The Trade Desk: Opportunity Or Trap?

How did the bad quarter influence TTD's quality score and the valuation?

Hi Multis

After the big drop in the stock price of The Trade Desk (TTD), you may wonder how attractive the stock is now. In this article, we will try to find out by looking at the quality score and the valuation.

Before this big drop, The Trade Desk had a poor valuation score of 3/10, giving it a low QPI (Quality-Price Index) score. This meant that even though the stock had high quality, it was not attractive to buy.

At this point, I'm curious myself if the stock is much more attractive after the drop or not.

The first condition is that the company's fundamentals have survived this quarter. Or, to put it differently, I wonder if The Trade Desk keeps scoring high for the PMQS (Potential Multibaggers Quality Score).

Let's find out first, before we move to the valuation to get the last piece of the puzzle to know if this is an opportunity or a trap.

Personal conviction 9/10

Since February 2025

This is my or your own conviction based on everything I/you know about the company. Your own conviction may be very different here and you can adapt this score to your own liking.

You can download the sheet here to give your own score alongside me.

I have followed this company for so long already, long before I finally decided to buy the stock in May 2019 at (a split-adjusted) $19.5.

What I have seen from Jeff Green's insights and the company's execution has impressed me the whole time without any faltering so far. Over five years of intensely following the company has made me realize how unique this company and its CEO are.

Up to now, my conviction was always 10/10. That doesn't mean there's no doubt at all, but that it's the highest possible level of conviction in investing.

With what happened in Q4 2024, I downgrade the score from 10 to 9/10. For the first time since I started using this system about three years ago, The Trade Desk does not have a perfect score. Not bringing down this score now would mean I just ignore this bad quarter. But we don't know all the details of why The Trade Desk missed its own guidance, so that creates some uncertainty.

But at the same time, I don't see a reason why I would slash my conviction score by multiple points. After all, the company outperformed in 32 of its 33 quarters as a public company. That's 97%, a score I would have wanted as a student. :-)

That's why I keep my conviction score at 9, which is still high.

Profitability 9.5/10

Since October 2024

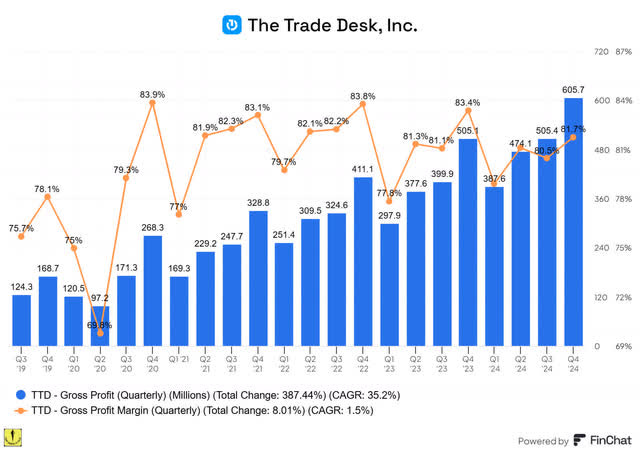

Let's first look at gross profit and gross profit margins. Normally, I show this per year because the quarters are lumpy, but with the bad fourth quarter, I wanted to see that quarter separately. I started from where I picked The Trade Desk as a Potential Multibagger.

You can see that the gross profit has a CAGR of 35.2% since Q3 2019, which is really impressive.

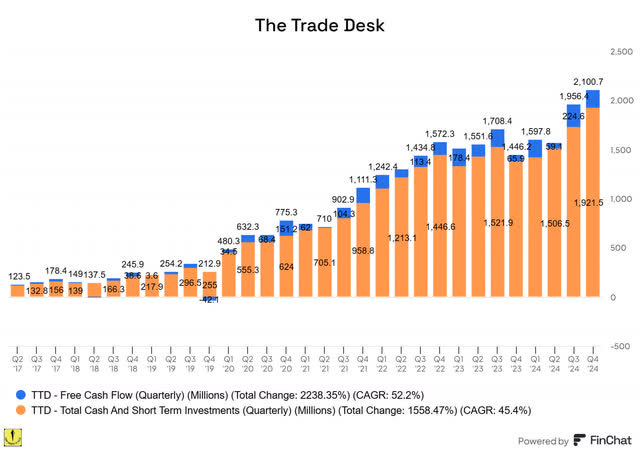

But gross profit is just that, gross profits. For The Trade Desk, which is not that new anymore, I also want positive free cash flow. That's not a problem either.

