Mercado Libre: Time To Buy?

Why Mercado Libre’s EPS Miss Might Be the Best Thing for Long-Term Investors

Hi Multis

Mercado Libre (MELI) released its Q2 2025 numbers about a month ago. While the market reacted to a single number, long-term investors should be paying attention to something entirely different.

Mercado Libre just made a series of bold moves that could define the next decade of growth in Latin America. From aggressive reinvestment in logistics and user acquisition, this quarter tells a much bigger story.

Let’s unpack what’s really going on behind the numbers.

The Numbers

Revenue: $6.79B (+33.9% YoY), beating estimates by $130M

EPS: $10.31, missing estimates by $1.58 (-13.2%)

Operating margin: 12.2% (-2.2pp YoY)

Free cash flow margin: 38.7% (+5.3pp YoY)

Gross margin: 45.6% (-1.1pp YoY)

Marketplace Performance:

GMV: $15.26B (+20.6% YoY, +37.2% FX-neutral) (GMV= gross merchandise volume, the total sum of everything sold on the platform)

Items sold: 550M (+30.6% YoY)

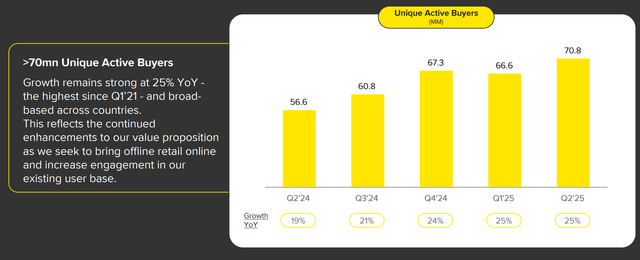

Unique buyers: 71M (+25.1% YoY)

Commerce take rate: 25.2% (+1.7pp YoY)

Mercado Pago:

Fintech revenue: $2.95B (+40.3% YoY, +63% FX-neutral)

TPV: $64.6B (+39.4% YoY, +60.9% FX-neutral) (TPV = Total Payment Volume, the total value of all transactions processed through the platform)

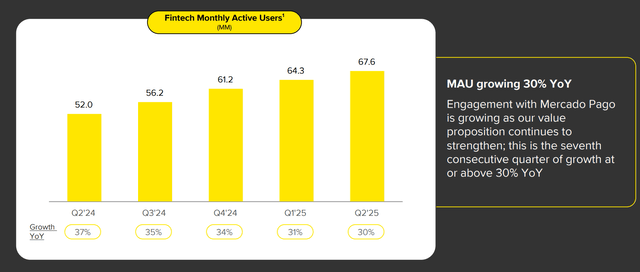

Monthly active users: 67.6M (+30% YoY)

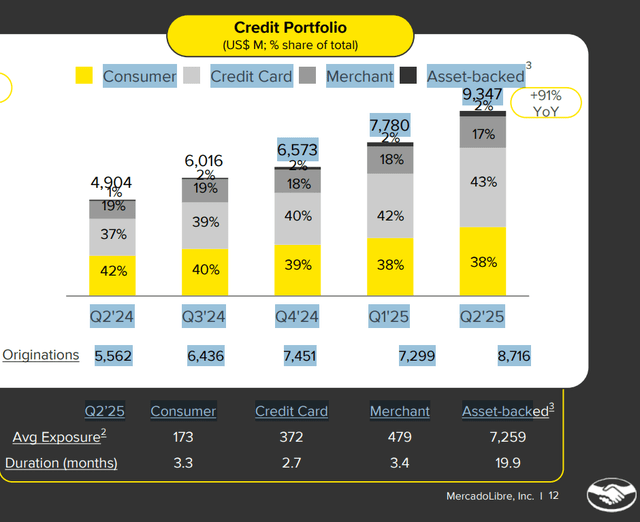

Credit portfolio: $9.35B (+90.6% YoY)

Regional Breakdown:

Brazil: $3.47B (+24.7% YoY, 51% of total revenue)

Argentina: $1.53B (+76.9% YoY, 22% of total revenue)

Mexico: $1.51B (+25.4% YoY, 22% of total revenue)

Other (combined): 4% of revenue

The Real Story Behind the Numbers

The stock sold off a bit because of the EPS miss, but the headline EPS miss that spooked some investors tells only a fraction of the story. MercadoLibre's "miss" stems from exactly what long-term investors should want to see: aggressive reinvestment in growth initiatives that strengthen the company's long-term competitive moat. So, I liked it.

