My 10 Stocks for 2026

Hi Multis

Last year, on December 30, 2024, I shared 10 stocks for 2025 with you. If you were a paying subscriber, you’ve been able to follow them live throughout the year.

The results are very strong: an average of +54.16% per stock, beating the S&P 500 by 37.36% and the Nasdaq by 34.02%.

Today, on the very last day of 2025, I present you my top 10 stocks for 2026. Three come back from last year, 7 others are new.

Of course, I absolutely can’t guarantee that these 10 will be as successful as my previous selection. The market is far too volatile for that. What I can say is that the probability that my selection outperforms the market is high when the market does well and low when the market does poorly. But even if the market performs badly, I’ll hold onto these stocks for the long term and add to my positions.

As always, I have maximum skin in the game and that also means I will buy all these stocks after publishing this article.

1. BE Semiconductor Industries (BESIY) - €133.70

Let’s start with what will probably be the biggest surprise. Just like that other Dutch company, ASML (in the list last year), BE Semiconductor Industries (BESIY) builds machines to make chips. Contrary to ASML, BESI focuses on the final step of the production process: the moment when chips are already on silicon wafers and ready to be packaged and connected.

(Source: BESI)

BESI’s core activity revolves around die-attach and hybrid bonding. Die-attach is the precise placement and connection of a chip onto its carrier. Hybrid bonding goes a step further: it stacks multiple chips on top of each other with very dense electrical connections. This stacking is necessary for High Bandwidth Memory (’HBM’), the type of memory that AI requires.

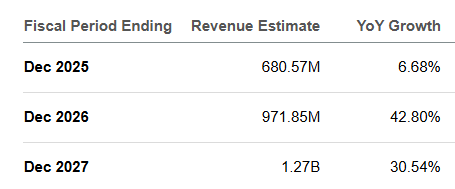

The explosive demand for artificial intelligence (’AI’) is driving BESI’s sales. But up to now, industry demand outside of AI, like mobile, automotive and memory markets has remained weak, which suppressed revenue growth in 2025. But orders have improved a lot. Many of those orders will be recognized in revenue for 2026 and 2027. Hence the expectations of 42.8% and 30.5% growth in 2026 and 2027 versus the meager 6.7% this year.

How about the valuation?

Looking at expected growth, you see a 2026 P/E ratio of 40.9. Many investors will find that outrageously expensive, but profitability is expected to increase by 96% in 2026.

That translates to a PEG ratio of 0.43, which is very cheap (anything below 1 is cheap).

For 2027, expectations are a P/E of 27.8, but earnings growth of 47% still gives a PEG of just 0.59. So I think the stock could shoot up considerably in 2026 and 2027.

I’m not sure if I will keep BESI as a long-term investment, but for the next year or years, it looks great.

2. Mercado Libre (MELI) - $2020.85

Of all 83,000 publicly traded companies worldwide, Mercado Libre (MELI) is the only one that has shown more than 30% revenue growth for 28 consecutive quarters. That’s simply fantastic.

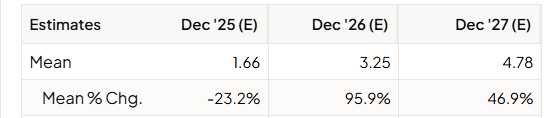

Latin America’s e-commerce giant and digital bank is currently reinvesting a lot of the money it makes, which is creating some negativity among analysts who only focus on the short term. The stock is currently 22.7% below its recent peak.

I see that as a nice end-of-year gift from the market.

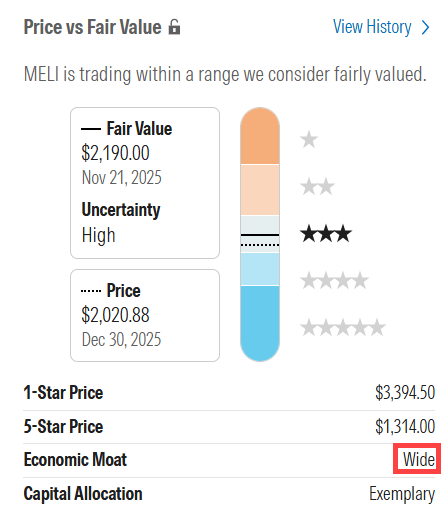

A crucial concept in investing is CAP, or Competitive Advantage Period. It’s the period during which a company can maintain its competitive advantage. Mercado Libre’s CAP is, by my estimation, exceptionally long. Morningstar also gives Mercado Libre a wide moat rating, meaning they estimate the company has a competitive advantage for 20 years or longer.

