The AI Fable (Overview Of The Week 33)

A story of volatility, vision, and the value of knowing what you own

Markets have been wild lately. This week, Adyen gave us another reminder; the stock plunged 20% intraday, only to recover most of that by the close, ending down just under 6%.

Moments like this are exactly why preparation matters. If you’ve been following my Adyen coverage over the years, you already understand the business better than most. That knowledge gives you an edge when volatility strikes.

Before we dive in, a quick personal note...

Aside from two quick days at the Belgian coast, I haven’t taken any time off from Potential Multibaggers this summer. But this Wednesday, I’m hitting pause for a bit. My family and I are heading to Curaçao for a week of proper holiday.

I might write a bit on the plane (if the Wi-Fi cooperates), and maybe even while we’re there. But expect fewer updates during this time. There probably won’t be an Overview Of The Week next week.

Now you know this, let's go to the Overview Of The Week.

Articles In The Past Week

This is the fifth article this week. Let's look back at the four previous ones.

In the first article this week, I looked at how attractive The Trade Desk is after the big drop.

The second article revealed what I had bought for my Forever Portfolio.

Like every 15th of each month, you also got the Best Buys Now this week on the 15th.

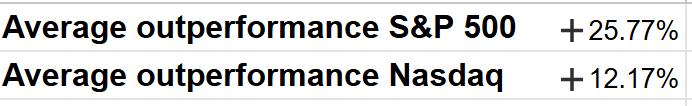

I've been doing Best Buys Now since May 2022. Over the three years from May 2022 to May 2025, the results of the Best Buys Now crushed the returns of both the S&P 500 and the Nasdaq.

The average Best Buys Now pick outperforms the Nasdaq by 12.17% and the S&P 500 by a whopping 25.77%.

So, it may be interesting to look at the Best Buys Now of this week.

The last article before this Overview Of The week was an analysis of Ayden's earnings, a Quality Score, and a Valuation update.

Memes Of The Week

Three memes this week. I made all three myself.

For the next meme, I want to make clear I've got nothing against Palantir. It's a phenomenal company, and if the stock were to see a big drop, I might even consider a position.

But the current valuation makes no sense at all. I've seen this picture before and I know how the story will end, even if the X Palantir fanboys don't want to hear it. The stock trades at more than 100x forward (!) sales. A P/S of 100 is not a stock you should buy.

That's why I made this meme.

I feel like there's more and more froth in the market. I'm not calling a top here, as that's impossible. And there are still opportunities in the market. But I see too many high-testosterone traders pounding their chest. It starts to resemble 2020-2021 more and more. But to be clear, I don't think we are there yet. As long as that happens, this still goes.

Interesting Podcasts Or Books

As a Shopify shareholder since 2017, I always love listening to a podcast with Founder and CEO Tobi Lütke or President (and former COO) Harley Finkelstein. This time, Finkelstein was on Shane Parish's podcast, The Knowledge Podcast. You can find the episode on your favorite podcast player or here on YouTube.

It's a great interview to give you more insight on Shopify and its founder, Tobi Lütke.

I also want to give a shout-out to the guys from Chit Chat Stocks. For years, Brett Schafer and Ryan Henderson have been bringing consistent quality content.

I'm a regular listener and I have been a guest a few times too. This week, I listened to the episode about Oscar Health. Again, you can listen on your favorite podcast player or here on YouTube.