Sales and marketing expenses jumped nearly 50% year-over-year, compressing margins by roughly 100 basis points. But this too was a strategic investment. The company launched high-profile celebrity campaigns across Brazil, Mexico, and Chile that drove significant improvements in user growth, app downloads, and engagement.

Despite the already massive scale with 71 million unique buyers and 550 million items sold, the platform achieved its fastest user growth since 2021.

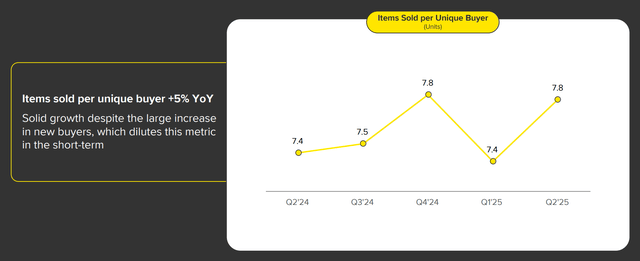

Simultaneously, engagement per user is rising, and items sold per buyer continue climbing, with now as many items sold per unique buyer as in Q4 2024, which is impressive.

These campaigns delivered great returns that will compound over time. Again, good move. Let the quarterly traders play their high-testosterone games. As a long-term investor, this is what you want from the company.

As mentioned in the Overview Of The Week before, MercadoLibre made an important move in Brazil by cutting the free shipping threshold from R$79 to R$19 (about $3.5). It's the third cut since 2017.

This decision, combined with reduced seller fees for items between R$79-R$200 (about $15 to $37), immediately impacted short-term margins but generated impressive results. Items sold in Brazil accelerated to 34% year-over-year growth in June, with GMV growth naturally following. In other words, it's fully working.

The free shipping initiative in Brazil gets criticized for those focusing on the margin impact, but this is the right move. The logistics infrastructure supporting this strategy is becoming increasingly sophisticated. MercadoLibre now operates 30 fulfillment centers across multiple countries, handling 57% of shipments with fulfillment penetration exceeding 60% in Brazil. This extensive network provides critical advantages in speed, convenience, and cost—advantages that competitors simply cannot replicate at scale. You could say Mercado Libre out-Amazoned even Amazon in Latin America, but definitely the rest.

Argentina's performance particularly stands out, with 75% FX-neutral GMV growth and 46% growth in items sold. As macroeconomic conditions stabilize, MercadoLibre's dominant position is translating into high growth in the country.

Fintech: The Crown Jewel Shines Bright

If commerce is MercadoLibre's foundation, fintech is rapidly becoming its crown jewel. More experienced Multis will know that was my initial thesis when I picked Mercado Libre.

MercadoPago's monthly active users (MAUs) reached 68 million, growing 30% year-over-year.

Even more impressive is the use of the platform by its customers. The average number of fintech products per user has increased 50% over the past 2.5 years.

The credit portfolio's 91% growth to $9.3 billion is impressive.

At the same time, it might raise eyebrows among conservative investors, but the underlying metrics tell a story of disciplined expansion. The 15-90 day NPL ratio (non-performing loans) improved to 6.7%, falling below 7% for the first time since reporting began. Over 50% of Brazil's credit card portfolio is now NIMAL (Net Income Margin After Losses) positive, with 2023 cohorts already profitable and early 2024 cohorts showing strong performance.

Credit cards represent 43% of the total portfolio and grew 118% year-over-year. Management issued 1.5 million new cards in Q2 alone while maintaining strict underwriting standards. The strategy of targeting higher-quality borrowers is paying dividends, with improved cohort profitability across all major markets.

