Sea: A Christmas Gift From Mr. Market?

A Q3 analysis, the Quality Score and Valuation

Hi Multis,

Baurzhan here to cover Sea’s (SE) third-quarter results.

Before I start, I should confess: as a relatively new writer on the Multibaggers service, it’s a special pleasure to write quarterly updates on this company! The reasons are simple: the “nerd-level” detail in the business trajectory (yes, I am a proud nerd since high school), leadership’s pragmatic “we do what we said” approach, and the gaming division, which still amazes me with its creativity. Hope you’ll enjoy this article as much as I enjoyed writing it.

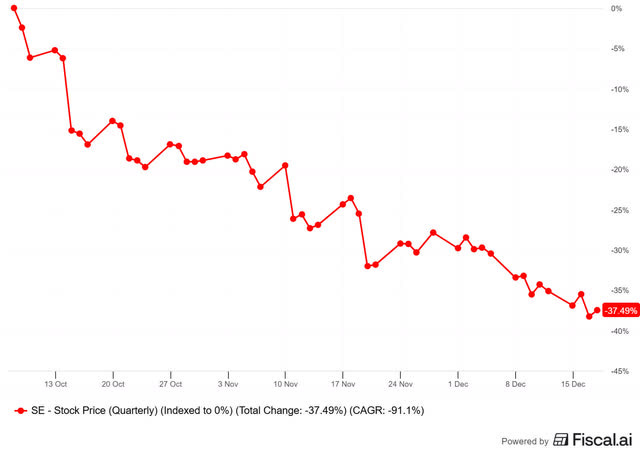

The company reported Q3 earnings on November 11, and the stock initially reacted well but then gave it all back and dropped.

The stock is down 37.5% since October 8.

Get 15% off for Fiscal with this link.

Is this the perfect Christmas gift from Mr. Market? Kris will tell you at the end of this article.

Before the Q3 update, let’s quickly recap the previous quarter, the Q2 quarter.

In Q2, the company surprised the market with revenue acceleration, but slightly missed the EPS consensus. The results confirmed the business caught another wave of growth and began to press harder on operating leverage. All three segments delivered: Shopee showed resilient GMV and improving profitability; Monee scaled fast with strong loan growth and stable credit quality; and Garena rebounded with renewed engagement and monetization momentum. Does the story keep rolling? Let’s see.

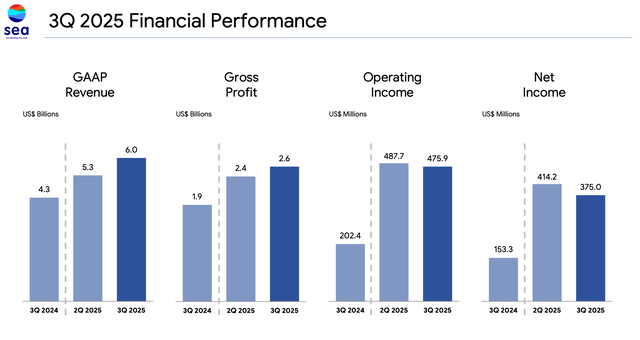

In the 3rd quarter, Sea crushed the revenue consensus again, this time by roughly $370 million, to $5.99 billion or a whopping 6.5% higher than the consensus. Poor analysts, beaten up big time for the second quarter in a row.

On GAAP EPS, Sea missed the consensus by $0.15, delivering $0.59. It may be the main reason for the negative price action. That’s not a tiny miss this time but management has been very clear: the priority is competitive moat and long-term growth, and that requires investments. Once they reach comfort on scale and moat, they can prioritize and deliver profitability. Sea did it before, they will do it again, no doubt here.

Let’s start with the overall group results.

Group Key Financial Highlights

Gross profit rose 43.4% YoY to $2.6B (+7.8% QoQ);

Margin expanded 14.3 pp YoY and dipped 2.4 pp QoQ.

Operating income surged 135% YoY to $476M, but dipped 2.4% QoQ.

Net income surged 135% YoY to $375M, but fell 9.4% QoQ

Total adjusted EBITDA was $874.3M, up 67.7% YoY and 5.4% QoQ.

