Hi Multis

It's almost Christmas and New Year and that's a time to look back. And I look back with a feeling of gratefulness.

I'm also grateful for my family, my friends and all the people I got to know (better) in 2024. It's been a truly enriching year in that area, as I went to Lisbon for a financial creators congress, to Omaha for the first time and to Vail for Value X Vail, for which Vitaliy Katsenelson invited me. In all those places, I met great people that I have regular conversations with. Seeing that many were impressed with Potential Multibaggers is much more than I could have ever dreamed of when I started this all those years ago.

But I'm especially grateful that you are here, dear Multis. I'm grateful that you value my work and you are reading this. I hope you can enjoy the upcoming period with your loved ones.

Articles in the past weeks

This is already the 4th article this week, so an overview is probably useful.

We started the week with the Best Buys Now for December.

The second article this week tried to answer the question if Mercado Libre is a buy now.

It's the third week of the month and then I usually add to the Forever Portfolio. I did that again this week and I explained my reasoning in this article. I added two new positions to the portfolio.

Visuals

This week, I made a PDF with 5 steps to master financial models. Last week, I learned that you can only upload documents of 10MBs but you can download it here directly.

Memes Of The Week

There was an abundance of memes this week.

The first is a clip.

It's funny because it's true. I see many investors who have invested in crypto that have a much higher pain tolerance level for volatility. That is definitely a good evolution!

Here's 2024 in review in the following meme.

Of course, it is hard to underperform. That was the same for growth investors in 2022. But stay respectful of every strategy, as someday, they will outperform again. That has always been the case.

I really had to laugh with this one, too:

And again, as so often, it's funny because it's true.

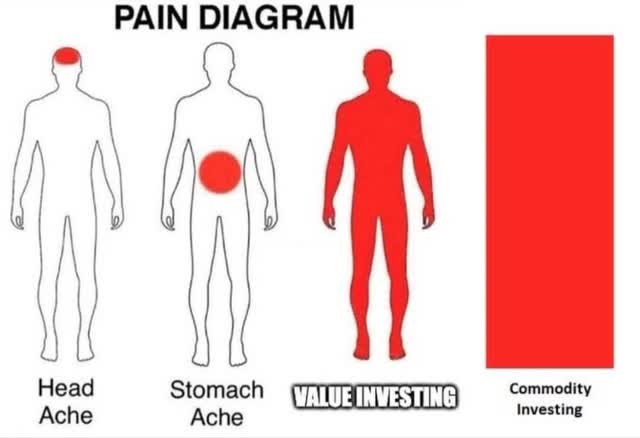

Value investors had a tough year again, but commodity investors even more. That's what this meme shows.

And I got this one from a value investor. Being able to laugh with yourself is usually a sign for a good person.

Interesting Podcasts Or Books

This week, I'm continuing to finish the books I want to finish before the end of 2025, so I didn't start any new books.

I also started beta-reading the new book of Vitaliy Katsenelson. It's not about investing but about how to live a good life. I can't share much more yet, as I only started it today. But if you haven't read Vitaliy's previous book, Soul In The Game, I highly recommend it!

Stocks On My Radar

I didn't add new stocks to the list this week.

The markets in the past week

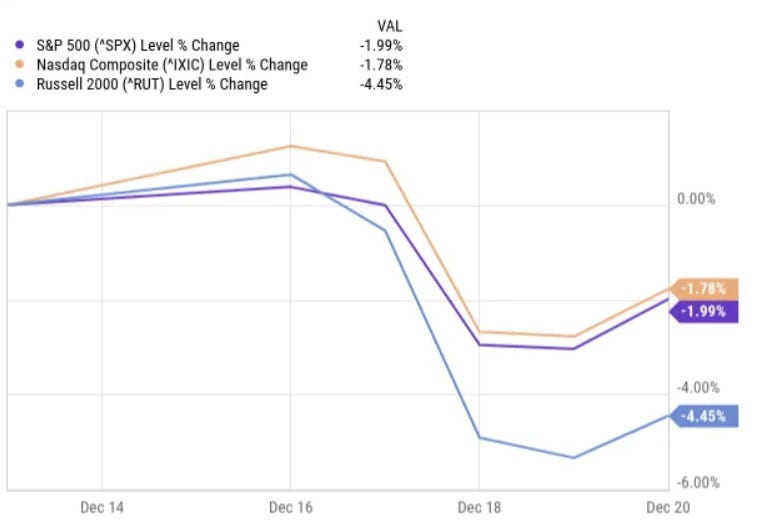

This week, all indexes were down. The Nasdaq lost 1.78%, the S&P 500 was down 1.99% and the Russell 2000 dropped 4.45%.

