Hi Multis

I have to confess something. Zack sent me his Shopify analysis a month ago... And I missed it. This weekend, Zack pointed it out to me. I’m very sorry this one had such a long delay. So, let’s not lose more time and start right away.

Hi Multis

Zack here, sharing my analysis on Shopify’s Q3 2025 earnings.

For those who don’t know, Shopify (SHOP) holds a special place in the community because it was the first Potential Multibagger pick at $ 7.74, and it’s appreciated a whopping 1,767% (as of the market close on January 20, 2026).

I’m guessing most of you weren’t holding your breath for this earnings release. I’ll openly admit that I often forget Shopify’s in my portfolio. There’s not much mention of the company on my social channels compared with the more dynamic, up-and-coming names or the companies with dramatic positive or negative price catalysts that tend to dominate retail investor conversations.

Shopify just quietly executes quarter after quarter, and spoiler alert: this quarter was more of that same consistent excellence. We’ll first take a look at the numbers for Q3 2025, and later in the article, I address what I think is the biggest bear case on the company.

The numbers

Q3 GMV (gross merchandise value, the total dollar amount of everything sold on the platform) was $92B, up 32% YOY. That shows that sales continue to grow fast.

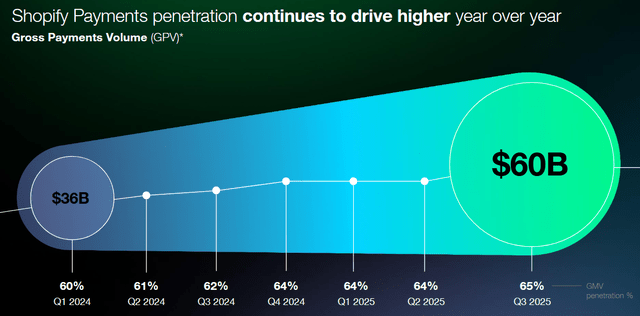

GPV (gross payment volume, everything that was paid through Shopify’s payment solution) was $60.2B, up 40% YOY. Again, this shows very strong growth. It’s not only coming from higher sales volume (GMV) but also from greater Shopify Payments penetration, as the graphic below shows:

Source: Shopify Q3 2025 presentation

A higher percentage of sales using Shopify Payments leads to more revenue for the company but slightly lower gross margin. Gross margin came in at 48.9% this year versus 51.7% percent last year. The reason that payments have lower margins is clear. Many players in the payment chain have to be paid: Stripe (or Adyen), Visa and Mastercard, etc.

The CFO, Jeff Hoffmeister, on gross margin:

This year-over-year change in gross margins is driven by the mix shift from subscription solutions to merchant solutions this year that I have mentioned above and on prior calls, coupled with the continued strength of payments overall. Increase in payments penetration will generally drive lower margins initially, but payments is often the on-ramp for merchants to adopt other merchant solutions products.

As a reminder, Payments, which sits within Merchant Solutions, has a lower gross margin (around 39%) than Subscription Services (around 80%). Subscriptions, so the fee merchants pay, have not been growing nearly as fast as Merchant Solutions for the past few years.

Grab your 15% discount for great charts like this at Fiscal.

Merchant Solutions continues to account for a larger share of total revenue over time. But to be clear, this is not an issue at all. As Jeff Hoffmeister said, payments are the on-ramp for future revenue-generating opportunities. Merchant Solutions still generates sizable gross profit, and more importantly, has a strong operating margin because of minimal incremental costs (e.g., headcount), benefiting from economies of scale.

