🔥The stocks I just bought🔥

2 New Positions!

Hi Multis!

How time flies… It's already the third week of the month again and, together with the first week, that's when I add to my portfolio.

Nu & Mercado Libre

Both Mercado Libre (MELI) and Nu Holdings (NU) dropped substantially over worries about the Brazilian economy.

Some pointed to the weak real (the Brazilian currency). And they are right. It's down 20% year-to-date versus the dollar. (see the first chart).

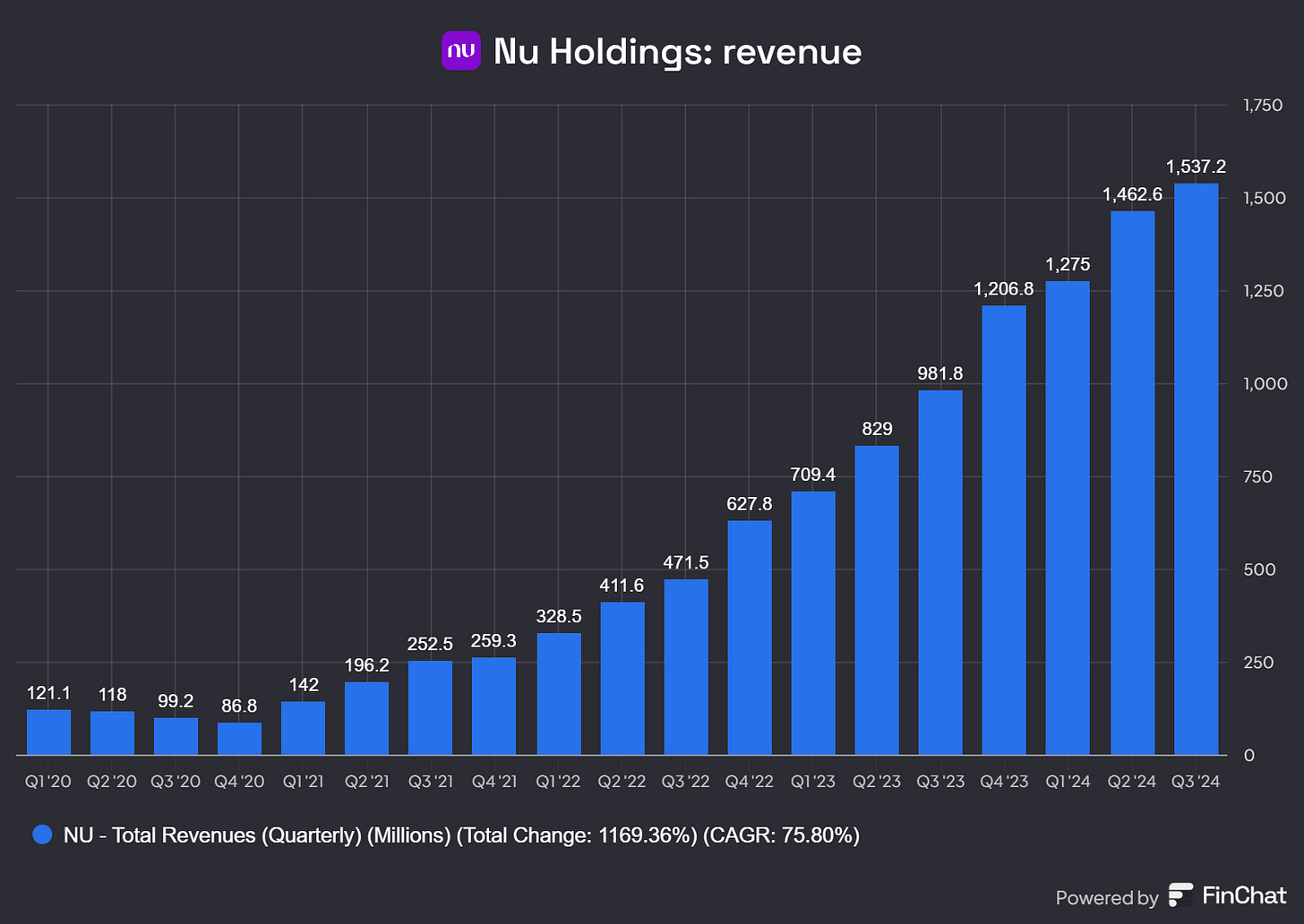

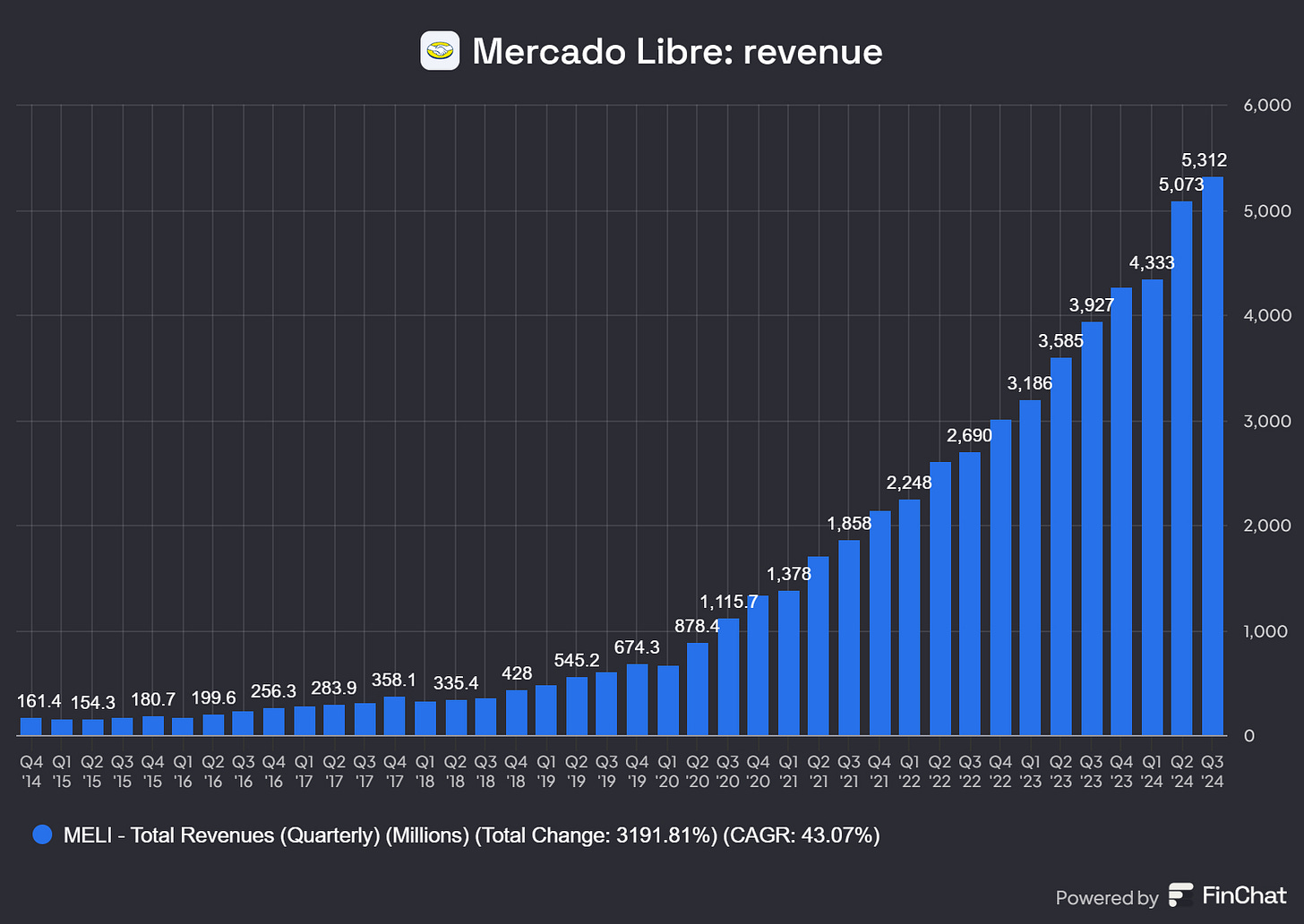

In the meantime, over the same period, Nu's revenue is up almost 40%, that of Mercado Libre 28%.

Source: Finchat, the best charting, screening and finance AI platform

But all in all, I think that the results show that Mercado Libre and Nu do pretty well despite the dropping real.

It's weird that only now people talk about this in the last few weeks. In the last month, the real is only down 5%.

But suddenly, commenters on Seeking Alpha write this:

It was in the news, so everybody jumped on this.

And, of course, a weaker Brazilian currency is a headwind. But it's not as if that's the first time for Mercado Libre. Just look at this.

Until a few years ago, Argentina was Mercado Libre's second-biggest market after Brazil. (Now, Mexico is second, and Argentina is third.) Some think the drop in the Brazilian real (down 5% in the last month) is a new problem, haha. As you can see, the Argentine peso was down 99.16% over the last decade. Over that period, Mercado Libre was up 1,250%.