The Greed & Fear Index dropped to Fear and it was in Extreme Fear on Thursday.

Quick Facts

1. The Fed

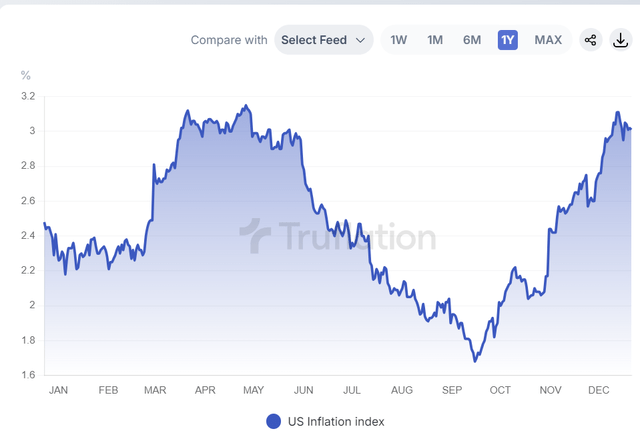

This week, the Fed cut rates by 25 basis points, but it foresaw higher inflation. It raised its outlook from 2.1% to 2.5%. It also reduced the outlook from 3 to 2 rate cuts in 2025. For some, that was enough to cry out loud that inflation is back.

Truflation tries to predict the real-time inflation based on many factors. I've been looking at their graphs for years and generally, they are quite reliable. Usually, 6 to 9 months later, the prediction shows up in the Fed's official numbers.

Truflation shows about 3% inflation right now.

So, yes, we could see higher inflation. But is that a disaster? No, not at 2.5% or even 3%. Inflation becomes a problem when it's much higher. Historically, inflation has been around 3% on average, by the way.

2. Mercado Libre’s New Global Shopping Feature

Mercado Libre has launched a new feature allowing buyers in Argentina to shop internationally, with free shipping and no customs hassles for certain products. That also means that merchants in the U.S. can now offer items directly to Argentine customers via the platform.

Certain weight limits apply, and products require a customs exemption. You can not buy more than three items. They cannot weigh over 50kg and should cost below $3,000. There's an annual limit of five shipments, and import tariffs are waived for items under $400 or for the first $400 if they cost more.

3. Nvidia A Cloud company?

This week, I saw this tweet.

There is the threat to Nvidia that the hyperscalers will make customized chips. That's why Broadcom is doing so well. But it would be much easier for Nvidia to make an AI cloud than for the hyperscalers to tread on Nvidia's property. In that same context, this X post also makes a lot of sense:

Interesting times...

4. CrowdStrike and SHI Hit $1B

CrowdStrike and SHI International have achieved a milestone: surpassing $1 billion in total sales together. This makes CrowdStrike the first SaaS cybersecurity provider to reach this level with SHI, a leader in global IT solutions. Over 70% of the revenue from this partnership has been generated in just the past three years, which shows how fast CrowdStrike is still scaling.

5. CrowdStrike named a leader in GigaOm Radar Reports

CrowdStrike also received two more rewards this week.

The first was that it was named a leader in the GigaOm Radar Report for Container Security. It got seven perfect scores across critical categories, including Flexibility, Interoperability, Lifecycle Security Management, Manageability, Registry Scanning, Scalability and Threat Intelligence.

CrowdStrike protects the entire cloud estate—containers, Kubernetes, cloud infrastructure, applications, data and AI models—all from a single, unified platform.

The second reward was from GigaOm as well. This time, CrowdStrike was called a leader for Ransomware Prevention. It got 10 perfect scores across critical categories, including Predictive Analytics, Data Exfiltration Protection, Response Automation, Security Ecosystem Integration and Ease of Management. CrowdStrike also achieved the top-average score among all evaluated solutions.