Adyen: The Ultimate Deep Dive

Everything You Need to Know About Adyen

Hi Multis and friends

Yes, there are two categories now. The Multis are the paid subscribers to Potential Multibaggers. We form a community, and every paid member will soon get an invitation to join our lively Multis community, where hundreds of fellow investors ask questions and discuss investing.

But if you are a free subscriber, don’t run away. You’ll still get a ton of value, much more than before. The reason is simple: you’ll get more articles. Even for the paid ones, you should get value from the parts I don’t put behind the paywall.

If you want to upgrade to a paid membership, NOW it’s the time to do this! The launch/Black Friday/Cyber Monday discount of 35% (!!!) is only life for 2 days after today. So, it’s better not to hesitate and upgrade right now.

That’s enough for marketing, right? I think you want the value now and that’s what I want to give you.

So, here we go.

This will be a long article, because it’s the synthesis of 5 articles I wrote at Potential Multibaggers. That’s also what you can expect in the future from Potential Multibagger picks. Normally, there are 5 articles for every pick, totalling about 15K to 20K words, so I can maximize the information I can provide for your due diligence.

Quick Facts About Adyen

· Founded in 2006 in Amsterdam, still headquartered there today.

· CEO: Pieter van der Does (founder) and co-CEO Ingo Uytdehaage, since 2023. Before that, Uytdehaage was Adyen’s CFO for 12 years.

· Trades on Euronext Amsterdam.

· ISIN: NL0012969182

· Stock price on Friday, November 30, 2024, after the market closed: €1,378.40

· ADRs (American Depository Receipts)

ADYEY: $14.52 (every ADR share here represents 1% of a share)

ADYYF: $1,467.00

· Market cap on the same day: €41.81 billion

· Revenue last 12 months: €1.8 billion

· Revenue in H1 2024: €913.4 million ($1B), up 24% YoY.

· EBITDA in H1 2024: €423.1M (+32%)

· Net income H1 2024 €409.6 million, up 45% YoY.

· Payment volume: €1.16 trillion (!) in the last 12 months

· Payment volume growth in the last 6 months: 45%

· Very low take rate: 0.147% of payment volume in H1 2024

An introduction to Adyen and what it does

Adyen was founded in 2006 by a group of 4 entrepreneurs, including Pieter van der Does, who still is the CEO today. Van der Does is a very remarkable man, who shares a lot with the great owner-operators that are described in Jim Collins’ classic book From Good To Great. Great CEOs are incredibly important and I think van der Does is one of the exceptional CEOs of our time. More about him further in this document

(Pieter van der Does, source)

Adyen is a payment technology platform company. Van der Does and his co-founders saw that the payment system was an antiquated patchwork of systems that were stitched together on completely outdated infrastructure, often dating from the fifties and sixties. They wanted to start from scratch and that's why they chose the name Adyen, which means ‘start again’ in Sranan Tongo, one of the languages spoken in Suriname, a former Dutch colony (until 1975). There is quite a big minority of Surinamese in The Netherlands, about 2.3% of the total Dutch population.

The use of the word Adyen thus refers to the fact that the founders wanted to start the payment business all over again but it also reflects their personal new start. Adyen is their second project, after they sold a company called Bibit to the Royal Bank of Scotland in 2004 for more than €700 million. Van der Does on why the people from Bibit started another company:

We always felt that we were apologetic over errors we didn't make, because some bank makes a mistake, a payment method doesn't have uptime. We thought if we do this another time around, let's try to build the company that we should have had. Let's try to build the ideal company.

(Source)

From the start, Adyen wanted to build a single platform that connected all card networks and all local payment methods worldwide. Its vision was a unified worldwide payment system focused on customers who want to sell, both online and offline.

On top of that, Adyen wanted to provide shopping data insights of customers to its merchants. Of course, the integration of online and offline payment solutions has become very important for merchants nowadays. Adyen is one of the few that offers one platform for omnichannel (offline and online), especially if you look at enterprise-level capabilities.

Van der Does explains in a 2015 interview:

Omnichannel is a bit of a difficult term, but what is very real, is that if you buy something online, you want to be able to return it in-store. And that person in-store somehow needs to link that to the payment because now he has the goods back as a merchant. You actually want the consumer in your store because he'll buy something else. So getting your consumer that bought something online in your store is a good thing. (...)

But the payment systems historically have been separated. So what we said is we do mobile, it's about half of all we do. We also do browser-based. If we also have the in-store terminal, then you can have, without a manual process, you can have people reversing transactions in the store, and make it all so much better.

