Hi Multis!

Anand here with the Datadog (DDOG) Q4 2024 earnings result.

Datadog reported Q4 results on February 13, 2025. After the result, the stock was down more than 10%. And, together with the whole market, and especially tech, it has to be noted, the stock kept falling. It's down more than 19% now.

Let's look at the numbers first to see if this drop is warranted.

The Numbers

Datadog reported a total revenue of $738 million, an increase of 25% year-over-year. The company's seven-year revenue CAGR of 54.35% shows how strong the company has delivered.

Source: Finchat

Datadog is expanding its existing products and extending the platform offering by adding security, Flex logs, On-call, and LLM observabilities products.

Datadog keeps building and innovating. They scale up the platform and solve more and more problems for their customers from Cloud to AI. They continue to add new customers, expand with existing ones, and deliver more value as customers adopt more products on the Datadog platform.

Datadog ended Q4 2024 with about 30,000 total customers, up about 10% from about 27,300 a year ago. 3,610 customers pad ARR (Annual Recurring Revenue) of $100,000 or more, an increase of 13% from 3,190 a year ago. 462 customers paid $1 million or more, an increase of 17% from 396 a year ago.

We see consistent customer growth. The company has put more effort into higher ARR customers since the margin and profitability are higher in that segment.

Source: Finchat

Source: Finchat

The dollar-based net retention rate has increased to 120%, up 5% from 115% a year ago. It looks like it bottomed there. Let's give it a quarter or two to confirm the up-trend.

Last year, that was some concern from a few investors, and on top of that, industry-wide cloud cost optimization efforts put more pressure on Datadog. I must mention that Datadog maintained a Dollar-based net retention rate of 115% during the tough times and remained a profitable company.

Source: Finchat

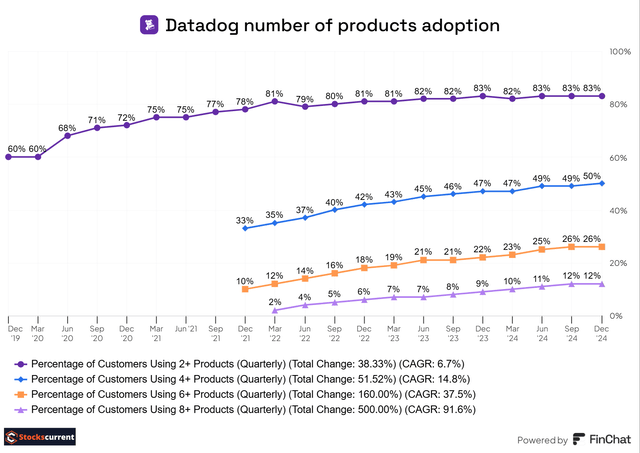

Datadog platform adoption is growing steadily. Their land and expand model is working as management expected.

By the end of the third quarter, 83% of its customers had adopted 2 or more products, the same as last year. Furthermore, 50% of Datadog's customers used 4 or more products, up from 47% a year ago. 26% of the customers were using 6 or more products, an increase from 22% in the previous year. Finally, 12% of the company's customers were using 8 or more products, up from 9% last year. These are impressive numbers.

Source: Finchat

In this fourth quarter, Datadog had a non-GAAP operating income of $179 million, resulting in a non-GAAP operating margin of 24%, while the GAAP operating income was $9 million, with a GAAP operating margin of 1%. Operating income and margin both decreased because they hired more sales and marketing organizations in the second half of the year.

Datadog reported a gross margin of 81.7%, compared to a gross margin of 81.1% last quarter and 83.4% in the year-ago quarter. The gross margin decreased 1.7% from a year ago but is still above 80%, so there is no need to worry about that.

Datadog reported a GAAP net income of $0.13 per diluted share, while the non-GAAP net income was $0.49 per diluted share.

The company reported billings were $908 million, up 26% year-over-year. The remaining performance obligations, or RPO, were $2.27 billion, up 24% year-over-year. Current RPO growth was in the mid-20s percent year-over-year. To clarify, RPOs represent all contracts that have been signed but cannot be recognized as revenue until the company performs the related service in that quarter. The current RPO refers to the revenue expected to be recognized within the next 12 months.

CFO David Obstler believes revenue is a better indication of business trends than billings and RPO, as those can fluctuate relative to revenue based on the timing of invoicing and the duration of customer contracts. He has emphasized this point in every conference call for over a year. Given that the company has achieved more than $2.5 billion in total revenue, and RPO has more variability and seasonal changes, I may not cover the RPO moving forward unless there is a big swing on either side.

