Hi Multis

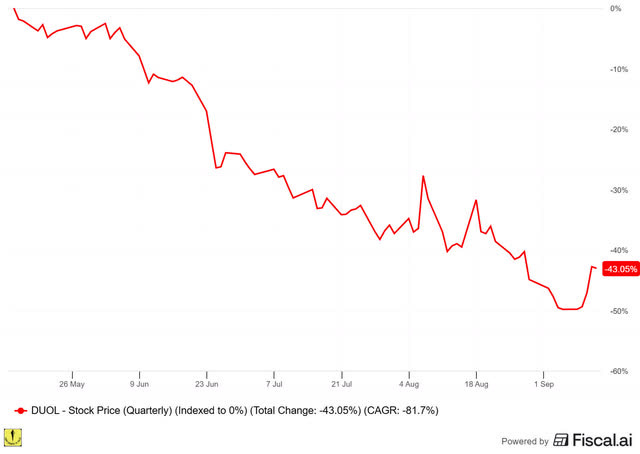

On August 6, Duolingo (DUOL) released its Q2 2025 results. This is what the stock has done since that date.

Since May 14th, the stock is down a whopping 43% and it was even down 50% just a few days ago.

You can grab a 15% discount to Fiscal here.

Initially, the stock shot up more than 15% but then it started tanking. And I guess many Multis were confused. What the hell happened there? Many investors will feel like Duo the Owl a while ago.

I looked at the earnings, and they looked strong, but I hadn't listened to the conference call yet. Now I have and this is my analysis.

After the analysis, we will also look how the Quality Score evolved for Duolingo and if the stock is attractively valued now.