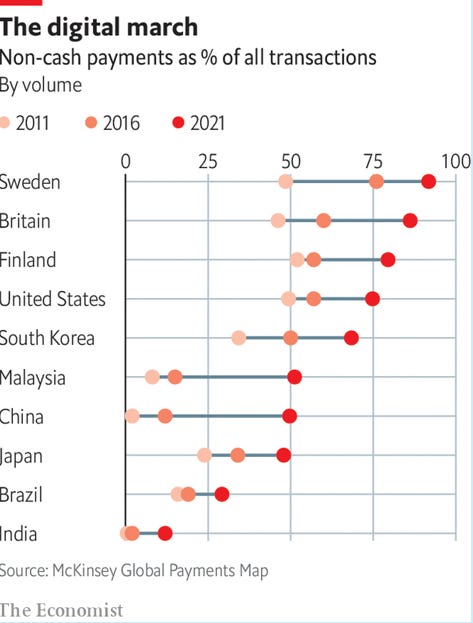

If you look at it from a wider angle, this is a story of what analyst Jason Moser calls "The War On Cash." This peaceful war started half a century ago, when the Visa (V) and Mastercard (MA) networks started processing payments without cash, but the movement is accelerating and globalizing.

The pandemic has given it an extra power injection, but the accelerating trend was already there in the years before.

Starting a few years ago, the disruption has formed a hockey stick chart, with the increasing use of cash alternatives. This chart shows the fast growth of non-cash payments worldwide.

(Source)

Between 2011 and 2018, Netflix (NFLX) expanded into 190 countries worldwide. That's a huge accomplishment in just 7 years, but without Adyen, it would have been impossible. Adyen could unify all the different payment systems and methods that Netflix needed on its platform and that's why Netflix could handle the payments. It is unnecessary to say that Netflix is one of Adyen's loyal customers, just like another fast-expanding streaming company, Spotify (SPOT). If you know that even Amazon uses Adyen in a lot of non-North-American markets, I think you can appreciate the power of Adyen’s platform even more, as Amazon has robust payment solutions in-house as well, but still decides to partner with Adyen.

We often don't realize how complex payments are, and we sigh when they don't work. But have you noticed that failures are becoming less frequent nowadays? That is because of Adyen and similar companies.

For e-commerce, there's even more complexity. There are much more cross-border interactions, for example. But a lot of payment systems are very local. In The Netherlands and Belgium, the biggest e-commerce player is bol.com. Dutch people can pay with iDeal, a local payment method that is not even known in Belgium let alone used. However, iDeal has about 80% market share in Dutch online payments. Because bol.com uses Adyen, it can easily accept all payment methods without having to diversify per country.

It is not a coincidence that Adyen is a European company. Stripe has European (Irish) origins too, by the way, in its founders, the Collison brothers, although it has now become mostly American.

The European payments system is extremely complex. There are literally hundreds of payment systems in the European market; e-commerce puts an extra layer of complexity on top of that. Cross-border adds complexity but also the different platforms: mobile and desktop, and if you have a brick-and-mortar store also POS (point-of-sale) technology.

Before Adyen, it was very complex for companies to interconnect the different payment systems and methods. Adyen unified them all on its platform. For companies, even big companies like Netflix, Spotify and McDonald, Dunkin, and Nike (more customers of Adyen), these integrations are too complex and too low of a cost to take in-house.

Because of that complex first market, Adyen can perfectly scale worldwide, where mostly the payment systems layered upon each other are still complicated, but not nearly as complicated as in Europe.

The more complicated, the better for Adyen. So QR codes, Google Pay, Apple Pay etc. are all complexity tailwinds, not headwinds.

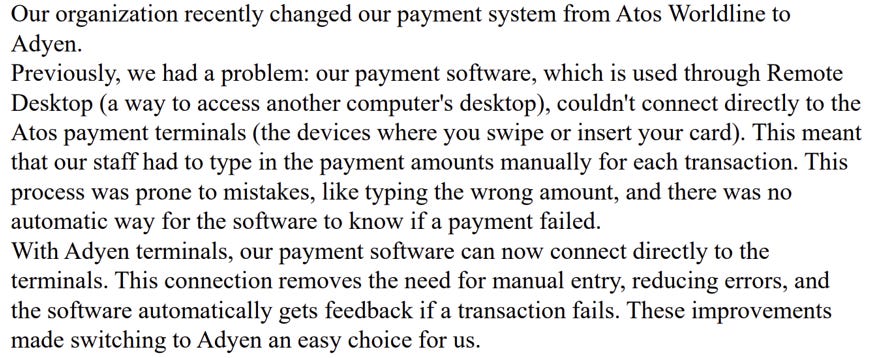

When I picked Adyen for Potential Multibaggers, this is what one of my subscribers sent me:

This is one very concrete example of a problem that Adyen solves. It’s taking market share from incumbents like Atos Worldline, Fiserv, Global Payments, JPMorgan Chase, Citi and other big banks, but also point-of-sale systems such as Ingenico and Verifone.

What you are missing as a free subscriber:

How Adyen makes money

Insight on the payment industry

10 competitive advantages and tailwinds

The company now and in the near future

Management

Finances

Risks

The current valuation