For Q4 2024, the company's operating cash flow was $265 million, with a free cash flow of $241 million and a free cash flow margin of 33%. Free cash flow and Free cash flow margin are improving.

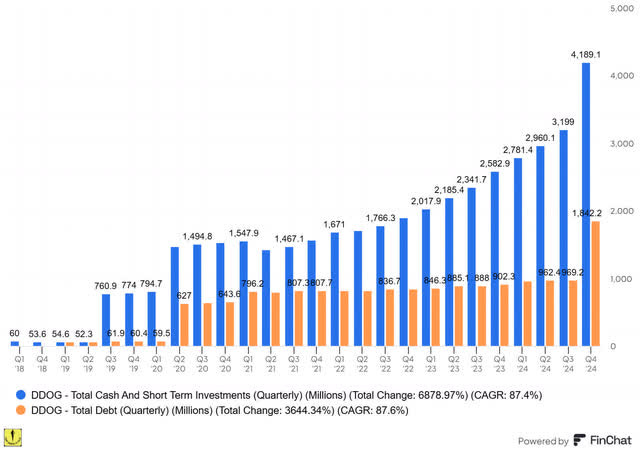

By the end of Q3 2024, Datadog has cash and cash equivalents totaling $4.2 billion.

Source: Finchat

Guidance

Q1 2025 Outlook:

Management guided revenue between $737 million and $741 million, which aligns with the consensus. That's up more than 21%. Datadog is probably guiding conservatively here. Non-GAAP operating income is expected to be between $162 million and $166 million, which translates to non-GAAP EPS from $0.41 to $0.43.

Datadog expects more than 21% revenue growth, while the non-GAAP earnings per share projections were slightly down, which was hard to digest for some investors. There was a question on Q&A about the conservative guidance. CEO Olivier Pomel and CFO David Obstler both confirmed that they haven't changed the method of calculating guidance; their method is the same as before; they see the trends in revenue recognition and apply the conservatism on top of it. Some investors took away with weak guidance. The management team is always under-promise and over-deliver.

Full-year 2025 Outlook

For the full year, revenue is expected to be between $3.175 billion and $3.195 billion or 18.3% on the midpoint. Non-GAAP operating income is expected to be between $655 million and $675 million. Non-GAAP net income per share ranges from $1.65 to $1.70.

I understand that every year is different. For example:

In Q4 2023, management guided full-year revenue in the range of $2.555 billion and $2.59 billion. The actual result? $2.68 billion.

Management guided non-GAAP operating income between $535 million and $555 million range; Actual is $674 million. They guided non-GAAP income per share between $1.38 to $1.44 range; Actual is $1.82

This was weak guidance, and the stock was down, but in hindsight, they had a significant beat by the end of this quarter. Because of that, I will not stress too much about full-year guidance because they are providing it conservatively right now. They always increase it in subsequent quarters as the information becomes more apparent.

Highlights from the conference call

1. Product Updates

Datadog has achieved the milestone of $3 billion in ARR, and they have achieved this milestone largely by growing their 3 pillars of products.

First is infrastructure monitoring, which now contributes more than $1.25 billion in ARR. Log management and Application Performance Monitoring, or APM, are the other 2 products, and both have contributed more than $750 million in ARR. These products still have more room to grow.

On the call CEO Olivier Pomel:

Now remember that even in the 3 pillars of observability, we are still just getting started as more than half of our customers have not bought all 3 pillars from us, or at least not yet.

Datadog has more than 850 integrations, making it easy for its customers to bring in every type of data they need to benefit from all the new AWS, Azure, GCP, and OCI capabilities and engage with the latest technologies, like the newly emerging AI stack.

Datadog expanded its Database Monitoring product to observe MongoDB databases. Datadog Database Monitoring supports the five most popular database types: MongoDB, Postgres, MySQL, SQL Server, and Oracle.

In the gen AI and LLM space, they keep adding capabilities to Bits AI, launching Bits AI for incident management and previewing Bits AI for autonomous investigations.

Datadog launched LLM observability in general availability to help customers evaluate, safely deploy, and manage their models in production, and they continue to see increased interest in generative AI.

At the end of Q4, about 3,500 customers (more than 10% of their total customers) used 1 or more Datadog AI integrations to send their data about their machine learning, AI, and LLM usage.

The management team saw a robust contribution from AI native customers, who represented about 6% of Q4 ARR, roughly the same as the previous quarter, up from 3% of ARR in the year-ago quarter.

