Introduction: The Software Selloff in Perspective

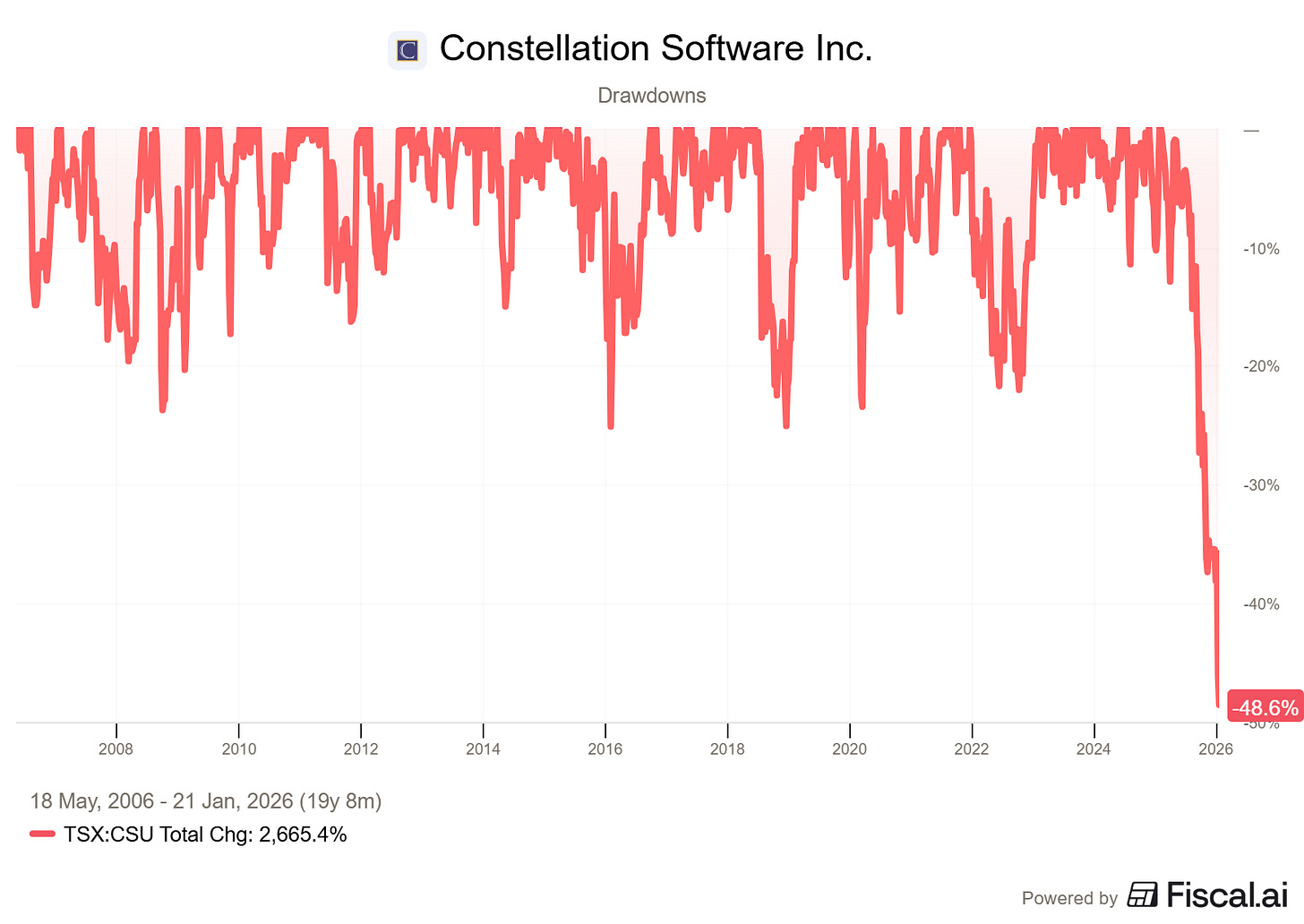

Constellation Software (CSU) is currently trading almost 50% below its all-time high. This is the first time ever the stock has dropped this hard.

The irony is remarkable. Constellation buys software companies. Lower valuations mean better deals. The market punishes the stock while the fundamental business actually benefits from it.

The Business Model: It’s The Data, Stupid

Adapting Bill Clinton’s historic saying, “It’s the economy, stupid,” we can use this to start the article.