Again, the quarters are volatile, but the company has generated positive free cash flow in every quarter since Q1 2020. Even with an FCF margin of 27.2% in Q4 2024, the "bad quarter," The Trade Desk still generates large amounts of cash.

The Trade Desk has also been profitable on a GAAP net income base every year since 2013. Except for three quarters, that has been even the case in every single quarter since 2013.

The dip in GAAP net income you see in 2022 is due to the big stock bonus Jeff Green got for getting the stock price above a certain level. Other such bonuses are also in his contract. I don't mind these too much, as they are not automatic. The stock has to be at certain levels for at least 30 trading days before he gets the bonus. This is the compensation summarized.

The stock crossed $115 in October 2024 and that why Jeff Green's compensation plan kicked in. The next trigger is $145.

If Jeff Green achieves all those targets before the plan expires in 2031, he will have received 16 million shares. Of course, we will return to this when we look at the dilution, as this is about profitability.

The Trade Desk is profitable on all ratios you can think of. That's why I keep my score at 9.5/10.

Sales efficiency 8/10

Since October 2024

The sales efficiency formula first looks at S&M (sales and marketing) as a % of revenue. Then I look at growth this year and the expected growth next year and I take the average. That is divided by the S&M number. That gives me the marketing efficiency. If you add gross margins then and you multiply, you get the efficiency score.

These are TTD's numbers.

I thought the score would drop because of the lower forward revenue growth, but sales and marketing as a percentage of revenue also dropped. That means the score remains the same.

Innovation 4.5/5

Unchanged since June 2022

This is part subjective, part measurable. Subjective as in: how many new products does the company issue versus its competitors? You can partly measure that, too, if you want, but the magnitude of the innovations is much more important than the sheer number of innovations.

As for measuring, you can look at the percentage of revenue that goes to R&D. At the same time, I want some efficiency there, too, so I look at R&D efficiency by dividing R&D expenses in the previous year by revenue growth in the trailing twelve months. Let's look at how The Trade Desk does.

The company spent 16.8% of its revenue on R&D last year.

With revenue growth of 22.3%, the R&D efficiency is 1.33, which puts TTD more or less in the first quartile (the lines are not that clear, as there's a jump).

Now, this is based on numbers from 2015 to 2018, when the environment was not as tough as it is now.

With the continuous roll-out of innovations like UID, the complete rehaul of its platform with Kokai, the long-time use of AI, and many other big, impactful new initiatives, I think The Trade Desk still deserves 4.5/5.

In Q4 2024, there were some struggles with Kokai, but that didn't have to do with innovation but with execution.

Must-have? 4/5

Unchanged since June 2022

I introduced it because of what Matthew Prince, the founder and CEO of Cloudflare (NET), said in 2022:

I think that the world is about to get sorted into must-haves and nice to haves.

For The Trade Desk, it came through the challenging Covid period quite well until Q4 2024. Its revenue growth continued to be at a high level. I don't want to give it a full score because I want to be cautious. After all, the sector TTD is in, is sensitive for the economic cycle.

Revenue growth 4/5

Since February 2025

This is very simple: how high was the revenue growth over the last twelve months? For The Trade Desk, that's 22.3%. That's still high enough, but with the guidance for 17% revenue growth in Q1, I still lowered this score by half a point.

Revenue growth durability 10/10

Unchanged since the start

At least as important as revenue growth, is the durability of revenue growth. This is what I always wrote:

The Trade Desk has a gigantic TAM and the trend is moving away from the walled gardens. With so little real strong competition when it comes to the open internet, with CTV still expected to grow for so long, and the company's innovation and execution, I rate The Trade Desk the maximum score here, 10/10.

