Hi Multis

Aaaaah, it’s Sunday again!

That means a fresh Overview Of The Week. It’s still a bit warm as it comes just out of the oven.

So, grab your Sunday evening tea or Monday morning coffee and indulge yourself.

Articles In The Past Weeks

This is the fourth article this week.

In the first article this week, I looked at Constellation Software after the 50% drop.

Now that Shopify has dropped, is it a buy already? That was the question that was answered in the second article this week.

I also bought shares for my Forever Portfolio. You can read all about that here.

Memes Of The Week

Just one meme this week. Thanks for sharing, Zack!

Interesting Podcasts Or Books

David Gardner, co-founder of The Motley Fool, is one of the people who influenced my investing the most, together with Phil Fisher and Peter Lynch.

There was a time I listened to every episode of David Gardner’s podcast and while it’s still interesting today, I don’t listen to every episode anymore since he stopped picking stocks for The Motley Fool.

But this week was a very interesting episode that will probably interest many Multis as well.

In the most recent episode of Rule Breaker Investing, David Gardner goes over his risk score system and uses Etsy and Duolingo as examples.

You can listen to the episode here.

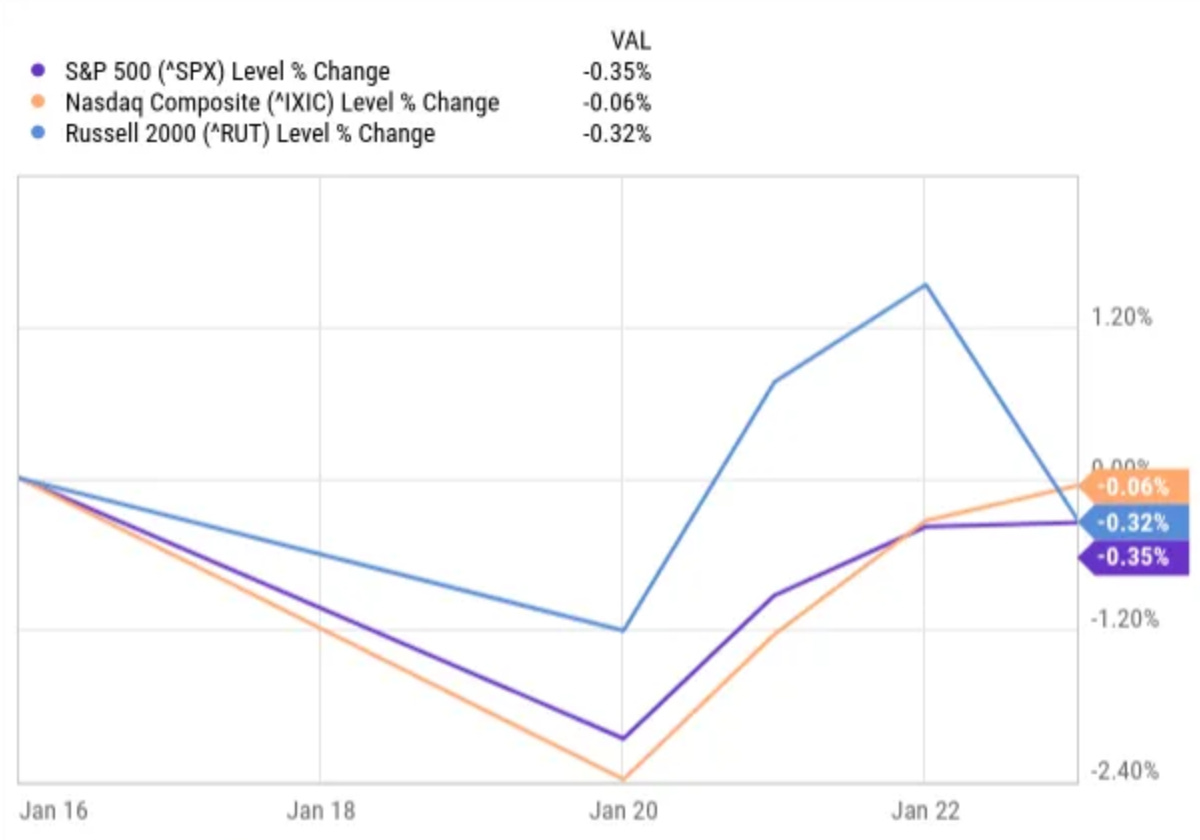

The markets in the past week

So, what did the markets do in this turbulent week?

While the Nasdaq and the S&P 500 were down substantially on Tuesday after the Greenland issue and associated tariffs for European countries, this turned out to be another TACO (Trump Always Chickens Out). Fortunately.