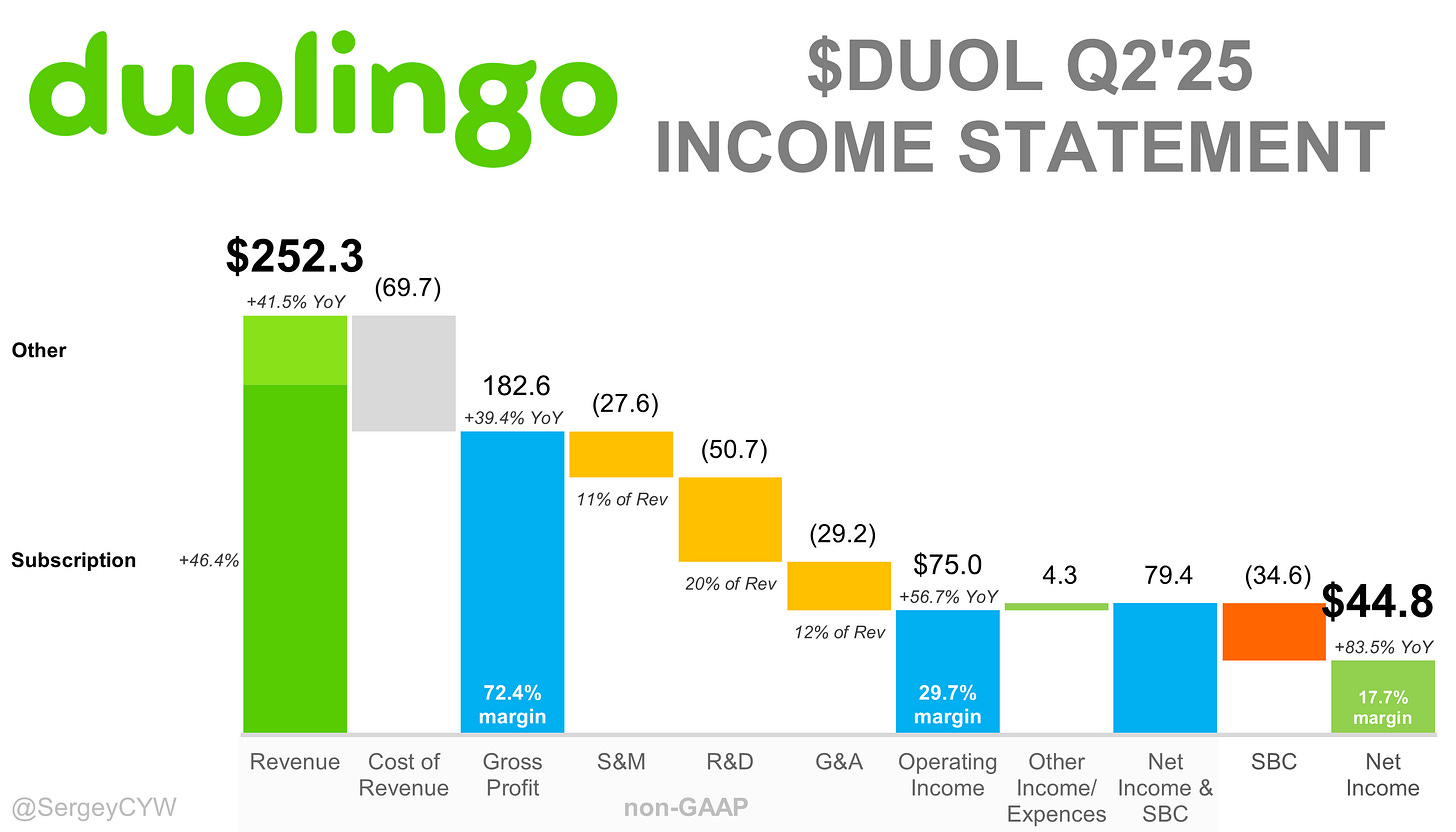

The Numbers

$252.3M in revenue, +41.5% YoY, +9.3% QoQ, beats estimates by 5.0%

Non-GAAP gross margins: 72.4%, a 1.1 percentage point decrease YoY.

Non-GAAP Operating Margin: 29.7%, +2.9 percentage points YoY

FCF Margin: 34.2%, +2.4 percentage points YoY

Net Margin: 17.7%, +4.1 percentage points YoY

Non-GAAP EPS: $0.91 beat estimates by a whopping 62.5%

That EPS beat is really something. 62.5% higher than the estimates? That's when you can use the verb ‘to crush.’

The foundation of Duolingo's success remains its ability to turn casual users into deeply engaged learners. You can see that in the numbers:

DAUs: 47.7M, +39.9% YoY (DAUs = daily average users)

MAUs: 128.3M, +23.8% YoY (MAUs = monthly average users)

Paid Subscribers: 10.9M, +36.3% YoY

Again, very strong numbers. The MAUs were down about 2% QoQ, but management attributed this to Q1's viral "Dead Duo" campaign (see the image above). That was so successful that it's a very tough comp. That explanation makes sense.

More importantly, the DAU/MAU ratio improved to 37%. It shows that users who engage are becoming more consistent in their usage. And management focuses explicitly on DAUs, not MAUs. CFO Matthew Skaruppa on the conference call:

We don't have a team focused on MAU growth. We have a team focused on DAU growth. Because language learning is a daily practice and so we're more focused on that metric.

As you may know, I have a big streak myself. I'm at 1,331 days now. I study Italian, Latin and music.

The Chess launch provides the most compelling evidence of Duolingo's platform potential. Reaching 1 million DAUs within weeks of launch, Chess became Duolingo's fastest-growing category, outperforming Math and Music. Don't forget that for now, it's only launched for English iOS users. I'm eagerly waiting for the international rollout for Android.

I played chess very intensely for a few weeks when I was 16. I was traveling with a group. However, when I got home, I found that none of my friends could play chess, so I stopped playing it after that, and I forgot how to play it. I'm really looking forward to reconnecting with this long-forgotten temporary passion. The company wrote in its shareholder letter:

we plan to expand Chess to Android and more UI languages throughout this year.