Sales & marketing expense rose 30.9% YoY to $1.15B and up another $150M QoQ, but stayed within 19% of revenue.

Hey, operating in 8 core highly competitive markets (Indonesia, Taiwan, Thailand, Vietnam, Singapore, Malaysia, The Philippines, and Brazil), deeply localizing in each and still delivering 38%+ revenue growth… that’s hell of a challenge. Hats off to the team.

Now let’s dive into segment results.

Business Segment Results in Q3 2025

Starting with Shopee, launched as a “side project” to Garena in 2017, it’s now nearly 72% of the group’s revenue. Talking about a successful side project.

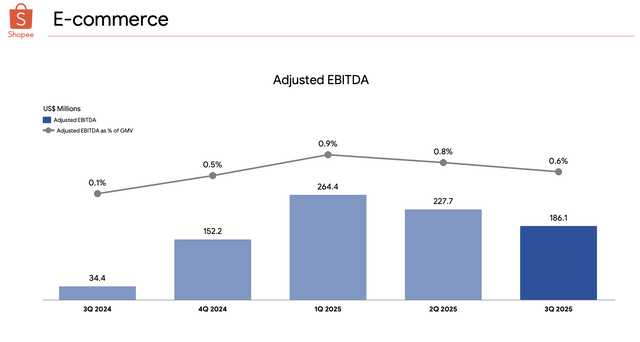

E-commerce (Shopee)

The first course in our three-course meal.

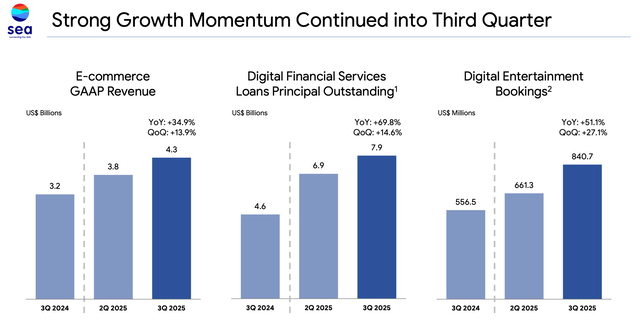

Revenue of $3.8B, up 34.9% YoY and +13.9% QoQ.

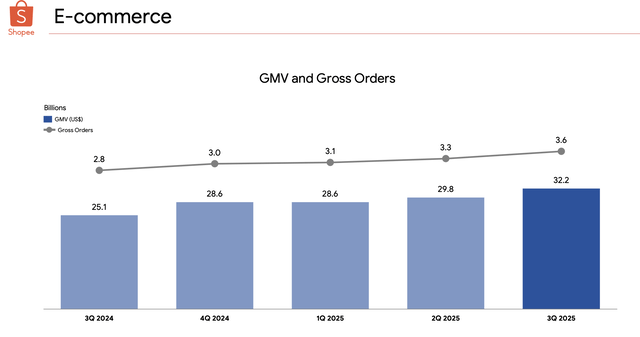

GMV (Gross Merchandise Volume) grew 28.3% YoY to $32.2B, +8% QoQ. The company now expects full-year GMV growth of more than 25%. Core marketplace revenue (from transaction fees and advertising) increased 55% to $3.1B.

The management continues the disciplined execution of its multi-market playbook:

Step 1 – probe the market with low-value orders and gather deep market insights (e.g., Mexico, Chile, Colombia), then make a fast “go/no-go” call (e.g., exited multiple European countries).

Step 2 - build “critical mass” in logistics (MELI sends a high five here) and localize deeply to deliver a superior user experience (e.g., Indonesia, Brazil) — the long-term moat foundation.

Step 3 – scale and monetize, moving upmarket (e.g., VIP membership in Indonesia, Thailand, Vietnam).

Step 4 – Repeat steps 1–3 in adjacent markets to leverage logistics infrastructure and regional learnings.

The result: a record-setting quarter, with new highs in quarterly GMV and gross order volume.

Let’s unpack what’s driving the numbers. I’ll quote CEO Forrest Li below (bolding is mine):

We launched SPX Express in 2018 when we recognized that reliable and cost-effective delivery was the most urgent logistics demand in our market due to wide differences in geography and in structure.