Of course, for Nu, there's no such track record, but I think the company is as strong as Mercado Libre and will navigate this environment as well.

Fede Sandler, the former Investor Relations Officer of both Mercado Libre and Nu posted:

Nu was founded in a recession, then went through an impeachment, then the worse recession in 100 years and then a pandemic. Yet it still grows like gangbusters and execute like a world class company.

BTW because it is the lowest cost producer and generates competition while it digitalizes cash it generates more tax revenue so left and right leaning governments lean on them.

Concerned zero.

Now, there's no denying that the currency headwind is strong for both Mercado Libre and Nu Holdings because they report their earnings in dollars (because they trade in the US).

But look at their last quarters: Mercado Libre: revenue up 35%. But in local currencies, it more than doubled its revenue, by 103%. Nu's revenue was even up 38% in dollars year-over-year and 56% in local currencies, mostly the Brazilian real.

So, the weaker Brazilian real is a buying opportunity, in my opinion. Of course, on a dollar-base, Mercado Libre and Nu may miss their Q4 consensus, and who knows, maybe the stocks could drop more then. But I will then use it as an extra buying opportunity. World-class companies don't often trade for such low valuations.

If you want to see the rest of the additions, and my full (real-money) portfolio, do yourself a favor and upgrade to a paid subscription. But if it’s not the right time, or you don’t have the money, that’s OK too. I hope you have enjoyed this free part.