Duolingo will also make more content for intermediate chess players and "the ability to engage in matches against others."

What makes Chess even more remarkable is that it was built by a two-person team who didn't initially know how to play chess or code. They leveraged AI to handle the entire development process.

Management emphasized that it wants even more integration of the several product offerings. The goal isn't to create separate product silos but to build a unified platform where users can learn multiple skills on the same gamified platform.

But back to the results.

Subscription revenue grew 46.4% to $210.7M, representing 83% of total revenue. The subscription mix continues to improve, with both Super Duolingo and Max contributing to ARPU growth of 5-6% year-over-year. (ARPU = average revenue per user)

Gross margins compressed slightly year-over-year to 72.4% (-1.1 percentage points) due to AI infrastructure costs for the Duolingo Max rollout. Some pointed to this when the stock started to slide. But the gross margins were 1.2 percentage points higher QoQ as compute costs became more efficient.

Important: the operational leverage remains intact:

R&D expenses: Down to 20.1% of revenue (-2.4 percentage points YoY)

Sales & Marketing: 11.0% of revenue (+0.5 percentage points YoY)

General & Administrative: 11.6% of revenue (-2.0 percentage points YoY)

Ok, S&M is up a little bit as a percentage of revenue, but considering the strong DAUs makes this worth it. 11% is still quite low. SaaS companies like Cloudflare, CrowdStrike and even Hims have S&M costs three or almost four times as high (as a % of revenue).

Free cash flow reached $86.3M with a 34.2% margin, showing that growth is converting efficiently into cash rather than being all spent by customer acquisition or infrastructure spending.

As I already said, Duolingo continues to show outstanding operational leverage.

I love the breakdown that Duolingo gives in its shareholder letter and that's why I want to share it here to summarize the part about the numbers.

Only one thing remains for the Numbers section, then, guidance.

Management raised the full-year guidance to $1.011-$1.019 B in revenue, which means +35.7% YoY at the midpoint, and +2.3% higher than the previous guidance. It also beat estimates by 2.0%. Management guided for adjusted EBITDA of $291.8M at the midpoint, meaning a 28.5-29% EBITDA margin.

More Insights

Duolingo Max remains the company's premium AI laboratory. Max subscribers now represent 8% of the total paid base, up from 7% in Q1 and 5% two quarters ago. While growth was slightly below expectations due to Super Duolingo's stronger-than-expected performance, Max is proving its value with higher lifetime value users.

The Video Call feature with Lily remains Max's flagship offering, enhanced with background environments, is highly appreciated by its users.

Management emphasized that much of the improvement happens behind the scenes. An example is the conversations that flow better and adapt more precisely to individual skill levels through continuous model fine-tuning.

During Q2, Duolingo switched from the legacy hearts system to the energy system. Management explained that it didn't want to punish mistakes, but reward engagement and correct streaks. Users start with 25 energy points per session, and lessons consume energy regardless of correctness, with bonus energy awarded for each five correct answers in a row.

This shift from punishment to reward-based psychology was one of the reasons for the higher DAUs and it also resulted in longer session times, and increased conversion rates. The system is now active in over 50% of iOS DAUs and under 50% of Android DAUs, with the full rollout expected within the next few months.

International growth continues to lead expansion, particularly in Asia-Pacific. China emerged as the fastest-growing region in Q2, driven by a partnership with Luckin Coffee that drove significant brand awareness.

Intermediate and advanced English DAUs now exceed 2 million, growing faster than any other language cohort. This segment shows strong engagement with Max features, especially Video Call. In other words, there's above-average adoption of paid subscriptions in Duolingo's highest-value user segment. As a shareholder, that's great news.

In the US, DAU growth has moderated due to lower marketing investment, but management plans to begin targeted campaigns. The company will try to adapt the successful Mexico growth strategy in the US. Duolingo tried out paid acquisition there, and it worked surprisingly well.