Over the years we have learned how to deliver packages by truck, plane, boat, motorbike, and more.

We deliver well in dense, congested, and high-rise cities. We also deliver well in rural areas where we need to cross rivers, navigate rice fields, and locate homes without formal addresses or postal codes.

This experience has given us a very deep understanding of every region in our market.

Our delivery capability has now developed to the point where we can identify and deploy service quality improvements addressing specific user needs in different markets. This helps us to serve more user baskets better while improving our operational efficiency even further.

In Indonesia (a country of 6,000 (!) inhabited islands, a logistic nightmare), Shopee saw strong urban demand for ultra-fast delivery, rolled out same-day and instant options (under two hours), and drove 35% YoY growth in fast-delivery orders in Greater Jakarta (the capital).

For rural areas, they introduced a lower-cost delivery solution, cut cost per order by 20%, and grew orders outside Java (the largest and most populated island) by 45% YoY in Q3.

In Taiwan, demand looked different: many buyers prefer self-pickup, so Shopee scaled its automated locker network to 2,500+ locations in under three years. It’s the only e-commerce player at that scale in Taiwan and lockers now account for 70%+ of deliveries. This made customers happier and reduced costs: lockers run at 30% lower per-order cost and also serve as last-mile hubs, a big reason Taiwan delivered double-digit GMV growth.

This management team is also excelling in logistics from the other angle. Here’s another example from Forrest Li on doing it smartly:

In previous calls, I have shared updates on initiatives such as Intelligent Demand Forecasting where we pre-ship commonly ordered products closer to where we anticipate buyer demand will be.

This helps us reduce buyer waiting time and fulfill orders more cost efficiently. For instance, in Indonesia, if we wait until an order comes in from a remote island before shipping the item out from Java, we must rely on more expensive forms of transport such as airplanes to get it there quickly.

In Brazil, logistics also continued to shine (and with MELI investing heavily there, you have to): average delivery time improved by about 2 days YoY, and Shopee Mall GMV grew more than 2x YoY.

The cherry on top (from Forrest Li):

We are investing in this capability in a capital efficient way, for instance by mostly leasing rather than buying land and warehouses. The most intense investment comes not in the form of money, but in time and effort.

It’s a costly game, but Shopee is keeping it profitable as scale kicks in.

So logistics, one of the core advantages in this business, is a priority, as you can clearly see. And the company succeeds.

What about the monetisation progress? Pretty good, it seems.

Ad revenue rose 70%+, and ad take rate expanded by 80+ bps YoY in Q3. The number of sellers using ad products rose 25%+, and average ad spend per seller rose 40%+ YoY (compounding growth). This is helped by smart partnerships with YouTube: Shopee orders driven by YouTube content across Southeast Asia grew 30%+ QoQ.

This worked great, right? So, of course, they’re pushing it further: announcing a Meta partnership that enables seamless product promotion and checkout between Facebook and Shopee accounts and extending YouTube to Brazil. No wonder purchase frequency across markets rose 12% YoY and average monthly active buyers rose 15% YoY. Both are clear signs of more compounding growth, music to long-term investor ears.

And premium expansion is moving fast, too. The Shopee VIP membership, comparable to Amazon Prime, grows fast. Another great nugget from Forrest Li on the earnings call:

“Our subscription-based Shopee VIP membership program is a great example and it has continued to gain strong traction. By the end of September, VIP members across Indonesia, Thailand, Vietnam surpassed 3.5 million, up more than 75% from the previous quarter.

Given the price sensitivity of many customers in our market, the success of our VIP program shows the high value we are delivering to our customers.

VIP members are demonstrating higher engagement in Indonesia. These members spend around 40% more after subscribing to the program. Shopee VIP members also buy three times more frequently and spent five times more than non subscribers in the third quarter, accounting for about 10% of total GMV in Indonesia.”

So, this was the first course. Let’s move to the second course, Sea’s “crown jewel,” as Kris calls it: Monee, followed by dessert: Garena.

