Hi Multis

What a week, huh? But it's Sunday again, which means it's time for your weekly dose of news.

Let's go.

Articles in the past weeks

This is just the third article this week. Brace yourself, because you will get much more in the upcoming week!

The first article was about The Trade Desk and whether buying the stock is attractive now that it's down so much.

The second article was Anand's earnings analysis for Datadog.

Memes Of The Week

Laughing is healthy, so (almost) every week, I share some memes with you.

This is the first one this week.

The second one is about Hims & Hers.

I answered to this meme with a variation.

Multi C-dub-diamond-hands shared this meme.

And I really liked this one too, as it goes for any investing style, so also investing in Potential Multibaggers. “We thought it would be easy.” Weeks like this week showed again that the volatility is high for Potential Multibaggers stocks.

Interesting Podcasts Or Books

This week, I listened to the Patrick O'Shaughnessy podcast Invest Like The Best, which is always great.

In this episode, he interviews Ravi Gupta, a partner at Sequoia Capital, the biggest venture capital player.

Gupta wrote an essay, "AI or die," arguing that you will disappear if you don't use AI. AI could mean that big companies will move slower and smaller companies will move faster. The traditional corporate context will be challenged. Companies that cling to bureaucracy, strict administrative procedures and outdated business models will be made obsolete by small companies.

You can listen to the podcast episode here.

The markets in the past weeks

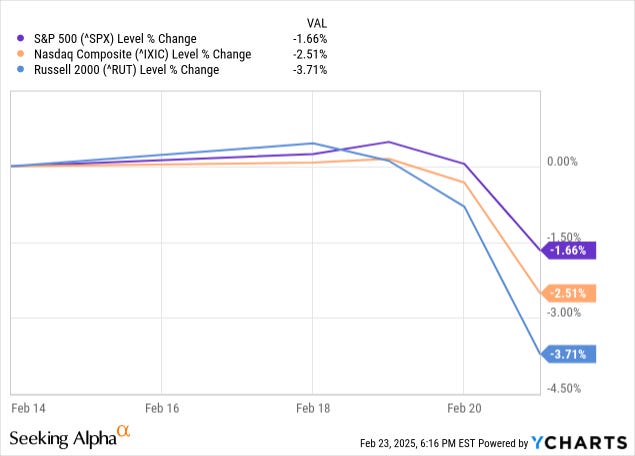

I don't think it's hard to tell what the markets did this week. We all felt that the markets were down.

The Russell 2000 lost the most, with 3.71%. The S&P 500 was down 1.66%, and the Nasdaq 2.51%.

The Greed & Fear Index dropped deeper into fear territory.

Quick Facts

1. Celsius buys Alani

This week, it was announced that Celsius will buy its competitor Alani.

The market reacted extremely positive. I'm still on the fence about my opinion, but I will share it with you with my earnings analysis.

2. Hims & Hers Buys Two Companies

And more acquisitions. Hims & Hers (HIMS) bought two companies this week.

The first one was a peptide production facility. Peptides are gaining traction in in healthcare for a wide range of applications: skincare, metabolic health, cognitive performance, recovery and much more.

The second acquisition was Trybe Labs. It's a company that offers at-home testing. This acquisition will allow HIMS to offer affordable tests of the whole body. This will give the company deeper health insights and more precise treatment recommendations.

Trybe offers blood tests for hormone levels, cardiac risk, stress markers, cholesterol, thyroid function, and much more.

More about these acquisitions when we analyze the upcoming Hims & Hers earnings.