Hi Multi 👋

Every year, I set aside time to think.

OK, that sounds weird. I think constantly, every day, every hour, every minute.

But what I mean is that once a year, I go to a seaside cottage to think about Potential Multibaggers with a friend.

We plan, bounce ideas off each other, offer advice, challenge one another, and help each other grow.

We did that this week for two days, and it gave me fresh insights again.

I don’t want to talk too much about the implementation of the new ideas yet, as it always takes some time. In the next few months, you should see more.

But I can already tell you I’ll be looking for authors to help with earnings overviews. David has already joined, and I’m working on a few others as well. There’s still room, so if you’re interested or know someone who would be a great fit, let me know.

Want To Write For Potential Multibaggers?

If you have writing experience or writing talent and are interested in growth stocks, I could use your help.

Compensation is flexible and depends on your experience and situation. Are you interested?

Let me know in the comments section! Or maybe you know someone who might be interested? Please let them know in that case.

Free Webinar In Dutch

On Tuesday, for many, that will be tomorrow when they read this, I’m speaking for Lynx, the Dutch broker, in Amsterdam. This is in Dutch. The talk will be about Multibaggers (which I call Raketaandelen in Dutch.)

If you want to be there, it’s free and you can follow from your lazy chair.

You can register through this link.

If you don’t speak Dutch, it will not make much sense, unless you use AI translation, but I’m not sure it’s worth it in that case.

Articles In The Past Week

This is the third article this week.

The first article was published on the 15th and experienced Multis know that’s when I release the Best Buys Now.

We also looked at whether Roku is a Buy or a Sell right now.

Memes Of The Week

It was a good week for fun this week.

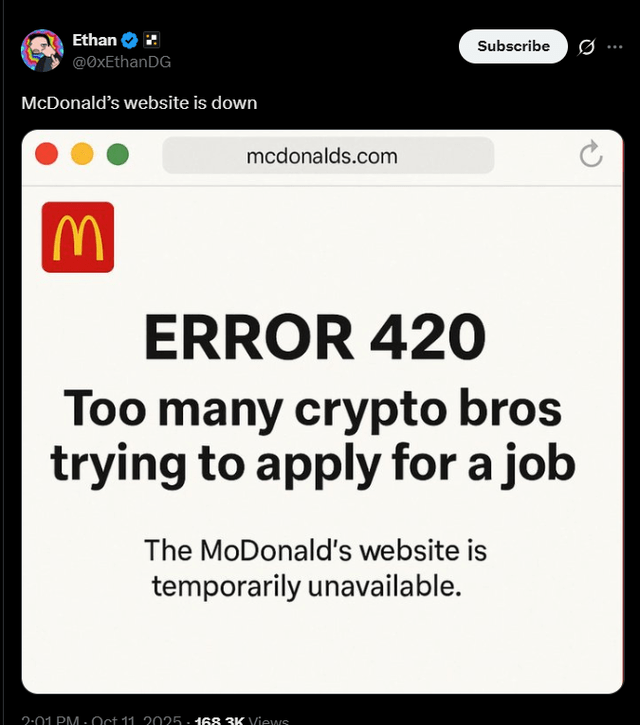

Last weekend, many crypto bros were wiped out because they were leveraged too much and many lost everything they had. This meme referred to that situation.

The second one is not really a meme, but it’s funny anyway.

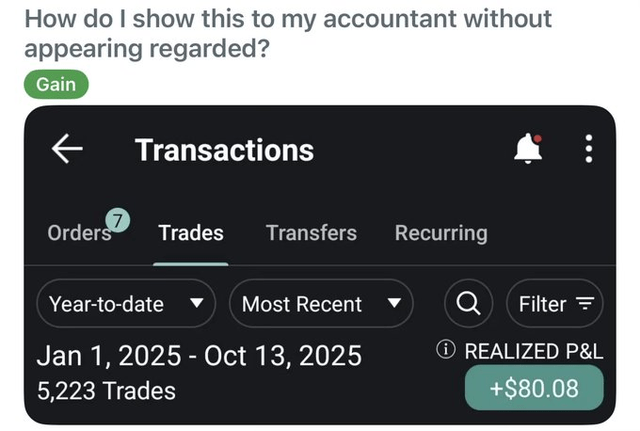

The third one is hilarious too. If you don’t get it right away, look closely.

After Walmart signed a deal with OpenAI, Multi Olivier shared this meme.