Now, after this quarter, I wonder if that's still true. Jeff Green explicitly said this was not a matter of more competition. As he has consistently told the truth for all those years, I decided to believe him (for now) and keep the score at this high level.

Management Quality Score 10/10

Unchanged since the start

Jeff Green is one of those rare CEOs that I will rate 10/10. Everything he predicted, including things outside his own influence, became a reality. IDFA postponed? Yep. 3rd-party cookies postponed? Yep. CTV growing like gangbusters? Yep. I could go on, but I think you know what I mean.

The introductory remarks of The Trade Desk's earning conferences are fantastic overviews of where ad tech stands. Also, you shouldn't forget that he invented ad-bidding exchanges in 2002 already. One bad quarter doesn't change what he has proven for over a decade.

Insiders' Ownership 5/5

Unchanged from the start

Does management have skin in the game? This is out of 5 (and not 10) as it is not always a make-or-break but often it's a useful indication.

Founder, Chairman and CEO Jeff Green owns 3.3 million Class A shares and 42.9 million Class B shares.

That means he owns 46,224,086 shares on a total of 493.96 million. That's more than 9.3%, worth more than $3.7 billion with the current stock price of $80.16.

That's a very high ownership stake and worth 5/5.

Multibagger potential 4/5

Since February 2025

When I picked The Trade Desk, it had a market cap of $9.5 billion. Right now, it trades at a market cap of $39.6 billion. That means it will probably be harder to 10x over the next 10 years, but I think it's more doable now than when the market cap exceeded $60 billion. That's why I add half a point to this score.

Of course, the multibagger potential also depends on revenue growth, which is by far the most important contributor to long-term stock performance.

The Trade Desk has grown its revenue by 24.4 % in the last 3 years and 30.7% in the last five years.

Revenue growth is expected to moderate in the next years, though.

(Source: Seeking Alpha)

But, of course, it's tough to forecast. Up to this quarter, The Trade Desk was a serial overdeliverer.

Now, suppose that 20% would become the norm in the next year, even with the multiple coming down, it could be a fivebagger, not bad at all, too, of course. In the end, we'll have to see.

The Trade Desk's TAM (total addressable market) has only grown, and it is an important player in CTV. So, it has the potential to become really big, like in a few hundred billion. Of course, I'm just pointing out the potential, nothing more.

TAM/SAM: 5/5

Unchanged from the start

TAM stands for total addressable market and SAM for serviceable addressable market, the market you serve because of your specific product and geographical limitations.

Both the TAM and the SAM are huge for The Trade Desk. Advertising is poised to become a $1T market. That's per year, yes. Jeff Green is convinced that all advertising will become programmatic. So, The Trade Desk plays on a huge field of opportunities, the field where Google and Meta became such gigantic players.

Financial Strength 10/10

Unchanged since the start

In this environment, financial stability is much more important than ever. That's why I rate it out of 10.

If we look at the financial strength of The Trade Desk, the first thing we notice is that the company has no debt. With a cash position of more than $1.92 billion and additional free cash flow, The Trade Desk is financially unshakeable.

So, I think a 10/10 is warranted here, especially because the company has been profitable every year since 2013.

The negatives

I also have negative scores, that can subtract extra points from that score. The scores are marked on 5 because a lot is implicitly captured in the other numbers.

Risk 1.5/5

Since February 2025

A lot is already baked in financial strength, but this overall risk score shows more than just financial risk.

With the bad quarter, The Trade Desk has become riskier than it was. That's why I add a full (negative) point to this score.

Competition 2/5

Since July 2024

How strong is the competition? Again, you can't objectively measure that but there are indications.

For The Trade Desk, it competes with the big boys. Walled gardens are under more and more pressure, both from the governments around the world and competitive pressures, they might be extra dangerous. When cookies are abolished, The Trade Desk has UID 2.0. Up to now, that has worked well to compensate for things like Apple's IDFA change.

When it comes to the open internet, The Trade Desk is the clear leader, also on CTV. However, YouTube still has a large portion of streaming, and Amazon has increasingly more ads, which is not really attainable for The Trade Desk.