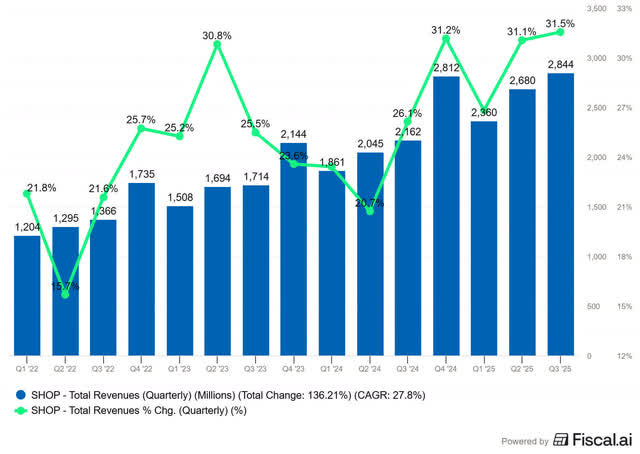

Revenue came in at $2.844B, 32% growth YOY, beating the revenue estimates by 3%. This is very strong topline growth, the fastest of the last 15 quarters.

Grab your 15% discount for great charts like this at Fiscal.

MRR (monthly recurring revenue) was $193M, up 10% YOY.

MRR is a more accurate measurement of merchant value because it removes revenue volatility tied to recognition rules, variable fees, and one-time items. MRR is calculated by taking the aggregate value of all subscription plans at the end of the period, assuming merchants renew the following month. As a result, MRR provides insight into future revenue expectations and demonstrates the stickiness of the product.

At first glance, 10% MRR growth might seem underwhelming, but Jeff Hoffmeister gave helpful context on the call:

We had two headwinds impacting our year-over-year growth rates in MRR. MRR for Q3 last year benefited from the one-month paid trial, which drove MRR higher and made for a tougher comparison this year. Second, we are also lapping the plus pricing changes, which went into effect in Q2 of 2024. We will have some year-over-year comparability headwinds on MRR until Q2 of next year, as our rollout of the three-month trials happened in Q4 of last year and Q1 of this year.

The noise from these changes should clear up by Q2 2026.

Free Cash Flow came in at $507 million, up 20% YOY, with an 18% margin. Again CFO Jeff Hoffmeister:

As I’ve mentioned consistently, we believe that these free cash flow margins strike the right balance between profitability, discipline, and investment in future growth.

To me, this sounds like Shopify could be far more profitable and cash flow positive if it wanted to, but instead chooses to keep investing heavily in the business.

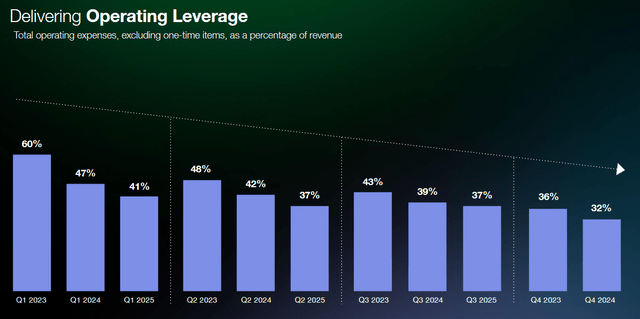

On the expense side of the business, Shopify continues to flex its operating leverage, managing lower expense growth despite higher revenue growth.

Operating expenses were 37% of revenue this year versus 39% last year. The graphic from their quarterly presentation illustrates this continued operational excellence:

Source: Shopify Q3 2025 presentation

CFO Jeff Hoffmeister also explains that headcount is the main source of cost reduction:

Our discipline on headcount has been the key force behind our increased operating leverage. For over two years, total headcount has consistently been flat to down, both sequentially and year-over-year, as we redeploy talent to the highest impact work. Our team’s productivity is rising through automation, better tooling, and the reflexive use of AI, so we can build, ship, and deliver more for our merchants.

Kris had this great chart a few months back:

As you can see, revenue efficiency began to jump significantly with the advent of AI in 2023 and 2024. Shopify is taking full advantage of AI to get the most out of its workforce.

Guidance

For Q4 2025, management expects revenue to grow in the mid to high 20% range YOY, in line with analyst estimates. It is a noticeable step down from the 30%+ growth the past few quarters but management explained this is due to tough comps from last year tied to the expanded PayPal partnership and also FX tailwinds. And of course, let’s not forget that management usually underpromises and overdelivers. Exactly how we like it.