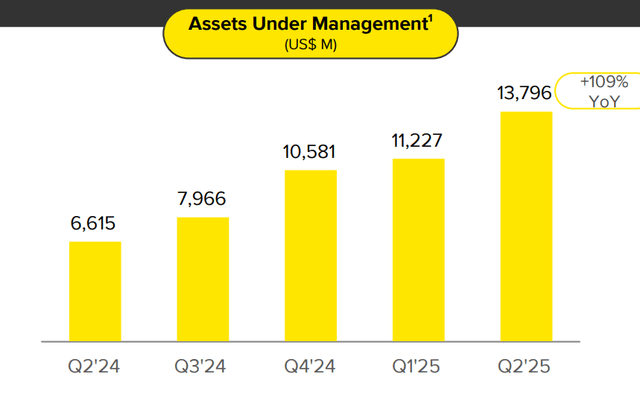

Assets under management doubled to $13.8 billion, up 109% YoY.

This surge was driven by attractive yields that are pulling customer funds away from traditional banks. In a region where financial inclusion remains limited, MercadoLibre is building the infrastructure for a more connected financial ecosystem.

I know this question often comes, so I'll address it right away. Yes, Nubank and MercadoPago will be competitors one day. But there's still so much green field. Underbanked customers (meaning they can't get credit cards or loans) and customers who hate the bureaucracy of the legacy banks are huge groups in LatAm. Both Nubank and MercadoPago will be big winners. And if one day, the real battle will be between them because they became number one and two in Latin America, that's when shareholders of both companies will have a big grin on their faces when they think about their profits.

The Advertising Opportunity

MercadoLibre's advertising business grew 38% in USD terms (59% FX-neutral), with display and video nearly doubling year-over-year. The launch of the Google Manager integration in Q2 is a milestone, as it helps Mercado Ads become as a strategic partner for enterprise brands rather than only a platform for SMBs

Argentina showed particularly strong advertising growth, benefiting from improved inventory availability and lower inflation. The monetization gap between Argentina and MercadoLibre's more mature markets is closing rapidly, suggesting significant room for continued expansion.

AI is playing an increasingly important role, from creative generation to campaign optimization. These tools are improving ROI across advertising while making the platform more accessible to small and medium-sized sellers. Another innovation that strengthens MercadoLibre's competitive position.

Looking Forward: Secular Tailwinds Intact

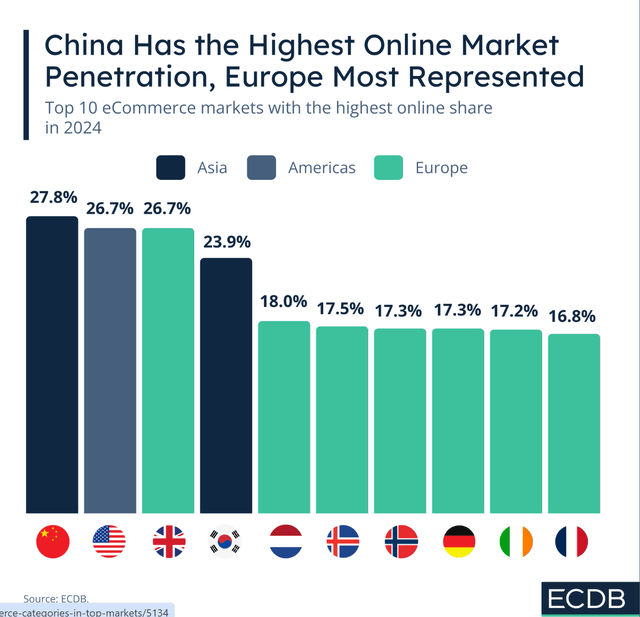

The bull case for MercadoLibre remains compelling because the secular trends driving its growth are still in early innings. E-commerce penetration in Latin America sits at just 15%, with much higher levels in developed markets, as you can see from the graph.

LatAm's gradual digitization creates a multi-decade runway for growth for Mercado Libre. It's not a coincidence that Morningstar gives it a Wide Moat rating, indicating that it believes the company has a moat that will last for 20 years or longer.

MercadoLibre is even actively accelerating the trends through strategic investments in logistics, financial inclusion, and technology infrastructure. It invests in AI and advertising.

Conclusion Earnings

The market's initial negative reaction to MercadoLibre's Q2 results illustrates again why successful investing is about looking beyond quarterly trends. Yes, the company missed EPS estimates. Yes, margins compressed. But it's to invest in the long-term story. If you are a trader, you hate that. If you are an investor, you love it.

