Hi Multis

Yesterday was the 15th of the month, and on or around that day, you will always get The Best Buys Now, 5 stocks I want to own and think are a good buy now.

To be clear, these are not stocks that I think will outperform in the next few weeks or months but stocks that I want to have in my portfolio for the long run. That often means that they can underperform in the next few months. I don't care. These are often good opportunities for the long term. It can take a year or longer before there's outperformance. I've seen Best Buys Now selections underperform for two years and then suddenly beat the hell out of the indexes.

And, of course, not every stock will play out, but that's not necessary to do well.

This time, I selected cheap stocks. Yes, you read that right. When so many say that the markets are overvalued, I still see stocks that I consider fairly valued or even cheap.

Of course, growth is always a part of the equation, and that's why I use the forward PEG. It's an adaptation from Peter Lynch. If you divide the forward PE by the expected EPS growth, you get the forward PEG. So, if a company is at a 2025 PE ratio of 20 and it is expected to grow its earnings per share by 20% in 2025, the 2025 PEG is 1.

A score of 1 or lower is cheap, between 1 and 2 is more or less fair, and above 2 is expensive.

I've been using this system for years already. Of course, it does not apply to all stocks. It depends on the phase the company is in.

That's why I developed this valuation overview, based on work by Aswath Damodaran, but with my own twist.

You see that the forward PEG is useful for companies in mature growth. But sometimes, for the best of companies, it can also be applied in high growth. Now that you know this, let's go to the Best Buys Now for December.

1. Nvidia

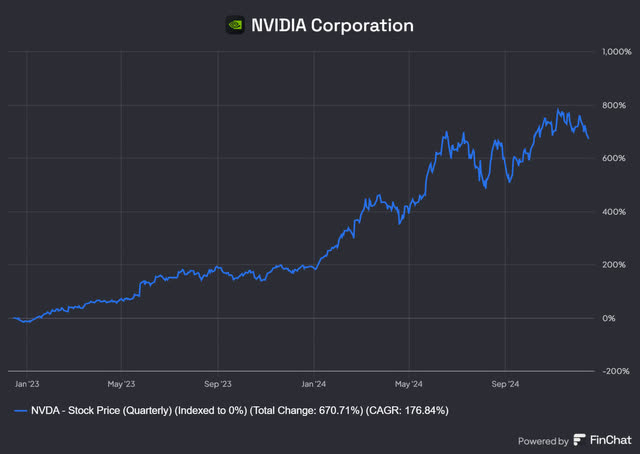

What? Nvidia (NVDA), the largest company in the world? According to some value investors, this is the peak AI hype king after the stock is up 670% in the last 2 years.

Source: Finchat, the best charting, screening and finance AI platform

Isn't this the new Cisco? Or the new Intel? Do you want to invest in a $3.3T company? Kris, are you really out of your mind???

Well, maybe I am out of my mind. I'm probably not the best judge for that, haha. But I still think there's a good investment case for Nvidia over the next decade.

We are still very early in the AI cycle. This is like the internet in 1998 or so. Some will claim that a 2000-2003-like crash will also come this time, but right now, I don't see the overextended valuations from back then. Yes, there are pockets of bubbles. I wouldn't buy Palantir (PLTR) or IonQ (IONQ) now. While I think they could have a fantastic future, especially Palantir, their valuations have already priced in years of high growth.

However, if the expected growth numbers are in the ballpark, I think Nvidia is still priced fairly or even cheaply.

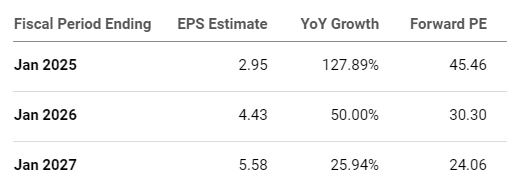

As you can see, the stock trades at 30 times 2025 EPS (even though it's a month later), with expected EPS growth of 50%. That puts Nvidia at a 2025 PEG of 0.6, which is very low. Granted, growth is expected to slow down in 2026, with "just" 26%, but even that, if true, still looks on the cheap side with the 2026 PEG of 0.93. And that's without Nvidia's huge earnings beats.

OF course, as for every stock, there are risks:

A new player may come out of the woods and disrupt Nvidia (unlikely).

The hyperscalers may continue to produce more of their own chips

AMD might take some market share.

But all in all, I think the risk-reward for Nvidia is still solid at this point.

2. Mercado Libre

The company invested more than Wall Street was expecting in Q3, making Mercado Libre (MELI) miss on EPS. More in the earnings analysis.

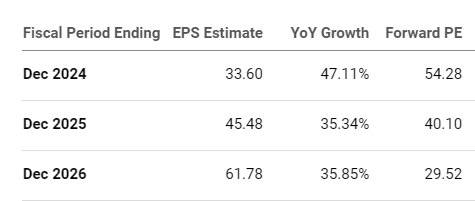

If we look at the next few years, this is what we see. From 2027, there's only one analyst covering, which is always hard to trust.

That's EPS growth, while Mercado Libre is actually not in the profit-optimizing phase yet. But with a 2025 PEG ratio of 1.13, it already looks fairly valued there. The 2026 PEG even stands at 0.82.

On top of that, this is also important.

(Source: Morningstar)

Morningstar does not easily give the wide economic moat label. This means that Morningstar sees the company's competitive advantage lasting for at least 20 years. Now, factor that in for growth. Additionally, the company has exemplary capital allocation. A great company trading at a fair price? Count me in! If the sentiment is not great, that gives me more time to accumulate shares.