Now, there are some workarounds, but that inventory could become even more valuable in the future. That, to me, is the biggest risk.

AppLovin announced it would start in CTV as well and it could become a competitor of The Trade Desk as well, but for now, that's not the case yet.

Overall, the Trade Desk will benefit from the move to programmatic advertising, even if the big boys also do well.

Dilution 0.5/5

Since October 2024

Dilution is a negative over the long run but that doesn't mean that companies should not issue stock when they are still growing fast. Look at Apple's shares outstanding before 2012, when it started buying back shares:

At the same time, I don't want to completely ignore SBC, and that's why I give a negative score.

Here we have to talk about Jeff Green's big bonus again. You know, this one, that I already shared before.

If Jeff Green gets all those targets before 2031, when the plan expires, he will have received 16 million shares.

Right now, there are 493.96 million fully diluted shares outstanding. That already included the first two tranches, of course. That means if Jeff Green would get all the remaining 12 million shares, that would mean a total dilution of 2.4%. For a 4.2x of the current stock price before 2031, I think that would be a small price to pay.

This is the evolution of The Trade Desk's outstanding shares over the last three years.

As you see, in the last three years, there was a total dilution of 2.18%. The CAGR is 0.7%. That's also because The Trade Desk has bought back shares opportunistically.

With its big war chest, no debt and a robust free cash flow generation, those buybacks make sense. Normally, that would not be the case, but The Trade Desk is already investing heavily in its infrastructure (and people), promised to ramp that even up, doesn't have to pay off debt and a dividend would be less efficient that a buyback. I'm happy with the buyback.

By the way, $1 billion for the buyback program is the expected cash flow in 2026, without touching their cash pile.

Source: Finchat

That's why I lower this negative score to 0.5.

Scale Advantage Shared 4/5

Unchanged from the start

When I look back at a few of the best investments, they did not only have substantial scale advantages, but also shared them with their customers in some way. For Amazon or Walmart (at the time), I think this criterion is obvious. Because they are bigger, they can give their customers better prices.

For Google (GOOGL), for example, it was maybe not that clear. But Google has always had a scale advantage: the more people use their products, the more they can give away for free. The data of people were leveraged to generate profits for Google, but the fact that Google could offer so much for free (Gmail, Fotos, Drive storage up to a certain limit, etc.) was because of this mechanism.

I have not come up with this concept myself. This is one that I borrowed from Nick Sleep from Nomad Capital. He uses this concept to guide all of his investments. That's why he started investing in Amazon in 2003 already. He has mostly held on to that position to now. He did the same thing with Costco, another company that shares the advantages of its scale with its customers, by only charging 15% on the purchase price, no matter what. This makes these companies almost impossible to compete with unless you start doing exactly the same thing.

I came across this concept in Richer, Wiser, Happier a few weeks ago and I dug deeper by reading several articles (like this one) about Sleep and this concept more particularly. The most prominent advocate of this? Jeff Bezos, who made this napkin sketch about it.

So, this competitive advantage can be significant. I'm going to withdraw or add points with this criterion. For some companies, extra scale only adds extra complexity. Those will get a negative score. I think of Uber (UBER) here. The normal scaling is the second level, which can be given little to no points. This means that if you grow, your scale gives you cost advantages. The third level is where all users also benefit from the scale. Here you will see higher scores, 4/5, maybe 5/5.

I give The Trade Desk 4/5, as the data its customers bring it can be leveraged on the platform for everyone. So, for example, if you want to target 30 to 35-year-old women with a Master's degree in Malaysia, that's possible because the data of all customers is used anonymously by the AI The Trade Desk has employed. That's incredibly powerful. 5/5 may be even more appropriate, but I want to be conservative. After all, we don't know all the details.

Conclusion

The Trade Desk's Potential Multibaggers Quality Score goes down a bit, from 85.5 to 83, but that's still a very high score.

If you want to see the valuation and to know if The Trade Desk is a buy now, consider upgrading your subscription.

If you are not ready or don’t have the money, that’s OK too. I hope you have enjoyed the content up to here.