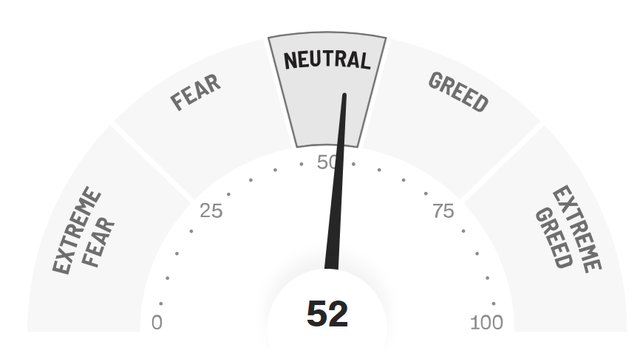

The Greed & Fear Index dropped back to Neutral.

Quick Facts

1. Greenland & Canada

This week, President Trump’s claim to Greenland was all over the news because of the World Economic Forum in Davos.

As I already said, this was another TACO (Trump Always Chickens Out). This is actually a classic negotiation tactic. It’s called the door-in-your-face technique.

If you want something, and you shock the other person by asking something outrageous. Any concession from that person to something that stays far from the brutal proposal is seen as a minor concession to avoid the extreme initial ask.

I don’t claim that Trump doesn’t want Greenland, but I don’t believe he’s willing to blow up NATO over the issue by attacking an ally.

But I’m not here to talk politics. Politics divides, and there are already more than enough people who divide others. So, let’s not discuss this. Of course, you and I have our own opinions, but I don’t feel tempted to vent mine on everything.

The reason I bring it up here is that the markets did very badly because of the threat to impose more tariffs on European countries. In the end, this threat was not pursued.

But a new threat started, this time with Canada. Canada and China would make a small trade deal to lower tariffs on specific goods. For example, China would reduce duties on Canadian canola/rapeseed oil from 85% to 15%, and Canada would cut tariffs on Chinese electric vehicles from 100% to around 6.1%.

This is not a full free trade agreement. Initially, Trump reacted quite positively to the deal, but then Canadian Prime Minister Carney gave a speech at Davos. In that speech, he said the deal is part of Canada’s preparation for a “new world order” with diversified partnerships. President Trump didn’t like that at all, and he shot back that the US would impose a 100% tariff on goods from Canada. His reasoning is that the deal could lead the Chinese to use Canada to circumvent American tariffs on Chinese goods.

Again, I’m not commenting on this situation, but it all shows that there’s a lot of economic uncertainty.

In my 5 Bold Predictions for 2026, I wrote:

The Nasdaq, S&P 500, and Dow Jones indexes will all drop at least 20% at some point.

I think this kind of uncertainty about where the world is heading could be the reason. Of course, there could always be a black swan, something really nobody could see coming (like the pandemic), but my guess is that it will be macroeconomic uncertainty. And of course, that’s just an educated guess.

2. The week ahead

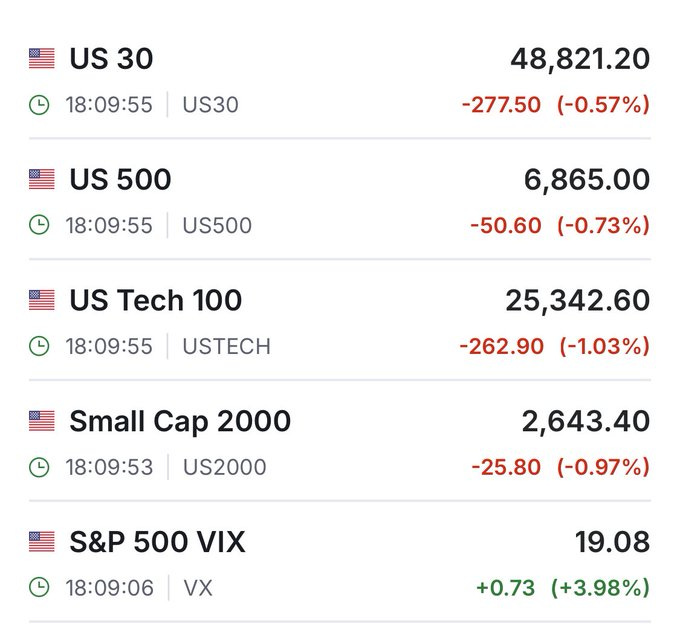

It looks like it’s going to be a bad start to the week. These are the futures.

The reason is that investors see a 75% for a government shutdown (again). What happened in Minneapolis, the Democrats will not want more money to go to ICE (Immigration and Customs Enforcement).

I know it’s probably tempting for some of you to post political comments, but once more, please don’t do this. I’m just pointing out why the futures are down.

3. Only if you speak Dutch

This part is for those who speak Dutch only, as it’s about an investing event in Ghent where I will be one of the speakers. It will be in Dutch, so it makes little sense to write this in English, as you won’t be able to understand me (and the rest of the speakers). You can scroll to the next thing if you don’t understand Dutch.

