Hi Multis

David dove into the Roku (ROKU) earnings.

Take it away, David!

Hi Multis

Since Roku’s Q2 earnings were released some time ago, we’ll focus less on the results and more on the context surrounding the report. And of course, Kris will assess if it’s a buy, hold or sell now.

Revenue: BEAT

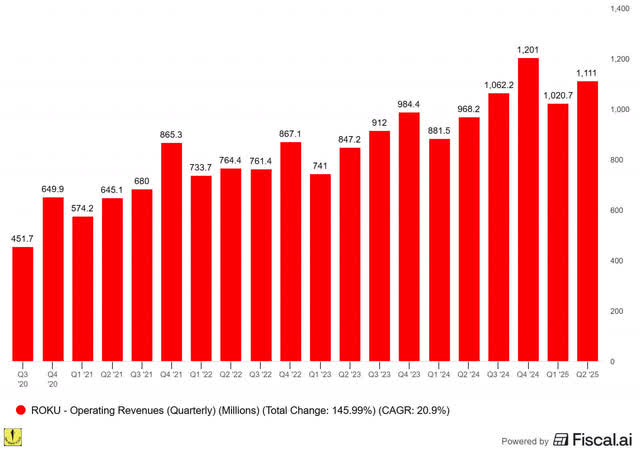

Roku beat revenue expectations of $1.07 billion, reporting $1.11 billion—up 15% year over year and 8.9% sequentially.

EPS: BEAT

The consensus for Roku’s earnings per share was -$0.16. Roku, however, managed to turn this around and deliver a GAAP EPS of $0.07.

Gross Profit

Gross profit came in at $498 million, up 17% year over year. A key surprise was that the devices’ gross profit broke even, contradicting prior expectations of a loss.

The results of Roku’s second quarter exceeded expectations. Driven by growing advertisement and subscription fees, +18% year over year, Roku was able to shift from a device-centric business model to a more sustainable platform model.

If you are from Europe, Roku might not sound like a household name. I’ve followed Roku for quite some time but haven’t had the chance to properly use its hardware or operating system yet. When analyzing a company, I find it essential to try out their products or, at the very least, ask others about their experiences. This allows me to compare the company’s offerings with similar ones and see how they compare to their competitors. I was able to find a couple of friends of mine (mostly living in the US) who are familiar with the product offerings. One of them is an avid user of the product.

This made me more curious, as with so many streaming offerings (Netflix, HBO, etc.) and devices (Google’s Chromecast, Amazon’s Fire TV, etc.), why would someone choose Roku above products from Google and Amazon?

There seems to be no specific reason, but when I polled my friends, the main reason was the user interface of the platform. Combine that with its content-neutral approach, and Roku stands out from many competing platforms.

Let’s go beyond Roku’s numbers to see what else the company achieved in Q2 and what lies ahead. Sit back, relax, and enjoy!

Strategy

Roku’s management recently reiterated its overall strategy. When I notice senior management discussing their strategy in detail across multiple broadcasts, I am always interested in listening carefully and conducting a brief analysis of their viewpoints. Let’s take a closer look.

Roku’s strategy consists of three parts: getting scale, increasing engagement, and monetization.

Scale is the first part of the strategy that needs attention; gaining sufficient market traction forms the foundation of Roku’s strategic plan. Currently, Roku’s broadband penetration stands at about 50% in its primary market, the U.S.

Roku’s other primary markets are Latin America, particularly Brazil, as well as Canada and the UK. This expansion is essential for increasing broadband penetration.

The second part of its strategy is increasing engagement on the platform. Achieving sufficient market penetration and engagement makes the platform more attractive to both content providers and advertisers. Currently, about 20% of all viewership in the U.S. comes through the Roku platform.

Engagement is driven mainly by Roku’s operating system (’OS’). This OS is critical for Roku because it allows the company to guide users toward specific content and, more importantly, learn from their preferences. Netflix does something similar: when you open another user’s account, the layout is familiar, but the suggested shows and genres are different.

Services like Netflix, YouTube, and HBO can all be accessed through Roku’s platform, expanding the available content library. Roku has refined its OS to nudge users toward content they’re more likely to purchase. One example of this can be seen during major sporting events. For events like the NFL or the Olympic Games, Roku creates dedicated zones and promotes them prominently on its home screen. Highlighting these events makes users aware of them and encourages participation.

This focus on driving purchases leads to the final part of Roku’s strategic framework. The focus has been on this part for the last two years, and we are finally seeing the impact of this focus in the figures. With cost structure adjustments and solid margins, Roku’s cash flows are now rising.

Advertising

Roku has different DSPs (Demand-Side Platforms) that allow advertisers to buy ad space on Roku’s devices and services. Roku initially planned to build and operate its own DSP. The next step would have been to drive ad volume through this DSP. However, after testing and research, they decided to go in a different direction. Roku now prefers a more open approach toward other DSPs and SSPs (supply-side platforms). In doing so, they can meet advertisers where they feel most comfortable transacting, creating a more diverse pool of advertisers.