I can envision Mercado Libre becoming the first trillion-dollar company in Latin America over the long term. It’s currently worth approximately $102.5 billion, so that would be a roughly 10x increase. Of course, something like that takes time. But currently, Mercado Libre generates 96% of its revenue in just three countries: Brazil, Mexico, and Argentina. As other Latin American countries grow, MELI will ride that wave as well.

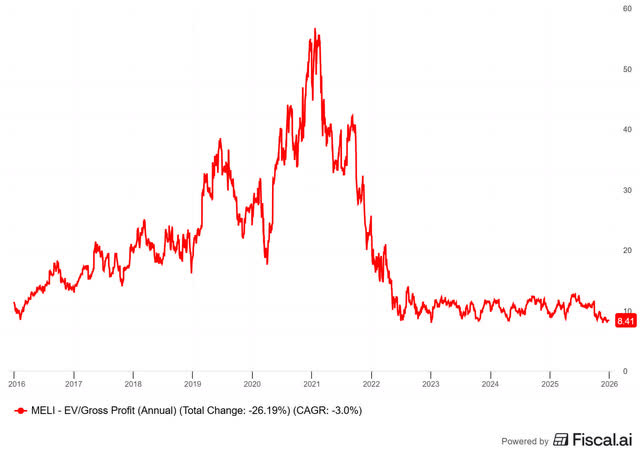

The stock trades at just 8.4x EV/gross profit.

Give yourself a New Year’s Day gift, with a 15% discount to Fiscal to generate charts like this, get all the filings, use AI to chat with the documents, get the Morningstar research integrated and so much more. Grab the discount here.

That’s cheap for such a quality company.

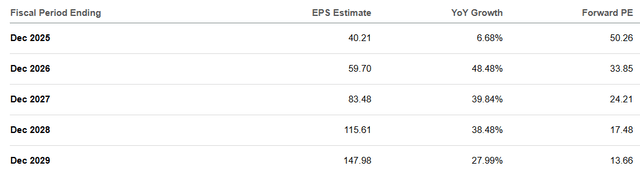

The PEG ratios for the coming years confirm this picture.

0.69 for 2026, 0.61 for 2027 and 0.45 for 2028. In other words: the market is undervaluing Mercado Libre’s growth potential. It’s my biggest position right now, but I keep adding.

3. Duolingo (DUOL) - $177.14

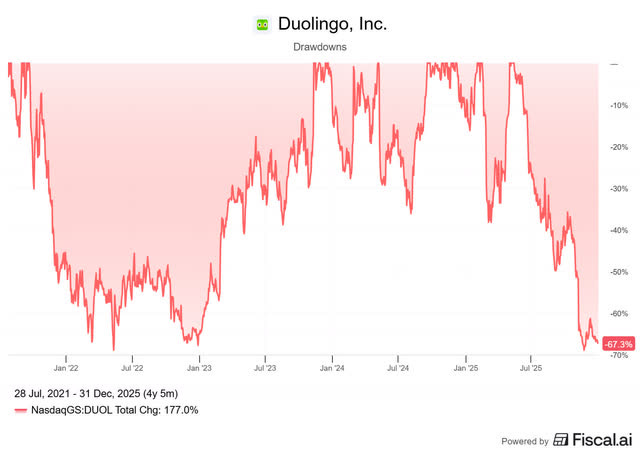

The stock has dropped like a rock in recent months. It’s now down 67% from its top.

The numbers remain excellent. In Q3, Duolingo had 41% revenue growth, strong margins, and growing user numbers.

The decline is because management is deliberately choosing long-term investments over quick money. There are three elements: the quality of the lessons, the engagement of free users and the monetization. Founder and CEO Luis von Ahn clearly said that the first two will be the focus for the near future.

My assumption is that this could become a learning platform for a wide range of knowledge (languages, mathematics, chess, programming, cooking, financial literacy, ...). The upside potential is then very high.

Let’s look at it differently. Would you say no to this unknown company?

The second-longest streak of 30%+ revenue growth in the world, with 22 consecutive quarters, second globally only behind Mercado Libre.

41% revenue growth in the last quarter.

Free cash flow margins of approximately 30% (sometimes above 40%).

Trading at a 2026 P/FCF of just 17.

Those are Duolingo’s numbers. Sometimes it’s helpful to remove the noise and look at the bare facts.

I’ve written extensively about Duolingo in 2025 and if the stock remains so attractive in 2026, I will continue to pound the table. Of course, being right and having the stock market price that in are different things.

4. Sea Limited (SE) - $128.35

Sea Limited’s most recent quarterly results were exceptionally strong, yet the stock price fell. I’ve been a shareholder since it traded at $54, five years ago. It’s one of the most impressive companies I’ve seen in my investing career, but probably also one of the most misunderstood.