The Big Picture

Taking in all the key metrics as a whole, we see beautiful reacceleration of growth over the last twelve months, with the exception of MRR, which we addressed earlier in the article.

Grab your 15% discount for great charts like this at Fiscal.

Despite a dip in growth rates in 2022 and 2023, growth began to pick up again, especially in the last three quarters of 2025. Combined with reduced operational expenses, Shopify continues to be a fundamentally fantastic company to own.

It’s charts like this that counter the biggest bear case against Shopify…

VALUATION

Most investors plug company metrics into forecasting models that assume decelerating growth over time. As a result, high-growth companies like Shopify often look overvalued.

And it makes intuitive sense. As companies scale, it becomes harder to grow 25% or more from an increasingly larger base.

But investors need to think deeper than surface-level valuation math. Shopify benefits from three advantages that break traditional DCF valuation models: pricing power, optionality, and durability.

Starting with pricing power, Shopify has made substantial increases over the past couple years:

Despite these price increases, there have been no clear signs of merchant attrition. That is what you call a MOAT with high switching costs, every investor’s dream. The price increases led to this:

Grab your 15% discount for great charts like this at Fiscal.

Good luck trying to factor that into a traditional DCF.

Of course, they cannot raise prices constantly. There is a fine line between corporate greed and preserving merchant goodwill. But it is very clear that Shopify can raise prices meaningfully every few years without much adverse effect.

Next comes optionality.

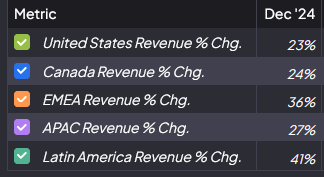

Shopify has meaningful geographic expansion ahead:

Grab your 15% discount for great charts like this at Fiscal.

The United States still accounts for the majority of revenue, but the smaller base and higher growth in other regions show the significant opportunity ahead.

Shopify is also expanding the types of merchants it serves. It is no longer just e-commerce B2C retailers. In the past few years, Shopify expanded into B2B commerce, which opens up higher ticket items and more recurring revenue. Even after two years of triple-digit growth, B2B GMV nearly doubled again in Q3 at 98% YOY.

Shopify has also expanded its offline solutions for merchants with both online stores and physical locations by integrating POS, payments, and back-office tools.

Through these tools, Shopify is creating as many on-ramps as possible so that its platform becomes the default solution for any merchant.

That said, the biggest prize is acquiring Enterprise merchants:

Source: Shopify Q3 2025 presentation

When Enterprise brands join, Shopify is not just collecting higher subscription fees. The real value is the gross payment volume across the entire brand, which Shopify can monetize through payments, B2B tools, POS, and other services that scale alongside the merchant.

In Q3 2025, Shopify announced another big acquisition:

Just last week, the Estée Lauder Companies announced they’re coming to Shopify. This is a global beauty empire with 80 years of heritage and more than 20 iconic brands under one roof: Clinique, MAC, La Mer, Bobbi Brown, and more. And now they’re trusting us to power their next chapter, so why are industry legends like Estée Lauder, Mattel, Aldo, Hunter Douglas all moving to Shopify?

Whether big or small, countries or merchants, Shopify is gaining incremental revenue by catering its product towards a diverse set of markets.

Another source of optionality is new product development, where Shopify has been innovating at a blazing pace.

Of course, not all will be a smashing success. If you remember, Shopify acquired Deliverr in 2022 to expand its logistics capabilities, then sold it a year later after realizing it did not fit its high-margin software model.

Shopify reminds me of Amazon. Ex-CEO Jeff Bezos repeatedly said the company needs big, visible failures because the few massive successes (Prime, AWS) outweigh the many misses (Fire Phone, anyone?). Shopify is similar, constantly experimenting, innovating, and shipping new products that deliver value to merchants.