Constellation Software acquires vertical-market software (VMS) companies: specialized software for specific niches such as municipal administration, hospital systems, utilities, and billing. These aren’t sexy products, but they’re absolutely essential for the organizations that use them. But at the same time, very important, the cost of the software is usually less than 1% of the budget and many of the customers don’t have to pay this themselves (government-paid).

What Constellation truly owns are the data of people, money and government bodies. CSU truly owns are systems of record: the authoritative source for money, people, or regulated data. This is fundamentally different from a point solution that sends emails, draws dashboards on top of someone else’s data, or can work from publicly available data that was used to train LLMs.

The AI Threat: Hype vs. Reality

The narrative goes that AI and “vibe coding” will commoditize all software. This is a fundamental misconception. AI commoditizes code, not the data. CSU’s moat doesn’t consist of the difficulty of writing code. Everyone who thinks that (and they seem to be the majority) doesn’t understand Constellation Software.

The transition from on-prem to cloud was much easier from a security and compliance point of view. And still, most of these software programs are still on-prem. Why? Security, ecosystem, switching costs, conservatism (a good attitude in administration, to a certain point), etc.

The data that was compiled over the years in those systems can’t be simply migrated. This is a painful process that takes years and it would cost a huge amount of money and time to migrate. And to what? A system that has not proven itself and is not trained on the data? To a system that doesn’t have the necessary certificates and regulatory approvals.

But suppose you are a real innovator in the administration and you take the risk. The auditors, regulators and other people with authority will miss the boards, interface and metrics they know. So, you will be an easier target for them.

But suppose you dodge that bullet, there are tens of thousands, probably hundreds of thousands of integrations that need to be solved. Tax authorities, banks, regulators, public services, insurance brokers, police forces, firefighters, etc. And you can’t solve that easily with AI.

If there’s just one integration that doesn’t work, your carreer is at risk. Would you take that much risk if you could just keep using the software you have been using for a few decades? I don’t think so.

Vibe coding makes it cheap to build an application, but that’s only 5% of a company’s value. The rest is in convincing customers, integration, stability, security, etc.

The narrative that “every company will build its own solution with AI agents” underestimates the non-coding tasks. It’s easy to build a product now, but it’s hard to execute. Most of the customers of the companies Constellation has, don’t even have the teams and/or the willingness to do this.

Some say: “But cheaper competitors will come.” Well, same thing. To code, everything will be cheaper indeed because you can code much faster now. But that’s 5% of the work. Going from a product to a company is much harder than making a product.

The problems that VMS software solves for customers are compliance, security, reliability, data management, reporting, etc. It’s not cost. The cost is very low compared to the budget, as said. As long as the software works, very few will want to migrate.

And AI can also be a boost to the company. AI capabilites like copilots, AI search, deeper insights etc can be used by the CSU companies as premium products on top of the existing stack.

Management Transition

Mark Leonard is stepping back as CEO and this is the second bearish take you hear. But his successor, Mark Miller, was an executive at the very first company Leonard acquired. He’s literally been there from the beginning of Constellation as COO. The COO role at a serial acquirer is crucial: he’s responsible for full execution, integration, and advising acquired companies.

Leonard was visionary because he decentralized the company from the start. Managers at the underlying levels can decide on acquisitions up to a certain size within their domain. They’re taught the Constellation method. This is the most decentralized company I know, even more so than Berkshire Hathaway.