The content on Roku is also increasing by allowing more content providers to be on the platform. By doing so, they generate more ad inventory. Inventory, in this case, means more advertising space on the platform. Having more inventory lowers the CPM (cost per mille—the price an advertiser pays for a thousand impressions) since Roku wants to sell all available inventory and minimize waste.

With more inventory, they continue to lower the CPM cost and set their pricing to capture the entire price curve, thereby avoiding unsold inventory. This creates a strong feedback loop.

Frndly TV Acquisition

On May 1st, Roku announced that it would acquire Frndly TV, a subscription service. Roku will pay a total of $185 million to acquire more than 50 channels, including The History Channel, Lifetime, and Hallmark Channel.

Roku made the acquisition to increase its subscription revenue, especially in the US, as Frndly TV is known to primarily cater to the US audience. The acquisition is in line with its whole strategy to broaden its user base, deepen engagement, and boost subscription revenue.

Personally, I can understand the acquisition within their strategy. Expanding content inventory should increase engagement and attract more users to the platform overall. I consider this to be a win for Roku.

Global Expansion

Roku’s core markets are the United States, Mexico, and Canada, followed by the United Kingdom, Latin America (mainly Brazil), and Germany.

It looks like solid growth already, but a platform business is mainly known for its easy scalability. Why is Roku then not involved in more countries?

The answer to this question holds many layers.

Let us begin with the content available on Roku’s platform. Roku has both its own content and third-party content. In both cases, the content is entertainment, ranging from movies, TV series, live sports events, and similar. For all this entertainment, different contracts and licenses need to be acquired depending on which region and/or country the entertainment is being consumed.

Not an easy feature, as adding another country into the mix will undoubtedly increase the legal fees and complexity in programming their OS.

A second reason for not expanding is the current focus on monetization. As just mentioned, Roku is planning to fully monetize the Canadian and US market. They will do this to increase their cash flow and cash balance, thereby gaining the flexibility to make new strategic decisions over time.

A third reason is undoubtedly the focus on scaling countries such as Mexico and Brazil. Increasing advertising opportunities in these countries and ensuring they can soon match the monetization levels of Canada and the US is the key focus.

In short, they want to focus on the current markets in which they are active. Improving them in terms of scale, engagement, and monetization is the main focus of Roku. Global expansion is therefore not their core focus.

Competition

oku competes in both hardware (streaming devices and smart TVs) and in its content and advertising platform.

Recently, Amazon and Walmart announced adjustments in their product portfolios that are directly correlated to Roku.

Amazon is building its own tech stack and expanding its ecosystem through Fire TV and Fire OS, both of which are streaming devices. Something that can be seen in a standard Prime subscription is that in recent years, Amazon has been slowly adjusting its OS and adding more streaming subscription options. As a frequent Prime user, I noticed this shift when Amazon revamped its OS to improve navigation across both online and smart TV devices. Prime now offers subscription add-ons for HBO Max, Apple TV, MGM+, and many others within its catalog.

Walmart, on the other hand, recently acquired Vizio in 2024, which is growing in the US. It’s integrating its software into new smart TVs, reducing the need for external devices like Roku.

Looking only at this information, we might conclude that Roku has an issue. However, Roku’s OS remains stronger and more user-friendly than Amazon’s. It also supports far more plug-ins and subscription options than Amazon currently does.

In the case of Walmart, the real risk lies in the details. Walmart is integrating the software directly into the TVs, which may give the impression that it will never be needed. My current TV has been a smart TV from the get-go, but its software is long outdated, and I don’t view current smart TV solutions as a direct threat to Roku’s business.

Roku’s OS simplicity and functionality are key strengths; its ease of use and hard-to-replicate design help preserve its competitive moat.

Conclusion

It is clear that with competitors such as Google, Amazon, and the likes, growth will be key for Roku.

But how can they generate this growth? In this sense, capital allocation will be one of the more essential aspects within Roku in the coming months and years. Initially, Roku plans to repurchase $400 million worth of Class A common stock. It’s a positive move, though it will make only a small dent in Roku’s $2.2 billion cash balance.

Dan Jedda, Roku’s CFO, is already hinting at new acquisitions. Currently, Roku is focused on acquiring companies with consistent growth track records that could benefit significantly from integration into its growing ecosystem.

Investing further in its operating system and user interface helps Roku maintain its competitive edge, expand content offerings, and eventually reach new markets.

And with this, I hand the pen back to Kris for the Quality and Valuation Scores.

If you want full access to Potential Multibaggers, here’s what you’ll get:

✅ My full portfolio (with every transaction)

✅ The most recent pick

✅ An archive with insightful articles

✅ Access to our private chat group

✅ Best Buys Now (outperforming the market by 30% over 3 years.)