Another meme took the same situation to an even greater extreme.

And the last one, but not the least one, is from Leandro from Best Anchor Stocks. This was about ASML:

Interesting Podcasts Or Books

This week, I listened to my friend Michael Gielkens on Bogumil Baranowski’s podcast Talking Billions.

Michael is a fantastic guy. This is a world where the term ‘friend’ is used loosely, but Michal is a real friend. And he knows more about family holdings and serial acquirers than anyone I know.

The markets in the past week

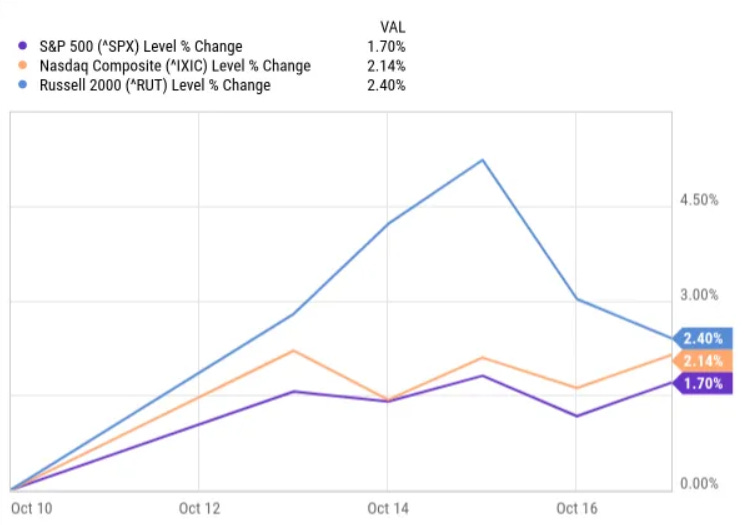

After the tariff-driven losses last week, the markets rebounded this week. The S&P 500 grew by 1.70%, the Nasdaq by 2.14% and the Russell 2000 by 2.40%.

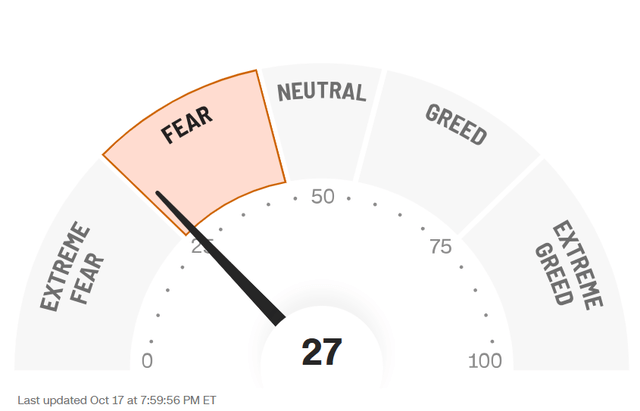

The Greed & Fear Index dropped to Extreme Fear early in the week and stayed there until Thursday, but it eventually ended in Fear.

Lesson Of The Week

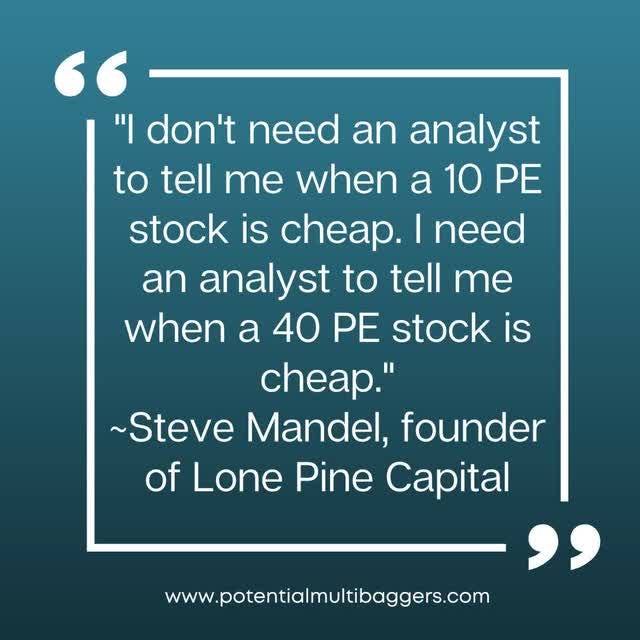

This week, it’s about this quote.

There are a few sides to this.