Beleggingsevent: Win tickets ter waarde van €100!

Op zaterdag 14 februari ben ik één van de sprekers op het beleggersevent Een Hart Voor Beleggen in Gent.

De organisatie (Lynx en VFB of de Vlaamse Federatie van Beleggers) heeft me twee tickets ter beschikking gesteld om uit te delen aan jullie. Een ticket kost normaal €50 (€25 voor VFB-leden).

Maar jij kunt dus een gratis ticket winnen. Meer daarover op het einde van dit bericht.

Zoals jullie zien komt er een brede selectie van onderwerpen aan bod: financiële onafhankelijkheid, de meerwaardebelasting, maar vooral heel veel beleggen.

U ontmoet meer dan 450 medebeleggers, breidt uw netwerk uit en versterkt uw financiële kennis.

Voormiddag

Jan Longeval opent de dag met een sessie over internationale macro-economie. Jan Longeval is de auteur van God Dobbelt Niet Op De Beurs en Heavy Metal. Volgende week komt zijn nieuwe boek Bitcoin Of Shtcoin uit.

Daarna volgt mijn goede vriend Michael Gielkens. Hij zal spreken over familieholdings. Als je vragen hebt over Constellation Software, Topicus, of Chapters Group, naast vele andere holdings and seriële overnemers, dan is Michael je man.

Gert De Mesure bespreekt buitenlandse vastgoedspelers, terwijl Kristoff De Turck in technische analyse behandelt. Ann Van Dingenen (The Money Mom) spreekt over persoonlijke financiën.

Ikzelf heb de eer de voormiddag af te sluiten met een lezing over raketaandelen. Ik zal hierbij iets meer focusen op selectie en waardering van groeiaandelen. Ik zal ook tien aandelen selecteren die ik op dat moment interessant vind.

Tijdens de middagpauze kun je eten, ontspannen en netwerken; je krijgt namelijk broodjes en frisdrank (inbegrepen in de prijs).

Namiddag

In de namiddag bespreekt Toon Cuypers (FIRE Belgium) hoe je geld onttrekt uit een beleggingsportefeuille. Dieter Plas (Beleggersuniversity) praat over interessante posities voor 2026 en Pieter Vandervelde licht de belangrijkste principes van vermogensfiscaliteit toe.

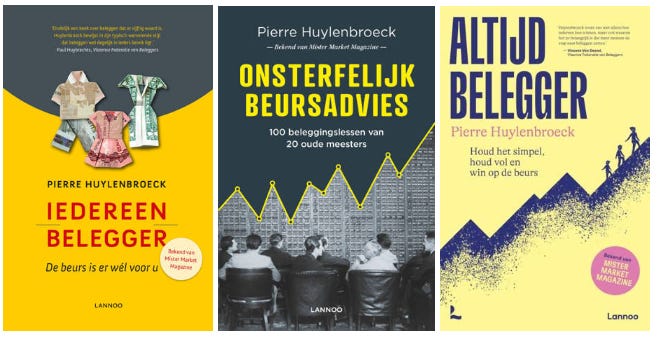

Daarna spreekt Pierre Huylenbroeck (Mister Market Magazine). Ook Pierre mag ik een vriend noemen. Hij is de voormalig hoofdredacteur van de krant De Tijd en is een vat vol beurswijsheden. Qua stijl (en humor) is hij de beste auteur die in het Nederlands over de beurs schrijft, zoals zijn vijf beursboeken bewijzen.

Dit zijn de meest recente. Iedereen Belegger is een klassieker, Onsterfelijk Beursadvies gaat te rade bij de beste investeerders ooit en Altijd Belegger is Pierres nieuwste boek.

Ik heb deze alledrie met heel veel plezier gelezen en kan ze iedereen aanraden.

Een Hart Voor Beleggen wordt afgesloten door Nette Buyens die zal spreken over meerwaardebelasting en fiscaliteit.

Praktische informatie

Prijs: €25 voor leden, €50 voor niet-leden, €25 voor studenten

Locatie: HoGent, Valentin Vaerwyckweg 1, 9000 Gent

Aanvangsuur: 9 uur

Het evenement vindt plaats in twee zalen met elk een vaste presentator: Zaal A onder leiding van Ben Granjé (CEO van de VFB) en Zaal B onder leiding van Justin Blekemolen (beursanalyst bij LYNX).

Broodjes en frisdrank voor ‘s middags zijn in de prijs inbegrepen.

Jij kunt een ticket winnen ter waarde van €50.

Ik heb twee tickets ter beschikking.

Wat moet je daarvoor doen?

Er zijn maar liefst drie manieren om deel te nemen. Je kiest gewoon de manier die het best bij jou past!

Je deelt dit programma via je sociale media. Deze afbeelding, dus.

