Hi Multis

It’s the 21st of December, and that means Christmas is just a few days away. Up to now, I have caught the coziness of Christmas: the lights, the warmth, the Christmas songs, but it should be about more than that.

The Christmas-New Year period is a period to look back on the year, to reflect, to be with your family and I didn’t have time for that yet.

In the upcoming week, I will, though. That doesn’t mean that you will probably get fewer articles in the upcoming week, maybe even none. Just so you know.

Articles In The Past Week

This is the third article this week.

In the first of this week, we looked at the Best Buys Now for this month.

The second article was about Sea Limited. You can read about deep insights into the earnings, the Quality Score and the stock valuation here.

Memes Of The Week

Two memes this week. This is the first.

The second one could be a conversation with my wife, haha.

Interesting Podcasts Or Books

This week, I listened to William Green’s interview with Howard Marks.

Howard Marks is the co-founder of Oaktree Capital Management.

To Marks, great investing is not about big wins or bold bets, but about being consistently good over a long time. He compares investing to tennis: avoiding mistakes matters more than hitting spectacular shots.

He stresses the importance of knowing your risk limits, staying disciplined, and focusing on what you understand best.

Marks is cautious about popular trends like AI stocks, Bitcoin, and gold, warning that many will disappoint.

You can listen to the episode here.