Would you want to own a company that has:

34% revenue growth

accelerating user acquisition (30%)

improving credit metrics

expanding market share?

I know that I do and it's not a coincidence that Mercado Libre is the biggest position in my portfolio.

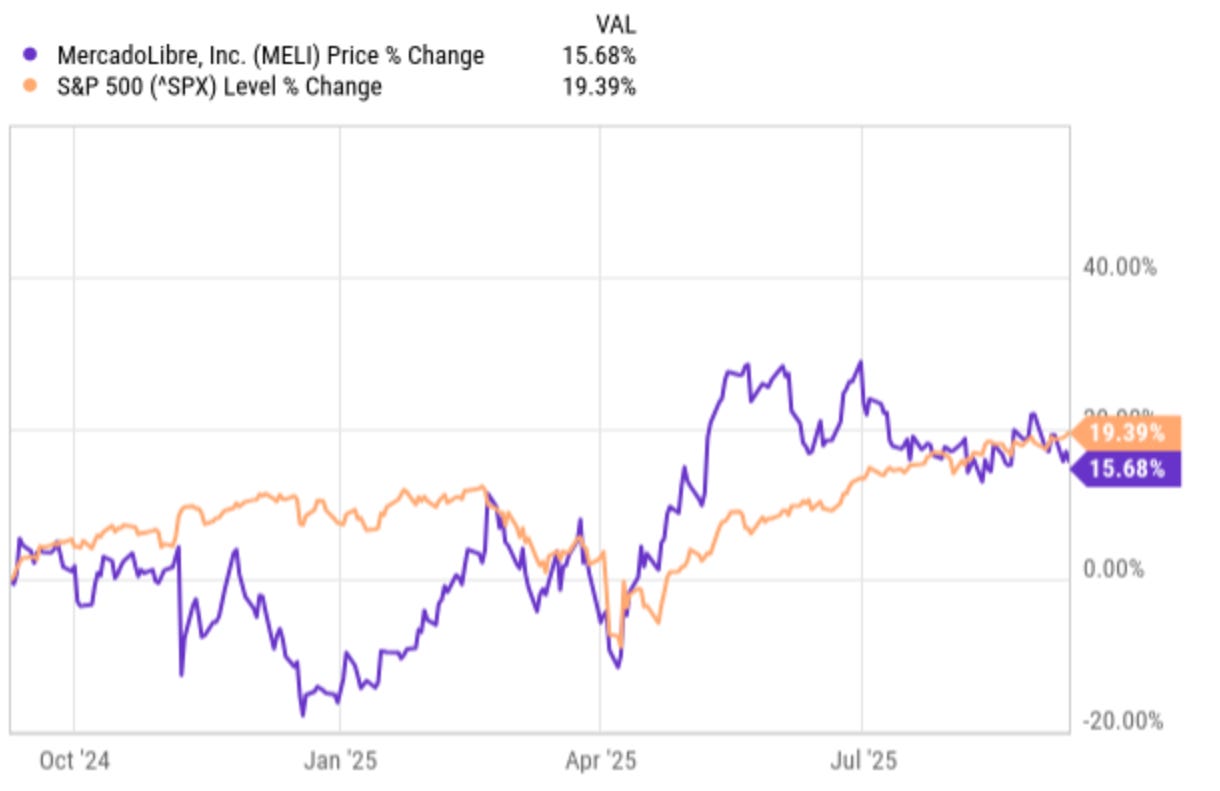

And I know that some may be impatient, as Mercado Libre has underperformed the market over the last year.

Some Multis may have this feeling.

For long-term investors, periods like these can be boring, but they are great for accumulating wealth. At least, if the price is right. And the quality is intact. And that's exactly what we are going to find out next.

Let's start with the PMQS.

Want to know if Mercado Libre is a buy right now?

You've seen the earnings breakdown.

But the real answer comes from the Potential Multibaggers Quality Score and the updated valuation.

👉 Get instant access to the full analysis, including the updated PMQS, valuation score, my personal portfolio, the Best Buys Now (outperforming the market by 29% on average!) and much more.