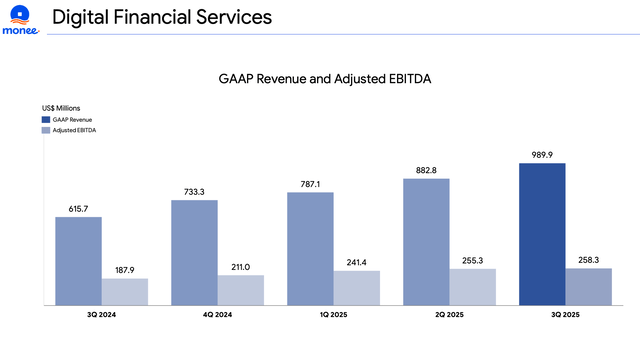

Digital Financial Services (Monee)

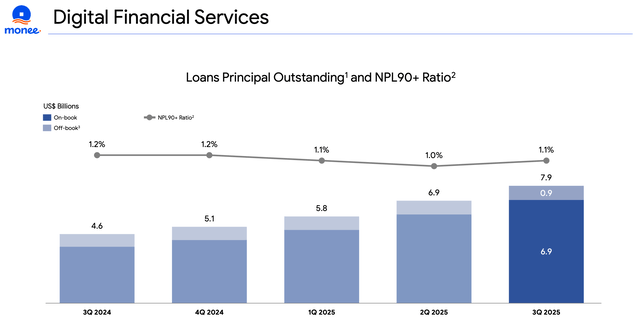

GAAP revenue:$989.9M, up 60.8% YoY and 12.1% QoQ.

Consumer and SME loans outstanding: $7.9B, up 71.7% YoY and 14.5% QoQ.

Credit expansion drove growth while risk stayed under control: NPL 90+ rose 0.1pp QoQ to 1.1%, but improved 0.1pp YoY.

Keep in mind: this is far more conservative than Mercado Pago, where similar delinquency metrics can run much higher (e.g., high teens), partly because Mercado Pago’s credit book is broader and includes different risk buckets (like credit cards).

Monee key highlights in Q3 2025

The idea behind Monee is is simple. Shopee has a big (and growing) e-commerce customer base, and the goal is simple: make payments seamless and remove friction. If they have the money, let them pay fast with the most convenient methods (easy, not very profitable). If they don’t, offer credit.

On the seller side, if a merchant needs working capital to stock up and sell more, give it to them fast. This can be an even bigger opportunity in emerging markets. The reason is simple: many SMEs (small and medium-sized businesses) are underserved by traditional banks because underwriting still leans on “official” financial statements and rigid rules. Of course, many SMEs in emerging markets don’t have those. Even when they do, traditional bank processes can take weeks (or even months) and “time-to-yes” / “time-to-cash” is often a matter of life-or-death for a small business.

This is where digital finance platforms like Monee win. They can underwrite using alternative data (e.g., transaction signals from Shopee) and fund almost instantly.

The results speak for themselves.

The credit portfolio continues to grow on the back of cross-selling to Shopee’s buyer and seller base. Monee added >5 million first-time borrowers this quarter. This helped active users across consumer and SME loan products reach 34M, up 45% YoY.

Thailand’s loan book surpassed $2B as of the end of September. In Brazil, the loan book grew 3x YoY in Q3, driven by improving portfolio quality and stronger user performance.

On-Shopee SPayLater GMV penetration ranges from single digits in early markets to 30%+ in mature ones and it’s still deepening.

So, SEA clearly nails the cross-sell. But the ideal outcome is when the product is so good that people want to use it outside Shopee, too, right? This is exactly what the management team has achieved. The numbers speak clearly there:

Off-Shopee SPayLater / BNPL grew 3x YoY and 40%+ QoQ — and it’s still <10% of the total loan book. In Brazil, personal cash loans grew by ~50% QoQ.

Forrest Li also framed it nicely:

Range of merchants is a key pillar of our strategy to grow our money businesses of Shopee in payments. It offers users a faster and more seamless experience, giving them direct access without having to go through the Shopee app.

Beyond payments, it helps us unlock more use cases, positioning ShopeePay as a one stop platform for users, broader financial needs of Shopee credit, insurance, wealth management and more. The app has launched in Indonesia, Thailand, Vietnam and Malaysia and is showing strong traction. More than 20% of our ShopeePay monthly transacting users are using the standalone app.