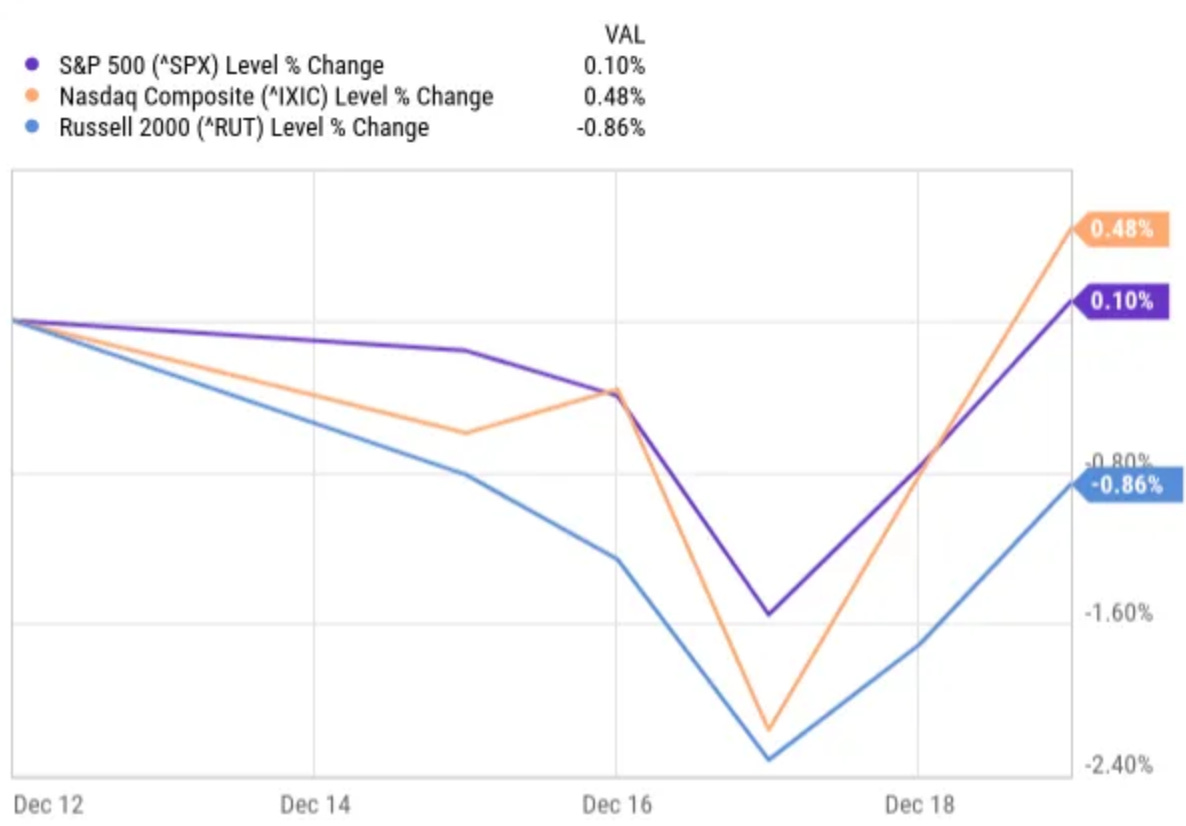

The markets in the past week

Last week, the S&P 500 lost 0.63%, the Nasdaq even 1.62%, but the Russell 2000 was up 1.19%. This week, we see the reverse pattern. The biggest winner of last week, the Russell 2000, was down 0.86%, the S&P 500 was up 0.1% and the Nasdacq was up 0.48%.

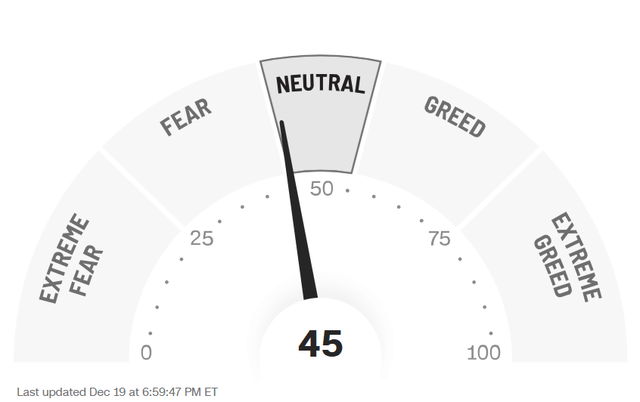

The Greed & Fear Index inched up from Fear to Neutral territory.

Lesson Of The Week

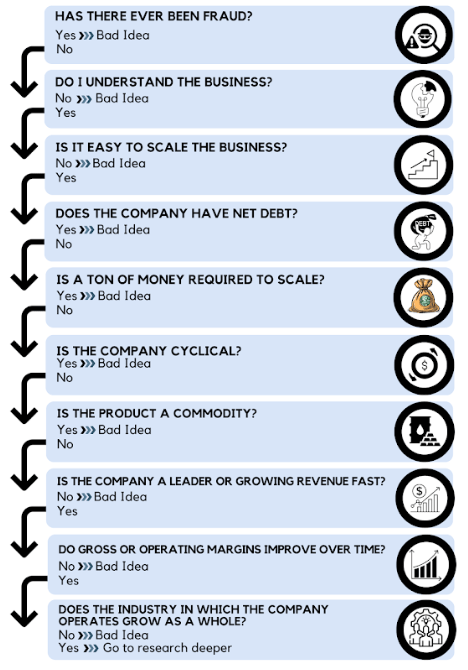

Sometimes, people ask me how I can flip through so many stocks. Over time, you develop a process that you go through very fast without making it explicit. In this visual, I tried to make it explicit.

Fraud is a “never invest” for me. Of course, if it’s 20 years ago and no key executives from that time are still there, that’s different.

Understanding the business is crucial. Warren Buffett called it ‘staying in your circle of competence.” What many people have wrong about this, though, is that Buffett himself tried to make his circle of competence as big as possible. Studying something that you don’t understand is very valuable. That can be for an immediate investment or maybe for a later one, but investing in your own knowledge will always pay off.

Sometimes, I see businesses that are doing great, but if they are hard to scale, they will see gradual growth at most, and I want more.

Net debt (so more debt than cash) is often a red flag to me too. Now, it totally depends on the business, why there’s debt and how fast it can be paid off but generally, financial stability is important. As I have written multiple times already: first you have to finish to finish first.

Is a ton of money required to grow? I made these a while ago, but this is a perfect reason why I wouldn’t want to invest in OpenAI. There are about $1T in commitments for the future. That’s a ton and it can kill the company.

I also avoid cyclical companies as much as possible. I’m talking about energy companies, for example. They are usually price takers. They have to take the price the market offers them. Unless they have a strong and durable competitive advantage, they can’t set the price.

These are commodity companies, so there’s some overlap there. But this focuses on a different aspect as well. Can your unique selling proposition be commoditized fast? Think of Tattooed Chef a few years ago. It was a plant-based frozen food brand known for vegan and vegetarian meals like cauliflower pizza, bowls, and snacks. It went public via a SPAC in 2020 but filed for bankruptcy in 2023. Why? Because the brands people knew also started offering the same meals. In other words, vegan and vegetarian frozen meals became a commodity fast.