Often, when I pick a Potential Multibagger, the first question I hear is, “Isn’t it very expensive?”

Well, if you have the stock of a great company that will experience high revenue growth for a long time, even when a stock looks expensive, it can be a great stock to own.

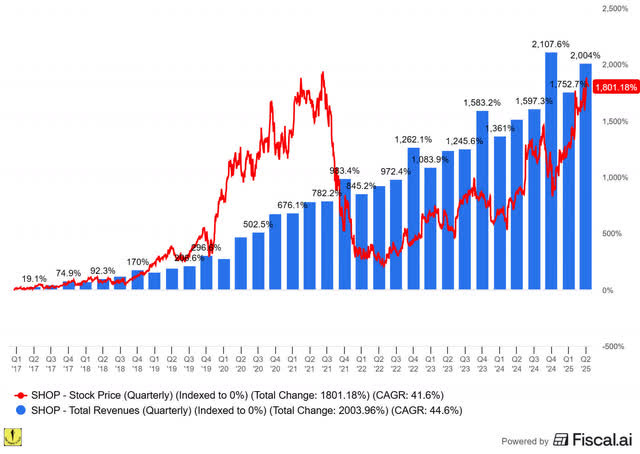

Just look at Shopify. This is since I picked it as the first Potential Mutlibaggers pick on May 2, 2017.

Revenue is up 2,004%, the stock is up 1,801%. It was ‘crazily overvalued’ then and it’s ‘crazily overvalued’ now.

Yes, it dropped 85% in 2022. As experienced Multis know, I bought several times during that period. That’s the advantage of knowing a company well and investing for the long term, not the short.

Still, probably 90% of the investors who claim to invest for the long term invest for the short term if you look at their behavior.

Actually...

Make that 95%.

Know the game you are playing. That’s the first lesson.

The second lesson?

Growth matters. You can have a stock trading at 40 times PE that’s very cheap. That’s why I made Nvidia a Best Buys Now stock in both December 2023 and January 2024.

Quick Facts

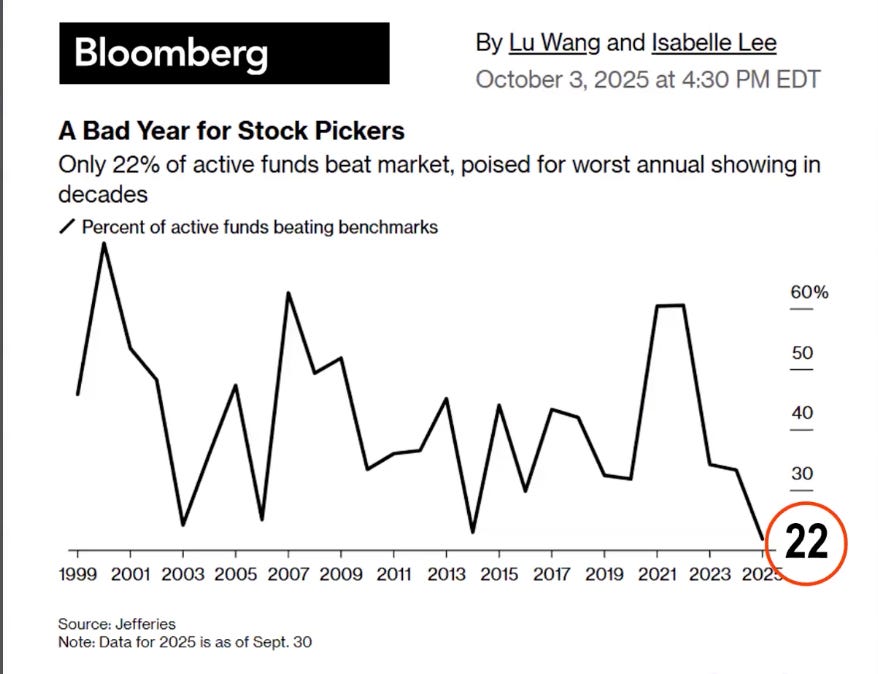

1. Active Fund Managers: Awful Year

Just 22% of active fund managers have outperformed the market this year. That’s the worst performance in more than 25 years.