Je deelt deze afbeelding op je Facebook, Instagram, TikTok, X, LinkedIn of om het even welk ander platform.

of

Je stuurt deze mail door naar iemand die geïnteresseerd kan zijn.

of

Je stuurt mij je beste vraag door. Ik zal één of enkele vragen behandelen tijdens mijn lezing in Gent.

Hoe doe je dat?

Alles gaat via dit formulier.

Deadline: Vrijdag 30 januari. Maar doe het nu maar al, anders vergeet je dat. :-)

Tot in Gent!

4. Duolingo

This week, I wrote two somewhat longer posts on X about Duolingo. I want to share them with you here as well.

Here’s why AI is a tailwind for Duolingo, not a headwind.

Duolingo used vibe coding and generative AI to launch 148 new courses in 1 year. That’s more than they built in the previous 12 years combined. Content scaling at marginal costs.

But doesn’t that make it easier for others to make that content? Yes, of course. But the difference is NOT in the content. If you wanted to learn a language or anything else, you could already have done that on the internet for free since, let’s say, 2010.

The difference is in the most challenging part of any learning process: consistency. Duolingo has 50.5 million DAUs (daily active users). I’m one of them, with a streak of 1,460 days. During that time, I learned Italian, music, Latin, and chess. No way I would have the discipline to be so consistent with anything else.

Of course, improvement is still possible. At a certain level, you get to a boring part (take verb tenses) that doesn’t stimulate you enough, and the algorithm should pick that up and interlace it with content you do like more or even cross-promote other courses at that moment.

Also: I’m waiting for courses like Python, C++, make-up (not for me personally, but our 11-year-old daughter would LOVE it), personal finance & investing (that would make a huge difference globally!!), mindfulness, Excel mastery, negotiation, statistics, productivity, etc.

And this is the second post:

Duolingo’s Rule of 40.

For growth companies, the Rule of 40 is often helpful. It adds the revenue growth percentage to the FCF margin. If the number is above 40, you have quality growth. So, we check Fiscal AI.

Revenue growth in the last quarter? 41%

FCF Margin? 29.2%

That means a Rule of 70%, which is very strong.

Revenue growth is expected to drop (Fiscal shows the expectations on the chart as well). So, let’s look at the low point here, 21%. The average FCF margin over the last 8 quarters was 36.3%. So, if Duolingo an just keep up that FCF margin, you look at a Rule of 57.

I know what some bears will say: Stock-based compensation! Ok, let’s weed it out. In the ttm, there was $131M in SBC and $272M in FCF. That means $141M in FCF-SBC. That results in 15% SBC-adjusted FCF.

Now, you can’t take the Rule of 40 anymore. That rule comes from VC and there, SBC is a normal part of business. For years, I have used the Rule of 25 in that case. And for Duolingo, it would mean 36%, which is outstanding.

You can always follow me on X: @fromvalue

5. Clawdbot: The New Shift

This weekend, I’ve been reading about Clawdbot and I’m definitely impressed already with what I see. I have no first-hand experience yet, but I want to try it this upcoming week.

Clawdbot is 24/7 personal AI assistant you run on your own devices. You can communicate with it through multiple channels (Discord, Signal, WhatsApp, Slack...) and it remembers everything about you, unlike LLMs. Even in projects where you trained them thoroughly, the model still deteriorates.

Unlike standard LLMs that only “chat” in a browser, Clawdbot is an active agent that lives on your hardware and manages your local files and folders directly.

While ChatGPT “forgets” or stays in the cloud, Clawdbot builds a permanent, private knowledge base from your personal information. Anything you feed it, actually.

Do you want to connect it to your Strava account and act like a coach based on the data that come in automatically? No problem.

Do you want it to check all incoming contracts on anomalies and send you a WhatsApp message if one comes in your mailbox? No problem.

Do you have 15 hours of meetings recorded somewhere? Great, now you can get real insights from that.

These are just a few examples I’m thinking of now. I’m sure we will see a huge number of applications coming out. This almost feels like a second ChatGPT moment.

It made me realize that I have to think through my investments again. This changes everything again, I think.

My very first thoughts: this will be great for Apple (many want the Apple Mini Mac to run it on) and for DRAM memory (the Micron party could just be starting).

But there will be many more implications. I have to think through these in the upcoming week.

What do you get as a member?

✍️ Multiple high-quality articles per week

📚 Full access to our entire library of deep-insight articles

🔎 Full investment cases

📊 Access to the Private Community

🎥 Regular Webinars

📈 The Best Buys Now every month

✍️ The Overview Of The Week each Sunday

🔎 Deep earnings analysis

📊 The 10 Best Stocks for 2026 (the selection for 2025 beats the S&P by more than 40%!)

Many Multis say that the community alone is already worth the price, but you get so much more.

Go to this page.

Subscribe to the annual plan.