Datadog believes that the adoption of AI will continue to benefit Datadog in the long term. At some point, if AI applications slow down or go through the digestive period, the impact will be minimal since it's just a single-digit contribution of the total ARR. Datadog is sitting at the sweet spot and giving actual AI adoption trends since they are sitting on production monitoring. So, as more AI apps and agents go into production, we will see a clear trend.

CEO Olivier Pomel confirmed the trend on both the inference and model sides. He mentioned that Datadog's customers use a third-party model through an API or a third-party inference platform. Regarding operating the inference stack, he observed relatively few customers are fully implementing it at this time, but he thinks that's something that's going to come next. I like his commentary on inference and model side since he is a very level-headed CEO.

In cloud security, Datadog has more than 7,000 customers using 1 or more security products. They launched agentless scanning to detect risks and security vulnerabilities within hosts, containers, and servers across a whole cloud account in a few clicks.

Flex Logs is now generally available for log management. It enables customers to retain and analyze large volumes of data cost-effectively over extended periods.

2. Updates on customer usage and sales trends:

In Q4, the management team saw the expected usage pattern for the year-ago quarter. They see a stable business environment where customers are growing their cloud usage overall while some are continuing to be cost-conscious and seeking efficiency and value from their spending.

Datadog is seeing the strongest year-over-year usage growth from our enterprise customers. Meanwhile, the SMB customers' usage growth remained solid, with a slight year-over-year acceleration compared to the last quarter.

Datadog has increased its capacity for sales and marketing. Because of that, its operational expenses grew 30%, up from 21% last quarter. By the end of 2024, with a sales and marketing headcount of about 3,000, up from 2,400 at the end of 2023. They are increasing investment and see a return on that.

CFO David Obstler on the call:

We said that in 2023, with the risks that we saw in the market, we did take a prudent approach, and we slowed down the growth of the go-to-market. So there is some catch-up essentially, as these are things that we pulled back on a little bit and took a little more conservative approach. And once we saw the evidence in some of these territories, we began to accelerate.

CEO Olivier Pomel added:

The good rule of thumb is when you invest in sales when you hire sales and marketing; you start seeing the impact in 1 to 2 years after that. When you hire engineering and build the R&D capacity, you start seeing the impact within 2 to 3 years after that.

This means we will see some uptick in growth in the next year or two, sales activity is picking up, and the market is becoming favorable. We also saw a similar trend with Cloudflare (NET), increasing its sales capacity this year and catching up on the pullback they have had in the last two years. This year, it will be interesting to keep an eye on sales activities.

3. Issued Convertible Senior Notes:

What is a Convertible Senior Note? It is a type of debt that can be exchanged for equity in a company at a future date. Companies often use convertible notes to raise money early on.

Datadog issued a $1 billion aggregate principal amount of 0% Convertible Senior Notes due December 2029 in a private placement. They used $122 million of the proceeds for transaction costs and cap calls associated with these notes. Simultaneously with the issuance of these notes, they have repurchased approximately 15% of its outstanding 2025 convertible notes and terminated the related cap calls for a net cost of $142 million.

Issuing convertible notes is common practice. This is actually to prevent dilution for shareholders. A cap call (or call spread) is a financial instrument used to offset potential dilution from convertible notes. As Datadog repurchased a portion of the convertible notes, they no longer needed that hedge, so they terminated the associated cap calls.

All in all, this is a technical matter.

Overall, the company remains a financial powerhouse, with $4.2 billion in cash and short-term investments and $1.8 billion in debt. That means $2.4 billion in net cash.

Conclusion

Datadog announced a strong financial quarter. It seems much more optimistic about 2025. I don't doubt that this company can grow its revenue by more than 20% moving forward. In fact, it sees a huge market opportunity to expand steadily into bigger customers and new modules on its platform.

While some investors are concerned about their weak guidance, this management team is very conservative and constantly delivers above expectations. Another worry will be valuation, and that's understandable, but Datadog is a premium company with GAAP profitability. Other than that, the thesis remains intact.

So, to answer the question in the title of this article: it probably has to do with sentiment. This company is priced at a premium price and high volatility is inherent to fast-growing companies with a high price. But I don't think I have to tell you that, as you probably already know this.

Kris will soon update the Quality Score and valuation.

Disclosure: I personally own the shares of Datadog (DDOG) since October 2019

Just for transparency purposes, here is a screenshot of my account.

If you like the article, please share your feedback in a comment on the article and follow me on X@anandkhatri.

In the meantime, keep growing