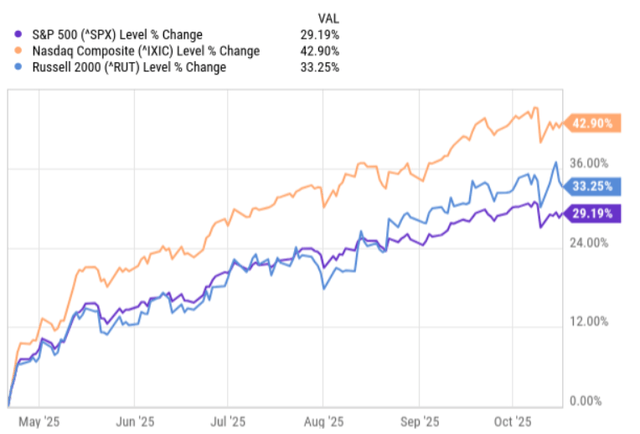

Many fund managers thought the April tariff tantrum problems would continue for the rest of the year and a recession was near. That’s why many shorted stocks. This is what has happened since the low.

These are the most intelligent people you can imagine. But still, they get it so wrong. Maybe it’s because they are so smart they think they can time the market?

Those are the same people who will tell you they were perfectly hedged. And maybe they are. But they will not tell you how much upside they missed for that hedge to work eventually.

I’ll keep repeating it, for me, it’s simple:

TIME IN THE MARKET BEATS MARKET TIMING.

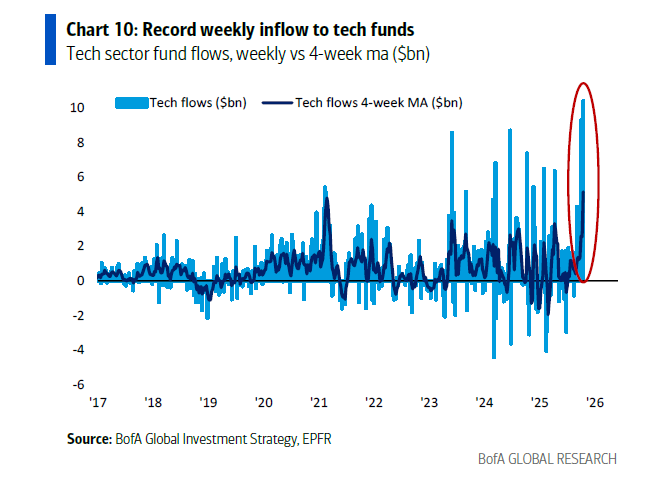

That underperformance might also explain this chart:

As you see, a lot of money was invested in tech.

I can already hear the condescending comments about “retail investors” (a term I hate, by the way; I prefer ‘individual investors.’). But if it’s that much money, usually, that doesn’t come from individual investors alone. Maybe professionals see a blow-off top coming and want to participate after having lost so much this year? You know, get some gains before the end of the year, so they don’t get too many complaining customers.