The markets in the past week

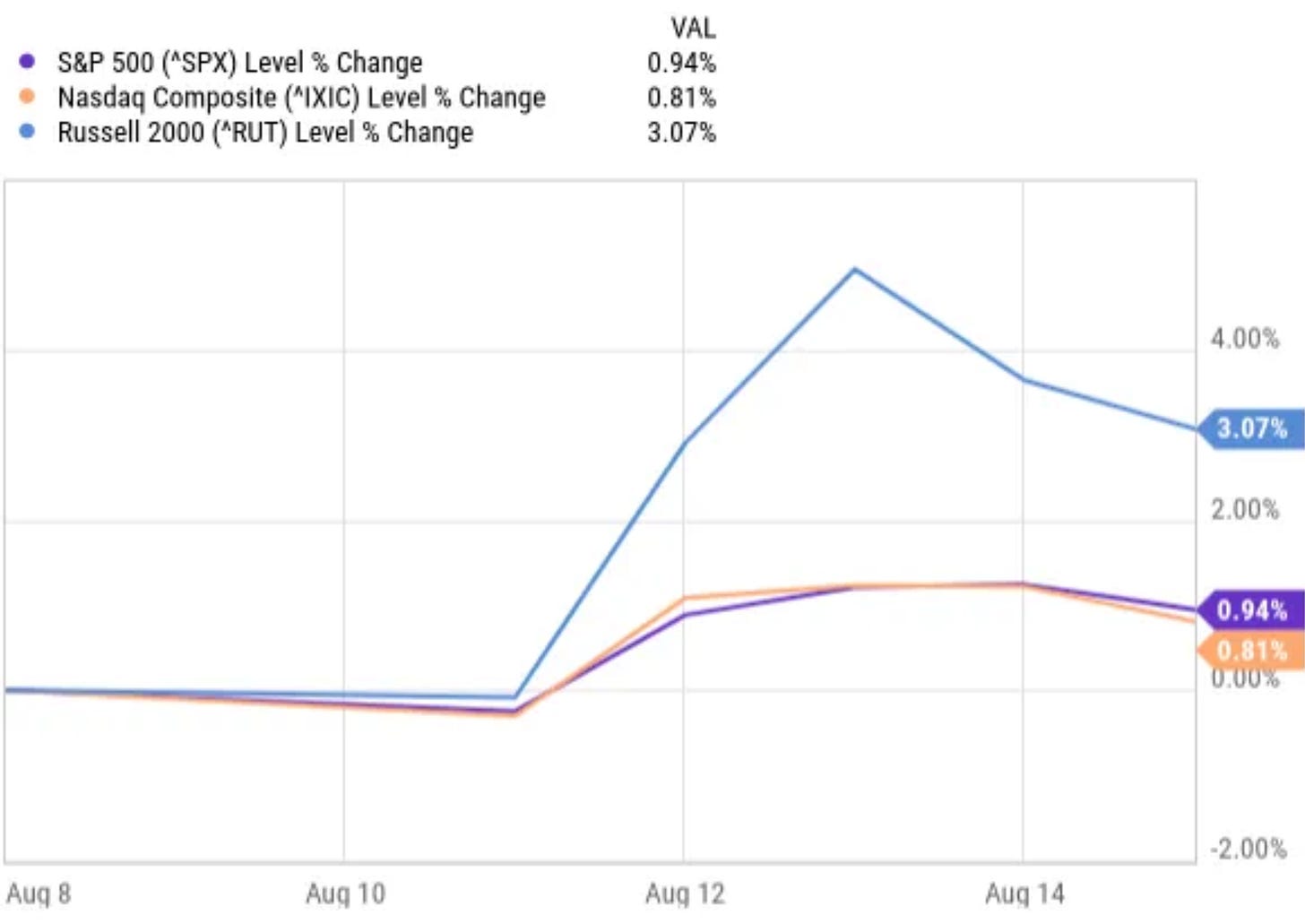

Like in an overwhelming majority of weeks after the April lows, the markets were up again this week.

The Russell 2000 was up 3.07% this week, much more than the S&P 500, which was up 0.93%, and the Nasdaq, up 0.81%.

As a consequence, the Greed & Fear Index climbed from 59 to 64 and remained in Greed.