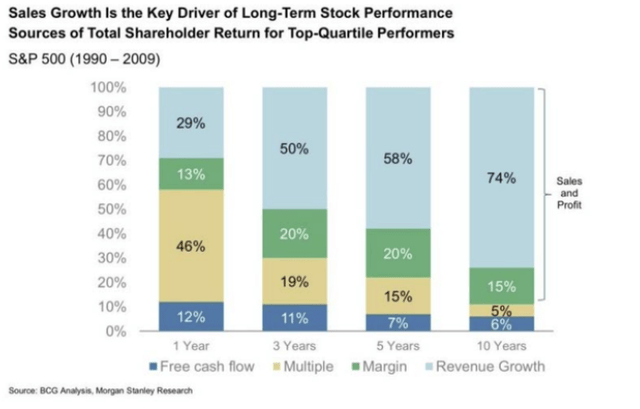

Revenue growth is always a key aspect of my investing. I have shared this chart so many times, but it remains important.

The clear message is that revenue growth is the most important factor in long-term returns. Often, the leaders in new or fast-growing industries have that long-term potential.

I also look at how margins evolve over time. Of course, there can be temporary investments that impact margins and that’s why it’s important to not judge too superficially. But generally, I want margins to improve or at least not deteriorate if they are already really high.

A dual engine is faster. That’s why I want the industry the company is in to be growing. A great company in that industry can leverage that industry growth with its own growth, creating a second engine.

Of course, there are nuances to all these criteria, but having a framework is useful.