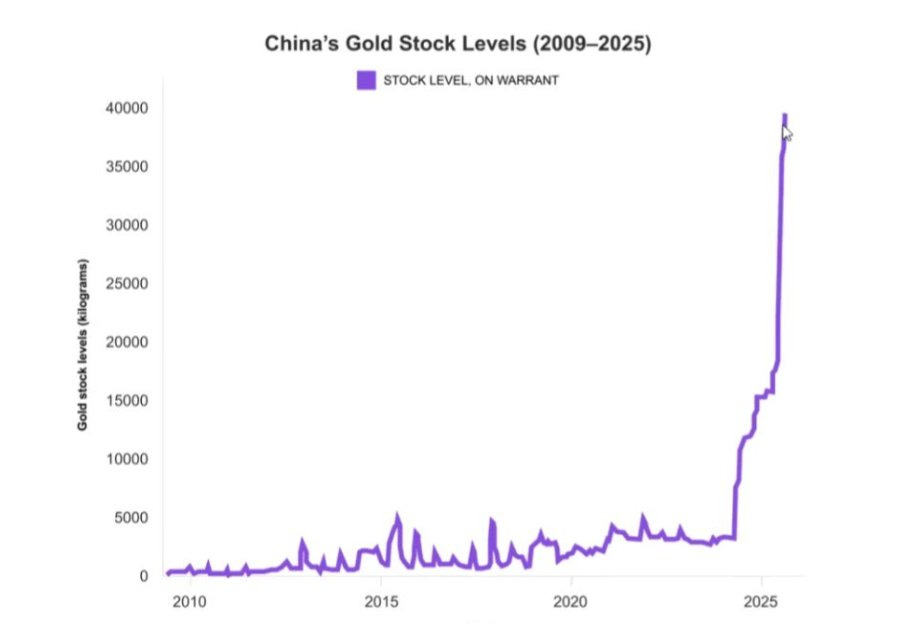

2. The Gold Bull Run & China

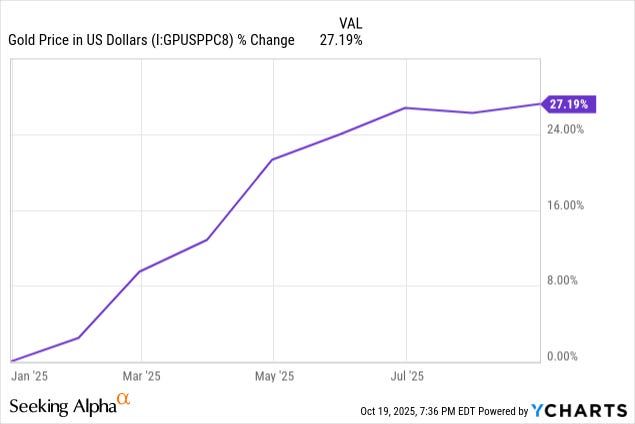

Gold bugs are swarming social media again. It’s a rare species that appears whenever prices spike. You don’t often see them in the wild, but they come out when the gold price spikes, which is the case right now. Gold is up 27.2% year-to-date.

Many see this as some sort of sign. A recession will be there soon. Or the dollar dominance will collapse. You read all sorts of explanations.

But how about this one?

China is buying gold like crazy.

Now, think about it. Doesn’t that sound logical? Especially if you combine it with this.

In other words, the Chinese sell dollars, which makes it drop. Why? Because of what happens with the tariffs.

We all know that the eventual game is not US vs. the world, but US vs. China.

If you were China, facing tariff uncertainty, would you prefer dollars or the neutrality of gold?

3. Is There A Bubble?

I have repeated this question a few times already now in the Overview Of The Week. Of course, the answer is that I don’t know. But the fact that it keeps coming up can also mean something.

In the last few weeks, my answer was also ‘I don’t know’ but I wanted to counter the people who have been bearish for a long time. For a long time, I said there was no bubble, and up to now, I’ve been proven right.

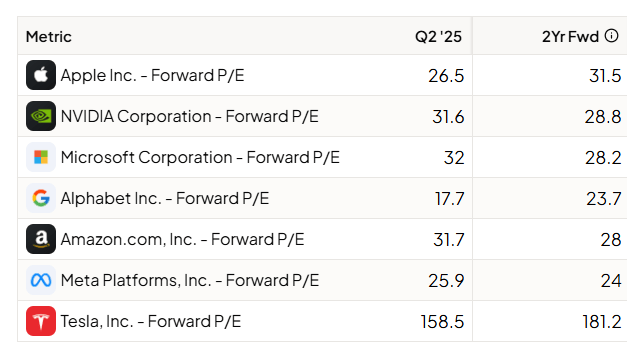

Right now, I’m not sure. This could be the start of a bubble. The OpenAI financing deals feel weird. But I don’t see excessive valuations for the Mag7, for example. Sure, they are expensive, but not out there. These are the PE and the 2026 PE (2 years forward is 2026, because this year is not over yet).

Yes, this is also from Fiscal. With this link, you get 15% off.

But “I don’t know” also means there are arguments on both sides.

OpenAI has said it will build 26GW of capacity. That’s more than $1.5 trillion at the current cost. Sure, Nvidia invested $100 billion in OpenAI and probably, OpenAI will sell AMD shares from the 10% stake it might get if the stock goes to $600. But where will the rest of the money come from?

Well, I’m pretty sure the current cost is not the future cost. DeepSeek already hit the AI world. It turns out a Chinese company found how to be more efficient. That’s how innovation works and it will probably work like this going forward as well.