Quick Facts

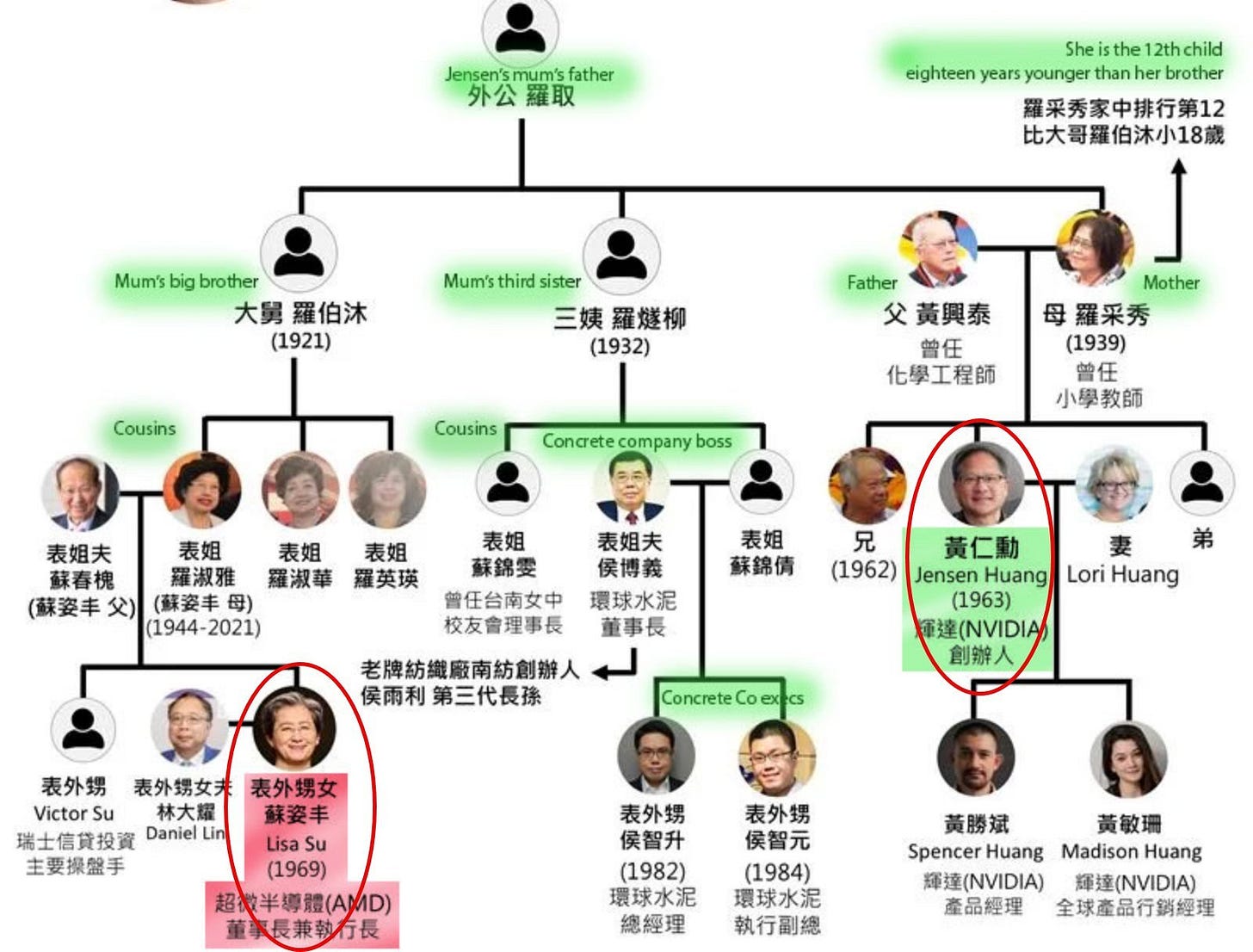

1. Did You Know... That Jensen Huang and Lisa Su Are Family?

Here’s something many investors still don’t know: Jensen Huang, the founder and CEO of Nvidia, and Lisa Su, the CEO who turned AMD around, are actually family.

Yep, two of the most influential figures in semiconductors share more than just industry dominance.

Both were born in Tainan, Taiwan and both immigrated to the US. Lisa's Su's mother and Jensen Huang are first cousins. Lisa and Jensen only got to know each other through their roles as CEOs of two of the most influential companies in the US.