Quick Facts

1. Bill Ackman’s Plan To Take SpaceX Public

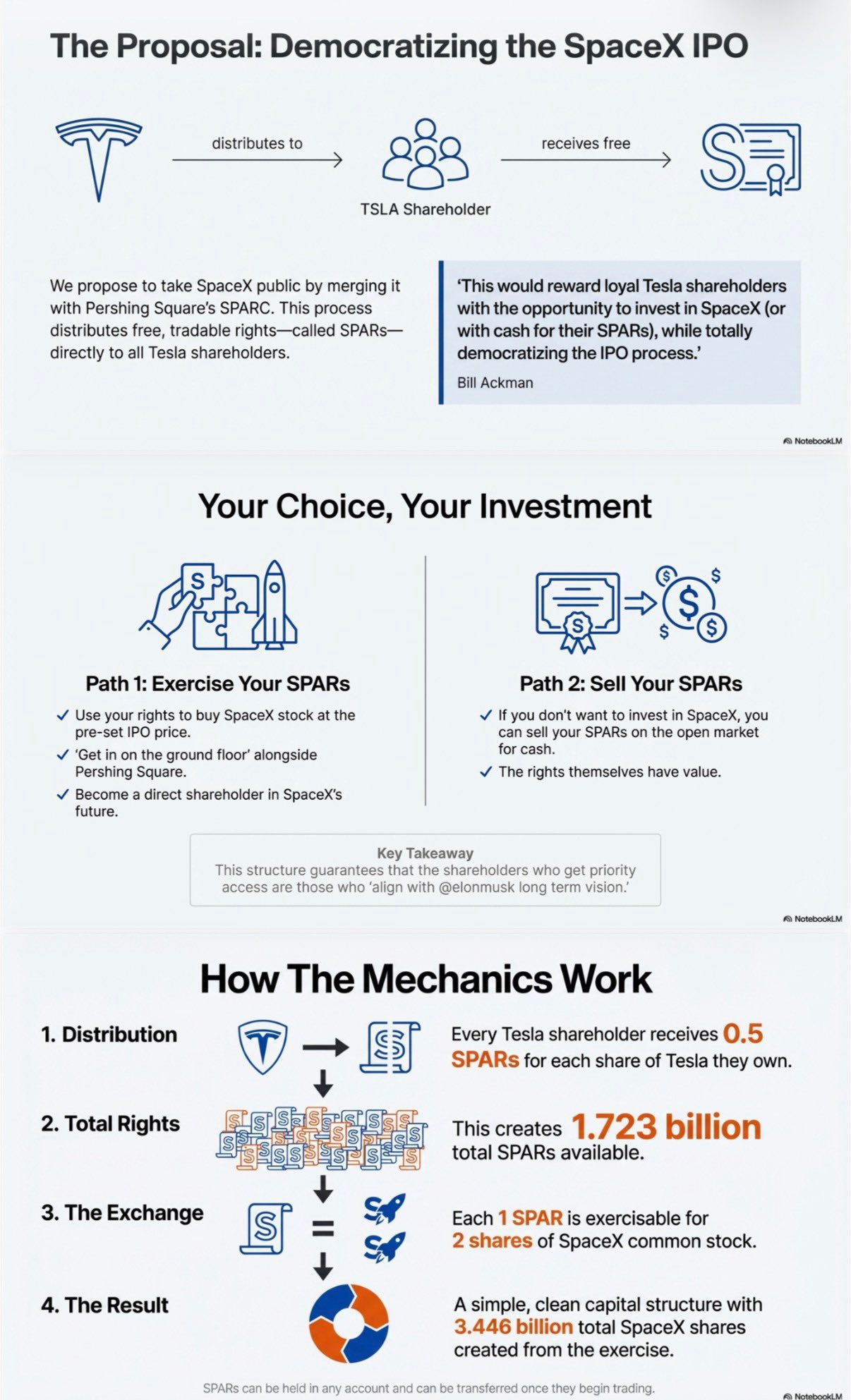

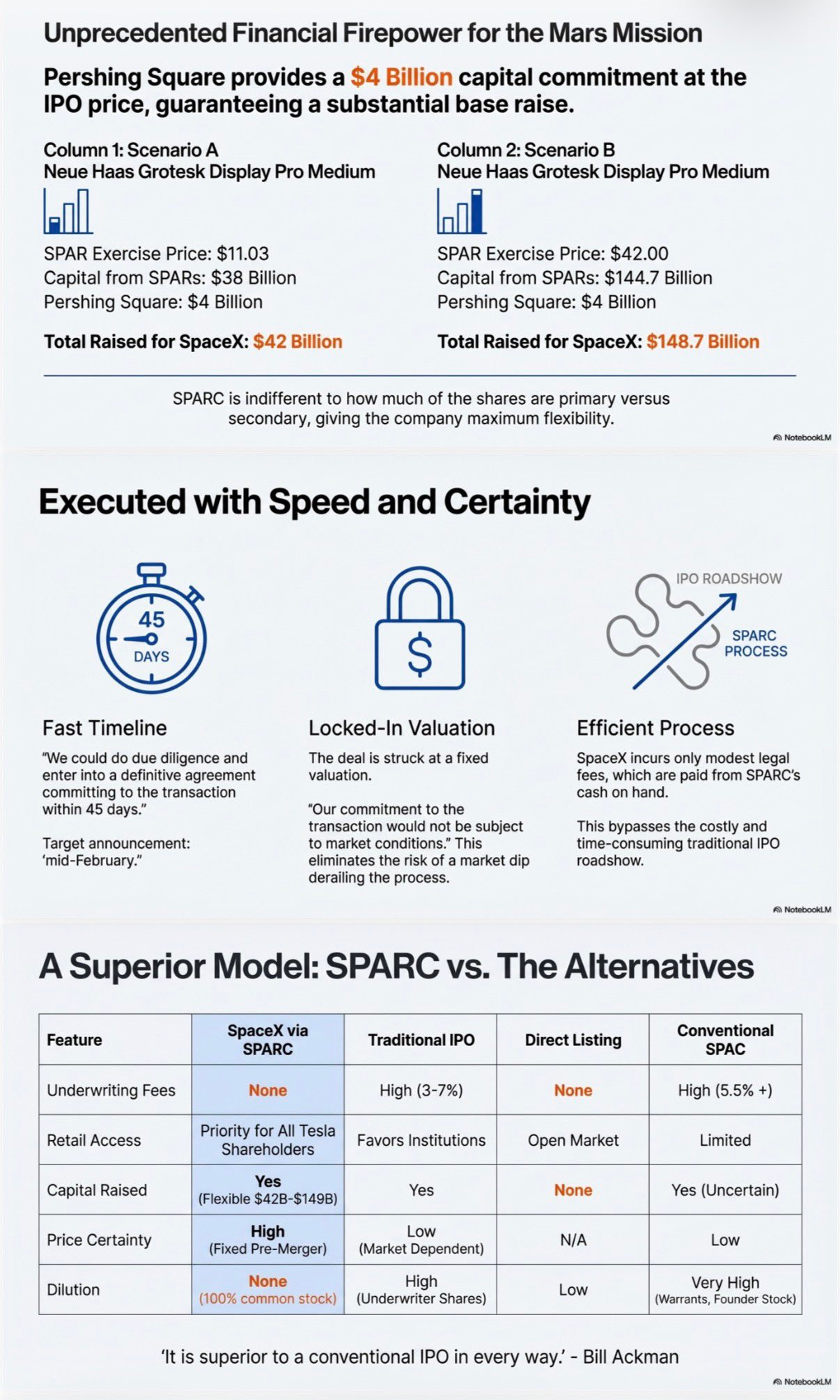

Never a dull moment on X. This week, Bill Ackman pitched Elon Musk an unusual idea: take SpaceX public by merging it with his approved SPARC vehicle. That means no bankers, no founder shares, no dilutive fees.

He proposes that all Tesla shareholders would get rights (’SPARs’) to buy into the SpaceX IPO or sell those rights on the market.

Ackman says Pershing Square would put up $4B and handle due diligence. The offer includes a second SPAR tied to Musk’s xAI, potentially setting up another IPO down the line.

Depending on the SPAR exercise price—say $11 or $42—SpaceX could raise between $42B and $149B.

He promises a clean, all-common-stock IPO, fast execution, and SEC compliance in just 45 days. His pitch: reward Tesla investors, bypass Wall Street fees, and give Musk full flexibility on capital raised.

A commenter made this presentation from the idea.

This is definitely an interesting idea. You can reward loyal Tesla/Elon investors through such a system, and you can circumvent the very costly procedures, which favor big institutions and leave individual investors behind.

You probably know that big institutions can usually get in at much lower prices than individual investors, especially for a much-anticipated IPO where the stock price shoots up like a SpaceX rocket.

You may wonder what Bill Ackman would do this for? After all, he proposes to take the costs of the procedures.

His main benefit is that he can invest $4 billion at a valuation of $800B and this investment can shoot up, as if he’s in pre-IPO.

Overall, I think this is a very interesting idea but I’m not sure the first test of a SPARC is easy to do at this size.

2. More Rate Cuts Coming?