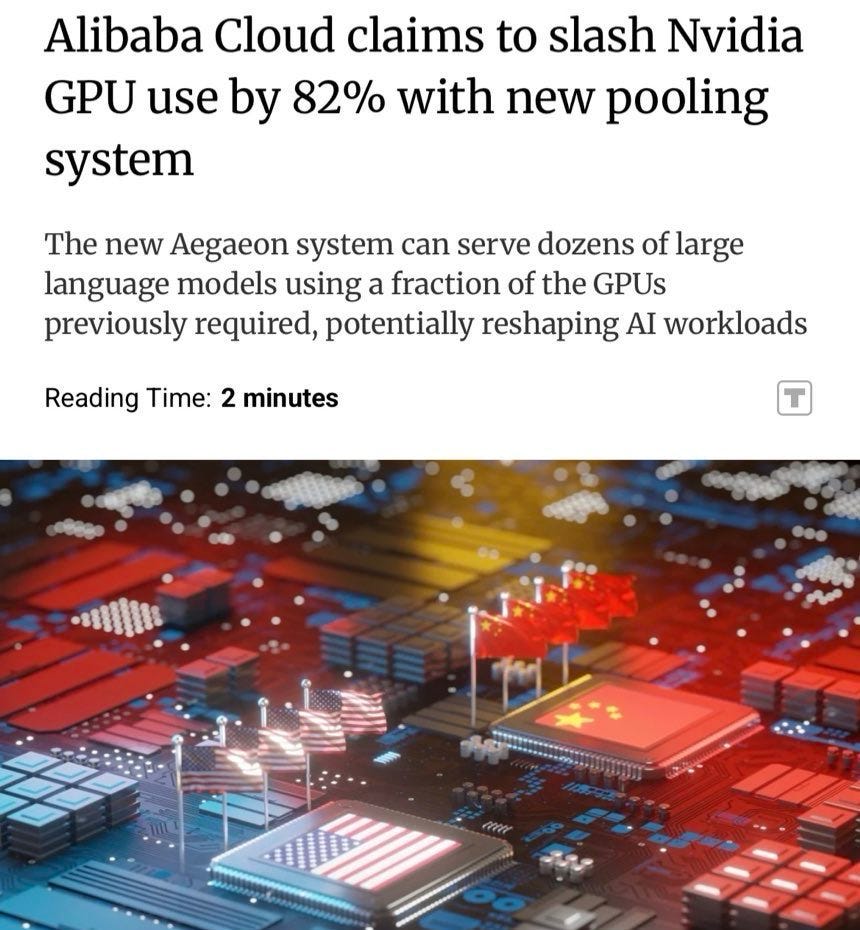

Not convinced? Look at this headline.

Now, is this bearish for Nvidia? I don’t think so. First, there’s no independent control if this is true. But let’s assume this is true. That 82% will be in optimal circumstances, which is often not the case. On top of that, this was just a beta test for inference.

To me, this is the bull case. If there are no innovations, this will be a bubble.

If OpenAI can’t pay for the expansion it has committed to, even if Big Tech can, the expectations and stock prices will drop. OpenAI is the weak link in the whole chain.

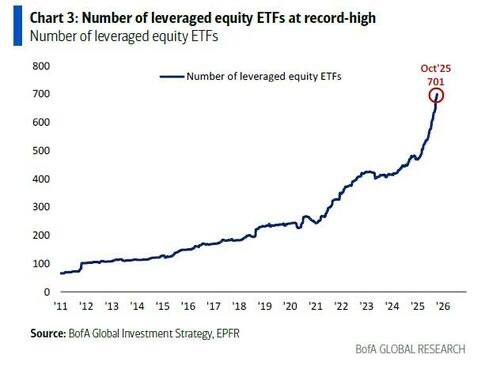

I also saw this graph.

Now, this is just the number of leveraged equity ETFs, not the number of people investing in them, but the two probably evolve in parallel.

That doesn’t mean I think the stock market is about to collapse. But it does feel more bubbly than in 2023 or 2024, when many were already calling it one

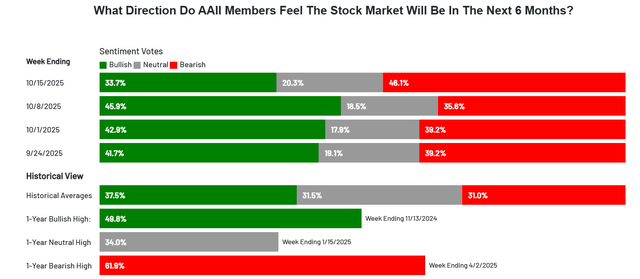

A counterargument is that the bearish sentiment in the AAII sentiment meter was up. The AAII is the American Association of Individual Investors.

