Overview Of The Week 1: Sunday, Funday!

The top? Maybe. But I Keep Buying. Here's Why.

Hi Multis

It's Sunday, and from now on, that’s your Funday, as you always get the Overview Of The Week on that day! Here we go.

Articles in the past weeks

You got two articles this week.

The first one was on Thanksgiving and gratitude.

The second article focused on Adyen with a deep dive.

Meme Of The Week

If there are stock market memes, I share them here every week. Many come from our Slack channel Stonk Memes. If you are a paid member, our Slack community is included in your membership and you got an invitation (check your mailbox). If you are not a paid member yet, the chat community is worth the subscription price alone already.

This week, two memes, both not really about the stock market for once. I think this is one many of you will recognize.

And the second one, well, it's not about stocks... but it is, in a way. :-)

Interesting Podcasts Or Books

This week (and in the upcoming weeks), I'm trying to finish some books. I'm always reading 8 to 10 books simultaneously, so sometimes, it takes a while to finish them. That could (!) mean that I won't mention books here in the upcoming weeks.

But I have something to compensate for this.

If you are a regular user of ChatGPT, copy and paste this prompt that I saw from Patrick O'Shaughnessy and be amazed.

Based on all of our interactions, what books or papers would I love that I probably haven’t heard of before?

The list it gave me is too long, but ChatGPT gave me some very interesting suggestions.

I also listened to a very good podcast episode this week. Maybe you have read the fantastic book Richer, Wiser, Happier by William Green? If not, do yourself a favor and read it. But I suspect many will have read it, as it has the highest score on Goodreads of all investing books.

William Green also has a podcast appropriately called the Richer, Wiser, Happier Podcast. This week, I listened to the 50th episode, which is a sort of "Best Of" of the first 49 episodes. You will hear guests like Ray Dalio, Bill Miller, and Chris Davis. Highly recommended.

On Spotify, you can find the episode here.

Black Friday Discount Finchat

Finchat is a partner that offers a special Black Friday discount. I know several Multis already took advantage to get 25% off and one (hi, Ben!) already messaged that he had used it all day long and was very happy about it.

If you want the 25% discount, it ends tomorrow (or maybe today, depending on when you read this). Cyber Monday is the very last day to grab the discount. You can secure your discount here.

The markets in the past week

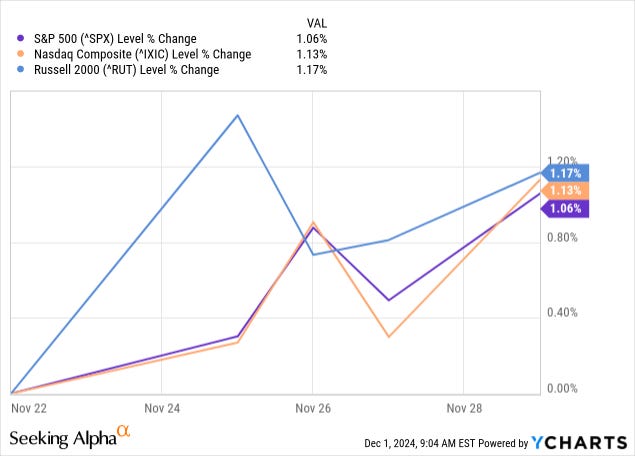

The indexes were up again this week. The S&P 500 was up 1.06%, the Nasdaq 1.13% and the Russell 2000 was up the most this week, with 1.17%.

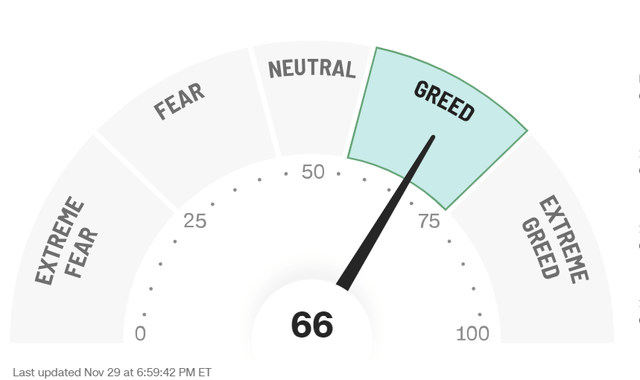

The Greed & Fear Index remained in Greed territory.

Quick Facts

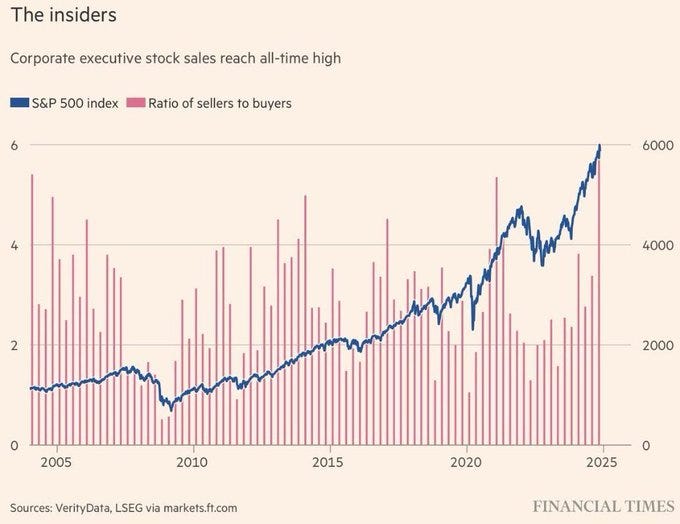

1. Insider Sales at an all-time high.

As you can see in this chart, insider sales hit an all-time high.

It's another sign that the markets are probably quite expensive right now. But it's not a clear sign. Just look at the bars I highlighted here.

As you can see, they are also very elevated and were not a sign. Bears will argue that some predicted drops, but those will have been minor drops.

Overall, I always say about these things: I don't know. I'm a big more cautious, as there are more signs that the market is quite expensive and investor sentiment really good, but you can never predict the market. It could go up 50% more before it goes down a bit.

2. Why I don't time

This second point is the reason why I don't time the market. Look at this graph, which I have already shown in many variations over the years.

Missing the best days makes you underperform.

Usually some argue then: "Yeah, but if you miss the worst days, your results will be better too." That's right, but good luck timing that. As you can see, the second-best day of the last twenty years came the day after the second-worst day. And you think you would have been out at the perfect time and in at the perfect time again? And that time after time after time? Good luck. I bet you also believe in Santa Claus.

While the opposite is not that hard: you just hold your stocks. Ok, I admit that can feel hard, but that's not the point. If I say it is not hard, I mean you don't have to be incredibly lucky or do complicated analysis that may or may not work. Just sit on your hands and wait.

Stocks On My Radar

From here on, it’s only for paid members, but if you are not a paid member, I hope you enjoyed this content so far. If you consider becoming a paid member, don’t hesitate. There’s a 35% discount and it ends on Monday 11.59 pm.