Scaling with risk control is the formula and you can see it in the EBITDA.

Just be patient and enjoy the show. Monee should keep shining for years, like a proper crown jewel. Now, please enjoy your dessert.

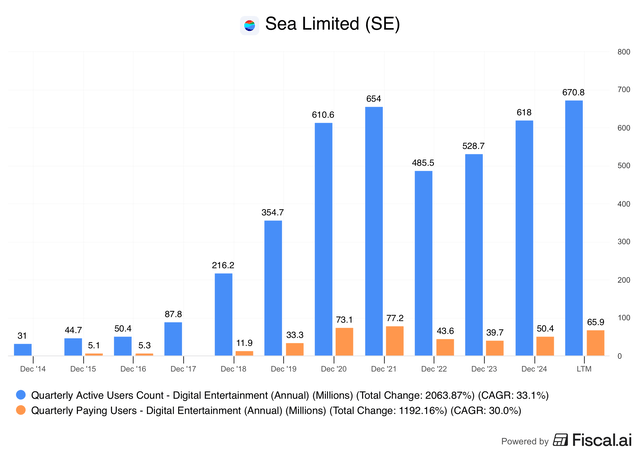

Digital Entertainment (Garena)

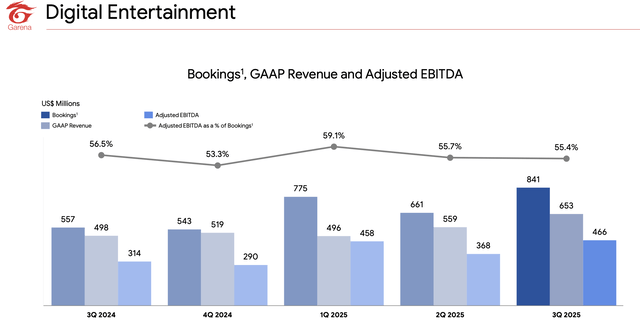

GAAP revenue rose 28.4% to $559.1M. Bookings accelerated to +51% YoY, reaching $840.7M. Growth was supported by record user scale and higher paying-user penetration.

This was Garena’s strongest quarter since 2021 and we all know 2021 had COVID tailwinds with everyone stuck at home. Nowadays, without such tailwinds, Garena managed to achieve similar bookings by building the intrinsic interest in its digital entertainment. Quarterly active users even surpassed the COVID era, and paying users got very close to those levels too.

You get more insights like these with Fiscal. I took it with Kris’s link (15% off!), and I’m very happy with the subscription.

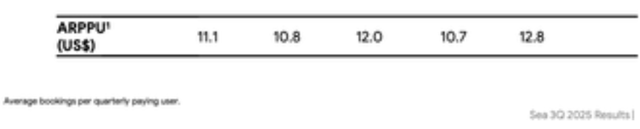

As a result, ARPU also grew 15.3% YoY to $12.8 (and 19.6% QoQ).

Outstanding performance. The key driver is the cash cow, Free Fire, launched about eight years ago. Garena didn’t just squeeze the hell out of it and let it die. It kept breathing new life into it with creativity and sharp IP collaborations.

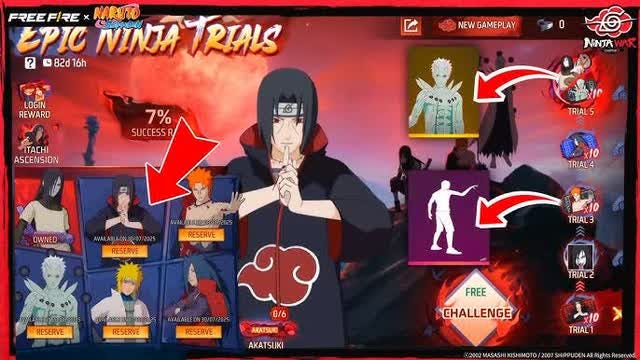

Remember last quarter. I got excited about Squid Game (the Netflix phenomenon) and Naruto (the iconic anime). This quarter showcased exactly why.

Just listen to Forrest Li:

“Free Fire anchored this strong performance with two high impact campaigns, Squid Game and Naruto Shippuden Chapter 2. The campaigns received a huge positive response, accelerating our growth momentum from the previous quarter.