4. Nu’s Top-Notch Quality

Several weeks ago, I added Inter (INTR) to the stocks on my watchlist, but the company couldn’t convince me to invest in it (yet?).

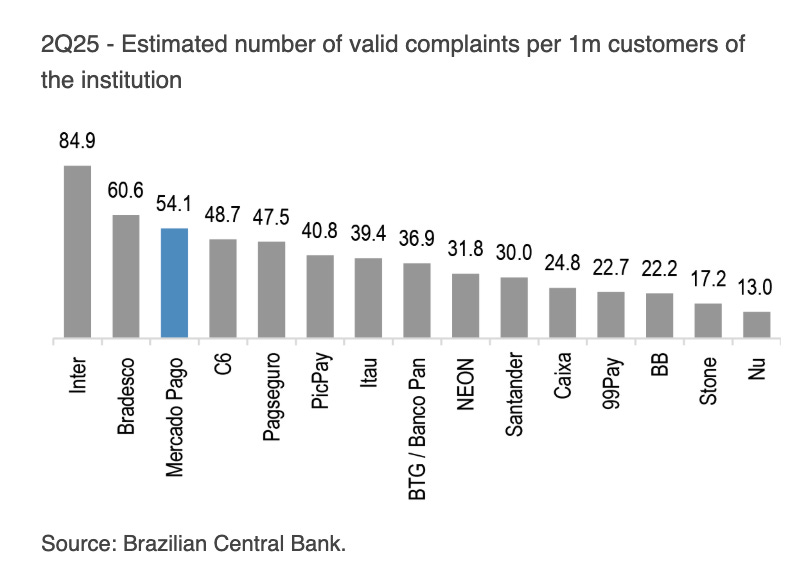

This week, I saw this chart.

Inter has most valid complaints per 1 million customers, while Nu is dead last, a position you want in this ranking.

Mercado Pago, Mercado Libre’s payment processor and digital bank, has quite a bit more. To me, that’s not a big surprise. Nu started out as a bank from the start, Mercado Pago didn’t. I have a suspicion if you looked at this a few years ago, Mercado Pago would have done even worse. As a banking institution, Mercado Pago is still very young. First, it was just payments, which is a totally different animal. So, I’m not concerned about that.

5. Hims’ Andrew Dudum, Shady Behavior?

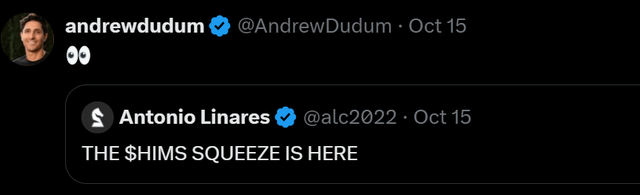

This week, Andrew Dudum, founder and CEO of Hims & Hers (HIMS), reposted a post on X with the eyes emoji.

Hims & Hers had an important launch on the same day (see later in the Overview Of The Week). And Dudum also proposed to sell shares a day later. Now, this was planned and a CEO selling shares on the way up is very common. Don’t forget he still owns about 10% of the outstanding shares worth about $1.25B.

I read many comments about this being so scammy.

He could have handled it better, but I wouldn’t read too much into it. It wasn’t illegal behavior.

Hims & Hers has been under attack from short sellers for a long time already and that must feel frustrating. Executives like Palantir’s Alex Karp and Elon Musk have spoken about short sellers in far stronger terms.

Remember Elon’s ‘Funding secured’ tweet? That was aimed at the short sellers.

Alex Karp was even more vicious:

I love burning the short-sellers. Almost nothing makes a human happier than taking the lines of cocaine away from these short sellers who are going short on a truly great American company.

They just love pulling down great American companies so that they can pay for their coke.

The best thing that could happen to them is, we will lead their coke dealers to their homes after they can’t pay their bills.

So overall, I think Andrew Dudum’s frustration wasn’t too bad.. Don’t forget that this guy built Hims & Hers from the ground up and the short reports and short sellers can be very frustrating in that context.

This is where the free part ends.

If you want full access to Potential Multibaggers, here’s what you’ll get:

✅ The rest of this article (with the Stocks On My Radar)

✅ All the picks, with two very recent ones.

✅ My full portfolio (with every transaction)

✅ The most recent pick

✅ An archive with insightful articles

✅ Access to our private chat group

✅ Best Buys Now (outperforming the market by 30% over 3 years.)

✅ 7-day money-back guarantee, no questions asked.