Here are a couple of their latest initiatives:

Agentic Commerce

Shopify has built tools that make it easier for AI agents to transact on their platform by improving product visibility for agents and creating a seamless checkout experience within conversations.

Source: Shopify.com

If this scales, it unlocks an entirely new channel of incremental GMV for merchants.

Sidekick

Sidekick is a personalized AI assistant that empowers merchants to accomplish various e-commerce tasks more efficiently, such as generating marketing content, automating store operations, editing themes, and providing business insights all through natural language chat.

Source: Shopify Q3 2025 presentation

In Q3 2025 alone, more than 750k merchants used Sidekick for the first time.

The company clearly wants to be at the forefront of e-commerce and AI, and Shopify has been on a steady upward trajectory in terms of both new product development and TAM expansion.

Source: Shopify Q3 2025 presentation

Now we get to the last point, which is durability, specifically in terms of revenue growth.

DCF models often assume companies grow for a set period, usually around 10 years, before dropping to a low terminal growth rate. But some companies with strong moats can compound at double digits for 15 to 20 years or longer. Even at more moderate rates, long runways dramatically change valuation math.

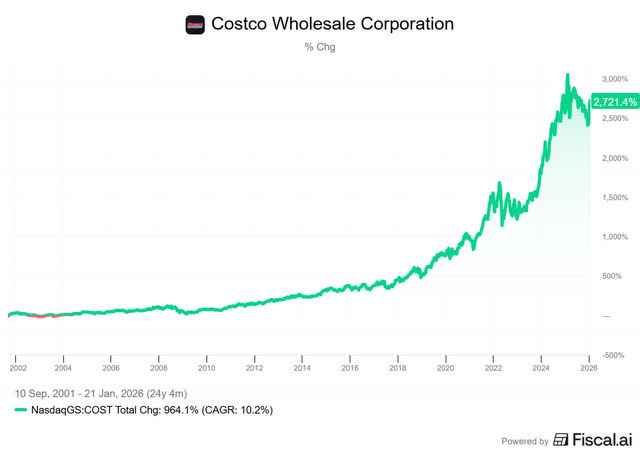

Take Costco as an example. It reported only 8% revenue growth last quarter, yet it trades at a P/E of 50. Investors know Costco is not going anywhere and can continue to steadily compound revenue because the brand and business model have proven durable for decades.

Costco’s historical revenue growth is steady, rarely flashy, but consistently in the high single digits or low teens. And what did the stock do over the last 20 years?

Yes, that’s over a 27-bagger from moderate growth over 20 years.

To make this point clearer, here is an illustration of two scenarios:

Scenario 1: 25% free cash flow growth rate for 10 years and then 2% terminal rate, using a 10% discount rate.

Scenario 2: 15% free cash flow growth rate for 20 years and then 2% terminal rate, using a 10% discount rate.

Believe it or not, both scenarios yield similar present values! Even with 10 percentage points of lower annual growth, the extra 10 years makes up the difference. The power of compounding over long periods is often understated.

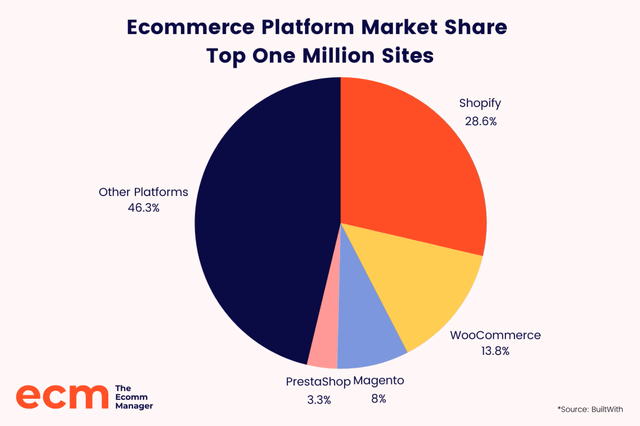

So what about Shopify? It is the clear leader in e-commerce and, from my own experience, the go-to solution for anyone wanting to start an online store.