Advertising revenue exceeded internal expectations, benefiting from stronger pricing and longer session times because of the Energy system rollout. This is a great way to monetize free users in lower-subscription markets.

The company is also testing Stripe-powered web checkout flows for iOS users in the U.S., bypassing Apple's 30% fee. Early results show minimal bookings loss with significant margin gains. This could be a great boost to Duolingo's profitability in the future.

Duolingo's marketing machine continues to fire on all cylinders. YouTube Shorts and Instagram Reels views grew 430% and 450% year-over-year, respectively. And once that organic reach has run most of its course, the paid acquisition strategy in Mexico proved to be very profitable too. I'm looking forward to comments from management on the rollout of paid advertising in the US.

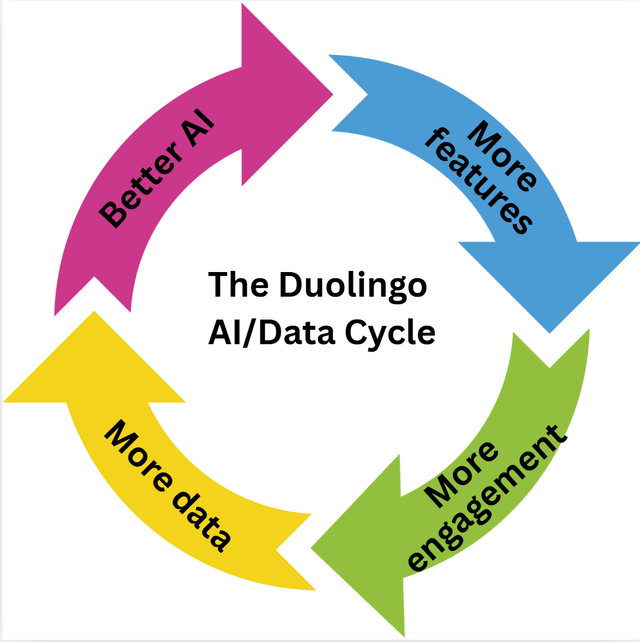

What really stood out for me, this quarter even more than the previous ones, is that that the company becomes more valuable as AI capabilities advance.

Unlike businesses where AI represents a cost or competitive threat, Duolingo's core value proposition (habit formation and motivation) becomes easier and cheaper to deliver as models improve.

This creates a flywheel effect: better AI enables more engaging features, which drive higher engagement, which generates more data, which enables better AI.

The Chess rollout is a great example. Better AI in the development speeds up new features, which creates more engagement, and as a consequence, more data, that can be leveraged by AI to create even better and more features, etc.

As compute costs continue declining, Duolingo can more and personalize its offering, both through interactive features (for example chess matches at your level) and content generation.

Conclusion Earnings Analysis

Duolingo's Q2 2025 results were very strong. Why the stock tanked after the earnings? ChatGPT-5 came out the next day and that spurred negativism about Duolingo again. This week, Apple came out with AI translation through its AirPods. If that is your bear case for Duolingo, you don't get it. People enjoy the gamification while learning something. Yes, I can ask ChatGPT to teach me how to play chess again, but I want to wait for Duolingo to do it.

The Energy system rollout shows how thoughtful product design can improve the user experience and business metrics and the Chess launch validates the thesis that Duolingo is not a language learning platform, but a broad education platform. In other words, thesis fully on track.

So, is the stock a buy now? Let's check the Quality Score and Valuation Score for that.

Paid members get the full Duolingo quality assessment and valuation.

On top of that, they can see my full portfolio and the Best Buys Now, my monthly picks that have outperformed the market by nearly 30% per pick since 2022. They will be released on Monday.

This week, I also released a new Potential Multibaggers pick. It’s a small company that is not on the radar of many but has 10x potential (at least). My previous pick is up 63% and the one before that almost 150%.

Don’t miss the next multibagger!