2. AI Productivity Gains

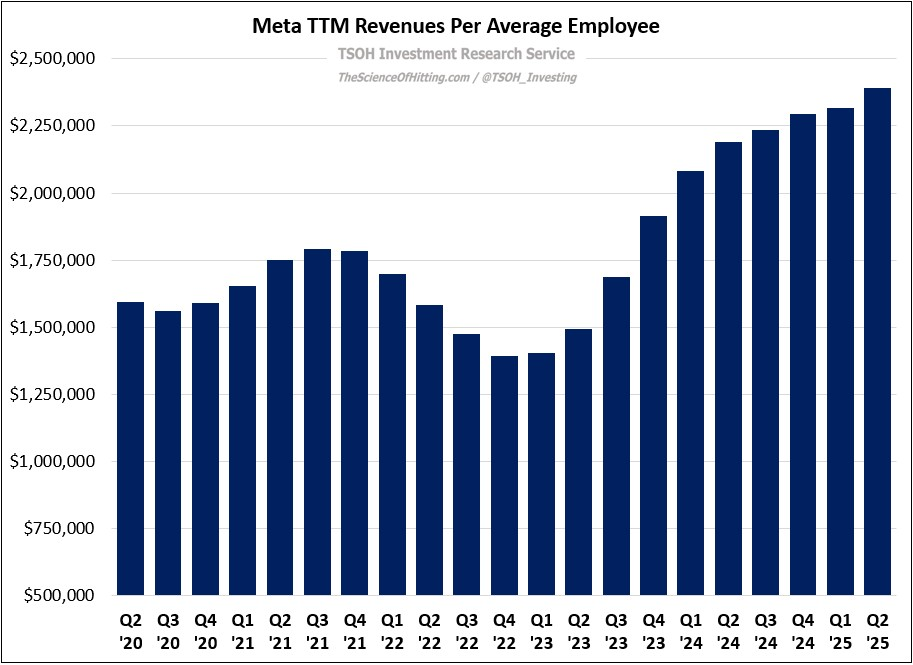

I still hear many claim, especially value investors, that AI doesn't bring value. I think they close their eyes. There are clear signs AI brings real value.

This is Meta's revenue per employee, for example. It's has nearly doubled in the last three years.

Another one?

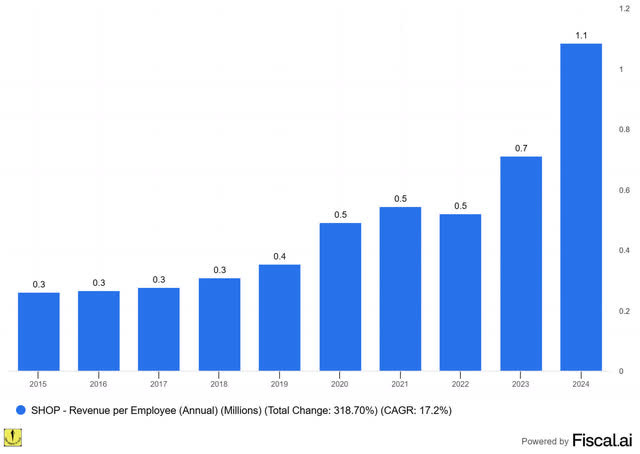

Shopify's revenue per employee.

In 2022, Shopify's revenue: $5.6B with 11,600 employees.

Shopify in 2025: Revenue expected to be $11.3B with... 8,100 employees.

If you think that's not valuable, think again.

Potential Multibaggers has a partnership with Fiscal ai (the research platform I use every single day, for charts, screening, research, conference calls, company-specific KPIs, and so much more, like this chart of the revenue per employee.

This allows us to give you a 15% discount with this link.

3. AI Is Not Eating Software

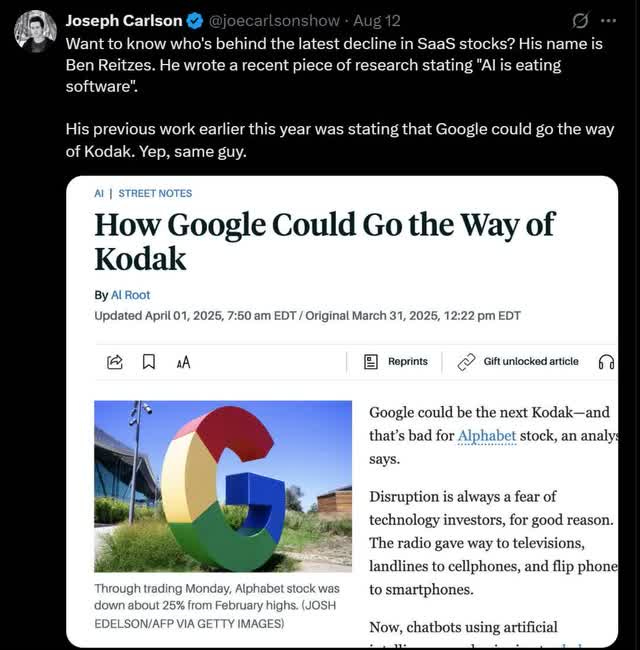

Joseph Carlson, who has a popular YouTube channel where he brings quality content, wrote this on X this week:

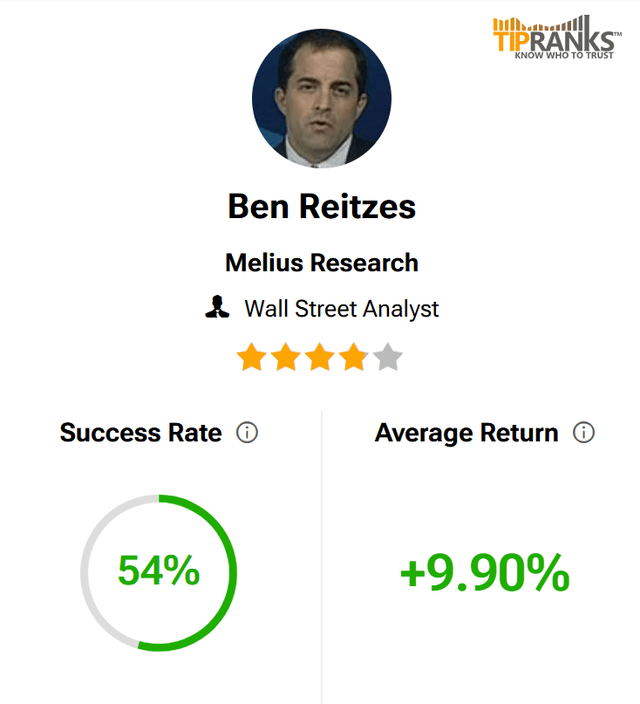

Ben Reitzes is a Managing Director and Head of Technology Research at Melius and has been in the industry for 25 years. That gives him some credibility. But for a technology guy, his track record is not that great. Tipranks follows the returns from analysts and bloggers after 1 year. I'm not a huge fan of this because it focuses on the short term (one year is short term for me) but it's all we have.

This is his track record:

9.90% is not that much in tech, especially not if your time frame is one year, so you should be optimally positioned for this game.

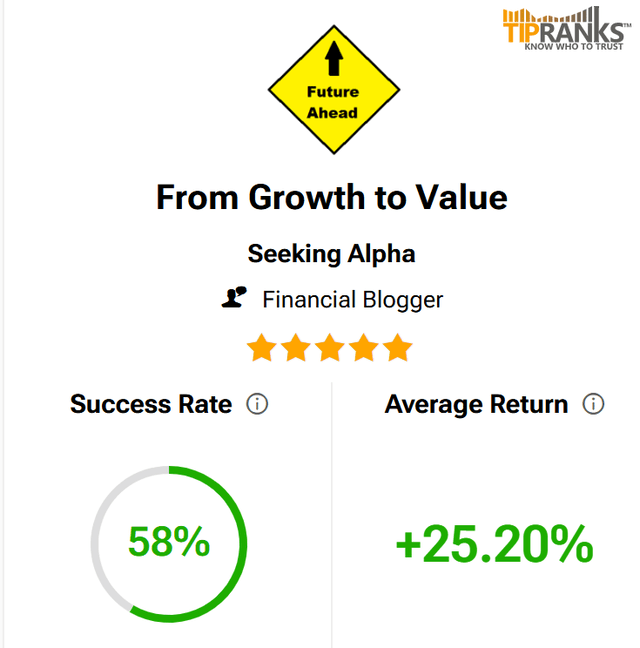

Now, I don't want to pound my chest here, but this is my track record over one year (funny that they still use my very first logo from 2016, by the way).

And as you know, I don't even aim for one-year returns.

It's a story, and a weak one, just like his Google story earlier this year. But it's repeated everywhere on social media.

And it's misleading.

It's not about building something. That's the easy part, now or a decade ago. The hard part? Getting the customer base, mindshare, the user interface, the integration in customers' systems, stability, reliability and security, the brand name and sooooo much more. I'm happy to go against the current here. If this story holds for a few months, we could see some great opportunities.

So, this is a story, an AI fable you should not believe.

This is where free readers stop. Paid users can scroll to the next section (‘Stocks On My Radar”)

What you miss as a free user:

My complete portfolio

All my transactions

The Best Buys Now

Deep analysis of the picks and the earnings

The Quality Score

Valuations

A private chat group where you can ask questions or just talk about stocks

A new pick soon. Some of my previous picks included Shopify at $7.78 (no typo!), Cloudflare at $39, CrowdStrike at $93, Duolingo at $92, Nu Holdings at $4.47, etc.

Upgrade now to unlock the full value of Potential Multibaggers.

👉