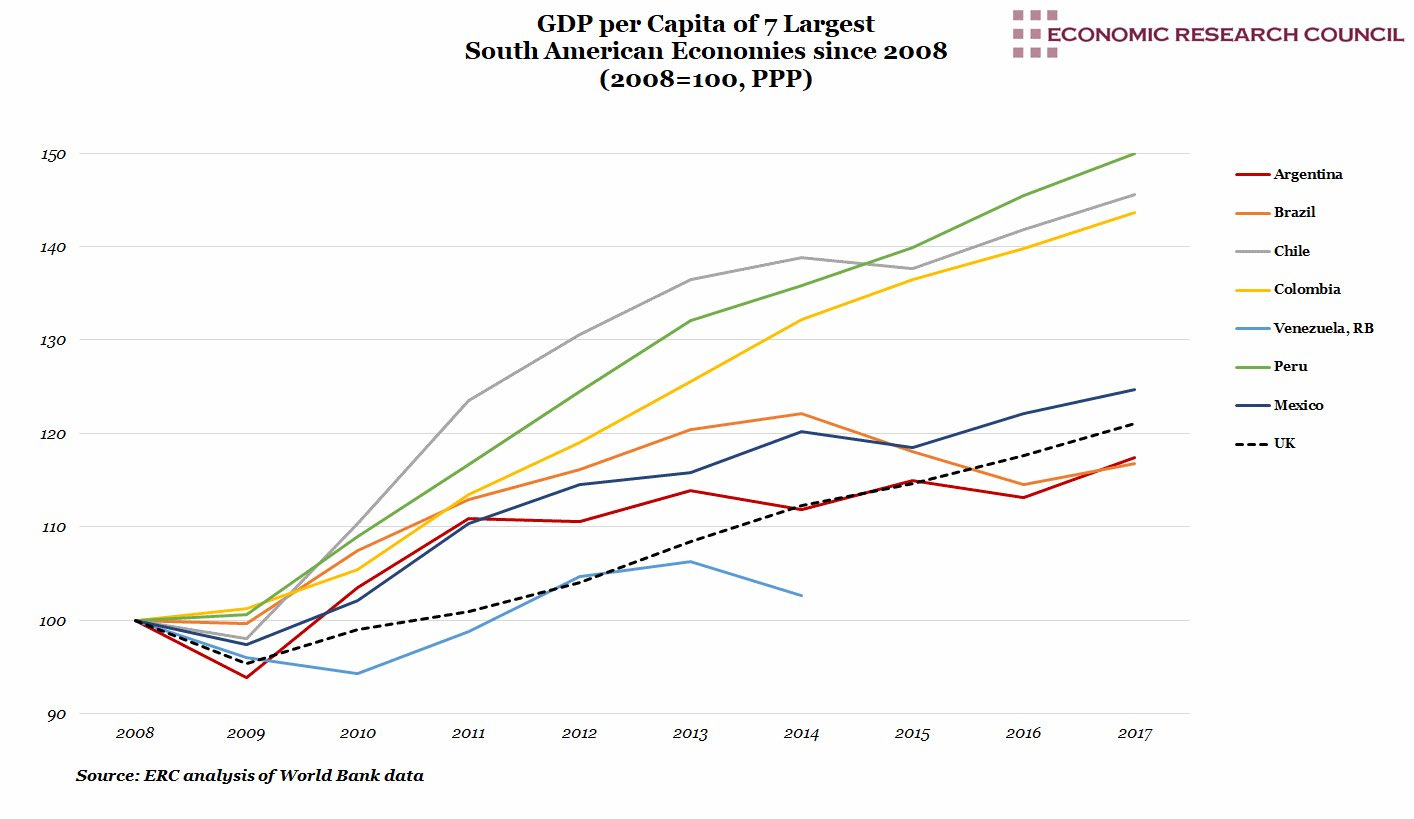

At the same time, GDP per capita is also growing fast in Latin America.

I know this is a somewhat older chart, but I have no reason to believe it has changed in the meantime.

Want more?

Tomorrow, I’ll drop my Best Buys Now, 5 stocks. Since I launched them, they have outperformed the S&P by almost 30% per pick over three years.

Subscribers also get full access to my real portfolio, deep dives on Potential Multibaggers, and our private investor community, where you ask all your questions about investing.

Upgrade now and don’t miss it.