Our Squid Game collaboration incorporated iconic challenges from the blockbuster Netflix TV series such as Red Light, Green Light and the Glass Bridge. The event drove strong participation with the Red Light Green Light Challenge being played more than 300 million times in the quarter.

And then about the even deeper, more creative Naruto collaboration:

Our Naruto Shippuden Chapter 2 event expanded on the resounding success of Chapter 1 in the first quarter of this year.

Based on gamer feedback and performance insights, we identified new fan favorite ninja characters, new attack mechanics, highly sought after collectible items, and a new one-on-one mode letting players use signature abilities from the series.

Chapter two went on to surpass Chapter one in both engagement and revenue. We saw an extremely high social media share rate for Chapter two, double the already high bar set by our eighth anniversary event.”

As a former semi-serious gamer (and a Naruto fan), this sounds incredible and I see where the magic is. Incorporating new attack mechanics and items, not just ninja characters... Honestly, I envy the kids playing this.

And when Forrest Li explains how they do it, it all makes sense:

This strong focus underpins how we take IP collaboration to the next level, and it is driven by Garena’s core creative culture.

First, we require every major IP partnership to be led by a team of genuine super fans of Dart IT within Garena to ensure authenticity and respect for the original work.

Naruto fans loved how closely the gameplay mirrored small but important details from the anime. For instance, one key storyline from the original anime was about rogue ninja returning to desecrate the ninja village they had been exiled from.

In Chapter one, we had built this ninja village into our map and introduced iconic attack skills from the main anime characters.

In Chapter two, we introduced attack skills that were specifically from the rogue ninja characters like fireballs, black fire and exploding birds, and redesigned the map to feature a destroyed version of the ninja village.

Zooming out, it’s the same formula again: deep localization + investment in the moat. Here it is applied to creativity, not logistics, but it shows SEA’s strength.

Beyond Free Fire, the team has also published other mobile titles.

For instance, they launched EA SPORTS FC Mobile in Vietnam and it became the country’s most downloaded mobile game in October.

These initiatives should push profitability even further. Digital Entertainment adjusted EBITDA grew 51% YoY, about 20pp faster than GAAP revenue.

And there might be more title hits to come, although Forrest didn’t throw much light on the 2026 pipeline, but promised to provide more details for the fourth quarter.

I hope you enjoyed the dessert as much as I did.

But the house wants to offer you a digestive drink. Maybe a few words on AI, since we’re living in an (imaginary?) AI bubble?

SEA is super pragmatic and AI is no exception. Forrest Li:

We try to focus on the applications and how to connect those fantastic technology to people’s daily life from every corner of the world. We believe we’ll see some similar pattern of AI revolution.

Probably we believe this impact and the value creation will be much, much bigger at this moment. We’re like the things you mentioned. Okay. We probably were not going to do what the big tech is going to do. We’re not going to like develop the... trying to make some fundamental large language model breakthrough. We’re not going to build data centers.

Sea is using AI in a practical, ROI-driven way: better search and recommendations, more personalized discovery, generative tools for sellers (images/video/text), and AI-driven customer service. It will partner with existing AI leaders rather than build its own data centers or foundation models. That is also a legit strategy.

Conclusion

It’s time for the conclusion. This quarter looked even better for the long-term trajectory than the previous one, despite slightly weaker margins. The market punished the stock, but for long-term investors.

I’m as curious as you about how Kris’s Quality Score and Valuation insights will turn out.

Hi Multis

Kris here. I think you will agree with me that Baurzhan did a great job with his earnings analysis. Let’s go to the Quality Score and the Valuation to see if the stock’s op opportunity now.

Here, the free part ends.

Do you want to know if SEA is a buy now?

Don’t miss the opportunities anymore? Get full access to Potential Multibaggers.

Here’s what you’ll get:

✅ The rest of this article

✅ Best Buys Now (outperforming the market by 22% over 3 years!)

✅ My complete portfolio (with every transaction)

✅ Deep insights through quarterly earnings deep dives

✅ The Quality Score and valuation updates every quarter.

✅ Access to our private chat group

Don’t hesitate. Don’t miss the next multibagger opportunity!