Kris recently posted this:

In addition, take a look at this chart illustrating Shopify’s dominance in the e-commerce platform space:

Shopify is clearly one of the top digital commerce solutions and if we look historically at how they have executed and innovated year after year, I don’t think it isn’t too far-fetched to consider Shopify being around for another 20+ years.

In summary, these factors show why valuing high-quality growth companies is so difficult. It is easy to assume linear or slowing growth, as happens with many mature companies, but Shopify has the characteristics to exceed traditional valuation assumptions.

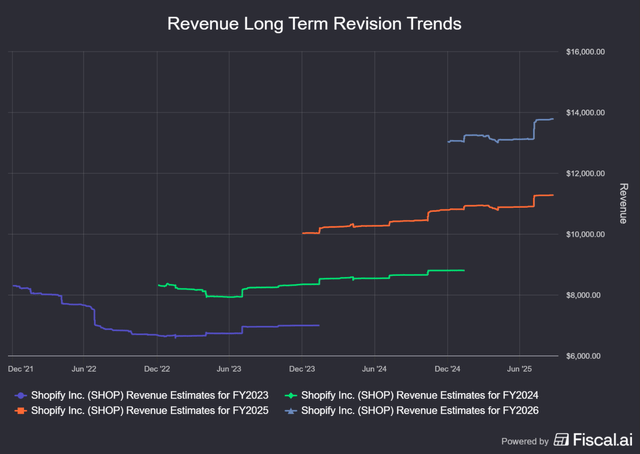

To further support the point, look at how much analysts revised their estimates over time:

Grab your 15% discount for great charts like this at Fiscal.

In 2025, analysts expected $10B of annual revenue back in 2023, but they revised that up to $11.5B, which is 10% higher. Repeat this dynamic over many years and the compounding of constant beats leads to upside that no valuation spreadsheet can fully capture.

I don’t want to steal Kris’ thunder in his valuation scoring later in the article, but a quick look at historical ratios shows Shopify has always looked expensive:

Some ratios look extreme, with price-to-earnings and free cash flow in the hundreds. Price to gross profit tracks more closely with the stock price but still looks expensive on the surface. A traditional investor could easily argue overvaluation at nearly any point in time.

BUT look at the stock price…

You could have bought at most points in time and still come out ahead. Yes, there were periods of clear overvaluation during the pandemic-era ecommerce boom, but most investors do not go all-in at the top. If you dollar-cost averaged, you would likely be up today, especially if you bought at the 2022 lows.

Reading this now, you might wonder what it means for today with Shopify at the current price. Is it a buy?

I’ll hand it over to Kris for his take on the quality score and the current valuation.

If you are not on the paid Potential Multibaggers plan yet, this is the ultimate chance to get your free upgrade worth $700. From now on, I will only show my portfolio in the $1,200 VIP-plan. Normally, I planned the upgrade for Tuesday , but there were some technical problems (a euphimism for me messing things up). That’s why I will extend this one last time.

Subscribe TODAY and you will will be upgraded for FREE FOREVER!

Tomorrow, you’ll pay $1,200.

What do you get as a VIP member?

📈 My Personal Portfolio, the Forever Portfolio

✍️ Multiple high-quality articles per week

📚 Full access to our entire library of deep-insight articles

🔎 Full investment cases

📊 Access to the Private Community

🎥 Regular Webinars

📈 The Best Buys Now every month

✍️ The Overview Of The Week each Sunday

🔎 Deep earnings analysis

📊 The 10 Best Stocks for 2026 (the selection for 2025 beats the S&P by more than 40%!)

Many Multis say that the community alone is already worth the price, but you get so much more.

Go to this page.

Subscribe to the annual plan.

You will be upgraded to the VIP plan for free

Now, let’s return,