SEA stands for South East Asia, and the company has three legs. Founder Forrest Li started with Garena, which focuses on gaming. Their self-developed game Free Fire is the most downloaded mobile game in the world. With Shopee, Sea is the largest e-commerce player in Southeast Asia, and with Monee, they also have a digital bank.

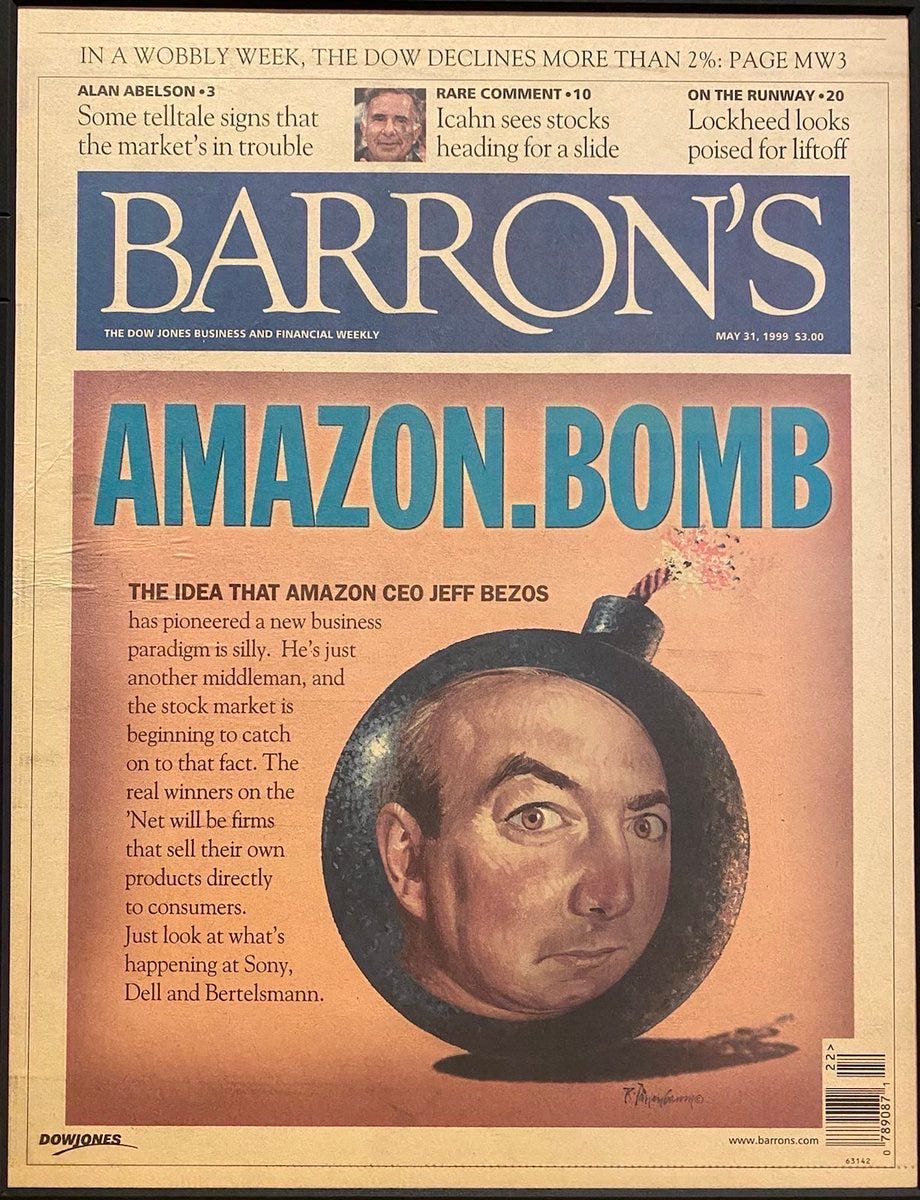

For me, Forrest Li is on the same level as Jeff Bezos.

Of course, Bezos is now much more respected, but back then, he was often controversial. You might remember the headline: Amazon.BOMB when the dot-com bubble burst. This is what the newspaper article said under that infamous title: “The idea that Amazon CEO Jeff Bezos has pioneered a new business paradigm is silly.”

Sea had 38.3% revenue growth in the last quarter. That’s high growth once again. In 2022, the company saw that the market wanted profitability due to the interest rate hikes. In just two quarters, Forrest Li turned the company completely around: from $1 billion loss per quarter to $400 million profit. That’s still the most impressive thing I’ve ever seen a business leader do. Jeff Bezos needed two years to do the same thing. Forrest Li did it in two quarters.