Valuation

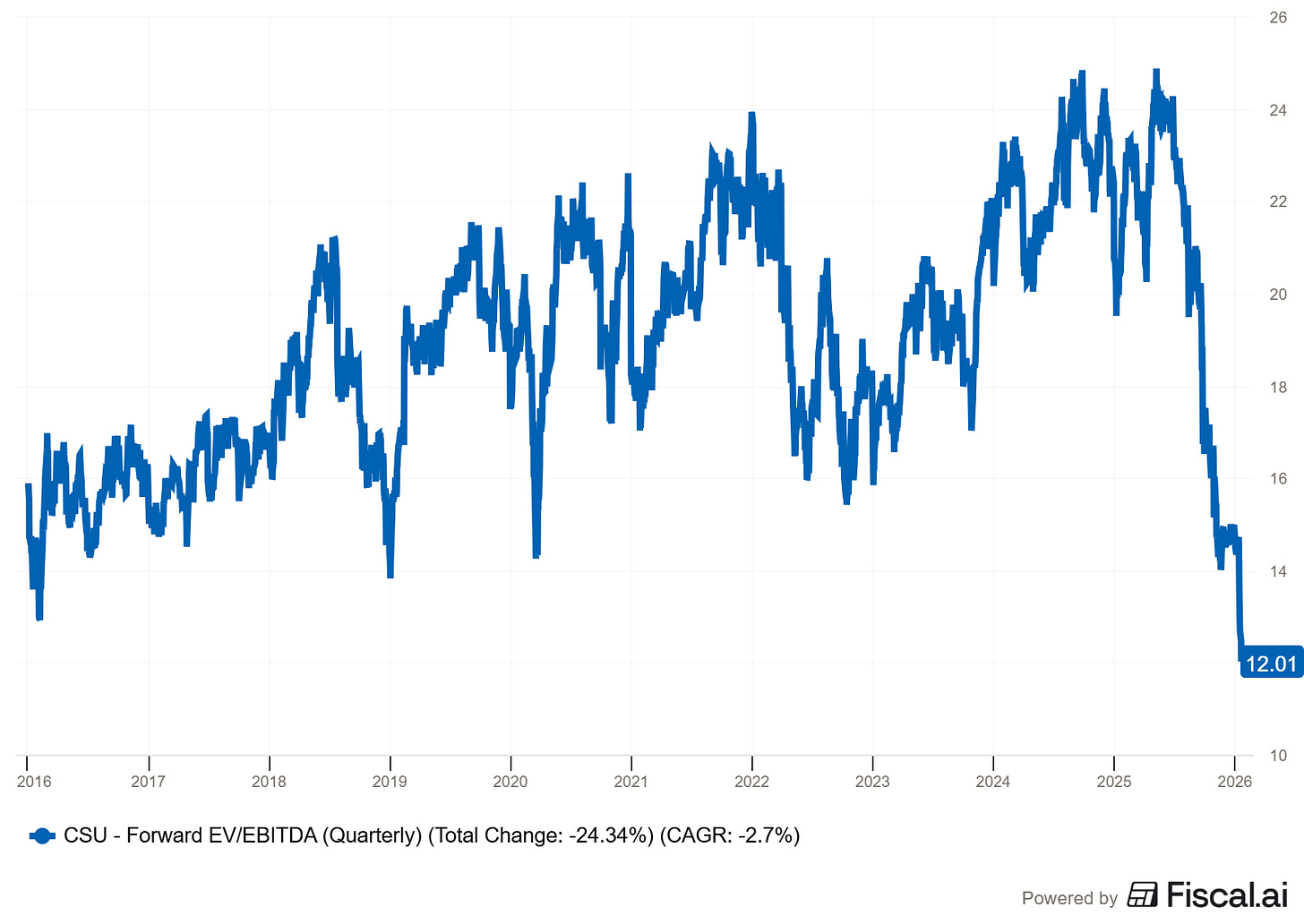

CSU currently trades around 12x forward EV/EBITDA. This is the lowest valuation in at least the last decade.

The market overreacts in both directions. Before the selloff, many software stocks were priced as if the sky was the limit. Now all names are being punished, regardless of fundamentals. Constellation was expensive as well, at 24x forward EV/EBITDA, because “it only goes up.”

Let’s zoom out a bit more. Since its IPO, Constellation Software has delivered a CAGR of 16.5% at the current price, while revenue grew by almost 20% per year. That means that there is a disconnect between the two right now and unless M&A really falls off a cliff (very unlikely), the stock is undervalued now.

Conclusion

Why doesn’t AI commoditize Constellation Software? Because its moat isn't in the programming. Whoever says that doesn’t understand the business. It’s about the deep entrenchment of the software, about reliability, compliance, regulation, integration, etc. AI will be an extension, not a threat.

The product isn’t the hardest part and never was. The hardest part remains finding customers, getting them to pay more, and hooking them into your ecosystem. Many forget that now. If you are a patient long-term investor, this is your opportunity.

Feel free to ask additional questions in the comments!

In the meantime, keep growing!

Disclaimer: I have a position in Constellation Software and I have used this crash to make it bigger.

Hello Kris. Thank you for your article on Constellation Software!

I have a vague question. I’m in the US and use Robinhood, Fidelity, and Schwab. What are the options for US folks to buy CSU shares? Any pointers would help.

Great article.. thanks for clearly articulating the reasons not to fear the bear case arguments put forth by AI and by Mark's retirement from the CEO position.