We all know that the last rate cut was not a unanimous decision by the Fed. Therefore, many commenters thought this could be the last rate cut for a while.

This week, though, the unemployment numbers came in. The unemployment rate was 4.6%, while 4.4% was expected. As you can see, that’s the highest percentage since 2021.

This could mean more rate cuts are on the horizon. We will see. I’m not much of a macro trader. There are just very few macro elements where you can get an edge, and usually, macro events and company-specific returns don’t correlate over the long term, although there can definitely be a short-term coupling.

3. Nasdaq Wants 23/5 Trading

This week, Reuters reported that the Nasdaq is preparing to file with the SEC to extend stock trading to 23 hours a day, five days a week.

There would be two trading blocks: a day session from 4 a.m. to 8 p.m., followed by a one-hour break, then a night session from 9 p.m. to 4 a.m. Nasdaq expects to launch the new schedule in the second half of 2026.

Over time, there will be a 24/7 trading window, I’m pretty sure. Crypto trading hours definitely have an influence here, but more foreign investors want more flexible hours.

All in all, I think the advantages for long-term investors will become even greater, as more people will start trading rather than investing. The fewer people there are in your game, the better.

Here, the free part ends.

Get full access to Potential Multibaggers. Here’s what you’ll get:

✅ The rest of this article

✅ Best Buys Now (outperforming the market by 20% over 3 years!)

✅ My 10 top picks for 2026

✅ My complete portfolio (with every transaction)

✅ Deep insights through quarterly earnings deep dives

✅ The Quality Score and valuation updates every quarter.

✅ Access to our private chat group

Don’t hesitate. Don’t miss the next multibagger opportunity!