Then, once it was profitable, Sea pivoted again and announced it would reinvest in growth while remaining profitable. And again, they did exactly that, with 38.3% revenue growth now. At this scale, that’s impressive, because Sea already had $21 billion in revenue over the last twelve months.

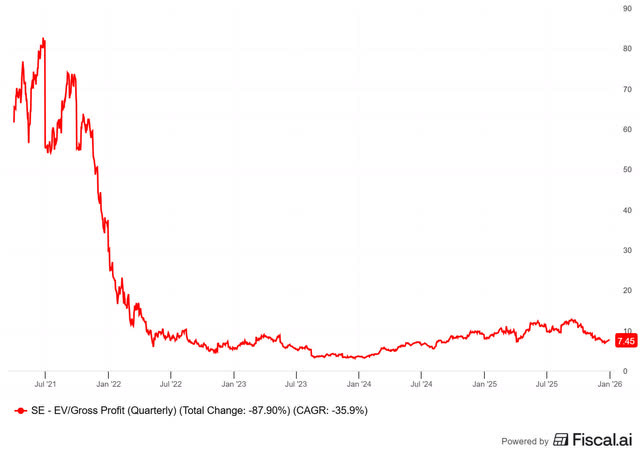

At just 8x EV/gross profit, Sea looks cheap, even cheaper than April, when the whole stock market dropped because of the tariffs of ‘Liberation Day.’

5. Rubrik (RBRK) - $77.87

Rubrik started as a data backup company, but it’s much more than that. The company had a simple but powerful insight: hackers aren’t after infrastructure, they’re after data. The entire cybersecurity industry secures endpoints, networks, and the cloud, but not the data itself. Rubrik flipped that around. Instead of trying to prevent attacks, it assumes every organization will be hacked sooner or later. The question isn’t if you’ll be hacked, but when.

Rubrik offers companies the ability to fully recover after an attack, often within minutes. No weeks of chaos, no paying ransom to cybercriminals. Home Depot, the largest home improvement retailer in the US, is a client. When hackers took everything down, Rubrik brought all 2,200 Home Depot stores back online in 45 minutes.

Additionally, Rubrik uses AI to continuously scan all data to alert for intruders the moment a suspicious pattern appears.

The numbers are strong: 48% revenue growth, 80% gross margin, 19% free cash flow margins, and net retention of more than 120%. That means all customers from last year, including those who are no longer customers, spent more than 20% more than last year.

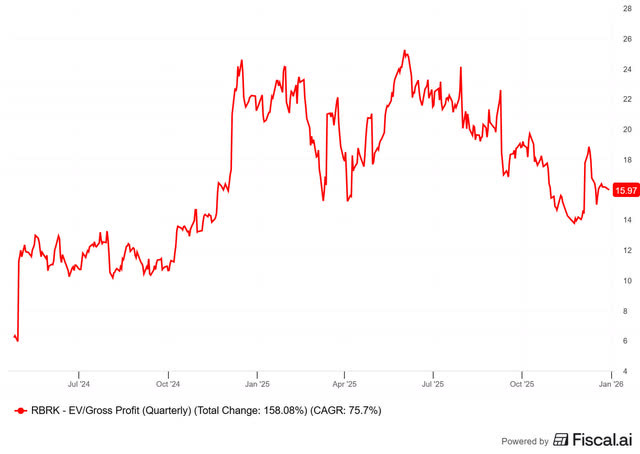

Microsoft has been a strategic partner for years, and basketball legend Kevin Durant is an early investor and advisor to the Board of Directors.For a cybersecurity company, the stock is still relatively fairly valued at 18.5x EV/gross profit.

For comparison: sector peers CrowdStrike and Cloudflare trade at 34.3x and 45.8x EV/gross profit, respectively.

If you are a free reader, this is where the content stops for you.

Are you sick of missing the best picks? Upgrade here.

In a few weeks, everyone will be upgraded to the premium subscription, worth $1200 per year. You can get that now for just $499.

If you want full access to Potential Multibaggers, here’s what you’ll get:

✅ The rest of my 10 stocks for 2026

✅ My full portfolio (with every transaction, but only if you act now; this will be on the $1,200 plan)

✅ All the picks

✅ Access to our private chat group

✅ Best Buys Now (outperforming the market by 20%+ over 3 years.)

✅ Deep dives on earnings, with a Quality Score and Valuation Score, so you know if the stock’s a buy, hold or sell.

Of course, I know that investing in Potential Multibaggers is spending money. But what if it brings you more money than it costs? That’s called investing. Potential Multibaggers may be a great investment for you.